I have previously told you how committing a crime such as dropping litter could be classed as an Event of Default with Starling Bank, well I am sure many of you are unaware that Cooperative Banks’ BBL terms state only they can lend you money whilst you have a BBL unless they give permission in writing. Anything a court would deem unfair is legally permitted.

Thanks to the new Hate Crime Law in Scotland, you could even find your Bounce Back Loan defaulted if you are convicted of a crime such as saying someone identifying as woman but born male with a beard and a penis still attached is a man.

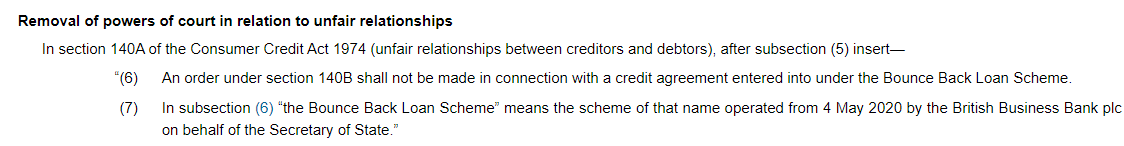

For those of you still amazed at what you are now discovering about the Bounce Back Loan scheme should read the changes to the Consumer Credit Act that were rushed into law to make that scheme live, in fact here they are:

That has of course led to many lenders for want of a better phrase, taking the piss and below are a few examples of them doing so:

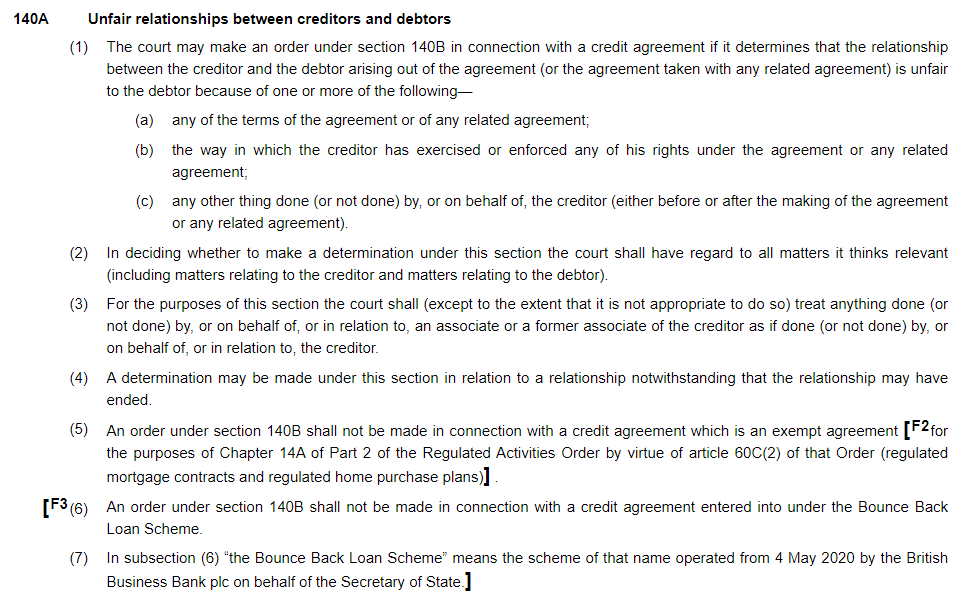

Cooperative Bank:

The Cooperative Bank won’t let you borrow money from anyone other then themselves unless they give you permission in writing whilst your loan is still in place:

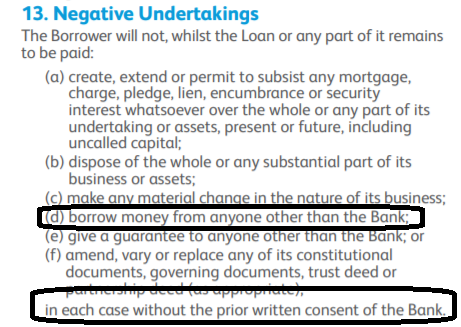

Conister Bank

If you cannot pay a debt when they are due, then Conister will see that as an Event of Default, does that mean if you cannot pay the window cleaner when he calls round then you are doomed?

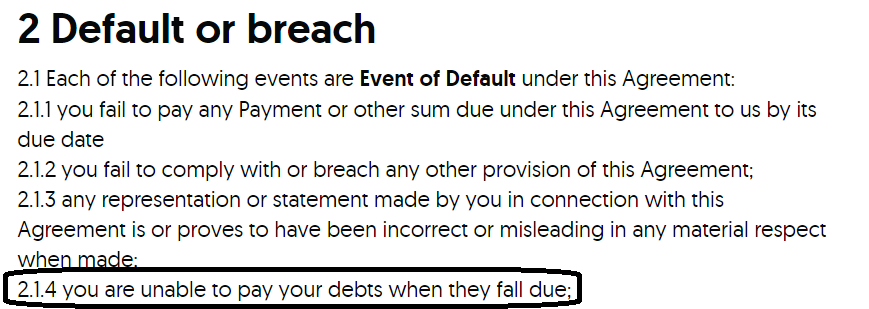

Starling Bank

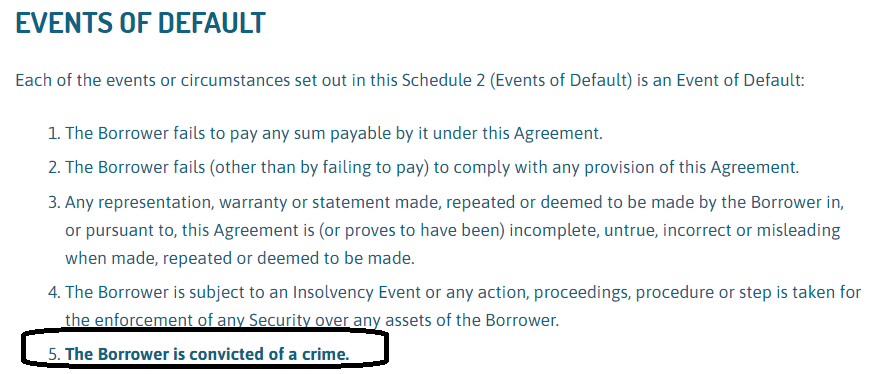

If you commit any crime and you have a Bounce Back Loan with Starling Bank, and one must assume no matter how minor that law breaking is, (dropping litter?) then they too will consider that an Event of Default:

If you have a BBL with any lender please do have a good long read through of the terms and conditions you agreed to when you applied, as you may fund some real shockers in them.

This is all of course due to Rishi Sunak and those in power forcing people to sign away their legal rights to obtain a Bounce Back Loan and rushing that change of law through the system and backdating it when it was given Riyal Assent to the start of the scheme.

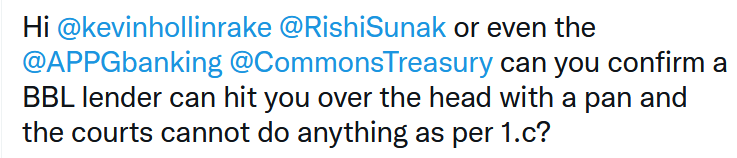

In an albeit tongue in cheek Tweet to Rishi Sunak and others I asked does that change of law allow for a lender to smack you in the face with a pan, a bit extreme I know but looking at the changes added to the bottom of that section of the CCA and section 1. c. it does say “any other thing done (or not done) by, or on behalf of the creditor (either before or after making the agreement or any related agreement).

Read your BBL agreements and the terms and conditions. However, they can change things after signing looking at the wording above.