AIB Group/Allica Bank Bounce Back Loan Performance Figures Quarterly Update 27th of February 2026

AIB Group (UK) Plc had a BBL drawdown value of […]

The latest Bounce Back Loan data dump came my way on the 27th of February 2026, which reveals that to date a total of £11,639,070,000 has been paid out to Lenders via the Government Guarantee with another £179,140,000 waiting to be paid out and some £177,180,000 in Guarantee claims waiting to be put in. To date, 61,586 BBLs are in arrears and 446,103 are now in default.

Bugs, Errors and Defects on BBL Lender platforms/software has seen them having their Guarantees yanked on some 14,107 BBLs worth a mind-blowing £499.29million, it’s similar to the Post Office Horizon scandal as many people may soon be convicted due to those often unreported bugs, defects and errors, when the Government begins their Enhanced BBL Enforcement Schemes later this year.

AIB Group (UK) Plc had a BBL drawdown value of […]

Investec Bank PLC had a BBL drawdown value of £3.30million, […]

TSB Bank PLC had a BBL drawdown value of £624.33m, […]

Please scroll down the page to find all the latest news and information about the BBL Scheme and the upcoming write-offs, enforcement and recovery action, read and digest everything and in order, as I have laid everything out so you can make sense of the current situation.

There are over 5,500 pages of Bounce Back Loan related news and information contained within the website so please do make sure you subscribe to the website so you don’t miss anything and by doing so you also gain access to the Helpline which is there if the huge amount of content scrambles your brain. The website is updated daily, so take a look at the Daily Updates section, or for the slightly juicer stuff, head on over to and immerse yourself in the Special Reports section of the website.

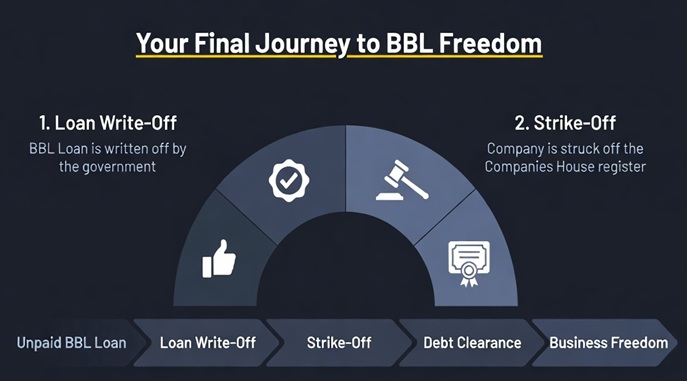

The Strike Off Mechanism for BBL owing Ltd Companies is shortly to be put in place, however have a read of the following to see how the Financial Ombudsman Service are getting into a muddle trying to explain to those who complain, why Strike Off applications are being blocked. […]

This page is updated daily with all of the information related to the Big BBL Write-Off Strategy and the Strike-Off Unblocking Mechanism for LTD Companies with an unpaid BBL sitting in their accounts. Along with ongoing personal, real life experiences of those who have utilized that new Government strategy/mechanism, to help those of you considering taking either for BBL freedom. So check it regularly! […]

Laws have been introduced, investigations carried out and enforcement teams have been assembled and for a lot of people, that niggling thought that sneaks up on them when they least expect it, that being their long defaulted Bounce Back Loan, and why Lenders have gone quiet and what are the Government planning, is going to rear its ugly head again at some point this year with something of a bang. For others however their BBL journey will come to an end this year, with their Bounce Back Loans officially being written off for good.

[…]

The Government is very shortly going to announce and begin a mix of criminal and civil action against those on the “Bounce Back Loan Naughty List” along with using the Public Sector Fraud Authority who will increase its letter writing campaigns using the threat of penalties under the Public Authorities (Fraud, Error and Recovery) Act 2025 to get BBL blaggers to pay up. Your level of “naughtiness” will determine whether you are subject to criminal/civil action or receive a letter. Need a chat? Give me a call on the Helpline whilst you still have time.

Let me start with the good news, that being if you did nothing wrong with a Bounce Back Loan then you have nothing to fear. If however you haven’t defaulted but need to as you are currently struggling to repay a legitimate BBL, then make sure you follow the rules when defaulting, as additional options will be made available to you:

Most weekdays, people get banned from being a Director of a Company, or Sole Traders and individuals get Bankruptcy Restrictions Orders for BBL related mischief, some people find themselves before a court and ultimately locked up for BBL fraud, and in most cases it is their own actions that have seen them being punished.

