Just a quick update on the Starling Bank saga, that being the Financial Conduct Authority investigating them for all manner of skulduggery, they have just been fined £29million as you will discover below.

Starling would have been fined £40,959,426, but it agreed to resolve these matters and so qualified for a 30% discount under the FCA’s processes. Let’s call that a “BBL Lenders Skulduggery Discount”….

Just as a reminder, Lord Agnew had them sussed a long time ago:

This adds more shame on the previous Conservative Government, as low and bloody behold Anne Boden was given a role by them! That role being the Chair of the “Women-Led High-Growth Enterprise Taskforce:

FCA fines Starling Bank £29m for failings in their financial crime systems and controls

The FCA has fined Starling Bank Limited £28,959,426 for financial crime failings related to its financial sanctions screening. It also repeatedly breached a requirement not to open accounts for high-risk customers.

Starling grew quickly, from approximately 43,000 customers in 2017 to 3.6 million in 2023. However, measures to tackle financial crime did not keep pace with its growth.

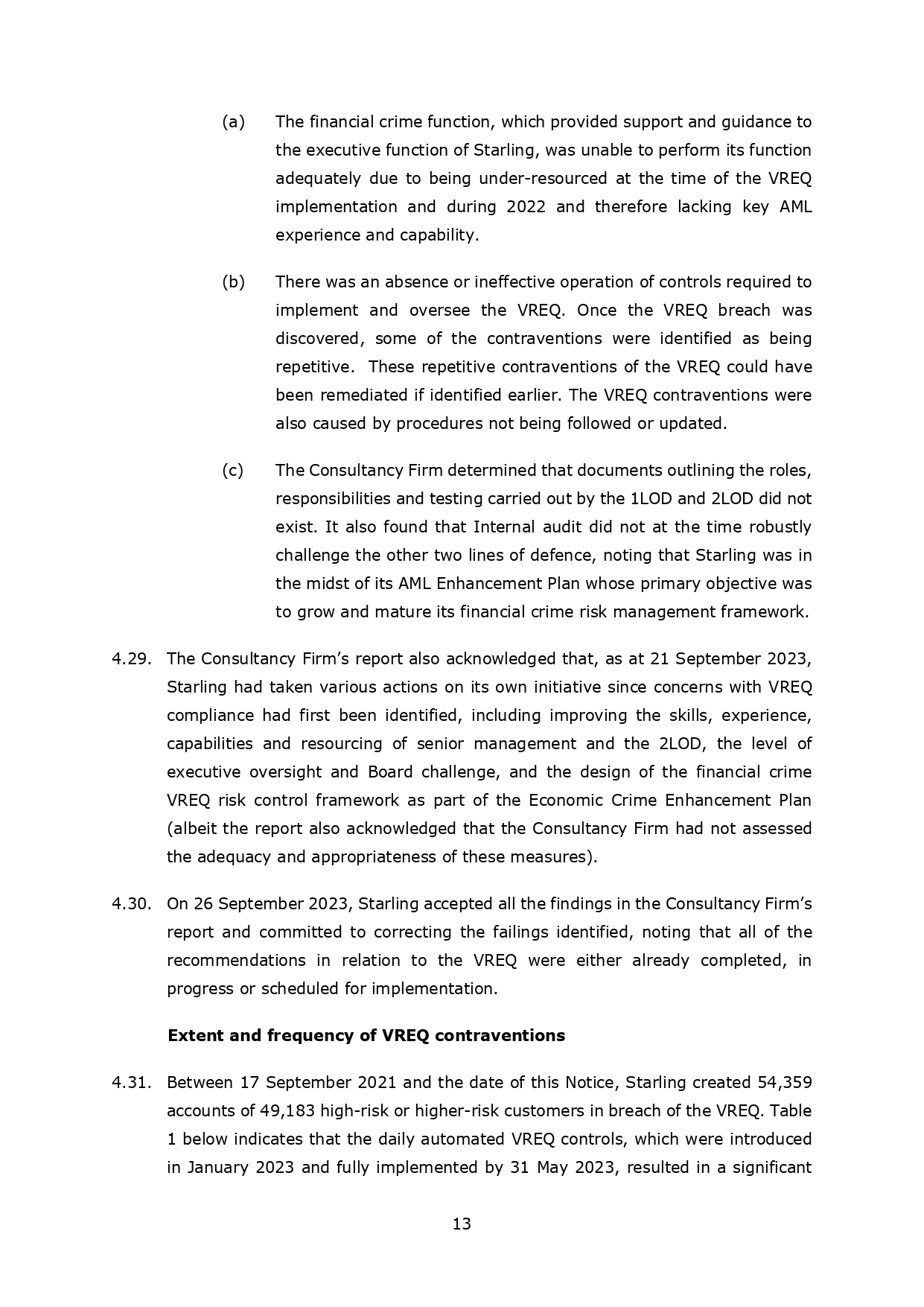

When the FCA reviewed financial crime controls at challenger banks in 2021, it identified serious concerns with the anti-money laundering and sanctions framework in place at Starling. The bank agreed to a requirement restricting it from opening new accounts for high-risk customers until this improved. Starling failed to comply and opened over 54,000 accounts for 49,000 high-risk customers between September 2021 and November 2023.

In January 2023, Starling became aware that its automated screening system had, since 2017, only been screening customers against a fraction of the full list of those subject to financial sanctions. A subsequent internal review identified systemic issues in its financial sanctions framework. Starling has since reported multiple potential breaches of financial sanctions to the relevant authorities.

Therese Chambers, Joint Executive Director of Enforcement and Market Oversight, commented:

‘Starling’s financial sanction screening controls were shockingly lax. It left the financial system wide open to criminals and those subject to sanctions. It compounded this by failing to properly comply with FCA requirements it had agreed to, which were put in place to lower the risk of Starling facilitating financial crime.’

This case took 14 months from opening to achieving an outcome – compared to an average of 42 months for cases closed in 2023/24. This is an example of how the FCA is improving the pace of its enforcement investigations.

Starling has established programmes to remediate these breaches and to enhance its wider financial crime control framework. The FCA continues to supervise firms to ensure that they have the right systems and controls to manage financial crime risks.

She Needs to Hand This Back

Final Notice for Starling Bank Limited