Alas, I take no pleasure in exposing the following and wish to hereby invoke my whistle-blower protection afforded to me recently by a certain Government department in doing so.

Now, if you have been following my Twitter feed for any length of time or have been reading my daily BBL updates on this website, you will know I have for months been warning the British Business Bank that the Bounce Back Loan Database (or whatever additional names it goes by) is flawed.

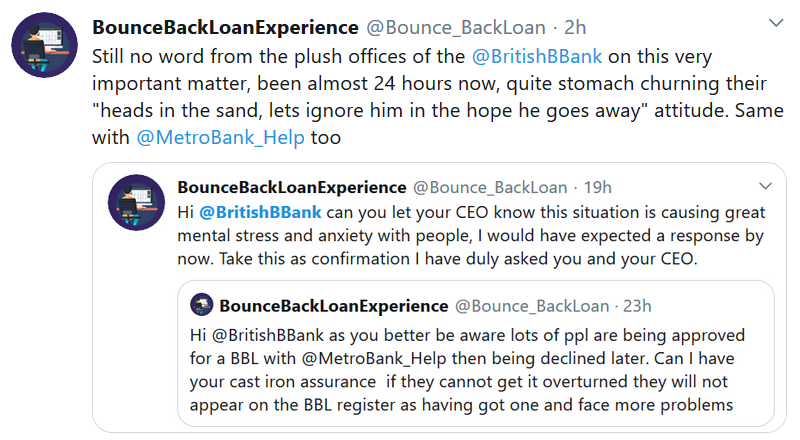

Tweet after tweet to the British Business Bank about it have been ignored, surprisingly though they always very quickly answer my tweets on most other topics/subjects.

Essence of the BBL Database Problem

The essence of the problem is that some bank staff are not using that database correctly.

