It could be a chapter in Nadine Dorries the (ex-Gov Ministers) book, The Plot, that being some of the extraordinary reasons why every single person who was associated with the design of the Bounce Back Loan Scheme has legged it, has been removed from their posts, or has even been paid off.

On a sidenote she is dishing some weird dirt currently over on X, she did mention an MP had been organising “gay sex orgies” and inviting straight MPs and Journalists, she may be telling the truth, maybe she is befuddled or even drunk who knows, she seems happy to dish the gossip or put you right when asked….

What a time to be alive!

Anyway, below you will find listed the five banks who were part of the initial design of the BBL scheme, and one that was fast tracked, along with the names of their now ex-bosses, along with Government Ministers and Civil Servants also associated with the scheme who have also left their posts, and the reasons why.

There is only one person remaining, that being Rishi Sunak. The man behind launch of the BBL scheme is still in his job, simply amazing, much more so when you read the article below.

But faced with being investigated by the Covid Corruption Commissioner, (who I am reliably informed Rachel Reeves has her eye on one particular person that she has pencilled in for the job) will he leg it out the door and flee abroad one day soon?

There is something almost biblical about him being the only one associated with then entire scheme still in his job, albeit as an MP and not the Prime Minister.

As always, I have included links below, so that you can verify everything for yourself, for you will need to verify some of them as they are that shocking, not even the most warped mind could make them up.

Oh, and Dear Reader, please do not choke on your coffee as you read on……

Barclays CEO Jes Staley and Jeffrey Epstein

In December 2015, Jes Staley became CEO of Barclays, he left in shame and stepped down as CEO on November 1, 2021.

“The FCA has decided to fine former CEO of Barclays, James (Jes) Staley, £1.8 million and ban him from holding a senior management or significant influence function in the financial services industry.

The FCA has found that Mr Staley recklessly approved a letter sent by Barclays to the FCA, which contained two misleading statements, about the nature of his relationship with Jeffrey Epstein and the point of their last contact.”

Verify > https://www.fca.org.uk/news/press-releases/fca-decides-fine-ban-james-staley

Barclays went on to associate themselves with Lord Agnew via his Bounce Back Loan “Bounty Hunters”, but more on that coffee choker later.

Anne Boden, Leaves Starling Bank Board Amidst an FCA Investigation

Director, Former CEO and Founder of Starling Bank from 2014

Having been called out by the Former Counter Fraud Minister, Lord Agnew as an out and out blagger, using the Bounce Back Loan scheme to fill her pockets, Anne Boden decided to leg it from the bank as it was revealed its being investigated by the FCA for alleged Money Laundering offences!

Verify > https://www.ft.com/content/c54d039d-48ab-43ff-a9f1-7c4b11872a56

Starling said in its annual report that the Financial Conduct Authority had opened an investigation focused on “aspects of its anti-money laundering and financial crime systems and control framework”. It also warned that the impact of the probe could be material.

Verify > https://www.starlingbank.com/docs/annual-reports/Starling-Bank-Annual-Report-2024.pdf

Below is Lord Agnew dishing the dirt on Anne and Starling Bank (more on him shortly)

Sarah Munby

Sarah Munby is now the Permanent Secretary at the Department for Science, Innovation and Technology (DSIT).

She was Permanent Secretary at the Department for Business, Energy and Industrial Strategy (BEIS) from July 2020 to February 2023, so was not part of the original design of the scheme, but was involved later and she did join BEIS in July 2019 as Director General, Business Sectors.

However, in true Bounce Back Loan Scheme fashion, she was called out as being a disgusting liar for lying to the Public Accounts Committee, telling them a few great big porkies related to how long Lenders can pursue BBL borrowers and how quickly Lenders can and do slap in their claims on the Government guarantee.

Where do they get these people from. She caused a lot of alarm and distress to BBL’ers with her lies. Oh, and you may have see her at the Post Office Horizon Inquiry, but I digress……

Watch her being shamed below:

Lord Agnew

Lord Agnew was the Counter Fraud Minister at the time of the Bounce Back Loan Scheme, he resigned in shame, and after resigning he joined Manolete Partners as part of their Bounce Back Loan Bounty Hunting team as I like to call them.

They are basically ambulance chasers (litigation funders) and buy up claims against Directors who have blagged the Bounce Back Loan scheme for £1 and get a huge cut of the money they recover, very little if anything went back to the Public Purse for the money taxpayers forked out to Lenders via the guarantee, they soon got rid of him though.

