You will, no doubt, have heard Rachel Reeves screeching “we want our money back“, and how she will be installing a Covid Corruption Commissioner, to chase down and attempt to recover money from those who scammed the Public Purse during the pandemic.

That is excellent news, and if she sets out rounding up those who outrageously blagged us with their dodgy PPE VIP Lane Contracts, and those who gave them those contracts, I am sure we will all back her.

But when it comes to the Bounce Back Loan scheme, Civil Servants over at the British Business Bank and in the Department for Business and Trade have been and will be sitting down with Rachel and her team and explaining some home truths, such as how chasing those who have defaulted as they cannot repay, will lead to a devasting sequence of consequences that nobody wants to see happening.

For the record I have spoken directly to her top team and will hopefully be continuing to speak to them moving forward, they did give me the following quote to help allay fears that BBL defaulters may have about Labour becoming the ruling party:

To be fair to them, Labour did step in and help me get around £2.5million in fraudulent fees and charges that I uncovered the BBL Lender, Tide, and their debt collectors were trying to scam out of their BBL defaulters pockets, so I am confident that they are true to their word.

They stepped in to help when I reached out to them having been batted aside and even threatened by the previous Conservative Government, who flatly refused to step in and help those BBL defaulters being scammed.

If you have a strong stomach, you will find out more about that saga on the following link >

But let us get back onto the main topic, that being how the system is currently set up when it comes to Bounce Back Loan defaults, and who can be chased and hounded and who cannot and should not.

Negative Credit File Markers the Main “Punishment” for Most BBL Defaulters

The punishment for defaulting on a Bounce Back Loan when you didn’t blag that loan is going to be nothing more or less terrifying than a negative credit file marker against your LTD Company, or against your trading as name if you are a Sole Trader.

It is worth pointing out though, that whilst you will see a BBL and any default on the credit file of a Limited Company, when it comes to a Sole Trader, BBLs do not show on the personal credit files of Sole Traders, they sit on a file that usually no one ever sees or even knows exists, that being the “trading as” name of that sole trader.

So if you are a Sole Trader and wondering why your BBL isn’t showing on your personal credit file, even in default, that is why. The only way you will see that BBL is by doing a Subject Access Request to the credit reference agencies, giving them your trading as name, and then they will try and match it all up and send you the file.

If you are eager to see your trading as name credit file, that you probably never knew existed, and no one ever sees, then here is the form that you will need to fill in:

Download it, in PDF form here > https://www.experian.co.uk/assets/consumer/stat-report/Stat-credit-report-app-non-limited.pdf

Just to reiterate, if you are a Sole Trader, the “punishment” for defaulting on a BBL without you having done anything dodgy, is that you will get a negative credit file marker on a credit file you and everyone else will never see, won’t be aware of, and probably didn’t know exists.

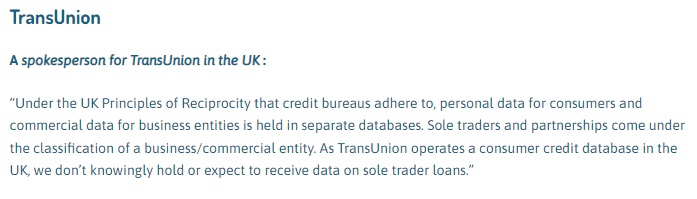

This is all due to the UK Principals of Reciprocity, very kindly explained to me below by TransUnion UK

Any Lender that only reports to TransUnion UK and not the others such as Experian, Equifax etc will never list your Bounce Back Loan at all, anywhere, due to what they have said above, and the other Lenders that report to one or more of the other main Credit Reference Agencies will only list your Sole Trader BBL on that separate “trading as” name file.

BBL Agreements, Contracts and Lenders Handbook

You can view the actual agreements agreed and signed by Lenders and the Government and some additional documents using the following links:

