Due to the nature of the following news story, I wish to state, if you are affected by some of the cases you are about to read about or have been a victim yourself, help is always available, if you are in a dark place please reach out to the Samaritans who can be contacted night or day on 116 123.

The Lord Agnew “Kraken” Files

You will of course all know Lord Agnew, he was the chap tasked with being the Minister of State at the Cabinet Office and HM Treasury which included Counter Fraud, during the time the Bounce Back Loan scheme was live.

How can we forget the time he had the mother of all hissy fits in the Chamber of the House of Lords and blamed everyone else for the failings of that scheme, banged his papers on the desk, threw his resignation letter at a colleague, and minced out of the Chamber to rapturous applause and cheers.

I have it on very good authority some of the applause and cheers were from Members who were glad to see the back of him.

Spend a few minutes reliving that moment, as its a beautiful work of art…..

He has of course, since he legged it, gone on to all manner of new business ventures and jobs, whilst of course remaining as a Member of the House of Lords.

One of those new jobs is the face of a Bounce Back Loan Bounty Hunting firm, who, in layman’s terms, buys up the rights to chase people found to have misused Barclays BBL funds, buying up those rights for as little as £1 and in return if they manage to get anything they get a huge chunk of the money recovered.

Here are a just a couple of the many news updates I have compiled about that role

Anyway, what you may not know is that Lord Agnew is the Director of Match the Cash Limited trading as Guarantor My Loan, they offer loans at interest rates that would cause you to fall off your chair at.

He was Appointed Director of that Company from 29 August 2013 then Resigned on 24 October 2017, then not long after he resigned and put on one of the best, what can I call it, “acts” in the House of Lords Chamber seen for quite some time, and worthy of an Oscar, he became Director again on 1 June 2022.

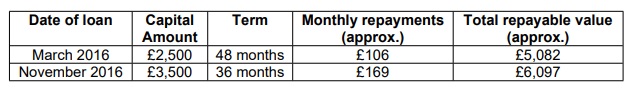

The interest charged on those loans really would make your hair curl, such as for example here are two loans that a young lady, sadly deep in the grip of a gambling problem that Match the Cash Limited had documents showing she was, got from his firm during his first stint as Director, during 2016.

I still shudder to think, who on God’s Green Earth thought the man offering loans like that to vulnerable people would be a spiffing choice in the Conservative Government and gave him the job as Minister of State at HM Treasury back on the 14th of February 2020. Oh, Boris was Prime Minister at that time, and Rishi Sunak the Chancellor, enough said.

Anyway, I can reveal that Match the Cash Limited trading as Guarantor My Loan have had their hands, legs and backsides slapped multiple times for some of the most heinous actions a very high interest rate loan provider could commit, a selection of the documents surrounding those cases and the outcomes I have loaded up below.

Before I do, here is Lord Agnew diverting attention away from himself, by laying into and accusing Starling Bank and in turn the much loved and respected CEO of Starling Bank at the time, Anne Elizabeth Boden MBE, of all manner of skulduggery.

Confirmed Cases of Grotesque Wrongdoing

Ok, here are the documents you may want to read, underneath each title are the documents for each case, due to the sheer number of them click on the first image under any of them and then use the “Next” button underneath each document to view the next one on each case.

Lending Money to Someone in the Grip of a Gambling Problem

Approving a Guarantor When He Was Being Abused/Coerced/ Manipulated

Irresponsible Lending of Two Loans to Another Gambling Addict

Failing to Act Fairly and Reasonably Towards a Customer

Lending Money to a Man Sadly in a Spiral of Debt

Irresponsible Lending of a Second Loan

Lend to a Customer Struggling to Manage His Existing Commitments

Knowingly Lending to a Customer That Would Lead to Him Experiencing Financial Difficulty

Issuing a Guarantor Loan and Failing to Act Fairly and Reasonably Towards the Customer

Issuing an Unaffordable Loan That Would Have Been Obvious if Reasonable Checks Were Carried Out

