- [ February 11, 2026 ] Having Failed to Simply Prove His Company, Newgen Fashion Limited, Was Trading on March 1st 2020 (a Rule of the BBL Scheme), Sean Martin Anderson Gets a 9 Year Ban for Blagging and Misusing a £45,000 Starling Bank Bounce Back Loan The Disqualification Files

- [ February 11, 2026 ] After Securing a Legitimate £20k Bounce Back Loan, Dale Thomas Howe the Director of Dales Logistics Ltd then Blagged a Second £50k BBL from HSBC Resulting in Him Being Hit with a 10 Year Ban The Disqualification Files

- [ February 11, 2026 ] Coastan Ahumuza, Director of RCT Accountants Ltd Slapped with an 11 Year Ban for Combining the Turnover of Multiple Companies to Arrive at the Turnover Figure Used to Blag a BBL for that Company and then Misusing the BBL Funds The Disqualification Files

- [ February 11, 2026 ] 75 Year Old Wendy Fenton the Director of Tarko Limited Slapped with a 9 Year Ban for Blagging a Bounce Back Loan from Lloyds Bank By Over-Egging the Turnover of that Company The Disqualification Files

- [ February 10, 2026 ] Middlesbrough Tops Championship After 2-1 Win Against Sheffield Gambling

- [ February 10, 2026 ] Emir Qureshi the Director of BB Construction Group Ltd Slapped with an 11 Year Ban for Over-Estimating that Company’s Estimated Turnover That He Was Allowed to Estimate to Get a £50,000 Barclays Bounce Back Loan and Misusing the Funds The Disqualification Files

- [ February 10, 2026 ] Ayal Kathriarachchi the Director of Treevalley Limited Slapped with a 7 Year Ban for Over-Egging that Company’s Turnover to Blag a £50,000 Lloyds Bank Bounce Back Loan The Disqualification Files

- [ February 10, 2026 ] Millicent Dontoh the Director of Aniconam And Co Ltd Slapped with a 9 Year Ban for Over-Egging that Company’s Turnover to Blag a £50,000 Bounce Back Loan from Barclays and Misusing the BBL Funds The Disqualification Files

- [ February 10, 2026 ] Stuart Matthew Niven, the Director of Britannia Maritime Security Ltd Slapped with a 7 Year Ban for Transferring and Losing Most of His Company’s £50,000 Bounce Back Loan to a Trading and Investment Company The Disqualification Files

- [ February 10, 2026 ] Robert Wallace the Director of STRS Recruitment Limited Slapped with a 9 Year Ban for Over-Estimating His Estimated Turnover He Was Allowed to Estimate to Get a £50,000 NatWest Bounce Back Loan The Disqualification Files

- [ February 9, 2026 ] Haaland’s Late Penalty Stuns Anfield, Brings Man City 2-1 Win Gambling

- [ February 7, 2026 ] Shakeb Hakime the Director of Ruzfishermonger Limited Slapped with a 9 Year Ban for Over-Egging His Company’s Turnover to Blag a £50,000 Santander Bounce Back Loan The Disqualification Files

- [ February 7, 2026 ] Mandeep Birk the Director of A1 Exec Ltd, Slapped with a 10 Year Ban for Over-Egging His Company’s Turnover to Blag a £50,000 Bounce Back Loan from Lloyds Bank The Disqualification Files

- [ February 7, 2026 ] Omer Cagatay Kulekci the Director of Noktada Limited Slapped with a 5 Year Ban for Not Proving £24,000 of His Company’s £30,000 Barclays BBL / £20,000 BBL Top Up Were Used for the Benefit of His Company After Transferring it to Himself The Disqualification Files

- [ February 7, 2026 ] Nathan Anidugbe the Director of 92Bricks Limited Slapped with an 11 Year Ban for Over-Estimating His Company’s Estimated Turnover That He Was Allowed to Estimate to Get a £50,000 Barclays Bounce Back Loan The Disqualification Files

Daily Updates

Please scroll down the page to find all the latest news and information about the BBL Scheme and the upcoming write-offs, enforcement and recovery action, read and digest everything and in order, as I have laid everything out so you can make sense of the current situation.

There are over 5,400 pages of Bounce Back Loan related news and information contained within the website so please do make sure you subscribe to the website so you don’t miss anything and by doing so you also gain access to the Helpline. The website is updated daily, so take a look at the Daily Updates section, or for the slightly juicer stuff, head on over to and immerse yourself in the Special Reports section of the website.

Latest

As We Wait for the Strike Off/Dissolution Unblocking Mechanism for LTD Companies with an Unpaid BBL to be Put in Place, Here is an Insight into the Options, Problems, Risks and Possible Solutions Currently Being Discussed and Evaluated by the Powers that be

Here is a complete insight into possible problems and solutions that are being discussed behind the scenes to address the specific cohort of companies that are trapped in the Strike Off/Dissolution Objections Process (DOP) due to defaulted Bounce Back Loans (BBLs). […]

Read the Public Sector Fraud Authority’s Policy Paper on the New Backdated Law That Extends the Time Limit from 6 Years to 12 Years to Bring Civil Claims Against Anyone Who Committed Any Type of Pandemic Related Fraud That They Issued to Counter Fraud Practitioners on the 2nd of February

Here is the Policy Paper issued to Counter Fraud Practitioners yesterday the 2nd of February 2025. […]

The Nightmare Begins – Rachel Reeves Instructs HMRC Its Time to Start Rounding Up Directors of Firms Investigators Have Red-Flagged as Bounce Back Loan Blaggers by Demanding Those That Owe Some of the £27 Billion in Overdue Corporation Tax, PAYE and/or VAT Pay Up or Face the Consequences

The time that many Bounce Back Loan Blagging Company Directors have feared has come, as HMRC have been instructed to start chasing Directors of Companies that collectively have amassed some of the £27billion in unpaid VAT, Corporation Tax and/or PAYE. […]

The Big BBL Write-Off

February 11th 2026 Update: The Big Bounce Back Loan Write-Off strategy is coming this month along with the mechanism to allow Companies with an unpaid BBL to apply for and get a Strike-Off/Dissolution or have a Strike-Off unblocked. As long as you tick the right boxes, you will be fine, keep the faith not long to wait now.