The Official British Business Bank Bounce Back Loan Scheme Lenders Manual

The Bounce Back Loan Guarantee Portal Manual for Arrears, Claims and Recoveries

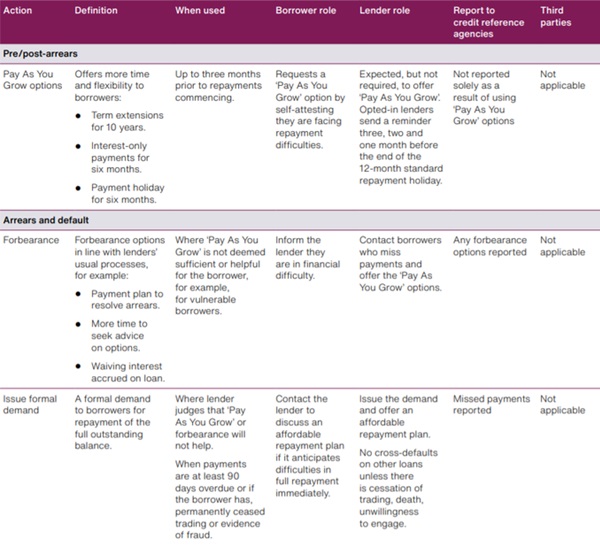

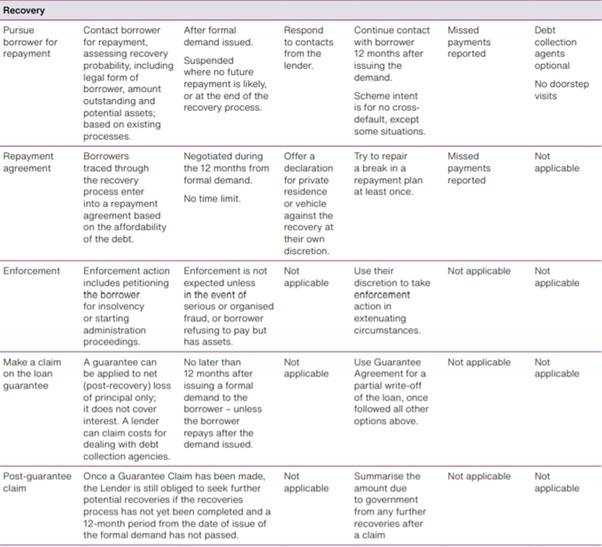

If you are new here and haven’t seen the entire process that Lenders are expected to follow with arrears, defaults and recoveries and what a Borrower should do to ensure a smooth journey through the process, then you can view that process below.

For the record that information was supplied to me by the National Audit Office after I quizzed them about it and badgered them to make it available when taking part in two of their investigations into the BBL Scheme, (yes I have been there and got the T-Shirt, still, the National Audit Office can never unhear what you tell them, so my chats to them did some good) and they very kindly agreed to make it public. You can thank me later for that dear Reader!

External National Audit Office Links:

Investigation into the Bounce Back Loan Scheme – NAO report

The Bounce Back Loan Scheme: an update – NAO report

“Playing the Game” When Moving From Arrears to a BBL Default

It might not be apparent to you yet, if you are not in arrears or haven’t defaulted on your Bounce Back Loan, but there is a game being played by everyone involved in the BBL scheme, that includes both the Lenders and the Government but borrowers also need to actively play that game too.

So, let me guide you through the initial arrears process and then progressing though to a default with a BBL.

Below I will point out what you need to do to keep your Lender onside and holding your hand as you both play the game together and skip through the BBL default journey together, as by doing so you both open up a world of magic for each of you, by working together and in unison.

Not much will happen if you miss one BBL repayment, or for that matter two repayments, however the usual key for a Bounce Back Loan default is you missing the third repayment.

I would strongly advise you to call your BBL Lender once you know you are going to miss your first BBL repayment, so they are aware and can advise you accordingly.

When you call your Lender, they needs to hear three things from you when you call them, firstly that you are unable to make your next BBL repayments, secondly, if you are in anyway vulnerable, whether that is feeling sick, worried, full of anxiety, can’t sleep, or any of the literally hundreds of other things that can come over you when you are worried and concerned, and thirdly you need to ask them can they offer you any additional help.

So call them pronto and say:

- I cannot afford to make any more repayments on my BBL moving forward.

- Next, lay on thick any and all issues and vulnerabilities the BBL is causing you.

- Ask them is there any additional help they can give you.

Be aware, dependant what you tell them as point number two, they are likely to say something along the lines of “do you mind if I make a note of that”, you say of course/yes, as they will then make a note alongside your account that you are vulnerable. Do not hold back from telling them everything negative that the BBL debt is causing you as they need to hear it to be able to help you moving forward.

I say lay it on thick, which you should do if your BBL is pushing you over the edge, as most decent Lenders will give you an instant breathing space to help you take a step back for a month or so to get additional help and advice without being hounded for a payment or any type of contact from the Lender whilst the breathing space is in place.

Now, if you have not taken any of the PAYG (Pay As You Grow) options, they will at this point in time try and pawn them off on you.

