It is the topic that is currently making the headlines, that being Bounce Back Loan fraud, so today I will be looking at who the likely suspects are, why it is happening and how that aspect of the scheme is causing the spotlight to be shined so brightly upon it.

You only need to look at the British Business Bank for a few pointers. We are all more than aware they were not happy with the scheme when they were tasked with putting it into place and making it go live.

By making public the Reservation Notice signed by the of the British Business Bank Chief Executive Officer & Accounting Officer that being Keith Morgan CBE, and his subsequent stepping down from that post, it is obvious he doesn’t want to be tarnished with the aftermath of the scheme, and got out whilst he could.

However, a quick check of the British Business Bank published figures for the scheme, will give you some idea as to how much fraud may already have been uncovered, or at the very least is currently suspected.

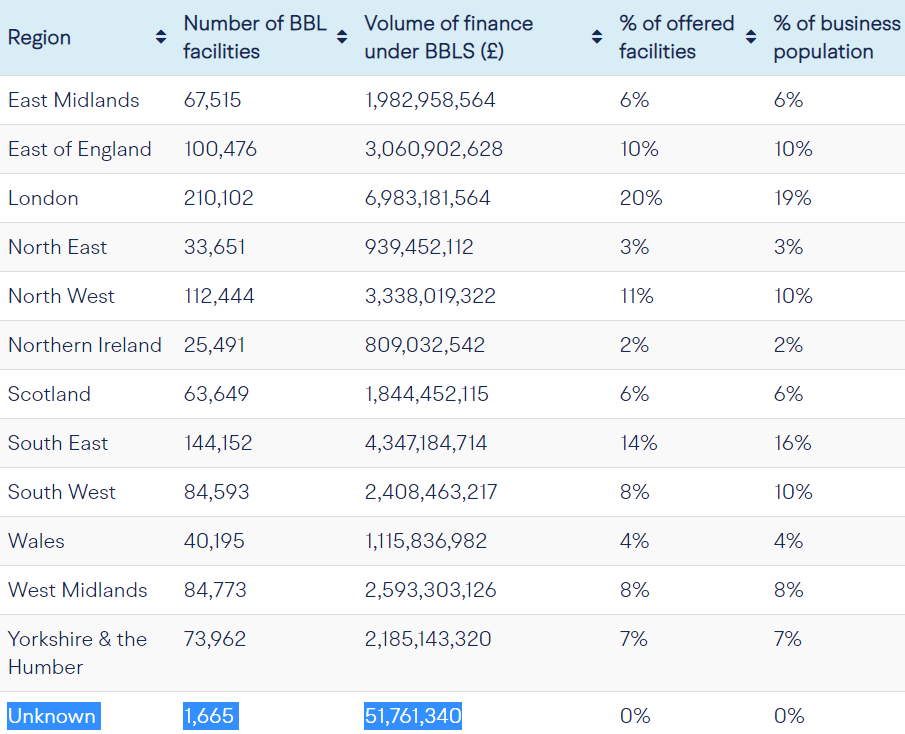

Breakdown of Bounce Back Loan Facilities Offered by Region

Whilst the British Business Bank like to remain silent for as long as they can do about Bounce Back Loan fraud (I say that based on the very late publication of their Reservation Notice), and the worries thereof, they did back on August the 7th publish a “Breakdown of Bounce Back Loan Facilities Offered by Region” report, and as you will see they very clearly do not appear to be able to account for some 1,665 BBL’s worth some £51,761,340:

What is worrying, is that even though approved BBL data has been published up to and including the 20th of September, the report above has not been updated.

So those figures do somewhat indicate at least £51,761,340, and possibly more (if the British Business Bank ever pull their finger out and update those figures) is in one way or another “unaccounted for”.

Bank Employee Fraud

I think it is worth remembering that whilst most bank employees are hard working and honest, history has proven there is a percentage of them that are lured over to the dark side.

With many bank staff working from home, and sadly spouting all kinds of nonsense to Bounce Back Loan applicants on a daily basis, when applicants have been chasing up their applications for BBL’s that does shine the spotlight on a failing of the banks.

