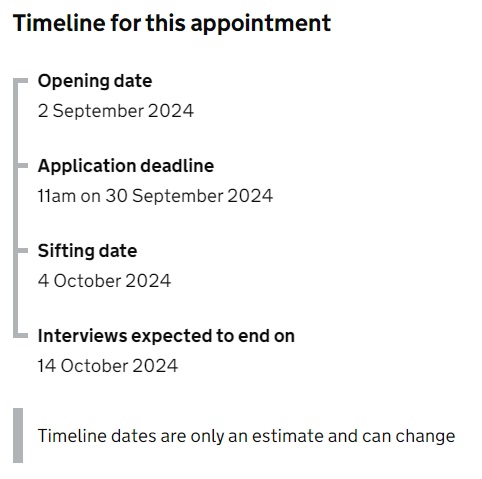

Monday, 11am the applications close for the role of Covid Corruption Counter Fraud Commissioner.

The last person to have a similar-ish role was of course Lord Agnew, who donated £134,000 between 2007 and 2009 to the Conservatives and was knighted and ultimately given the role of Minister for Counter Fraud!

There is something of a Lord Alli air about him, some would say.

He now runs a payday loan type firm in Norwich, which has been uncovered multiple times by the Financial Ombudsman as being “Loan Shark-esque”. More on that >>

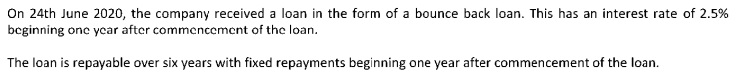

Oh, and if you didn’t know his “Loan Shark” business did of course get a Bounce Back Loan.

You can verify that yourself on their Company Accounts “18 Mar 2021 Accounts for a small company made up to 30 September 2020”

HERE > https://find-and-update.company-information.service.gov.uk/company/08667447/filing-history

So, the bloke now running a Loan Shark-esque type of business was in charge of Counter Fraud during the Pandemic, you couldn’t make it up. He also has questions to answer over the “VIP Lane”.

The Good Law Project revealed Lord Agnew referred Worldlink Resources, a company advised by former MP Brooks Newmark that landed a £258 million deal.

Lord Agnew was also the source of the referral for one of the largest beneficiaries of Covid procurement – Uniserve.

The company was awarded £304 million in PPE contracts thanks to the VIP Lane, alongside its existing £572 million contract to handle PPE logistics.

More recently, Uniserve has been paid over £124 million (£1 million/day) to store excess PPE.

Gatenby Sanderson

Anyway I digress, Gatenby Sanderson are helping Rachel Reeves select a suitable person for the exciting new role of “Covid Corruption Counter Fraud Commissioner”.

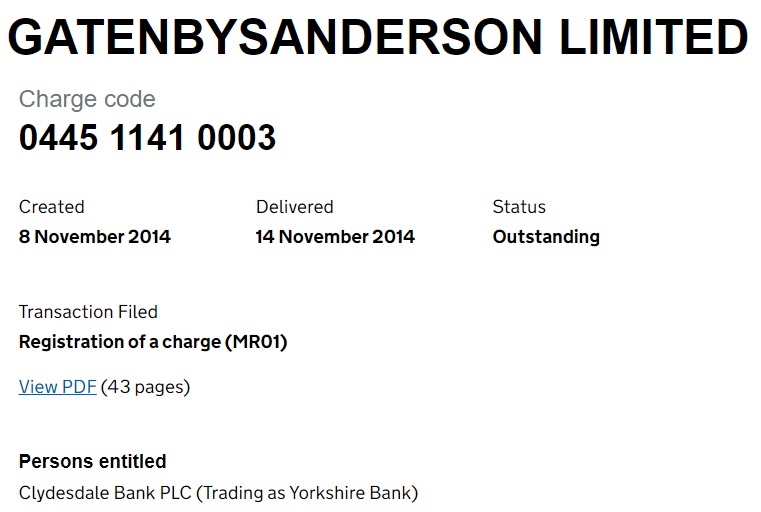

That firm currently have a charge over their head from Clydesdale/Yorkshire Bank and previously had one from NatWest.

Outstanding:

Settled:

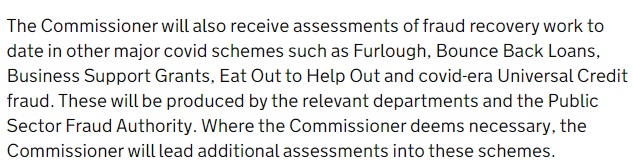

What worries some people is that as the Commissioner will be casting his or her eyes over the banks that were part of the Bounce Back Loan Scheme, will Gatenby Sanderson be completely honourable and be prepared to help Rachel Reeves select someone, how can I put this, who is not sympathetic to the banks, and someone who isn’t going to give the bank Gatenby Sanderson owes money to an easy ride?

One needs to remember most Bounce Back Loan Lenders got up to all sorts of skulduggery with the Bounce Back Loan scheme, and not just some of those who applied for a BBL.

Much more so, when you consider just how much the BBL Lenders have had snatched away from them, by having their Bounce Back Loan Guarantees yanked. In fact as per the latest stats and facts that is currently some £441,750,000.00

Here are just a few tales of BBL Lender skulduggery that have been uncovered and I have reported on, over the years:

Those are just some of the 100’s of cases I have reported on and in some cases have helped people get justice on, you will find plenty of other, similarly shocking cases in this section of the website > https://mrbounceback.com/category/bbl-complaints-and-outcomes/

We will soon know who the Covid Corruption Counter Fraud Commissioner is and I will of course report on the progress and any recommendations he or she makes to Rachel Reeves moving forward.