Well dear reader, a real-life miracle occurred yesterday, that being I found myself agreeing with the British Business Bank, who have in no uncertain terms made public how toxic and unenforceable Bounce Back Loans possibly are!

Yesterday something known as a “Reservation Notice” was made public by the British Business Bank which was sent by the grandly titled Chief Executive Officer & Accounting Officer of the BBB that being Keith Morgan CBE to the equally grandly titled Secretary of State Department of Business, Energy and Industrial Strategy that of course being the Rt Hon Alok Sharma MP.

The letter was sent way back on the 2nd of May 2020 just 2 days before the Bounce Back Loan scheme went live. Below I will go through that letter paragraph by paragraph.

You can view the Reservation Notice Here > https://www.british-business-bank.co.uk/wp-content/uploads/2020/09/200502-BBB-BBLS-reservation-notice-FINAL.pdf

Be aware of the following announcement below by the British Business Bank also, as it certainly makes you think. Much more so with him being the author of the Reservation Notice:

“Keith Morgan has today announced that he will be standing down from the role of Chief Executive of the Government-owned British Business Bank at the end of 2020 after eight years at the helm of the UK’s economic development bank for smaller businesses.”

Pushed, shoved, jumped, who knows?

Dear Secretary of State BBLS – RESERVATION NOTICE

Over the last ten days, we have been working rapidly with your officials and with HMT to prepare for the launch of the Bounce Back Loans Scheme (BBLS). We are all doing the best we can in an unprecedented situation, and we are acutely aware of the imperative for us to act at pace to support the economy.

Note: The BBB admit they are working away at getting the scheme ready for launch

I understand that you have seen my letter of April 26th to Sam Beckett, advising on the risks associated with the rapid launch of BBLS, and my subsequent e-mail of May 1st that set out in more detail the very significant fraud and credit risks associated with it (including those highlighted in a draft review that we commissioned from PWC, which classifies the fraud risk as “very high”).

Note: The BBB state they had PWC look at the risk of fraud and they classified it as “very high”.

Acting under your direction, Sam Beckett instructed the Bank to implement BBLS yesterday. In light of the concerns we have raised and the findings of PWC’s fraud risk review, the Bank’s Board met this morning to discuss the launch of BBLS. Following those discussions, it has requested that I raise a formal Reservation Notice to you in response to this instruction on BBLS.

Note: Despite the potential and highlighted risk of fraud the BBB implemented the scheme but want to cover their arses with a Reservation Notice.

A Reservation Notice is a mechanism in the Bank’s constitution through which we may raise concerns on particular grounds. In this case, the relevant grounds are: propriety; value for money; and feasibility. I will explain the Board’s position on each of these in turn.

Note: Just in case the Rt Hon Alok Sharma MP is hard of thinking/understanding they explain what a Reservation Notice is.

On propriety, our primary concerns relate to the extensive reliance on customer self-certification and the corresponding fraud risk (as discussed in detail in my e-mail of May 1st), as well as to the potential market distortion.

Note: BBB worried giving applicants the option to self-certify certain aspects of the BBL application they think many of them could/will in some way possibly abuse it.

With an interest rate for BBLS being set at a uniform 2.5% across the market, it is now very likely that many smaller providers will not be able to compete with BBLS in the sub £50,000 lending market, leaving the large banks as the main providers.

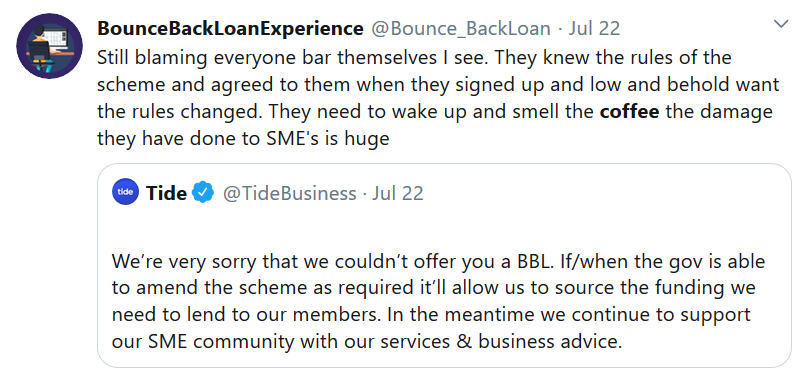

Note: Concerns raised that the exceptionally low interest rate will see smaller lenders being unable to compete with the bigger banks. – Think Fintech’s such as Tide who could only secure £50million then were unable to secure any more funds to continue lending.

This is a competitive issue now as it reinforces their dominance of the market. Over the medium to longer-term, if alternative finance providers fail it may also bring into question the potential diversity of the SME finance market and its ability to support economic recovery.

Note: Serious worries raised by the BBB that smaller lenders could fail, due to the influx of low interest rate BBL’s and the favourable terms associated with them, therefore possibly causing a problem in the future with SME’s accessing additional but unrelated business loans.

Maybe, that is why Rishi Sunak has hinted at an additional business loan programme in the New Year, the details of which of course have not yet been announced?

The Board also discussed the conduct-related risk that borrowers sign away rights under the Consumer Credit Act and may then later claim they were vulnerable and so cannot be held accountable for doing so.

Note: There you have it, the bombshell. Having received 10000’s of emails, messages, tweets and phone calls as soon as the scheme launched, and continuously throughout the scheme from business owners who were on the verge of things I will not repeat, I can say most were in a very, very dark place and without a shadow of a doubt “vulnerable” and had no other option, whilst completely and utterly vulnerable to save their businesses, livelihoods and futures but to apply for a Bounce Back Loan, and as the BBB put it “sign away rights under the Consumer Credit Act”.

