As you are probably aware if you followed my Twitter feed yesterday, “imaginary Bounce Back Loans” are now proving to be a major problem.

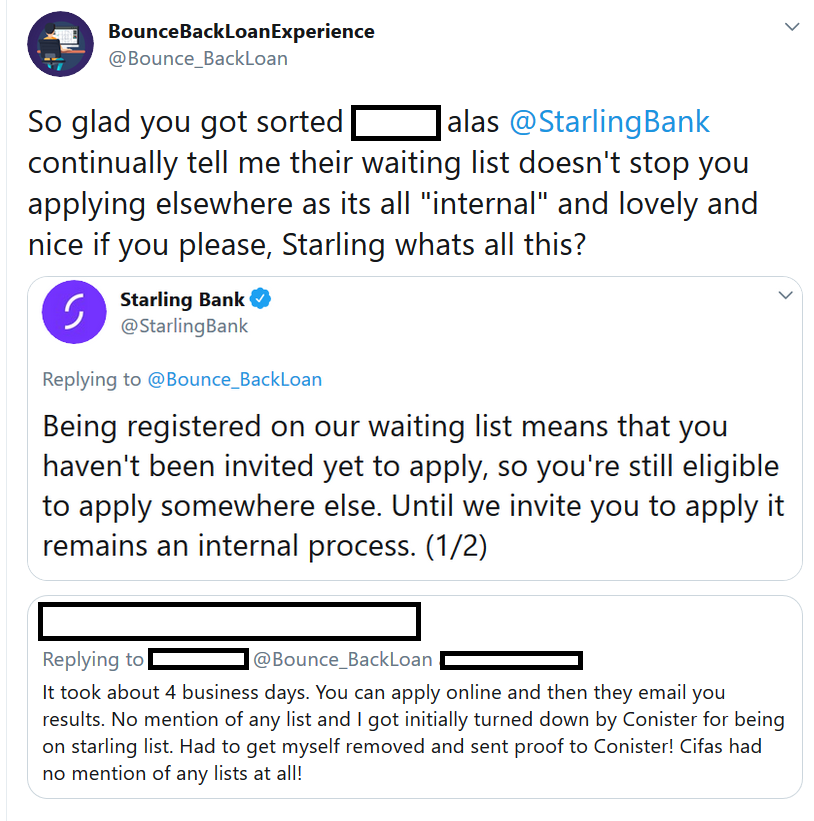

An imaginary Bounce Back Loan is exactly that, one that does not exist, and is caused by a British Business Bank accredited Bounce Back Loan lender seeing, on a database or register or inter-bank check that no one will admit exists, that you have applied for, are on or are have been on a BBL waiting list or interest list or have even been given a BBL by another lender.