Lord Agnew then returned as Director of his Payday Loan type firm in Norwich, which amazingly got a Bounce Back Loan, however that firm has been chastised no end of times by the Ombudsman for behaviour befitting a Loan Shark. You will find the documents on that on the link below.

Here is Lord Agnew throwing his toys out of the pram, blaming everyone bar himself for the failings of the Bounce Back Loan Scheme, and resigning on the spot.

I wont mention his links to Michelle Mone……

Sir Thomas Scholar

Bumbling Sir Tom Scholar was dragged in and grilled on the design of the Bounce Back Loan Scheme, he and Lord Agnew did not get on and in true Conservative Party fashion, Liz Truss along with Kwasi Kwarteng decided to pay him off and get rid of him.

If anyone knows where the bodies are buried regarding the BBL scheme it is Tom, as he was the Permanent Secretary to the Treasury from 2016 to 2022.

As he knows so much his pay off had to be huge, and of course it was. He bagged a whopping £335,000 pay off.

Verify > https://www.bbc.co.uk/news/uk-66257579

Here are his “best bits”

HSBC Chief Executive Noel Quinn Unexpectedly Steps Down

Noel Quinn was appointed Group Chief Executive in March 2020.

“After an intense five years, it is now the right time for me to get a better balance between my personal and business life,” Mr Quinn said.”

Verify > https://www.bbc.co.uk/news/articles/czkvnd4g44ro

Sir Alok Sharma Stood Down at the 2024 Elections

Alok Sharma was the Conservative MP for Reading West and Secretary of State for Business, Energy and Industrial Strategy, Department for Business, Energy and Industrial Strategy during the Pandemic and was instrumental in the design and launch of the Bounce Back Loan scheme.

He decided to leg it in 2024 and stood down.

He was knighted in 2023 by His Majesty King Charles III, for his services to tackling climate change.

Verify > https://www.theguardian.com/politics/2023/sep/26/alok-sharma-to-stand-down-as-mp-at-election