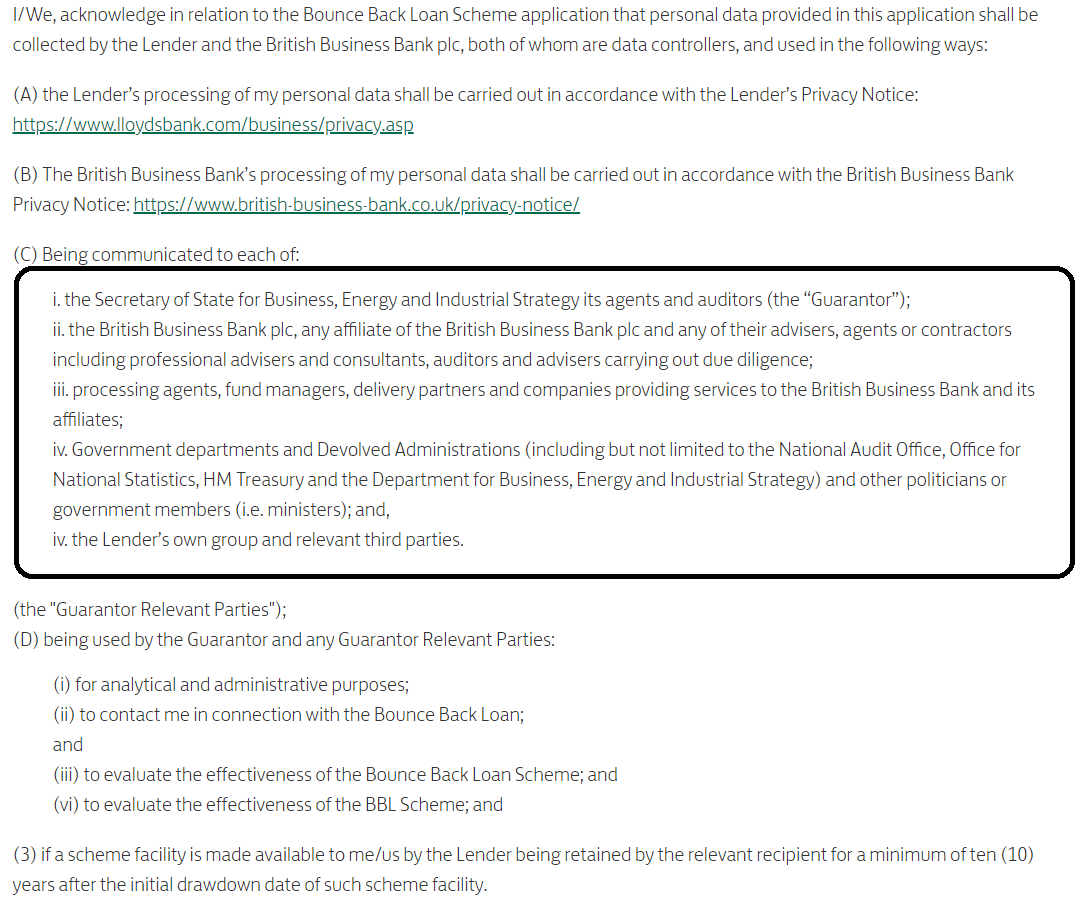

That database exists so that a British Business Bank Bounce Back Loan accredited lender can double check to see if any BBL applicant has a BBL with another bank, and that is of course something they must do.

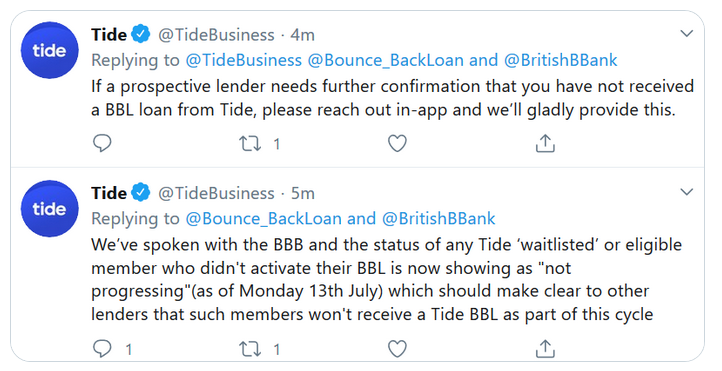

However, when BBL applicants added their name to the Tide BBL waiting list, it appears their details were added to the database as a potential BBL in progress, rather than just then showing an interest in a BBL and being on a huge waiting list to hopefully secure one.

As you will probably be aware Tide quickly used up their allocated funds to issue BBL’s and have been unable to secure any more funds, and as such they closed their waiting list and ceased lending as part of the BBL scheme.

Fully aware of the problem with applicants details being added onto the BBL database they have, according to them alerted the British Business Bank, and as of July the 13th any other lender scanning the BBL database/register will see (or should do) anyone who may or have been on the Tide waiting list having not received one but has simply shown an interest in one.

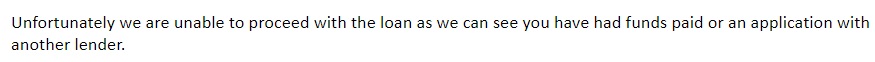

I know for a fact having had multiple verified reports of applicants applying with other banks for a BBL such as Clydesdale and Yorkshire Bank that their staff members will initially approve someone for a BBL but upon checking the BBL database to register that loan will see an applicant on the Tide waiting list and will sadly then decline that applicant.

In all fairness to the team at those banks, if that applicant gets it in writing they have not received a BBL from Tide they will overturn the decline and go on to approve the BBL once again.

Just imagine though, if you had simply been on the Tide waiting list, then discover they had no more money to lend, then had applied to for example Clydesdale Bank for a bank account, then finally got one, then applied for a BBL how you would feel if you got approved then got declined.

I am worried about how many people are blissfully unaware of the Tide waiting list problem, and how many people did not appeal that decline and have been left bereft of a BBL. That is something the British Business Bank should also be worried about.

They should immediately launch a full audit of both Clydesdale and Yorkshire Bank and find out if anyone has been declined a BBL for simply being on the now defunct Tide waiting list and contact them and put the situation right.