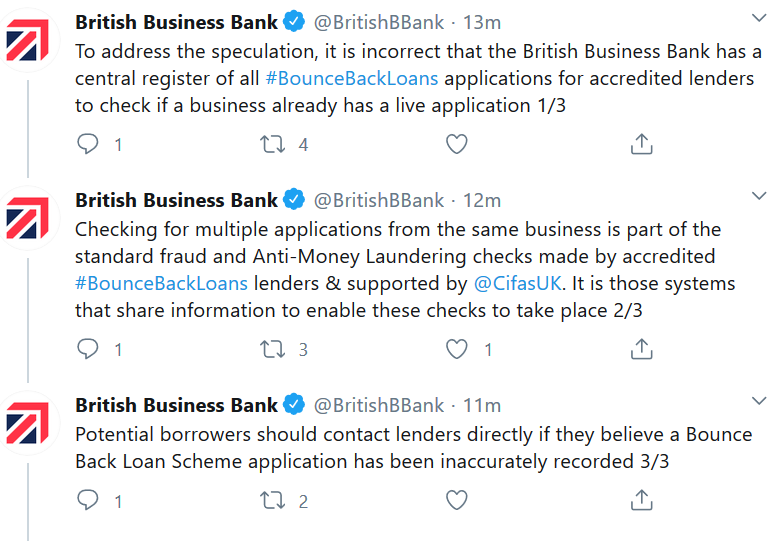

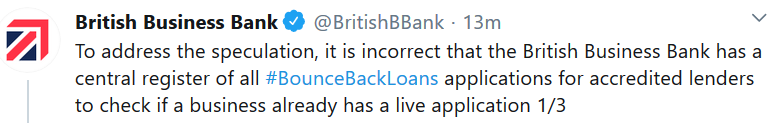

As for who operates that BBL database or register or inter-bank check list of BBL’s, well the British Business Bank have denied they do:

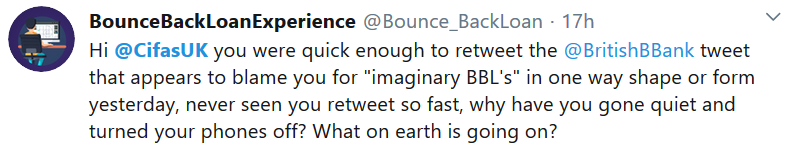

They suggest in some cryptic tweets that Cifas have such a list, as you can see from above, however Cifas have gone into hiding, have switched their phone lines off and are bizarrely in hiding!

I am not wasting any more of my valuable time with Cifas, any organisation that turns their phones off and does not respond in my opinion are a joke, and I am amazed at their lack of a response, but hey ho, suppose they will be getting a story together when they do come out of hiding. Shame on every single one of their team.

Do not come to me bleating later with any concocted story Cifas, you have proven to be a JOKE, people need answers and direction to help save their businesses and livelihoods and get a BBL in a hassle free way and you have failed to give them any such help or answers. YAWN zzzzzzzzzzzzzzz.

Oh, and your “sneaky” and some have said “colluding” and “smug” little retweet of the BBB’s tweet didn’t go unnoticed! Busted, what are you up to over there a “fraud” agency up to such tricks, how very, very strange and unbecoming of you, still not surprised in the slightest, nor are 10000’s of other people.

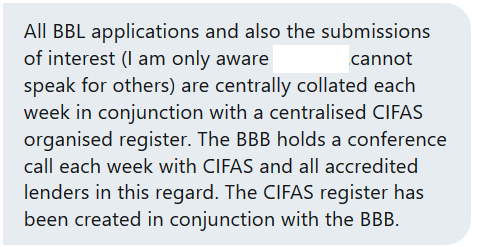

As for who operates/manages/oversees such a database or register or inter-bank check , well without anyone admitting they do and leaving themselves open to the very obvious potential legal action for the incorrect information, breaches of data on it, and the incorrect reading of information contained on it by BBL accredited lender processing teams, its anyone’s guess, and there are plenty of people who have their own ideas and opinions of who is behind it:

So, today I will be looking at how you can appeal a Bounce Back Loan decline, as there is now a very good chance you will be declined unfairly, based on any of the reasons surrounding an imaginary Bounce Back Loan I have highlighted above, and you will not get sense out of any bank or other organisation as proven.