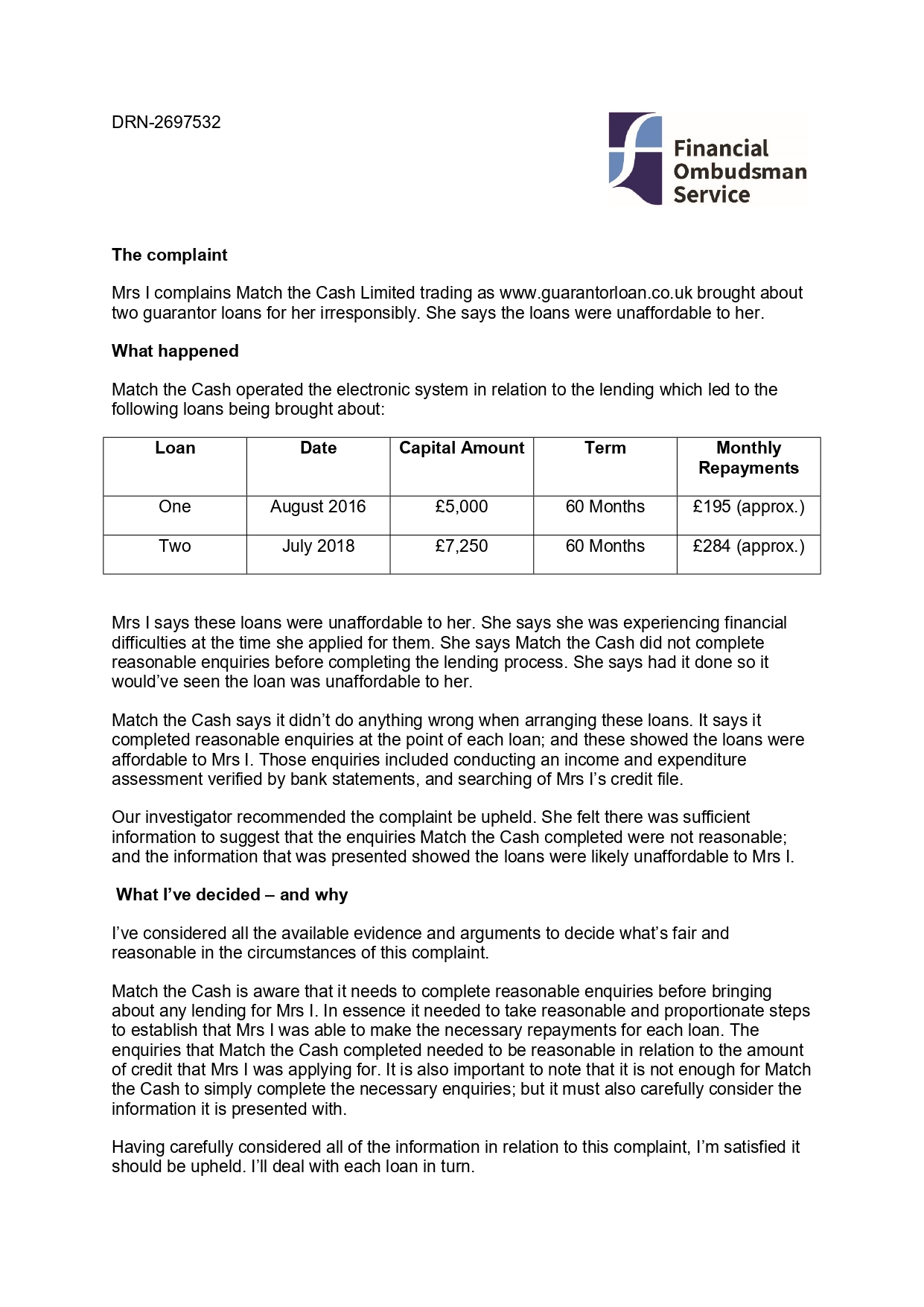

Giving Two Loans to Someone Not in a Position to Repay Such Lending Sustainably

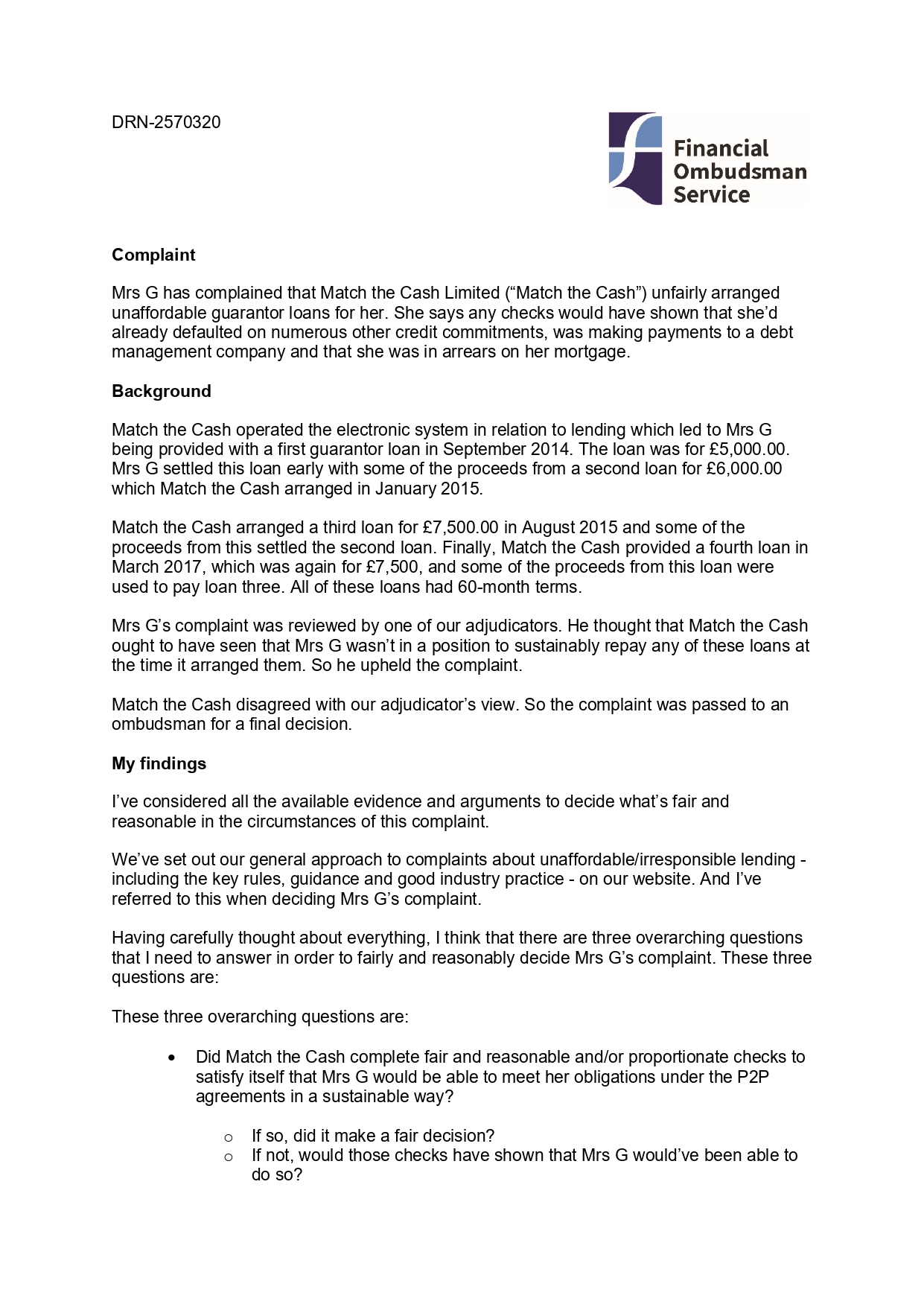

Not Carrying Out Fair and Reasonable and/or Proportionate Checks on a Customers 4 Loans

There are many other cases, but I think the ones above will give you some idea of what a character he really is.