I do of course expect the new CEO of the British Business Bank to swoop into action, as I am sure she will be very eager to massively compensate anyone that has been declined the right to apply for or who has faced delays in getting a Bounce Back Loan due to the flaw in the database/register, and save their business and livelihood based on her employees apparently ignoring my reporting of said problem repeatedly.

I will not hold my breath on that one, based on their previous history.

Scraping Data from the BBL Database

Now, let me move onto a much more serious breach of the data held on the BBL database, and the culprit this time is Conister.

I do of course get fed a constant stream of information from Bounce Back Loan applicants 24 hours a day, and the following is most disturbing and once again needs a full investigation.

If you are the boss of Lloyds Bank, Tide or in fact any other bank part of the Bounce Back Loan scheme, pull up your chair and read and digest, oh and do not drink anything as what I am about to expose will possibly see you spitting out that drink…..

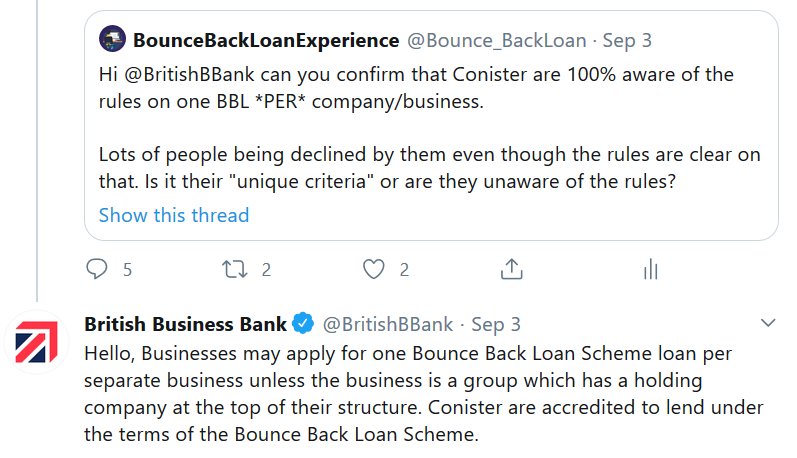

I was contacted by two Bounce Back Loan applicants who had applied with Conister for a Bounce Back Loan and were declined.

One of them for being on the Tide waiting list and the other was applying for a BBL for a second business they own. The rules of the BBL scheme are clear, but just so you know here are the basics of the rules as per applying for a BBL for a second company you may own:

The applicant who had applied for a BBL with Conister for a second business sent off the application form using an email address unique to the business they were applying for, however to their surprise the decline email from Conister was sent out to the email address for their Lloyds Bank BBL application for another business they own and for reference was granted a BBL.

That puzzled them greatly and did of course concern them as how on God’s green earth had Conister got that email address. I told that applicant to email immediately the COO of Conister and demand an answer, and that is what they did.

A reply was hastily sent out by the COO who instructed a staff member to check into this, and despite initial waffle they finally admitted that they had scraped/copied the email address off the BBL database for the Lloyd’s Bank Bounce Back Loan application and had sent out the decline to that email address, and not the one used by the applicant to apply for a BBL with Conister.

That opens up a whole can of worms regarding privacy issues of course and a data breach, however what then happened shows you just how messed up and “dubious” the whole BBL saga is, but it did help that applicant.

The staff member then hastily reviewed the decline which was suddenly turned into an approval and the applicant has been sent out the Echo-Sign forms and I have just had confirmation they have been paid out their BBL in full.

One could say that BBL was paid out either to hush up the applicant and pacify them or that Conister wanted the problem to go away or they simply realised their error and put it right speedily. Whichever one of them it was it leaves an unbelievably bad taste in the mouth and warrants a full investigation by the British Business Bank.

However, many other people have been declined for a BBL wrongly by Conister and have not heard back from them, possibly due to the fact their decline email has gone to the email address that applicant may have used to apply with another bank?