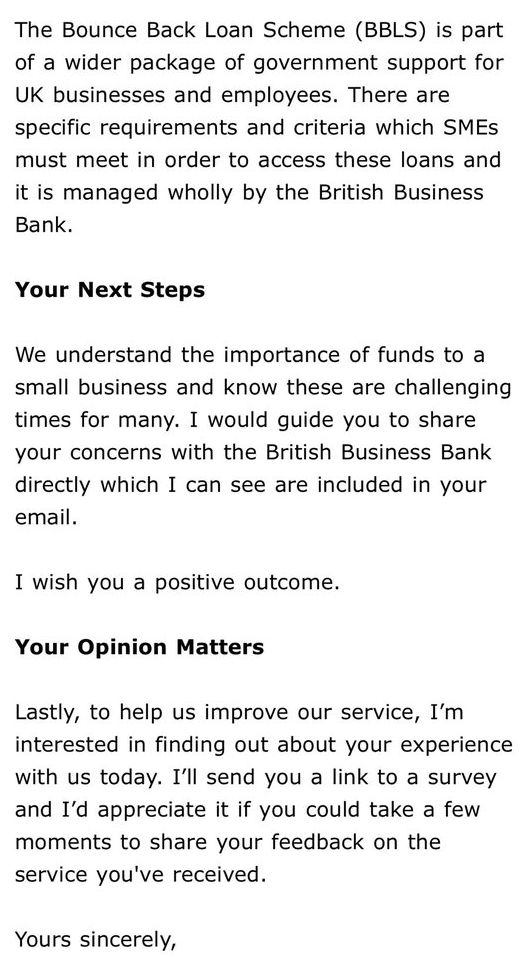

In fact, upon asking the FCA to assist in being declined, one applicant got the following reply:

Be aware some banks, namely Metro Bank, Clydesdale, Yorkshire and even now Barclays are initially approving people for a Bounce Back Loan, and then declining them for having an imaginary Bounce Back Loan.

Sadly, the onus is on YOU to initially determine just why you have been declined for a BBL, the banks often decline you without telling you. So, therefore if you are declined ask them if it is due to them checking a database/register or doing an inter-bank check and seeing you apparently being listed on whichever one they use the name of.

Be aware also, if you own more than one business and have been declined for one of them it could be that your name and not the company name is the cause of the decline, as a lender may see your name on the database/register/inter-bank check and are using that in the mistaken belief to presume incorrectly that you have a BBL for the additional company or companies you own and are applying for a BBL for.

Get Proof You Have Not Got a BBL

The only way that you are going to be able to get proof that you do not have a Bounce Back Loan for any business that you own is by contacting the bank who have declined you and asking them which bank they mistakenly believe you have a Bounce Back Loan from.

Declined a Bounce Back Loan?

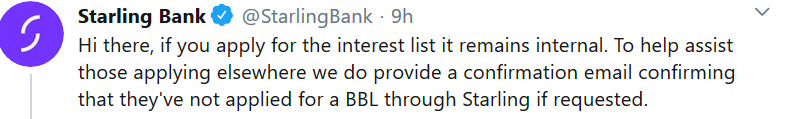

Starling Bank – Bizarrely Starling Bank claim that you will not appear as having shown an interest in a BBL on any database/register or inter-bank check when your name is on their “interest” or as it is also known their “waiting” list.

However, they will give you proof if you do experience a problem:

So why on God’s Green earth would they offer an email to show other lenders if there is no chance of you appearing on a database/register or inter-bank check?

If you have been declined by a lender and they name Starling Bank as the bank you have an “imaginary” BBL at then ask for such a “confirmation email”, many people have and have then been able to go on to get a decline overturned with another bank.

If you have been declined for a Bounce Back Loan with Starling Bank, you need to be aware that they have publicly made it known they have their own criteria bolted on top of the standard British Business Bank listed BBL criteria.

As such, if they do not like anything what so ever about you, your business or anything else they can and may just decline you and toss you aside like a used tissue and will rarely if ever allow you to appeal then overturn their decline, so be warned they do not play by the same rules other banks do.

They have been given the green-light shockingly to act in that way by the British Business Bank and HM Treasury are also aware of that and have chosen to shrug their shoulders and allow Starling Bank to get away with declining anyone they don’t like for any reason.

What did stick in my throat when that bank did decline 3000+ applicants one Friday night back in May, was that Anne Boden was very quick to point out some who had applied and the bank declined were “cryptocurrency traders” to give the impression she and her bank had acted prudently in declining them, it turned out the majority of declines were “standard” business types.