Subscribers/Donors I will be here to guide you through the process via the helpline and/or via written guides on the website and give you feedback from those who have made use of the process, give me a bell if you need a chat.

Take a Look

When Bounce Back Loan Lenders Can and Can’t Come after Your Home (Principal Private Residence) and/or Your Car (Primary Personal Vehicle) and Use Funds from Such as Part of Their Standard Non Fraud Related BBL Recoveries Process

Here are the key principles which relate to Principal Private Residences (PPRs) and Primary Personal Vehicles (PPVs) of Borrowers. […]

BBL Lenders Have Responded to My Urgent Requests for Clarification on the Annual Statements That Have Started to Be Sent Out, That Show the Amount Still Owed When a BBL is Not Being Pursued Due to Vulnerabilities or When a Defaulter Discount Has Been Agreed and Paid – Read What They Have Said (It’s Good News)

I have been badgering quite a few Lenders this past week or two asking them why, when BBLs are not being pursued any longer due to customer vulnerabilities or when a customer has agreed and paid a final settlement (BBL Defaulter Discount) the amount left unpaid is still showing on the annual statements that borrowers have started to receive for the very first tim […]

What to do if Your Bounce Back Loan Mischief, Skulduggery or Even a Simple Mistake When Applying for it Comes Back to Haunt You in 2026 – Plus Dates and Schedules for BBL Enforcement Action and Write-Offs Coming This Year

Laws have been introduced, investigations carried out and enforcement teams have been assembled and for a lot of people, that niggling thought that sneaks up on them when they least expect it, that being their long defaulted Bounce Back Loan, and why Lenders have gone quiet and what are the Government planning, is going to rear its ugly head again at some point this year with something of a bang. For others however their BBL journey will come to an end this year, with their Bounce Back Loans officially being written off for good.

[…]

I remember telling the Covid Corruption Commissioner in one of my meetings with him, to not mess up the recoveries, enforcement and write-offs of Bounce Back Loans as I will be the one mopping up the mess, and here I am now that he has left his post, doing just that. Feel free to immerse yourself in the 5.400+ pages of the website, or conversely if you don’t fancy doing that and just want a chat to get your head around things, as they currently stand, give me a bell on the Helpline.

The Government is very shortly going to announce and begin a mix of criminal and civil action against those on the “Bounce Back Loan Naughty List” along with using the Public Sector Fraud Authority who will increase its letter writing campaigns using the threat of penalties under the Public Authorities (Fraud, Error and Recovery) Act 2025 to get BBL blaggers to pay up. Your level of “naughtiness” will determine whether you are subject to criminal/civil action or receive a letter. Need a chat? Give me a call on the Helpline whilst you still have time.

Latest Nonsense

NatWest Customers Who Have Agreed a BBL Defaulter Discount Settlement With BBL Debt Collector Moorcroft, are Receiving Terrifying Annual Statements Indicating They Still Owe the Bounce Back Loan They Agreed to Settle for a Few Pence in the Pound – View the Letters and Statements They Are Sending Out

Bounce Back Loan Debt Collector Wescot Acting on Behalf of Barclays are Telling Recognised Vulnerable Business Owners if They Don’t Respond to Their Letters, Barclays “May” Designate a Different Debt Collector and Not Tell Them You Are Vulnerable – That is of Course a Lie and is Tipping Such Customers Over the Edge

Revealed: People Hounded to Death, Bank Staff Blagging BBLs, Lender Bugs, Errors and Defects, False Allegations of Fraud, Bad Advice From Bank Staff Which Could Have Seen Borrowers Jailed, Plus Scams Pulled by Official BBL Debt Collectors and Abhorrent Treatment of BBL Borrowers That Have Seen Bounce Back Loans Written Off, Compensation Paid and Apologies Given by BBL Lenders

We are now in the “lull before the storm” stage when it comes to the enforcement of BBL debts, which is going to be increased several gears very shortly, along to be fair with the soon to be announced write off of a huge number of them, and as such, as we wait, here are some of the worst examples of very poor and illegal treatment BBL borrowers I have come across. […]

Tide, Conister, Metro Bank, Starling Bank and Other BBL Lenders Caught Abusing the Bounce Back Loan CIFAS Database Due to Bugs, Errors and Defects, with Completely Innocent People Being (and Still Are) Labelled as Suspected Fraudsters for Having Imaginary BBL’s (or worse) and Now Risk Having the Public Sector Fraud Authority Chasing Them – Take Note in Case You Become a Victim

In light of the imminent enforcement action against suspected BBL Blaggers please have a read through of the following scandals in which people were labelled as suspected blaggers, and some of them still are. Make a note just in case you get your collar felt in the months ahead and are completely innocent. […]

For Those of You Waiting to Strike-Off Your Ltd Company with a Bounce Back Loan Still Owing or Get a Strike-Off Block Lifted Due to There Being an Unpaid BBL Attached to That Company – His Majesty’s Treasury, the British Business Bank and Companies House Have All Provided Me with an Update – Things Are Being Arranged and Decided Upon, Take a Look

Ok, here is the latest update as to if, how, when, why and where the Government are going to be allowing Companies with a Strike Off Block or a Director of a Company wishing to apply for a strike off of their Company if there is just an unpaid BBL lurking in the background on those Company’s books […]

Can’t Repay a Legit BBL?