As always, all of the above is backed up by cold hard proof, and should the British Business Bank or any auditing company or investigation team instructed to investigate the ongoing BBL saga wish to contact me you may do just that to see that proof. I am always more than happy to help.

Here is an overview of the proof, edited to protect the identity of the applicant, but posted with their approval.

Initial reply to the email sent to the COO of Conister:

Reply from staff member tasked with dealing with the complaint:

Reply after asking about the wrong email address:

Email sent to that staff member:

Reply from staff member admitting all:

What a way to run a bank! Not sure how Lloyd’s Bank will take the above, knowing one of their customers has had their email address supplied to them used by another bank, but then again looking at the way the British Business Bank have been ignoring me due to flaw after flaw with that database/register and the fact their privacy policy does imply, all and sundry can have a nosy at that register, they may not care, but you should be worried about your personal data/information even if they are very clearly not.

Oh, and to my army of Followers and Lurkers on Twitter and website visitors, if you also experienced the above I.E your decline email going to an email address you didn’t apply with, then I would contact the COO of Conister, they owe you a review of your application at the very least, and possibly a BBL too based on what they have done above.

The Bounce Back Loan Scheme MUST Be Extended

Based on the fact the BBL register/database, call it what you will is being misread and oh so obviously being misused, and with recent events such as Metro Bank now approving BBL’s then declining them, that is seeing innocent applicants being denied the right to apply elsewhere in a smooth and hassle free type of way.

That could see those now scrambling to get a Bounce Back Loan facing added and unnecessary delays , by for example them being forced to get proof they have not received a BBL from another lender to then supply to another lender they have approached, much more so with Bank customer service teams being overwhelmed and not being able to handle the volume of customers contacting them, or simply giving out incorrect information.

Failure to act now and correct the errors made by all accredited lenders could see it coming back to “bite them on the bottom”.

I know many lenders are in secret and not so secrets talks with each other on how to manage events after the scheme ends, but just so you know, to those interested, the same can be said of those unfairly declined the right to apply for and get a Bounce Back Loan and other aspects of the scheme, and legal minds are lining up to step in and help them and others. It cuts both ways as the saying goes.

To those who are experiencing anxiety, worries and even severe mental health related problems with any aspect of the Bounce Back Loan scheme, I am always here to listen and help if required, I have committed over 4 months to that cause and will be here until the day the scheme ends, whenever that is, and possibly beyond too….

UPDATE

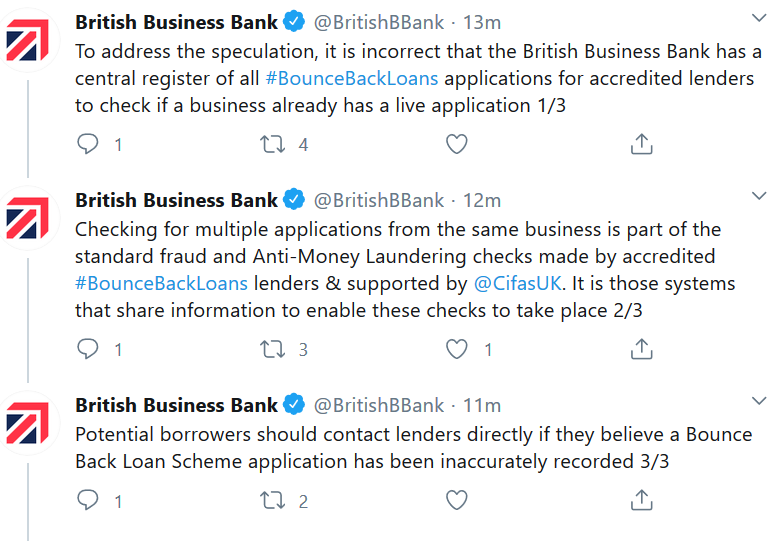

Within minutes of making this expose live, the British Business Bank, for the first time ever (even though I have been telling them for months) replied to the logging of BBL’s:

Those of you who have experienced the above know its too late. They have been part of the problem by not addressing the problem for a long long time.

Shame on you BBB.