What has since tickled me and many others and has somewhat turned her into an industry laughing stock, is that one of the co-founders of Starling Bank has gone on to launch, wait for it, a cryptocurrency exchange! Sheesh.

Being on their waiting/interest list is in no way a guarantee you will get a BBL or even be invited to apply for one.

anne@starlingbank.co.uk

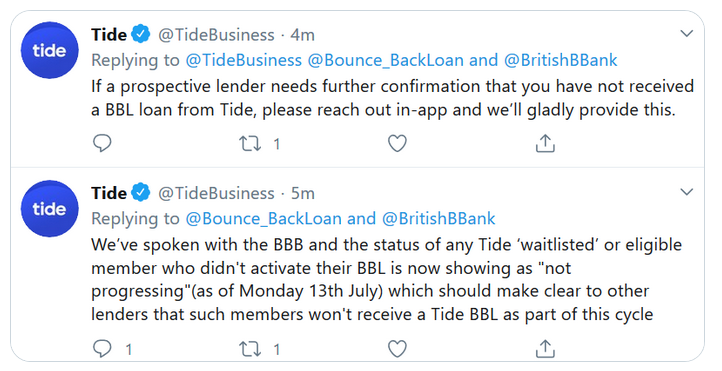

Tide – Now if you are or have been on the Tide waiting list there is a very, very good chance you are going to be declined a BBL from another lender as your name could very likely be listed on the database/register or inter-bank check as having shown an interest in a BBL, some lenders take that interest as a reason to decline a BBL.

Once again other banks that have declined you for a Bounce Back Loan if you get a letter off Tide saying you have not had a BBL from them can overturn that decline, Tide do openly admit they offer such a letter, and even admit to telling the British Business Bank about that problem:

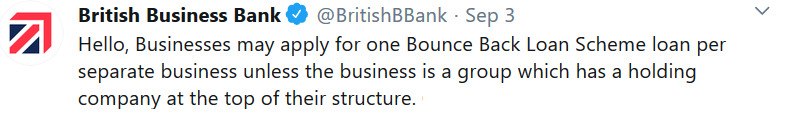

The same British Business Bank that deny they operate any such database/register or inter-bank check.:

Why would Tide tell the British Business Bank that an application put in with them is now showing “not progressing”, where is it showing “not progressing”, is it displaying that on the database/register or inter-bank check that the British Business Bank say they do not have and know nothing about? Oh what fun.

Barclays: Barclays have recently massively upped their game regarding processing of Bounce Back Loans, however they will decline you for a BBL if they see you on any database/register or inter-bank check, as either having shown an interest in, I.E. being on a waiting/interest list or your name and not necessarily your business name is shown on a BBL you may have with another bank for another business you own.

Just to be 100% clear, you CAN apply for a BBL for each business you own, as long as each business is eligible and meets the criteria and does not have a holding company at the top of the structure:

If you have been declined by Barclays, all is not lost as they are 100% aware of the database/register or inter-bank check and will work with you to get a decline overturned. However, it is all dependent on who your Business Manager is, as some sadly still do not have a clue about the problem.

Once again you need to ask that Business Manager which bank or banks they believe you have a BBL with, and then get a letter from that bank letting you/them know you have not got a BBL with them.

If Barclays say you have a BBL with a lender for another business you own and you do, then simply furnish them with a copy of the agreement from that lender for the other business showing them the name of that business, to prove it is for a different/seperate business and not the one you are applying for.

Jes.staley@barclays.com

Metro Bank – Boy do Metro Bank have a problem, they not only misread the database/register or inter-bank check but have also been declining people after approving them and paying them out.

Now, if you fall into the latter category of applicant, the onus is on you to track down a Business Manager and appeal your decision.

If you phone up the bank to complain, there is an exceedingly high chance that you will simply be told to “write into the bank” with your complaint.

DO NOT DO SO, track down either in branch or by email/phone, but ideally in branch a Business Manager, stand your ground and get him or her to review your decline.