Let me start with the good news, that being if you did nothing wrong with a Bounce Back Loan then you have nothing to fear. If however you haven’t defaulted but need to as you are currently struggling to repay a legitimate BBL, then make sure you follow the rules when defaulting, as additional options will be made available to you:

Egg on Their Faces

It is not all Director Bans and Prison Sentences for those accused of Bounce Back Loan wrongdoing, a huge number of people have had the allegations and court cases against them dropped, (usually at the last minute) once a legal representative steps in and puts up a good defence for them. With that in mind, and as many people will be accused of all sorts in 2026 with the new enforcement action planned, here are some actual real-life cases that have resulted in no further action and cases being dropped by the Insolvency Service. Take a look at the Cases Dropped section of the website for more real life BBL related cases that have been dropped:

Insolvency Service Drops Eight-Year Disqualification Threat Over Alleged Over-Egging of Turnover to Get a Bounce Back Loan

Here is another case involving turnover over-egging allegations that were dropped by the Insolvency Service after they were brought to heel and forced to see sense. […]

Six-Year Disqualification Bid Over Alleged Misallocation of Bounce Back Loan Funds Completely Abandoned By Insolvency Service Investigators

The usual trick pulled by the Insolvency Service of trying to get a Director accused of misusing BBL funds to sign an undertaking which would have seen that Director getting a shorter length ban didn’t work in this case as you will read, and ultimately they dropped the case entirely. […]

Six-Year Disqualification Threat by the Insolvency Service Over Alleged £50,000 Bounce Back Loan Misuse Dropped After Full Justification of Expenditure

The number of cases dropped by the Insolvency Service relating to alleged Bounce Back Loan wrongdoing continues to grow, and here we have another one, always be prepared to battle your corner like the Director in this case did. […]

If any more Solicitors, Law Firms and Barristers want to contact me and give me details of your recent Bounce Back Loan related casework and successes, feel free to get in touch and I will give your work the publicity it rightly deserves.

It has become very apparent to me, and it will become very apparent to you too as you look through the cases the Insolvency Service have pursued, that your level of vulnerability, nationality, race and/or religion can often play a big part as to whether they will use those attributes to hound you and try and push you over the edge, both mentally and physically, when it comes to alleged BBL wrongdoing. The fact that it is done on behalf of, and with the approval of the Secretary of State is utterly repugnant.

Dirty Little Secrets

The PSFA are Currently Chasing “Blaggers” Who Got Multiple BBL’s, However, I Can Reveal that the Government, Due to the Complexities of the Interpretation of the Word “Group” in the Guarantee Agreement Which was Causing Confusion to Lenders (and Applicants) They Amended Their Guidance to Lenders Weeks After the Scheme Launched, But Continue to Keep it Secret from Borrowers, Who Therefore May Have Fallen Foul of that Guidance Initially – Here is That Guidance, Revealed for the First Time

Whilst I am sure the Government wouldn’t be so evil as to go after those in a Partnership, LTD Company Directors and Sole Traders who innocently got one BBL for each of their multiple companies or businesses, it is best that you are armed with the facts if they do, and with that in mind here is a document that has never been revealed before to anyone bar the Government and BBL Lenders, which could and would have stopped people, from making an innocent mistake. […]

Two-Tier Justice?

Unhappy with the Work of Tom Hayhoe the Covid Corruption Fraud Commissioner or Have Any Serious Worries or Concerns About the Recommendations and Adopted Policies in His Final Report? – The Public Accounts Committee Wants to Hear Your Views

You can request anonymity or confidentiality when you send evidence, but it is for the Committee to say whether it will agree.It may treat submissions confidentially, even where you have not requested this. […]

Watch as a Barclays Boss Explains That If You Over-Egged Your Turnover to Get a Bounce Back Loan from Her Bank and Are Paying it Back or Have Paid it Back, That Won’t Get Classed as Fraud, If You Don’t Repay a Blagged BBL Then It Will Be Classed as Fraud – What a Time to be Alive!

As the powers that be get back to work after the Christmas and New Year breaks, many BBL blaggers will soon start receiving letters about their mischief, unless you are repaying a BBL that you blagged from Barclays, for as you will see below, as a boss of the bank says, it won’t be classed a fraud. […]

CEO of the British Business Bank Puts Up a Spirited Defence of Bounce Back Loan “Blaggers” – Watch as He Explains Most Blagged BBL’s Are Performing and By Going After Those Who Over-Egged Their Turnover or Claimed They Were a Director of a Company Before They Were Would Result in the Very Act No One Wants – A Non-Performing Loan

As you will see in the video, there is now a dilemma for the powers that be when it comes to Bounce Back Loan blaggers, will the Government have a two-tier approach to rounding them up or go after all Blaggers? […]

The government will establish the Public Authorities Fraud Investigation and Enforcement Service by 2026-27, which will recruit skilled investigators to pursue recovery of fraud against the public sector; and trial innovative approaches to enforcement activity for fraudulent Bounce Back Loans.