Conversely some people get compensated or their BBLs written-off or reduced in value when complaining about unfair treatment by Lenders or due to irregularities with their Bounce Back Loan, here are the latest outcomes of people in those three categories:

Let’s now move onto what is coming in 2026. For years now the Government have been working out who did what when it came to Bounce Back Loans, including, data matching exercises and checking who Lenders have already flagged up as suspected BBL Blaggers. They now have a rather long “naughty list”, that being a list of people they are going to be actively chasing as part of their recovery and enforcement action from 2026. This is how they worked everything out:

Moving into 2026, the new Public Authorities Fraud Investigation and Enforcement Service are going to be using some imaginative initiatives to bring to justice anyone they know committed any type BBL wrongdoing that their data-sharing exercises have uncovered, using operational efficiencies for trial by the Insolvency Service.

Such as Directors who have pulled any stunts with their LTD Company or not paid their taxes etc this will be achieved by the Insolvency Service using the “stunts pulled” or “non payment of taxes” as an excuse and an indirect way to get the BBL wrongdoing brought to light and punished by applying to the High Court for a winding up order and then seeking compensation orders in favour of the company’s creditors against any Director who ultimately is disqualified for BBL related wrongdoing, which is fully uncovered and confirmed during liquidation. Here are some very recent real life examples:

Other initiatives will include action against those who over-egged their turnover to get a Bounce Back Loan and those who misused the funds. Those initiatives will operate on a ‘test and learn’ basis: gathering data to discover how best to reclaim BBL funds. The over-egging of turnover to get a BBL and the misuse of BBL funds is much higher than initial official Government estimates suggested and has been confirmed due to enhanced data sharing and A.I. analysis exercises.

However, Lenders have lobbed a huge legal spanner into the Governments aim of recovery action on Bounce Back Loans. The Commissioners report ever so slightly hints at that in a roundabout fashion, when he states “the loans are ‘owned’ by the commercial lenders” so 2026 will be an interesting time for all concerned….

The Voluntary Repayment Scheme ended as the clock struck midnight on the 31st of December 2025, and as such the Government are now blasting into 2026 by launching their many Bounce Back Loan recovery and enforcement initiatives:

As the BBL Naughty List is rather large, it was decided to launch a scheme to scare and nudge people to repay a dodgy BBL they got, or at least get people to set up a repayment plan, the initial aim was to give people the peace of mind of knowing that by making use of the scheme they wouldn’t face any enforcement action for their BBL wrongdoing. As such on September the 12th 2025 the Voluntary Repayment Scheme was launched.

Sadly due to all manner of legal reasons which saw many banks refusing to touch the scheme with a 12 foot barge pole, the Government had to chop and change the rules and aim of the scheme, and diluted it so much it became a scheme offering nothing. As you will discover in my reports uncovering that saga below, the scheme closed on 31st Dec 2025:

Whilst I was in the fortunate position of being able to see the behind the scenes work being put into the Voluntary Repayment Scheme, due to my meetings with the Covid Corruption Fraud Commissioner and may daily back and forth with him via email, those not associated with that scheme were not. […]

Back in March 2025 I alerted you to the fact that the Government were getting mighty annoyed at the growing number of Insolvency Practitioners that were not doing their jobs properly when liquidating Ltd Companies. […]

Just when you thought the Bounce Back Loan scheme couldn’t get any more ridiculous, it has. For the record, I have alerted Peter Kyle the Secretary of State for Business and Trade of this situation as such cases are brought before the courts on his behalf, sadly the last time I checked he was too busy tweeting on X about the pop group Abba. […]

Below is the final report and recommendations of Tom Hayhoe, the Covid Corruption Fraud Commissioner (who left his post on December the 2nd). Please do read his report as it will give you a good idea of what is coming by way of write-offs and both enforcement and recovery action from 2026.

He has, for the 180,000+ of you with a Strike Off blocked due to an unpaid BBL, put forward a recommendation, which will allow many of those Companies, whose Directors did nothing wrong, other than not making it through the pandemic to be dissolved, with the BBL being written off, which is based on the solution I gave him in one of my meetings with him, and funding has been allocated to make it live as soon as possible.

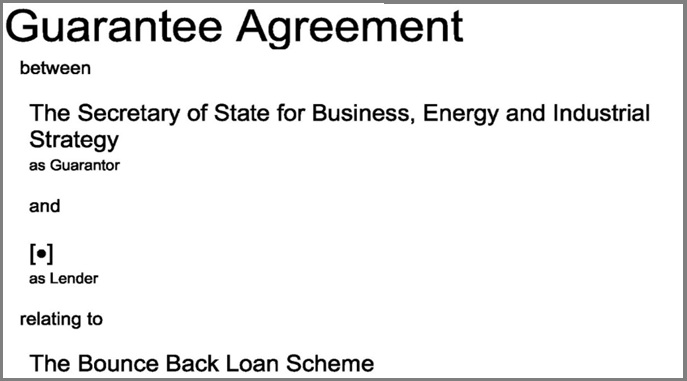

Here is a copy of the Guarantee Agreement your BBL Lender signed and is now in place to cover them and ensure they get their money back if you default on your BBL. […]