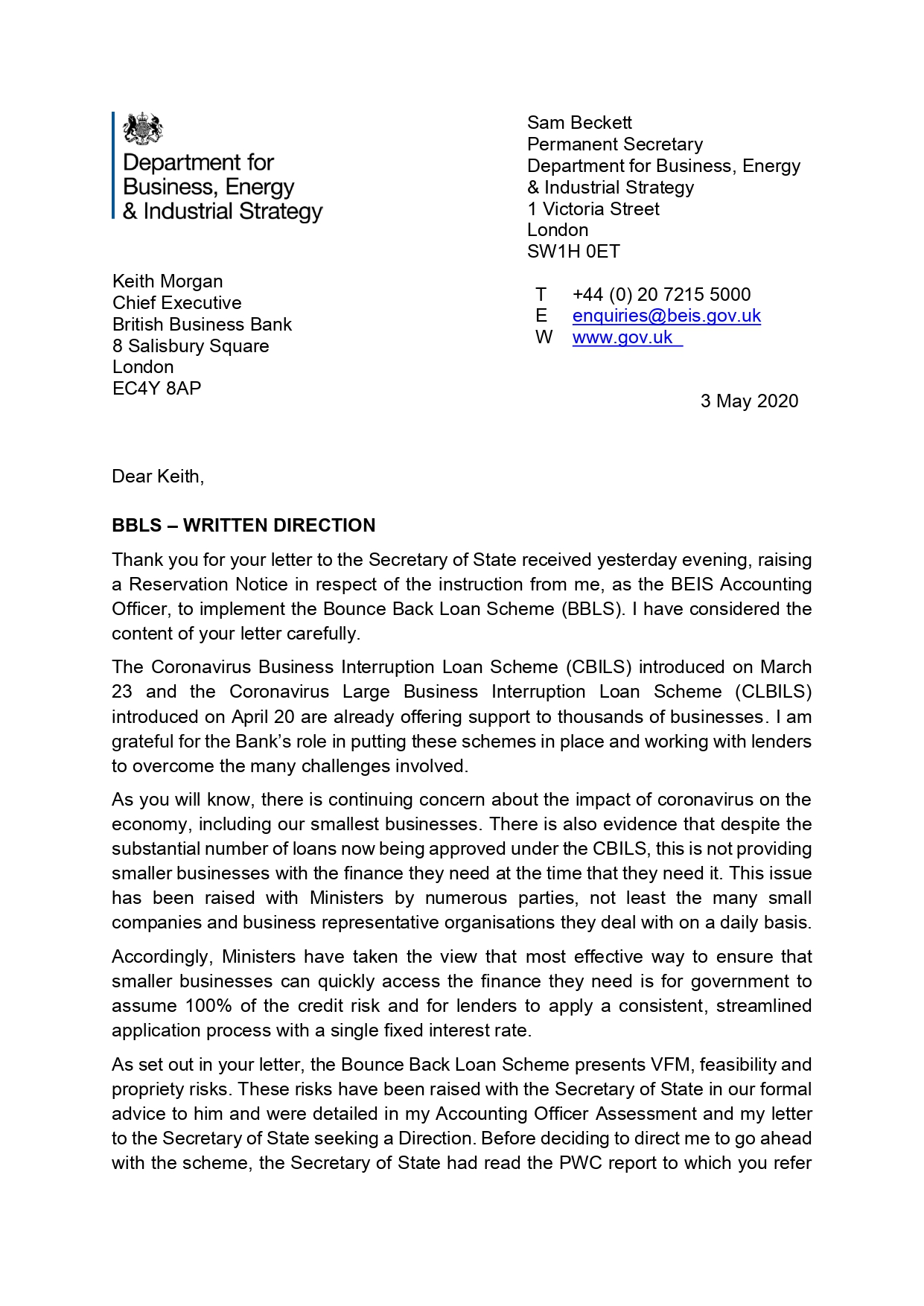

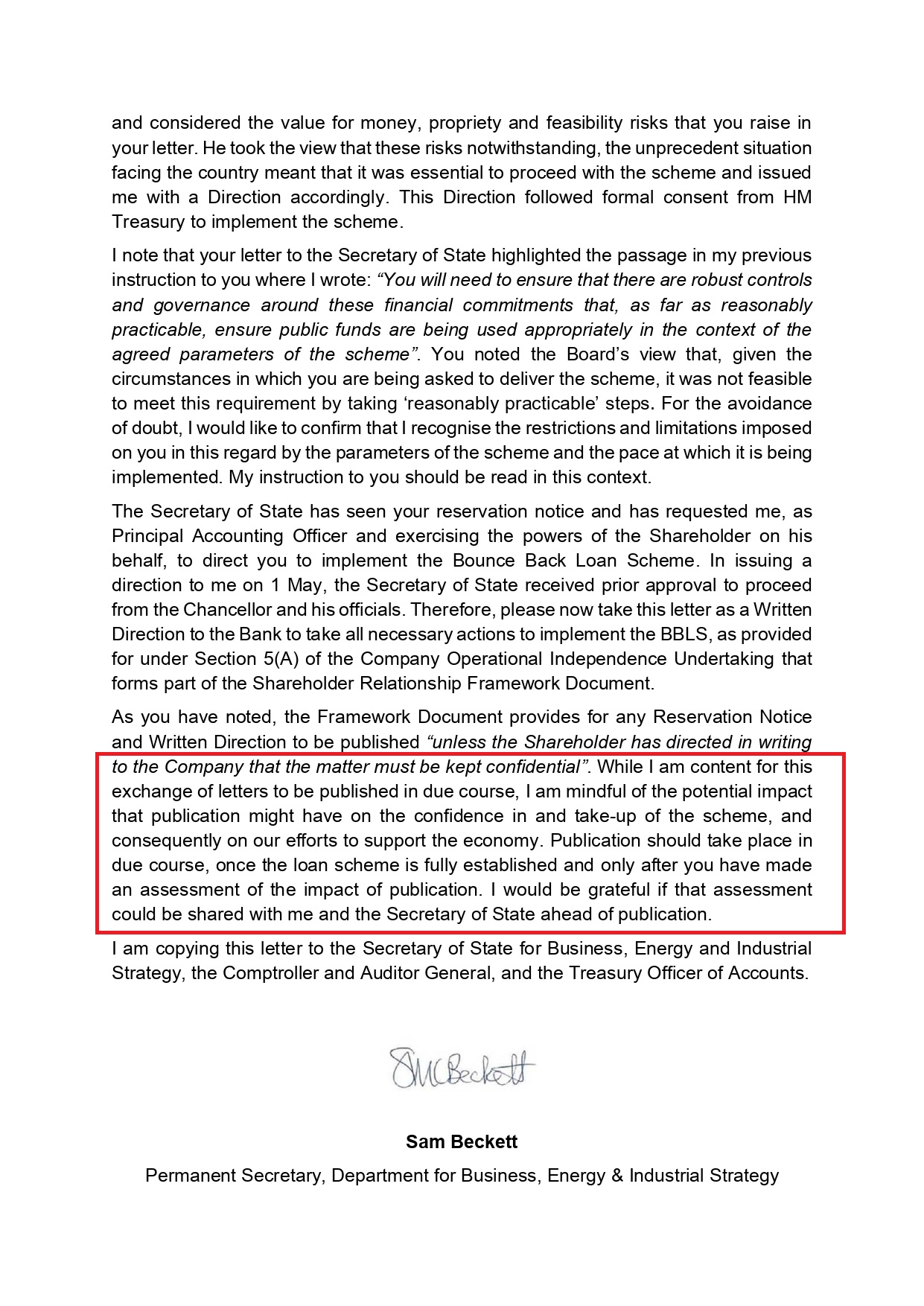

He was the Minister mentioned in the letter below that, when warned of the dangers of the Bounce Back Loan scheme, and vulnerable borrowers, by the British Business Bank, got his Permanent Secretary to ask for the matter to be hushed up until the scheme had become established, ordering them to make the scheme live, faults and all.

Keith Morgan to stand down as Chief Executive of the British Business Bank

Keith Morgan sent the famous “Reservation Letter” to Alok Sharma and the Government warning them of the dangers of the BBL scheme, that letter is a masterclass in covering your backside by the way.

Having been ordered to keep quiet about this letter, not long after he did finally release it Keith Morgan stepped down as planned and skipped out of the door knowing his conscience was clear.

Catherine Lewis La Torre to step down

Catherine Lewis La Torre replaced Keith Morgan as acting CEO of the British Business Bank, I uncovered some, let’s say unusual links with her and other people as you will see on the link below.

When a new replacement was finally found to take on the role of full time permanent CEO that being Louis Taylor.

Verify > https://www.british-business-bank.co.uk/about/who-we-are/our-people/louis-taylor

Catherine moved over to another department in the BBB that being British Patient Capital.

However, she too legged it in December 2023

Patrick Magee stands down as Chief Commercial Officer and Executive Director of the British Business Bank

In June 2017 Patrick was made Chief Commercial Officer of the British Business Bank.

I interviewed Patrick Magee in the video you can watch below and discussed the chaotic scenes as the Government scrambled to launch the BBL scheme with him taking a lead role.

He is one of the people I did feel sorry for, for whilst he said in the interview it was time to move on, I got the gut feeling, both on and off camera that he was only doing so due to pressure from above and those in power looking for scapegoats to blame for the BBL scheme.

Personally I wish him all the best for the future and would say he was a victim of the BBL scheme rather than someone to blame for it going pear-shaped.

He left the BBB in June 2022, days after I interviewed him.