Recovery Action Begins

The Voluntary Repayment Scheme ended as the clock struck midnight on the 31st of December 2025, and as such the Government are now blasting into 2026 by launching their many Bounce Back Loan recovery and enforcement initiatives:

As the Voluntary Repayment Scheme Ends, the Public Sector Fraud Authority Gear Up to Start Targeting Even More BBL Blaggers with Their “Pay Up or Else” Threats – The Pilot I Told You About Has Resulted in 40 Dodgy BBLs Worth £2million Having Had Repayment Plans Set Up on Them by Blaggers, Who are Paying as Little as £10 Per Month – Discover if You Are in the Next Batch to be Targeted

Disgruntled Business Associates, Ex-Lovers and Nosey Neighbours Annoyed at Seeing People Swanning Around in New Cars, Having House Extensions and Living the High Life Have Utilized Another Pilot Scheme to Grass Up 207 People to the Public Sector Fraud Authority’s Intelligence Team for Alleged Bounce Back Loan Wrongdoing – The Government are Eager for More People to do the Same

As a Sole Trader or LTD Company Director, Are You Unsure as to Whether You “Blagged” or “Misused” a BBL or Were Actually Eligible for One in the First Place? Are You Worried That You Are Due to Get Your Collar Felt in 2026 by the Public Sector Fraud Authority’s Enforcement Unit or Wound Up by the Insolvency Service?

Take a Look at How the Public Sector Fraud Authority Intend to Punish Anyone, Including Covid Business Grant Scammers and Bounce Back Loan Blaggers Using Civil Penalty Powers – Early Indicators Are That BBL Blagging Will be Deemed to be a Low Level Fraud with Minimal Penalties

Government Ministers Celebrate Appeal Court “Immediate Custodial Sentences ARE Necessary for BBL Blaggers” Ruling, and the Proposed Removal of Juries from Trials, the King Signing Into Law the Public Authorities (Fraud, Error and Recovery) Bill and BBL Enforcement Action Begins – This is Your Last Chance to Protect Yourself

Plenty of people have taken my advice over the last 5+ years and have already set up repayment plans or agreed and paid a settlement figure, and are now managing their massively reduced BBL repayments or have paid it off at a much reduced amount, or haven’t paid anything back as their business was unable to and will not face any problems or enforcement/repayment demands moving forward, as they played by the rules.

Uncovering BBL Blaggers

Let’s now move onto what is coming in 2026. For years now the Government have been working out who did what when it came to Bounce Back Loans, including, data matching exercises and checking who Lenders have already flagged up as suspected BBL Blaggers. They now have a rather long “naughty list”, that being a list of people they are going to be actively chasing as part of their recovery and enforcement action from 2026. This is how they worked everything out:

Voluntary Repayment Scheme

As the BBL Naughty List is rather large, it was decided to launch a scheme to scare and nudge people to repay a dodgy BBL they got, or at least get people to set up a repayment plan, the initial aim was to give people the peace of mind of knowing that by making use of the scheme they wouldn’t face any enforcement action for their BBL wrongdoing. As such on September the 12th 2025 the Voluntary Repayment Scheme was launched.

Sadly due to all manner of legal reasons which saw many banks refusing to touch the scheme with a 12 foot barge pole, the Government had to chop and change the rules and aim of the scheme, and diluted it so much it became a scheme offering nothing. As you will discover in my reports uncovering that saga below, the scheme closed on 31st Dec 2025:

The BBL Problem

Most weekdays, people get banned from being a Director of a Company, or Sole Traders and individuals get Bankruptcy Restrictions Orders for BBL related mischief, some people find themselves before a court and ultimately locked up for BBL fraud, and in most cases it is their own actions that have seen them being punished.

Conversely some people get compensated or their BBLs written-off or reduced in value when complaining about unfair treatment by Lenders or due to irregularities with their Bounce Back Loan, here are the latest outcomes of people in those three categories:

-

Government Scrambles to Correct the Wording on Their Ill-thought Out BBL Voluntary Repayment Scheme, Amending the Wording 56 Days After the Launch on Their Original Announcement and Now Adding Additional Guidance 76 Days After Launch Which Contradicts Their Original Press Notices – Read and Compare All the Differences You Will Be Shocked – A Total Cock-Up Like the BBL Scheme Itself

Final Report from the Commissioner

Below is the final report and recommendations of Tom Hayhoe, the Covid Corruption Fraud Commissioner (who left his post on December the 2nd). Please do read his report as it will give you a good idea of what is coming by way of write-offs and both enforcement and recovery action from 2026.

He has, for the 180,000+ of you with a Strike Off blocked due to an unpaid BBL, put forward a recommendation, which will allow many of those Companies, whose Directors did nothing wrong, other than not making it through the pandemic to be dissolved, with the BBL being written off, which is based on the solution I gave him in one of my meetings with him, and funding has been allocated to make it live as soon as possible.