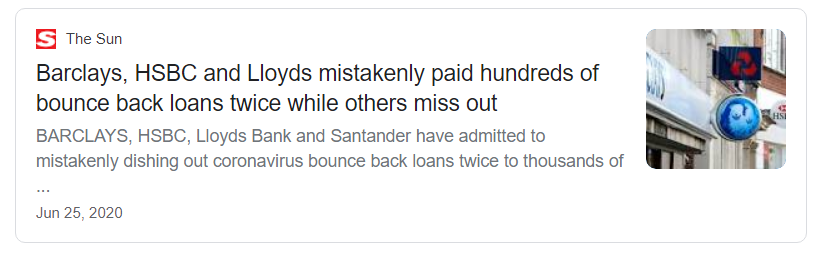

There have been some very well documented cases when some banks have double paid applicants their BBL’s, and trying to get a bank support staff member to correct that or even to get them to understand the problem has turned into something of a nightmare for some applicants.

As for whether any bank employees are part of a fraud ring, well time will only tell of course, but history does have a way of repeating itself. No applicant should be accused of wrongdoing, until a bank or any investigator is 100% sure and confident it is not through the fault of incompetence or neglect or even outright fraud by bank staff members.

You only have to look at some recent cases (and I have seen no end of them) whereby bank staff members are making up rules that do not exist, which in turn could see the potential for innocent or not so innocent problems to occur.

If Noel Edmonds can be victim of dodgy bank employees, then anyone can be.

Organised Crime Rings

The National Crime Agency has announced that organised “Crime Rings” have for want of a better term been plundering the Bounce Back Loan scheme and based on their announcement that is something that will have been taking place.

That is of course something that does warrant a full investigation, however that is a bank problem, and much more so for those banks that have at no point in time allowed new customers to open a bank account during the time the Bounce Back Loan scheme has been live, and there are a couple of dozen of banks that have flatly and stubbornly refused to accept new customers throughout the entire lifetime of the BBL scheme.

It will be a failing of those banks systems that allowed their “current customers” to apply for a Bounce Back Loan, and customers who had a bank account long before the scheme was announced.

As the Bounce Back Loan scheme has evolved, sadly some of the additional initiatives brought in to negate the chances and risks of fraud, have actually gone on to cause more problems for genuine Bounce Back Loan applicants than reducing the chances of fraudster defrauding the scheme.

Take for example the highly flawed “Shared Industry Database”, I see an endless stream of genuine Bounce Back Loan applicants daily being listed on that database, and in some cases being incorrectly listed up on it as having been paid a BBL when they have not received a BBL.

Some banks are also declining genuine BBL applicants when they see them listed upon that database when all they have done at one point in time added their name onto another banks BBL “waiting list”. It could be argued and probably will be if anyone loses out on getting a BBL and is denied their right to get a Bounce Back Loan due to the problems with that database, that incorrect entries on that database are a type of fraud, but one a bank is guilty of.

However, the banks will probably state it was an innocent mistake. Imagine losing out on a business and livelihood saving Bounce Back Loan due to an “innocent mistake” or a deeply flawed shared industry database. It does not bear thinking about, but it is happening day after day.

Bounce Back Loan Brokers

One thing I will continue to do is fight for any legitimate business owners right to get a Bounce Back Loan, its what I have been doing since the day the scheme launched and something I will continue to do.

However, one thing I will not tolerate in any way shape or form is anyone trying to take advantage of some business owners who are now obviously desperate to get a BBL before the scheme ends.

I am aware of websites and companies purporting to be a “Broker” they claim on their websites and literature they will get you a Bounce Back Loan, often “quickly and easily”, and will charge you a fee to utilize their services or even worse will take a “cut” of your Bounce Back Loan.

DO NOT ever be lured into taking anyone up on such a service. I have been warning about this for quite some time and have even been contacted by such brokers.

Be aware when stumbling on such a “Broker’s” website they will ask you for all your personal and business details and will often also ask for documents, bank account statements and the such like, that will then leave you wide open to been defrauded.

What does upset me somewhat is when I warn people not to make use of such “Brokers”, I am often then asked by desperate business owners who have faced many struggles trying to get a BBL could I let them know who those “Brokers” are.

For the record I will not divulge their details to business owners for the reasons outlined above, however I do pass them over to the relevant authorities so they can take whatever steps they deem necessary to investigate them.

So once again do not be tempted to utilize the services of any supposed “BBL Broker” you come across, there is a very good chance you will regret doing so.

Corrupt Employees of SME’s

There is also the risk of corrupt employees of SME’s taking advantage of their position in a business and defrauding the Bounce Back Loan scheme and their employers.

There have already been a few cases of that happening, however the numbers are surely tiny, but that is a wake up call for any business owner to double check all is well with those they trust with the day to day running of the financial aspects of their businesses to. You can never be too careful.