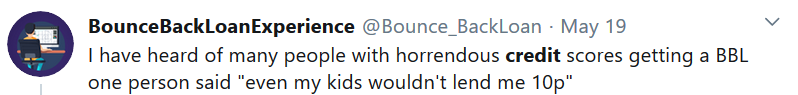

On value for money, my e-mail yesterday set out clear concerns based on our own assessment and that of an expert third party. The scheme is vulnerable to abuse by individuals and by participants in organized crime. Alongside the fraud risk, there will be considerable credit risk in the current economic environment, which will be exacerbated by removing significant elements of the credit checks that would otherwise have been undertaken.

Note: I have spoken to many people who confirm that they had been, whilst vulnerable, able to secure a Bounce Back Loan, and would never have been offered a loan based on their credit rating with any lender under “normal” circumstances.

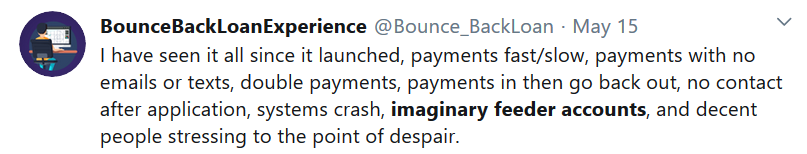

On feasibility, the compressed timetable has created huge operational challenges for delivery partners, who are facing considerable challenges to stand up systems ahead of launch on Monday.

As an example of the compromises made to meet the timetable in order to avoid derailing the builds of the large banks’ systems, it has been impossible to agree a methodology to prevent duplicate applications.

Note: Having seen the utter shambles once the scheme did go live, and some banks not having a robust or even fully operational system in place the BBB did raise a valid point. You only have to look at HSBC and their “feeder accounts” right at the start to know they couldn’t offer anyone a working one at the start of the scheme, in fact I did christen them “Imaginary Feeder Accounts” in the early days of the scheme.

On the theme of feasibility, my Board have also asked me to highlight the clause in the Permanent Secretary’s instruction that states: “You will need to ensure that there are robust controls and governance around these financial commitments that, as far as reasonably practicable, ensure public funds are being used appropriately in the context of the agreed parameters of the scheme.”

Note: The BBB letting everyone know who was pushing for the scheme to go live with checks and failsafe’s in place.

Given the pace at which decisions are being made and processes built, and the imperative for simplicity throughout, it is not feasible for us to achieve this to the standard implied by any ordinary interpretation of what is either “robust” or “reasonably practicable”.

While we recognise that you have already provided a direction to the Permanent Secretary as Principal Accounting Officer in relation to the scheme, the Board have concluded that it is appropriate that we raise a Reservation Notice with you directly.

We have flagged to officials at HMT and BEIS as part of the discussions of the scheme that these concerns on propriety, value for money and feasibility could have been mitigated either by proceeding with modifications to CBILS instead of a new scheme, or by delaying the implementation of BBLS to ensure these issues were worked through.

Note: This is how the BBB let the Secretary of State Department of Business, Energy and Industrial Strategy know if they delayed the launch of the Bounce Back Loan scheme, they could “tweak” the Cbils scheme to offer a slightly more robust system for offering BBL’s.

As I have communicated previously, however, we do also fully understand both that this is a time of unprecedented market disruption in which an incremental approach itself appears much more risky than in normal times, and also that Ministerial objectives and considerations may in these circumstances be broader than ours.

Given the concerns of the Board, and under our established constitution, in order to ensure the scheme can be launched as planned it will be necessary for you to respond to this letter by instructing the Bank directly.

The Board have requested that this wording be unambiguous, and that it should acknowledge the limitations on the Bank’s ability to mitigate and control risks which are inherent in the design of the scheme. I look forward to your response.

Note: The BBB have now warned the Secretary of State Department of Business, Energy and Industrial Strategy of the risk but they will make the scheme live if he replies informing them to do so taking into account the contents of their Reservation Notice.

The Board and I fully appreciate that expectations have been raised and there is now huge public pressure to deliver BBLS. Our implementation efforts continue at pace, and should you direct us accordingly, we stand ready to deliver this programme to the very best of our ability.

You should be aware that I will be required to copy your reply to the Comptroller and Auditor General and the Treasury Officer of Accounts. I am further required to arrange for the existence of your letter of direction to be published unless you direct me to keep the matter confidential.

Given the potential impact that making the existence of your direction public might have on the confidence in, and take-up of, the scheme you may alternatively choose to ask me to delay publication of its existence until a later date.

Note: “you may alternatively choose to ask me to delay publication of its existence until a later date” Speaks for itself really.

HSBC Slam The Door

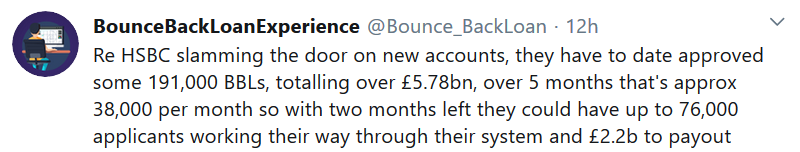

One thing that sadly did boil my blood yesterday so to speak was HSBC deciding to slam the door shut on new business account customers.

Rishsi did announce an extension to the Bounce Back Loan scheme extending it from November the 4th until November the 30th, however surely he didn’t imagine at 09:00 on September the 30th one of the biggest banks offering non customers the chance to apply for a feeder account to open the way for a Bounce Back Loan would close their doors.

Having said that though, HSBC did enter into the spirit of the scheme right from day one, by offering feeder accounts, and a quick calculation on the back of an envelope may give you some idea of why they have slammed the door:

If they can sort of 76,000 applicants and fire out an estimated £2.2billion before the scheme closes, then that is to be admired, however that will now put even more pressure on the five lenders that are still accepting new customers.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website