-

Strike Off Solution

Strike Off SolutionDirectors of LTD Companies with a Strike Off Block Due to an Outstanding Bounce Back Loan Debt, There is a Solution Coming – I Proposed One to the Covid Corruption Commissioner – Will It Feature in His Recommendations to Parliament Due Imminently? – Take a Look and See What You Think

-

It's Happening

It's HappeningThe Insolvency Service Boost Their Birmingham Office With Five New Team Members to Vet and Investigate Suspected Bounce Back Loan Blagging Directors of Both Live and Strike Off Blocked LTD Companies for Prosecution – Four to be Employed in their Criminal Targeting and Compliance Team and One within their Search and Return Team

Enforcement and Recoveries

Moving into 2026, the new Public Authorities Fraud Investigation and Enforcement Service are going to be using some imaginative initiatives to bring to justice anyone they know committed any type BBL wrongdoing that their data-sharing exercises have uncovered, using operational efficiencies for trial by the Insolvency Service.

Such as Directors who have pulled any stunts with their LTD Company or not paid their taxes etc this will be achieved by the Insolvency Service using the “stunts pulled” or “non payment of taxes” as an excuse and an indirect way to get the BBL wrongdoing brought to light and punished by applying to the High Court for a winding up order and then seeking compensation orders in favour of the company’s creditors against any Director who ultimately is disqualified for BBL related wrongdoing, which is fully uncovered and confirmed during liquidation. Here are some very recent real life examples:

-

Not Eligible

Not EligibleThe Government have a list of Companies that blagged a BBL due to the Company not being eligible, based on the March the 1st 2020 required trading date and will be going after the Directors soon – Rahmanuddin Jabrkhel Director of Hairstylists (Edgware) Limited Has Just Been Given a 10 Year Ban for That Exact Wrongdoing

-

Multiple BBLs

Multiple BBLsThose Who Blagged More Than One Bounce Back Loan for Their Company Are Right at the Top of the Government’s Naughty List and Will be the First to Face Enforcement Action – In Fact Jason Arnold, Director of J Arnold Transport Ltd Has Just Been Banned for 10 Years for Blagging Not One But Two £50,000 BBL’s

Other initiatives will include action against those who over-egged their turnover to get a Bounce Back Loan and those who misused the funds. Those initiatives will operate on a ‘test and learn’ basis: gathering data to discover how best to reclaim BBL funds. The over-egging of turnover to get a BBL and the misuse of BBL funds is much higher than initial official Government estimates suggested and has been confirmed due to enhanced data sharing and A.I. analysis exercises.

However, Lenders have lobbed a huge legal spanner into the Governments aim of recovery action on Bounce Back Loans. The Commissioners report ever so slightly hints at that in a roundabout fashion, when he states “the loans are ‘owned’ by the commercial lenders” so 2026 will be an interesting time for all concerned….

Enforcement Dates

The Public Authorities (Fraud, Error and Recovery) Act 2025 which became law in December 2025 is currently going through its “Public Consultation” stage regarding a “Code of Practice” for the terrifying Civil Penalties Powers aspect of that Act including banning people from driving, dipping their bank accounts etc, based on the Minister for the Cabinet Office being satisfied, on the balance of probabilities, that someone committed fraud.

That is due to be completed on 27th Feb 2026, and then within 12 weeks from that date the Government will respond. As such, there will be no Government instigated enforcement action using that law, until it introduces its Code of Practice as per those dates and schedule.

Due to Lenders acting weird recently, for example refusing to take part in the BBL Voluntary Repayment Scheme and other irregularities, that I am monitoring, there are now serious legal questions to be answered as to whether these new Government powers will or will not be used against some or even all BBL blaggers.

If not, then it will be left to the Insolvency Service in conjunction with HMRC, Companies House and the Public Sector Fraud Authority to go it alone and look for non-BBL related wrongdoing committed by, for example, LTD Company Directors, and go after that, which will then allow for the actual BBL wrongdoing to be investigated and then punished.

View a Copy of the Bounce Back Loan Guarantee Agreement Your Lender Signed Alongside the Secretary of State to Ensure They Get Their Money Back if You Default On Your BBL

Here is a copy of the Guarantee Agreement your BBL Lender signed and is now in place to cover them and ensure they get their money back if you default on your BBL. […]

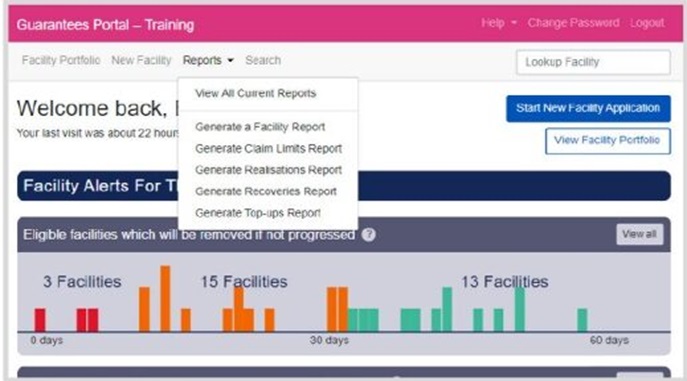

The Bounce Back Loan Guarantees Portal Manual for Bounce Back Loans – Discover the Information Entered Onto and Held on That Portal When a Lender Is Claiming the Guarantee on Your BBL

Here is the current version of the Bounce Back Loan Guarantee Portal Manual for Bounce Back Loans […]