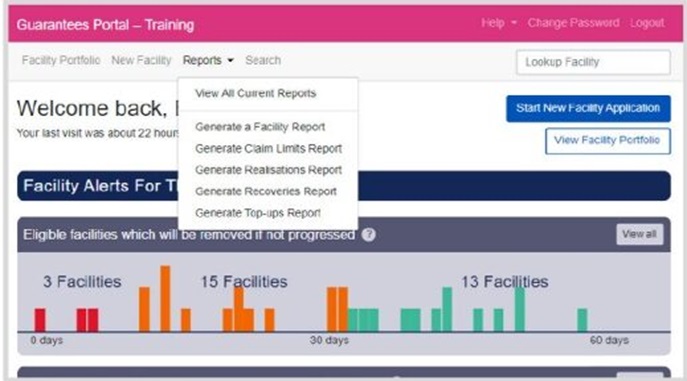

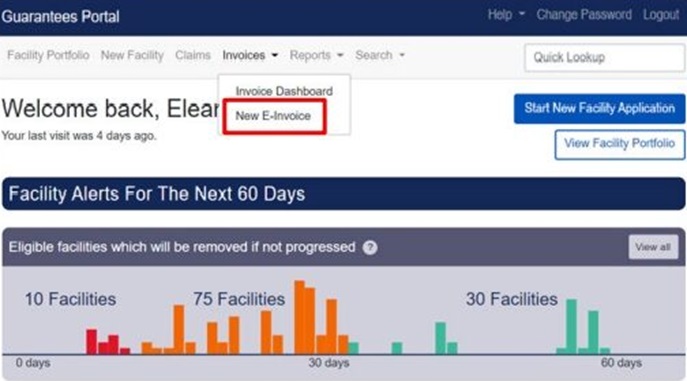

Here is the current version of the Bounce Back Loan Guarantee Portal Manual for Bounce Back Loans […]

Here the current version of the Bounce Back Loan Guarantee Portal Manual for Arrears, Claims and Recoveries. […]

One of the problems is hidden in the BBL Guarantee Agreement above, that states: “Save as many be expressly agreed between them from time to time, neither the Lender or Guarantor will, as a result of the participation in the Scheme, (i) be (or have the authority to act as) agent for the other or (ii) be (or be treated as being) in a fiduciary relationship to the other.” Some Lenders do not want to do anything to put at risk their BBL Guarantee, and as such do not want the Government acting on their behalf as BBL debt collectors or BBL enforcement officers.

As you will see by the cases below, they are banning people for over-estimating their estimated turnover when those people were allowed to estimate their turnover. Many people in such a position fail to provide proof of how they arrived at their estimated turnover figure and some also fail to explain where the BBL funds went, often taking the ban offered to them rather than face court action. So make sure you have records and defend your actions, should you found yourself in a similar position.

The deal that they get offered is often just a reduced length of ban if they sign an undertaking, or if they refuse, they get taken to court and face a longer ban and often get slapped with a compensation order for the full amount of the BBL. So you can see why some people, often mentally beaten and battered down into submission by the Insolvency Service, simply agree to a ban.

Whilst the Voluntary Repayment Scheme was up and running, the Public Sector Fraud Authority tested out a pilot by writing to a modest number of BBL blaggers, telling them we know what you have done, now here are your options.

Below you will find more information on that pilot and a copy of the letters they sent out along with details of just how successful a very early pilot of the upcoming enforcement action went on.

It’s not just Government Departments that have been and are set to wind up even more Ltd Companies in the High Court when they know the Director(s) blagged one or more Bounce Back Loan or pulled some other stunts like over-egging their turnover to get a BBL or even used the BBL funds like a lottery win, some Lenders have also been doing so quietly in the background for quite some time, usually when they have had their BBL Guarantees yanked.

The warning sign for Borrowers is that they get sent a Notice of Assignment from their BBL Lender. Barclays Recovered a Fortune and set the High Court action rolling with over 100+ Companies successfully wound up, here’s the list of Starling Bank Winding Up Orders who also got into the swing of things, and then the list of Companies Lloyds Bank Wound Up began to grow in number. Finally both NatWest Started Issuing Winding Up Orders, which spurred on Santander to Start Winding Up Companies too.

It is of course due to the number of people who took the biscuit with the Bounce Back Loan Scheme such as the random ones featured in the articles below, that rattled Rachel Reeves, who before the election promised she would take on a Covid Corruption Fraud Commissioner and seek his guidance on how to go after anyone and everyone who blagged a BBL in one way or another.

If you are interested, in the latter part of 2025, namely December, the Covid Inquiry turned its attention to the Bounce Back Loan Scheme, quizzing those involved on its many failures. Below you will find the “best bits”, which are things I have been reporting on for many years, but it’s nice to finally see those responsible for the never ending cock-ups answering questions and/or trying to cover their backsides.

Copyright © 2020 - 2026 | Mr Bounce Back | Contact | Disclaimer | Privacy Policy | Corrections and Updates | Terms and Conditions |