NatWest boss Alison Rose Resigns Over Nigel Farage Debanking Row

Alison Rose was of course the CEO of NatWest during the entire length of the Bounce Back Loan scheme, and her career also came to a sudden end after the scandal surrounding Nigel Farage being debanked.

What everyone seems to also forget, and I have never heard it mentioned by Nigel, is that most BBL defaulters with most banks also get debanked and, often due to erroneous CIFAS fraud marker issued by dodgy BBL Lenders, never get access to a bank account again.

Nathan Bostock Leave Santander

Nathan Mark Bostock was the CEO of Santander UK, until leaving the role in 2022.

Verify > https://www.ft.com/content/9a073f3b-37ab-454e-a1bb-3d37a7e16242

On a side note, in January 2018, the Liberal Democrat leader Sir Vince Cable stated in Parliament that Bostock had been responsible for RBS’s Global Restructuring Group (GRG), when it had “engaged in an intentional strategy that resulted in mistreatment of business customers”.

Verify> https://www.thisismoney.co.uk/money/markets/article-5410239/Santander-investigates-bosss-toxic-past-RBS.html

António Horta-Osório leaves Lloyds Bank After 10 years as Chief Executive

So with the four big bank bosses who were part of the design of the BBL scheme now gone and the fast tracked Starling Bank also seeing their boss leg it, that just leaves Lloyds Bank, and you guessed it, he legged it in 2021

Verify > https://www.lloydsbankinggroup.com/insights/antonio-horta-osorio-leaves-group-after-10-years.html

So everyone who met with the Government in the days before the BBL scheme went live, and haggled and cobbled a deal together have now gone, bar of course little Rishi Sunak.

Did you have the on your Bounce Back Loan Bingo Card?

Tales from Rishi’s Village

There are rumours in Rishi’s village of Kirby Sigston up in Yorkshire, that in the dead of night locals can hear a twitching sound emitting from his sprawling Manor House, some say that is the sound of his sphincter twitching as he nervously awaits a visit from the Covid Corruption Commissioner.

On a Serious Note

If you are in a dark place with worries about your Bounce Back Loan, please give my helpline a call, its me you speak to and I can and will help you make sense of the scheme, something that Rishi will never dream of doing.