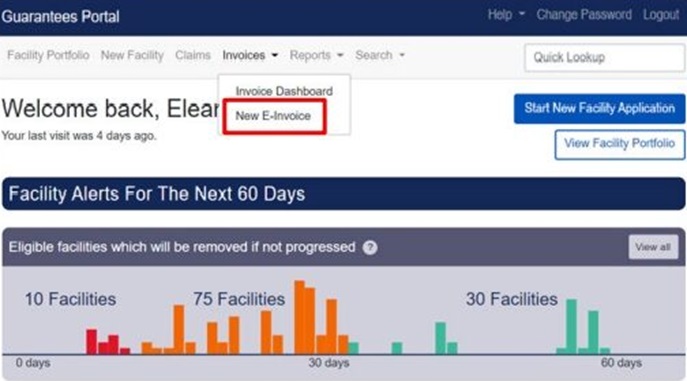

The Bounce Back Loan Guarantee Portal Manual for Arrears, Claims and Recoveries – Discover What Lenders Report to the Government When Your BBL Is In Arrears or Has Defaulted

Here the current version of the Bounce Back Loan Guarantee Portal Manual for Arrears, Claims and Recoveries. […]

One of the problems is hidden in the BBL Guarantee Agreement above, that states: “Save as many be expressly agreed between them from time to time, neither the Lender or Guarantor will, as a result of the participation in the Scheme, (i) be (or have the authority to act as) agent for the other or (ii) be (or be treated as being) in a fiduciary relationship to the other.” Some Lenders do not want to do anything to put at risk their BBL Guarantee, and as such do not want the Government acting on their behalf as BBL debt collectors or BBL enforcement officers.

-

BBL Complaints and Outcomes

BBL Complaints and OutcomesNatWest Cross Default a Customers Bounce Back Loan and Close Her Business Account After Requesting She Pays Back Her Company’s Small Overdraft (Which She Promptly Did) – Ombudsman Says You Can’t Do That and Orders Them to Restore the BBL – View the Rules on Cross Defaults

Turnover Dilemmas

As you will see by the cases below, they are banning people for over-estimating their estimated turnover when those people were allowed to estimate their turnover. Many people in such a position fail to provide proof of how they arrived at their estimated turnover figure and some also fail to explain where the BBL funds went, often taking the ban offered to them rather than face court action. So make sure you have records and defend your actions, should you found yourself in a similar position.

The deal that they get offered is often just a reduced length of ban if they sign an undertaking, or if they refuse, they get taken to court and face a longer ban and often get slapped with a compensation order for the full amount of the BBL. So you can see why some people, often mentally beaten and battered down into submission by the Insolvency Service, simply agree to a ban.

Enforcement Pilots

Whilst the Voluntary Repayment Scheme was up and running, the Public Sector Fraud Authority tested out a pilot by writing to a modest number of BBL blaggers, telling them we know what you have done, now here are your options.

Below you will find more information on that pilot and a copy of the letters they sent out along with details of just how successful a very early pilot of the upcoming enforcement action went on.

-

Early Pilot

Early PilotDiscover How One of the Pilots of the “BBL Winter of Regret” Panned Out – Over 100 Companies Wound Up with Litigation Funders Hunting The Directors Down – Discover How Much Was Retrieved – If Your Company Has a BBL Related Strike Off Block, and You Blagged The BBL Read On, as This Is (But Even Worse) What is Likely to Happen to You

Lenders Take Action

It’s not just Government Departments that have been and are set to wind up even more Ltd Companies in the High Court when they know the Director(s) blagged one or more Bounce Back Loan or pulled some other stunts like over-egging their turnover to get a BBL or even used the BBL funds like a lottery win, some Lenders have also been doing so quietly in the background for quite some time, usually when they have had their BBL Guarantees yanked.

Whilst it can take ages for the Judge appointed Insolvency Practitioners to investigate and discover what went on and officially report any and all actual BBL wrongdoing, several cases have now finally worked their way through the system and have resulted in punishments being handed out just the other day to the respective BBL blagging Directors:

Poacher Becomes Gamekeeper?

Duncan Beach, previously the Managing Director, Global Head of Risk & Compliance Transformation at HSBC during the time the bank kept quiet about bugs, defects and errors in their BBL application platform, and the bank that has been ordered to remove unfair BBL related CIFAS fraud markers from business owners and the bank that didn’t implement the duplicate database causing 1,000’s of duplicate BBLs to be issued by multiple other Lenders has been appointed as the new Chief Executive of the Insolvency Service and is due to start in January. Quite remarkable!

The warning sign for Borrowers is that they get sent a Notice of Assignment from their BBL Lender. Barclays Recovered a Fortune and set the High Court action rolling with over 100+ Companies successfully wound up, here’s the list of Starling Bank Winding Up Orders who also got into the swing of things, and then the list of Companies Lloyds Bank Wound Up began to grow in number. Finally both NatWest Started Issuing Winding Up Orders, which spurred on Santander to Start Winding Up Companies too.

After HSBC and NatWest’s BBL Online Application Forms/Platforms Were Found to Have Been Full of Bugs, Errors and Defects, It’s Now Been Revealed Santander’s Was Too and the Government Have the Brassneck to Try and Threaten People with the Public Sector Fraud Authority

It’s a scandal that I did warn the Labour of, before they got into power, but alas it is still rumbling on, and I know a lot of people are affected, but sadly a lot of them are unaware they can get it sorted out. […]

HSBC Default a Customers BBL, Shut His Account, Log a CIFAS Marker, “Lose” His Phone Calls, Confuse Him Over His Trading Dates and State He Over-Egged His Turnover – Ombudsman Says He Didn’t Commit Fraud and His Turnover COULD Be Estimated and Orders the Removal of the Marker and Compensation