However, no matter which of them you take and in any order, if you haven’t taken them, you will end up paying more interest if you use them, so clearly refuse them if offered them if you do not want to simply kick the can down the road by making use of them which will only increase the value of the unaffordable BBL debt if you let them talk you into taking them.

Please check out the following section of the website that will walk you completely through what you need to do and say when you are heading for BBL arrears or default.

CIFAS Fraud Markers

As Lenders can slap a claim in for the BBL Guarantee payout from the Government if they have defaulted whether they suspect someone has blagged them or not, that is what they do in both situations and quickly too.

However, there is a whole world of difference as to what those Lenders then do, some will log a CIFAS fraud maker against the name of the Sole Trader or Ltd Company Director who they suspect has blagged them, other Lenders do not do that and can’t be bothered doing so.

Here are some articles that will help you wrap your head around that aspect of the BBL scheme, and what you should do to check to see if you have had such a marker logged against your name.

It you do get a CIFAS fraud marker you are going to find it almost impossible to get a loan, overdraft, credit card or even a bank account. Give me a bell on my Helpline if you need help getting one removed.

Upcoming Decisions to be Made

A dastardly scheme is currently in operation behind the scenes, which is going to reveal who blagged a Bounce Back Loan, but sadly, that scheme has the very real potential to cause absolute carnage and label completely innocent business owners as BBL fraudsters.

The results of that investigation, which has been tracking everyone with a BBL for several years and matching up what they put on their BBL application as their turnover, with their actual turnover, declared to HMRC, will be known, and a decision made on what to do with the findings, in or around November 2025, with Rachel Reeves and the Secretary of State having to decide how to proceed with its findings.

That is the parting gift from Rishi Sunak and his shower of ne’er do wells of course.

So be warned, and ensure you keep records, for one of the worst cases I have seen so far, when someone was wrongly accused of BBL fraud, could have seen that person being jailed if they hadn’t battled their case, won, and got their BBL written-off. Just play the game and follow the rules and you will be fine.

I have to say though, I did laugh with what the CEO of the British Business Bank has said about the upcoming decision to be made, he says, “well we did try to warn the Government”, and by “chasing those who over-egged their turnover, you are going to cause an outcome no one wants, that being an avalanche of defaults”, as “most over-eggers and BBL Blaggers are still repaying their loans but will then have to start defaulting if they are labelled fraudsters”!

I will be keeping my eye on how that saga eventually plays out!

More on that >>

The Only Time When Lenders Will Pursue BBL Debts

The contracts and agreements put in place and signed by Lenders and the Government, firmly puts the power with the Lenders, who simply have to follow a straight forward set of rules to get their money back, should a BBL borrower default.

Lenders can only pursue Bounce Back Loan debts if they suspect or know the borrower is part of a criminal gang or when a borrow has hidden away all their assets and for want of a better term of phrase, robbed them.

So if you are not part of the mafia or a criminal gang, and you didn’t rob the bank of a BBL and did not hide away the dosh, then the chances of enforcement of your BBL debt is zero.

Three Lenders are making some effort when it comes to pursuing BBL debts, by going to the High Court with winding up petitions for LTD Companies that they suspect either robbed them of a BBL or the Directors are part of a criminal gang, and they are:

- Barclays

- Starling

- Lloyds

They are NOT going after anyone else who has defaulted on a BBL, just a handful of Directors who fit the criteria mentioned above.

More on that >>

The Only Time When the Government Pursue BBL Debts

The only time when the Government will get involved in pursing Bounce Back Loan debts, is when someone with a BBL takes the insolvency route with their LTD Company or takes the personal bankruptcy route with a BBL as a Sole Trader themselves. and wrongdoing is uncovered.

Or when such people have had their hands forced by BBL Lenders who have taken them to the High Court and got their companies wound up as mentioned in the section above, and wrongdoing is uncovered.

There are some very dodgy Insolvency Practitioners out there who will tell Company Directors they can “get rid” of their Bounce Back Loan with no problem if they sign up to use their service when liquidating a Company.

That is of course not true, and what really happens, once they have handed over the money to get their Company liquidated, is that the Insolvency Practitioner reports the Director for BBL wrongdoing if they discover, as they peruse the Company Accounts and Bank Statements, a Director over-egged their turnover to get a BBL or didn’t use some or all of the BBL funds for the benefit of the Company, meaning the Director used it for personal benefit.

The report goes to the Insolvency Service who then start questioning those Directors and demanding to know answers why, for example, they over-egged their turnover or didn’t use the funds as they were required to be used.