I have seen plenty of very strong willed people do just that and if you do get a good Business Manager they will look at a review, but be warned, much like they did when they only offered in branch new account openings, they will ask for all manner of documents to overturn a decline.

So go armed with everything you will need to prove you are 100% legit, and you are eligible for a BBL. Sadly though, Metro Bank do not have an “appetite” for some business types, so if your business operates in a certain market sector they may not allow you to open an account and may not entertain a review of a decline.

Clydesdale/Yorkshire Bank – There is a very high chance that you will be approved for a BBL with Clydesdale and Yorkshire Bank if you open a business account and obviously are eligible for a BBL but a very high chance if you have an “imaginary BBL” listed on the database/register or inter-bank check that approval will be declined at a very late stage.

However, both banks know the problem with the database/register or inter-bank check “imaginary BBL” situation and will happily work with you to get it sorted out, once you send them in proof you have not got a BBL with another lender.

They have been doing that for months, so I have all confidence in their team, who should be praised for helping many, many people overcome that problem, which is often due to applicants being on the now defunct and wretched Tide waiting list by the way.

david.duffy@cybg.com

HSBC – You could be declined for a BBL with HSBC for a range of different reasons, if you have applied for a feeder account their feeder account portal has proven to be riddled with errors and technical problems.

You could be declined simply for not having loaded up your I.D documents when you believe that you have done so, and be blissfully unaware your documents didn’t load, the portal will then “time you out” and close your applicant and you will possibly get an email saying your application has been declined but not be aware it is due to that problem/time out.

It is also possible that you have been declined due to a KYC credit reference check or similar.

The only way to appeal a decision quickly is to contact their CEO team and get them to allocate you a case handler, so make sure that is what you do and keep badgering them until a case manager contacts you and sorts the problem out, if they can.

Ian.Stuart@hsbc.com

noelpquinn@hsbc.com

Conister – Conister are a gift that keeps on giving, but not in a good way, their inexperience at processing and issuing Bounce Back Loans means their staff members keep making errors and mistakes and only when you point them out will they allow a decline to become an approval.

They flat out decline anyone if they check the database/register or inter-bank check and see you have got a BBL with any other lender or have been on a waiting/interest list, they also appear to be saying to many people they have a Cifas marker.

A Cifas marker is a fraud marker, but many people know they have not got such a maker, which does lead one to believe they are mixing up that marker with Cifas being the organisation behind the mysterious database/register or inter-bank check.

Conister also scrape/copy email addresses off the database/register or inter-bank check and reply to applicants with those email addresses supplied to other banks and not them, and not the one an applicant may have listed on the application form for a BBL with them. I have 100% proof of that and an admission from them that they have done that, in fact another one came to light just yesterday. Data breach?

Long story short, they will offer to review a decline based on you not having a BBL with another lender for the business you own if you supply them with proof, but you will have to get them to name the lender which could be HSBC, Tide or one of several other banks.

But, their £10 million they set aside to payout BBL’s is quickly vanishing so if you have been declined there may not be enough money in the pot left for them to correct THEIR mistake and pay you out. Whilst that is not fair their mistake and the problem of imaginary BBLs listed on the database/register or inter-bank check has probably cost you a chance of getting a BBL from them.

Someone needs to be accountable for that.

Below is the COO of Conister, who fair play to him has shuffled people up their list that I have sent over to him to have a BBL decline reviewed and overturned:

haseeb.qureshi@conisterbank.co.im

Delayed Bounce Back Loan Payouts

One final thing to note, many banks may say once you have been approved payment will be in 24 hours, be aware that many of them do sadly miss that payout timeline, so if you have been approved and your BBL does not hit your account in 24 hours do not be overly concerned, as it could take a day or two longer.

That is certainly the case with HSBC BBL’s paid via a feeder account and Metro Bank to name but two banks.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website