Have a read of this shocking case, which shows just how disgusting HSBC really are, and how they treat customers whose first language is not English, and the vile stunts they pull. […]

22,000 Duplicate Bounce Back Loans Handed Out Mainly Due to the Negligence of HSBC – Some of Them are Covered by the Guarantee, Some are Being Quietly Written Off, However, Some Lenders are Very Vigorously Pursuing Those Debts, Personally Against the Directors Involved

As the audits continue of the Bounce Back Loan scheme, and the men and women armed with calculators try and work out just how much fraud has gone on in that loan scheme, and whilst banks and the Government try and work out what fraud is in the first place, some interesting facts and stats are coming to light. […]

Talking of HSBC, a Company with links to Sarah Ferguson the ex-Duchess of York which had a Bounce Back Loan is now in Administration, fortunately the amount not paid back and due to be picked up by taxpayers isn’t as big as the defaulted taxpayer backed loan Carole Middleton the mother of Catherine, the Princess of Wales left unpaid.

Rachel Reeves Thanks Tom Hayhoe the Covid Corruption Commissioner During Her Budget, Whilst Allocating an Additional £25million to the Insolvency Service so They Can Investigate Dodgy Directors Including Those Who Shut Down a BBL Owing Company and Opened Another Identical Business

The funds will help pay for a new “Abusive Phoenixism Taskforce” which will be a 50 person unit tasked with investigating Directors who closed down one business to escape its debts only to open a new offering exactly the same type of services or goods, which is known as phoenixing into another new business. […]

The British Business Bank Express Sympathy to Those Who Died and Experienced Mental and Physical Health Issues During the Pandemic and Beyond, Whilst the Cabinet Office Do the Opposite, Giving an Insight at the Covid Inquiry of How They Will Start To Chase Those Who Blagged the Public Purse

As you will see the Cabinet Office KC explains fraud isn’t as bad as it could be in the BBL scheme, and how the upcoming bill, due to be signed into law will give the Public Sector Fraud Authority lots of powers to chase anyone and everyone who robbed the Public Purse during the pandemic. […]

The BBL Voluntary Repayment Scheme Isn’t a Total Loss Despite the Rules and Guidance Coming Out 56 Days After It Launched – I Have Had Some Successes with Helpline Callers in the First Batch of People the Public Sector Fraud Authority Started Chasing – Discover How They Got On

The Public Sector Fraud Authority (PSFA) have initially been chasing a select number of people who are on the Government’s naughty list for Bounce Back Loan related mischief as a pilot before they go gunning for everyone. […]

The Government Plans to Wind Up Lots of Companies That Owe Bounce Back Loans When the BBL Voluntary Repayment Scheme Ends – Read This Real Life Story of What Happens When the Insolvency Service Gets Stuck Into You – No Mercy Given

One person got in touch with me recently, and I will give you an insight into their case. I have edited that person’s story so they can remain anonymous and that person has given me their permission to publish this. […]

Rachel Reeves Considering Pursuing ALL Bounce Back Loan Defaulters and Not Only BBL Blaggers, Citing Small Print Liability Clause – I Have Challenged the Fairness of That Clause, Read the Official Response

Chancellor Rachel Reeves, who today, the 4th of Nov 2025 gave her pre-Budget speech, is reportedly contemplating a stringent new approach to recover funds from the Bounce Back Loan Scheme (BBLS), targeting not only fraudulent borrowers but ALL defaulters, according to government sources. […]

Unsure Whether You Blagged a BBL or Not? Keep In Mind That Around Half of the 420,000+ Defaulted Bounce Back Loans Are NOT Going to Be Pursued Above and Beyond the Standard 12 Months – Give Me a Call to Confirm Whether Your BBL Debt Will or Won’t Be Pursued

If you a want a full run through of the rules so you will know, one way or another whether you are on the Governments naughty list, feel free to call me for a chat. […]

Received a Letter About Your Dodgy Bounce Back Loan from the Public Sector Fraud Authority or Your BBL Lender, or are You Expecting a Letter? If You Need to Set Up a Repayment Plan Before December to Stop Enforcement Action But Are Afraid to Do So, Give Me a Call and I Will Help You Get It Sorted Out

The Public Sector Fraud Authority and the Insolvency Service are gearing up for December when they can well and truly get stuck into taking enforcement action against everyone they know or suspect blagged a Bounce Back Loan. […]

HM Treasury Warn Those Who Are Choosing to Ignore Their Voluntary Repayment Scheme , of Which There are Many, That They Will Take You to Court and You Will Face Civil Penalties – You Have Until December to Make Amends

New powers for the government will make detection easier and allow the government to levy civil penalties, which will ensure that those who have defrauded the taxpayer face the consequences […]

Whilst They May Look and Act it, Those in Power Are Not Completely Barking Mad and They Know Most People Cannot Pull £50,000 or Whatever Out of Their Back Pocket Before December to Repay an Erroneous Bounce Back Loan – This is What You Should Consider Doing If You Have Any Worries or Concerns About the Legitimacy of Your BBL

If you are going up the wall with worry, and a lot of people are doing so right now what with the BBL Voluntary Repayment Scheme going live, then read on, digest what I am saying and make your own mind up on what you need to do. […]

What is the Minimum Monthly Amount I Can Offer to Repay a Defaulted Bounce Back Loan? Read What the Rules Are and How Lenders Must Handle £1, £10, £25 (or Any Other Small Amount) Monthly Repayment Plans Plus, View a Copy of a Standard Income/Outcome Form