Over-Estimating Self-Certified Business Turnover

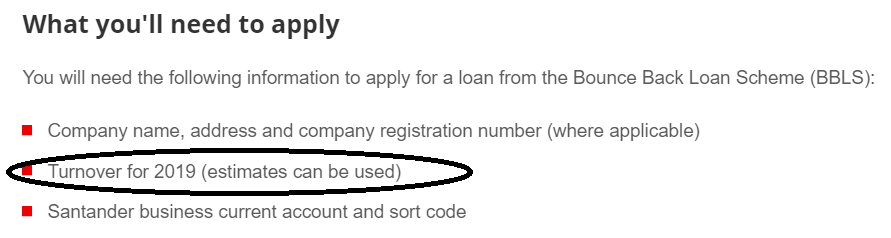

Obviously the banks, and the British Business Bank are going at some point or another, try and blame those applying for a Bounce Back Loan for some aspects of “fraud”, in fact the BBB have already raised their concerns before the scheme went live that allowing those applying for a Bounce Back Loan to self-certify their business turnover could lead to some applicants over-estimating their turnover.

The BBL scheme is of course designed to fire out money to business owners, and one of the questions applicants had to answer was to self-certify their business turnover for the calendar year 2019.

Those applicants could then apply for up to 25% of that self-certified turnover. But and this is a big but, that turnover could be “estimated”.

It doesn’t say when that estimate had to be arrived at and worked out, so any attempt to blame in any way shape or form business owners for allegedly “over-estimating” their turn over would be, not that it would ever get that far, laughed out of court.

By stating estimated turnover, that is just that, estimated, and no indication was or has been given as to when that estimate had to have taken place. A business owner could have estimated their 2019 calendar year turnover in 2018, and as per the rules of the scheme that is when the estimate will be a valid estimate from.

That is not fraud.

I would like to add, that I have over the last few months been contacted by many people who did apply for and get a Bounce Back Loan, and being financially prudent they only asked for a small percentage of the possible 25% of their turnover they qualified for.

They did so thinking the pandemic would not be as long lasting as it has become, and are now in a position whereby they wished they had asked for more than they did when applying for their Bounce Back Loan, and want to “top it up”.

Alas, as it stands, and with it not looking like a change to the “no top up” rules are to be made, they are quickly running out of funds to tide their businesses over. A top up would have been a welcome addition to Rishi’s Winter Economic Plan.

The Long-Term Solution

Let us face some facts, the Government, and fair play to them, wanted to fire out money into the economy hence Rishi dreaming up the Bounce Back Loan scheme, like it or not its helicopter money, and has without a shadow of a doubt has been and is being fed back into the economy.

If the truth be known the banks hate the bloody things, they want to go back to doing what they have done for decades, that being lend out to their customers with their usual checks in place, and of course their much higher interest rates.

The banks, and those that did enter into the spirit of the scheme by allowing both their current and new customers to onboard with them and then apply for a Bounce Back Loan do need thanking for doing so, without them 100,000s of business owners would not have been given access to a Bounce Back Loan.

Those that stuck two fingers up at the Government, and small business owners by stubbornly never opening their new account systems to new customers need naming and shaming.

The long-term solution is to turn Bounce Back Loans into grants. Full Stop.

Look at the way the economy is going, look at the way the new and potentially long term effects of the pandemic are causing business to stop or reduce trading, look at the continuous Covid related rules and regulations being imposed on business owners day after day.

Just make sure those genuine businesses, and make no mistake about it there are still a huge number of them who still haven’t been able to secure a Bounce Back Loan due to no fault of their own, get one before the scheme closes.

The latest set of figures show that as of the 20th of September some £38.02bn has been paid out to 1,260,940 businesses as part of the Bounce Back Loan scheme alone. If this Great Nation we call the United Kingdom cannot afford to turn that £38.02bn into grants to help take the pressure off those 1,260,940 businesses and those who hopefully will secure a BBL before the scheme ends, there is something very wrong.

Failing to turn them into grants, will see plenty of defaults, defaults mean business failures. Small and medium sized businesses should not be allowed to fail, they are at the heart of the UK economy.

Deep breath Rishi, bite the bullet and get them turned into grants, and do so before December 25th if you can, that will be the perfect Christmas present for SME’s, and will allow them to have a clear head and work out, and believe me SME’s are very, very good at this, how to get their businesses back on track without a 10 year loan around their necks.

Do it.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website