If the Directors do not give the right answers, then the Insolvency Service will inform them they are considering banning them for a certain period of time, and if the Director wants that to be the end of the matter they must sign an undertaking, if not the Insolvency Service may consider taking them to court, where of course a Judge will decide the punishment, which could be far worse than just a disqualification.

Most people will sign the undertaking to end their nightmare and just accept the disqualification. Much more so as the Insolvency Service may offer to knock a year off the disqualification if the Director signs the undertaking quickly!

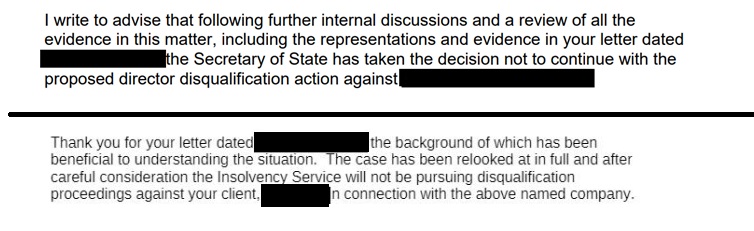

However, from what I have seen, if someone battles their case, much more so explaining to the Insolvency Service, in no uncertain terms, they were vulnerable when they applied for the BBL and/or when they used the BBL funds, and wrongdoing was uncovered, the Insolvency service often drop the case like a hot stone, and do not pursue the Director for the debt or a disqualification.

If you are accused of such, give me a bell as I can point you in the right direction of help if you feel you have mitigating circumstances and it is not in the Public Interest to pursue you for a disqualification and/or you are not a danger to the Public. I have seen lots, and I do mean lots, of such proposed Director bans being dropped:

If a Lender succeeds in getting a winding up petition in the High Court, when they suspect or know that a BBL recipient is part of a criminal gang or if they hid away their assets and robbed them of the BBL then the Court decides who the Insolvency Practitioner shall be.

Obviously they pick one who is famed for not taking any prisoners so to speak, and they will often ensure the Directors of such firms wound up are pursued personally for every single penny they blagged.

Those Insolvency Practitioners often sell the debt recovery to a litigation funder who buys the case for as little as £1 in exchange for a big chunk of the money they recover, and they will then set about chasing the Director, through the courts if needed for the money back, and that is when they can lose their homes and personal belongings, if the Litigation Funder decides to get that Director made personally bankrupt.

Bounce Back Loan Abuser Tracker

Full List of Company Directors Given a Ban for BBL Wrongdoing

They are also jailing some Bounce Back Loan blaggers, such as members of criminal gangs who robbed lots of BBLs from Lenders, and also those who managed to apply for a BBL, got paid it out to them, then they put it in their pocket and illegally got their Company Struck Off.

Bounce Back Loan Jailbird Tracker

Full List of People Locked Up for BBL Wrongdoing

Also, do check out my Subscriber Special Reports section of the website for a plethora of additional information that you may have missed over the years.

Here > Subscriber Special Reports

If all else fails and your head is in a spin, give my BBL Helpline a call on the helpline, the details are here >https://mrbounceback.com/bbl-helpline-tracker/

Subscribe and Help Me Continue Helping People in Distress

I have been following the twists and turns of the Bounce Back Loan scheme, which is now in its fifth year, since the day it launched, that being on the 4th of May 2020.

Please read and digest any of the additional articles to put your mind at rest if you are worried about anything.

You will need to subscribe to the website to access the additional resources, but all funds raised keep my Bounce Back Loan helpline going, which is available 12 hours each day, 7 days a week.

I am proud to say whilst not only helping people in distress allay their fears and worries about defaulting, my helpline has also saved lives, thanks to several bank bosses stepping in and assisting very vulnerable defaulters, on the brink of doing something stupid, when I have alerted them of someone needing urgent help.

Subscribe here > https://mrbounceback.com/membership-join/

Or make a donation here > https://fundrazr.com/d2Psr2

Without your help and support, there may come a time, and fairly soon, when I have to stop.

I was a complete pain in the backside of the previous Government, having turned up at Parliament and Government buildings and offices, hounded Ministers, appearing at BBL related Government Committee Meetings and all the time badgering those in power for more clarity and help for those in difficulty with their Bounce Back Loan.

You may have heard me on the radio, seen me on TV or even watched some of my Fireside Chat Videos, if not feel free to do so on the following links:

My Fireside Chat With Jeremy Vine Discussing BBL Arrears, Defaults and Everything Else

My Fireside Chat About Bounce Back Loans With Julia Hartley-Brewer on Talk Radio