Setting up a repayment plan means that you have done the right thing and will not be chased, hounded or even locked up for that innocent BBL application mistake […]

Covid Corruption Commissioner Targets Zombie Firms with Unpaid Back and Defaulted Bounce Back Loans in “BBL Summer of Love – BBL Winter of Regret” Crackdown, with One Serving Member of Parliament, James McMurdock, the MP for South Basildon and East Thurrock Having Been Told to Get His Dodgy BBL’s Sorted

The Covid Corruption Commissioner, Tom Hayhoe, has set his sights on the “zombie” companies languishing in limbo with unpaid Bounce Back Loans ( […]

A Reminder of How to Set Up a Repayment Plan on a Defaulted (But Possibly Not a 100% Legitimately Acquired) Bounce Back Loan, and an Insight Into What Each Individual Lender Will or Won’t Ask You During That Process

Not one of those people who have set up a repayment plan have been hounded in any way shape or form after setting it up, and that is something that will be continuing moving forward if you are quick. […]

Additional Reading

Once the Voluntary Repayment Scheme ends on the 31st of December 2025, the Cabinet Office, Public Sector Fraud Authority, Insolvency Service and others are going to set about chasing and trying to bring to justice everyone who has blagged a Bounce Back Loan.

They will be aided in such due to the new Directors I.D. Verification Scheme launched by Companies House and the passing into law of the Public Authorities (Fraud, Error and Recovery) Bill. Below are some more recent articles that I have compiled that you may find of use.

League of Shame

The latest Bounce Back Loan data dump came my way today, the 28th of November 2025, which reveals that to date a total of £11,417,650,000 has been paid out to Lenders via the Government Guarantee with another £221,660,000 waiting to be paid out and some £170,760,000 in Guarantee claims waiting to be put in. To date, 67,448 BBLs are in arrears and 433,115 are now in default.

Bugs, Errors and Defects on BBL Lender platforms/software has seen them having their Guarantees yanked on some 14,063 BBLs worth a mind-blowing £497.84million, it’s similar to Post Office Horizon scandal as many people could have been convicted due to those often unreported bugs, defects and errors, (some possibly have been) but spotted them and have managed to have their BBL’s written off by noticing them and complaining.

Outrageous BBL Blaggers

It is of course due to the number of people who took the biscuit with the Bounce Back Loan Scheme such as the random ones featured in the articles below, that rattled Rachel Reeves, who before the election promised she would take on a Covid Corruption Fraud Commissioner and seek his guidance on how to go after anyone and everyone who blagged a BBL in one way or another.

Clydesdale / Yorkshire Banks Bounce Back Loan Performance Figures Quarterly Update 28th of November 2025

Clydesdale Bank Plc (which includes Yorkshire Bank and are both […]

Barclays Bank Bounce Back Loan Performance Figures Quarterly Update 28th of November 2025

Barclays Bank PLC had a BBL drawdown value of £10,778.23million, and as such were the largest Bounce Back Loan lender. That represents 23.17% of the total BBL’s issued. […]

HSBC Bounce Back Loan Performance Figures Quarterly Update 28th of November 2025

HSBC UK Bank PLC had a BBL drawdown value of […]

BBL’s Covid Inquiry

If you are interested, in the latter part of 2025, namely December, the Covid Inquiry turned its attention to the Bounce Back Loan Scheme, quizzing those involved on its many failures. Below you will find the “best bits”, which are things I have been reporting on for many years, but it’s nice to finally see those responsible for the never ending cock-ups answering questions and/or trying to cover their backsides.

-

No Scapegoats

No ScapegoatsThe British Business Bank Finally Dish the Dirt on the BBL Scheme and Explain How Rishi Sunak Demanded No Fraud Checks, 24 Hour Payouts, Saying “Loans Not Grants” (as That Way The Government Gets Something Back!) and How Rishi Blindsided Them By Doubling the Maximum Value of BBL’s from £25k to £50k Without Asking/Telling them First, and Why Lord Agnew Needs to Wind His Neck In!

-

Rishi and BBLs

Rishi and BBLsWatch as Rishi Sunak Admits Most BBL Applicants Had Never Had a Business Loan Before and Were Confused About the Bounce Back Loan Scheme, Much More So As Lenders Demanded Banking Rules, Regulations and Laws Were Removed from Those Loans or They Wouldn’t Give Any Out, Hinting That Rachel Reeves Should Stop Screeching!

-

PSFA Pinocchio

PSFA PinocchioHead of the Public Sector Fraud Authority Causes Widespread Stress and Anxiety by Lying in His Signed Statement of Truth to the Covid Inquiry, Stating Only Those Who Incorporated Their Business “After the 1st of January 2020” Could Estimate Their Turnover to Get a BBL, When the Rules Clearly Stated 1st of January 2019 – What Is He Playing At?

-

PSFA Boss

PSFA BossWatch as the Boss of the Public Sector Fraud Authority Explains How He and His Team Have Worked Out Who Blagged a Bounce Back Loan, and the Methods They Used – He Gives an Insight Into How Data Sharing and Random Sampling Uncovered the Over-Egging of Turnover, Dodgy Directors and a Whole Lot More – If You Did Blag a BBL He Will be Coming After You Very Soon (If the Banks Let Him – Some of them Won’t!)

Copyright © 2020 - 2025 | Mr Bounce Back | Contact | Disclaimer | Privacy Policy | Corrections and Updates | Terms and Conditions |