Please read through the following, and make your own mind up as to just what is going on and went on behind the scenes regarding the Bounce Back Loan scheme and other Government backed schemes.

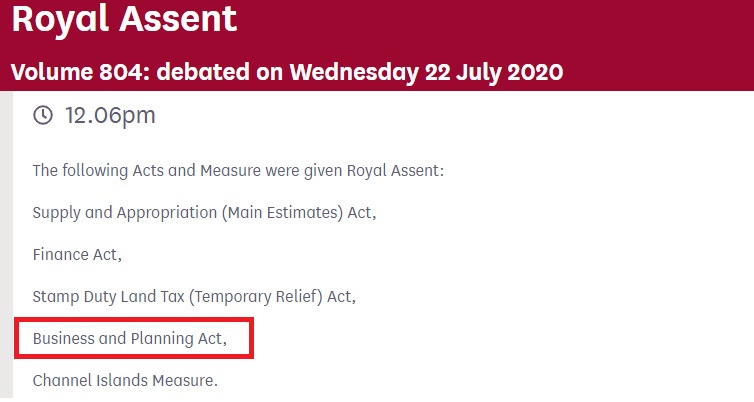

I feel sorry for HM the King, knowing his now sadly deceased Mother, the much loved Late Queen backdated the law removing many of the protections people had, so that the Government could rush through the Bounce Back Loan scheme and make what was once illegal, legal

In layman’s terms, that being giving business owners loans, with no credit checks, no forward looking affordability checks etc, I’m sure we can all agree, she would be upset many are now unable to repay those loans she made possible.

Perhaps that is one reason no one is currently being hounded for not repaying them once the cycle of default has played out?

Background

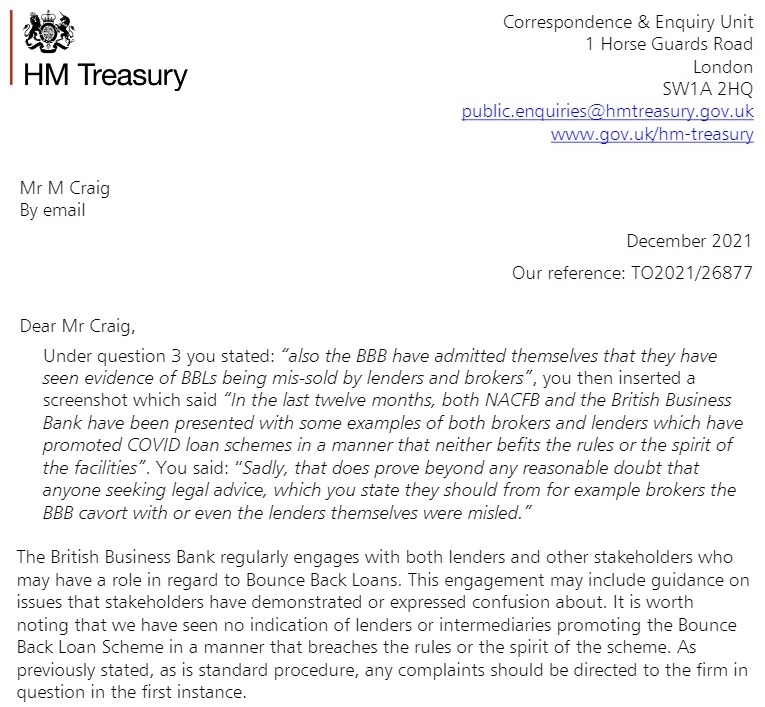

In November 2021 I wrote to HM Treasury with a list of complaints about the Bounce Back Loan Scheme, and they replied on December the 29th of that year.

Today I am revisiting those complaints, as I do feel HM Treasury need to come clean about why they turned a blind eye to some of the revolting things that went on when the BBL scheme was live.

I also would like to point out that days after I got an official reply from HM Treasury, Lord Agnew resigned from his role as the Minister of State at the Cabinet Office and Her Majesty’s Treasury, and is now coining it in, having been head hunted by, what I call a BBL Bounty Hunting firm, but more of that later.

Relevant Part of My Complaints and HM Treasury’s Reply

Let me start with one of the complaint responses:

As you can see, HM Treasury clearly state that they have seen no indication of Lenders or Intermediaries promoting the Bounce Back Loan Scheme in a manner that breaches the rules of the spirit of the scheme.

But why one God’s Green Earth would they say that, when the opposite is true?

April 2021

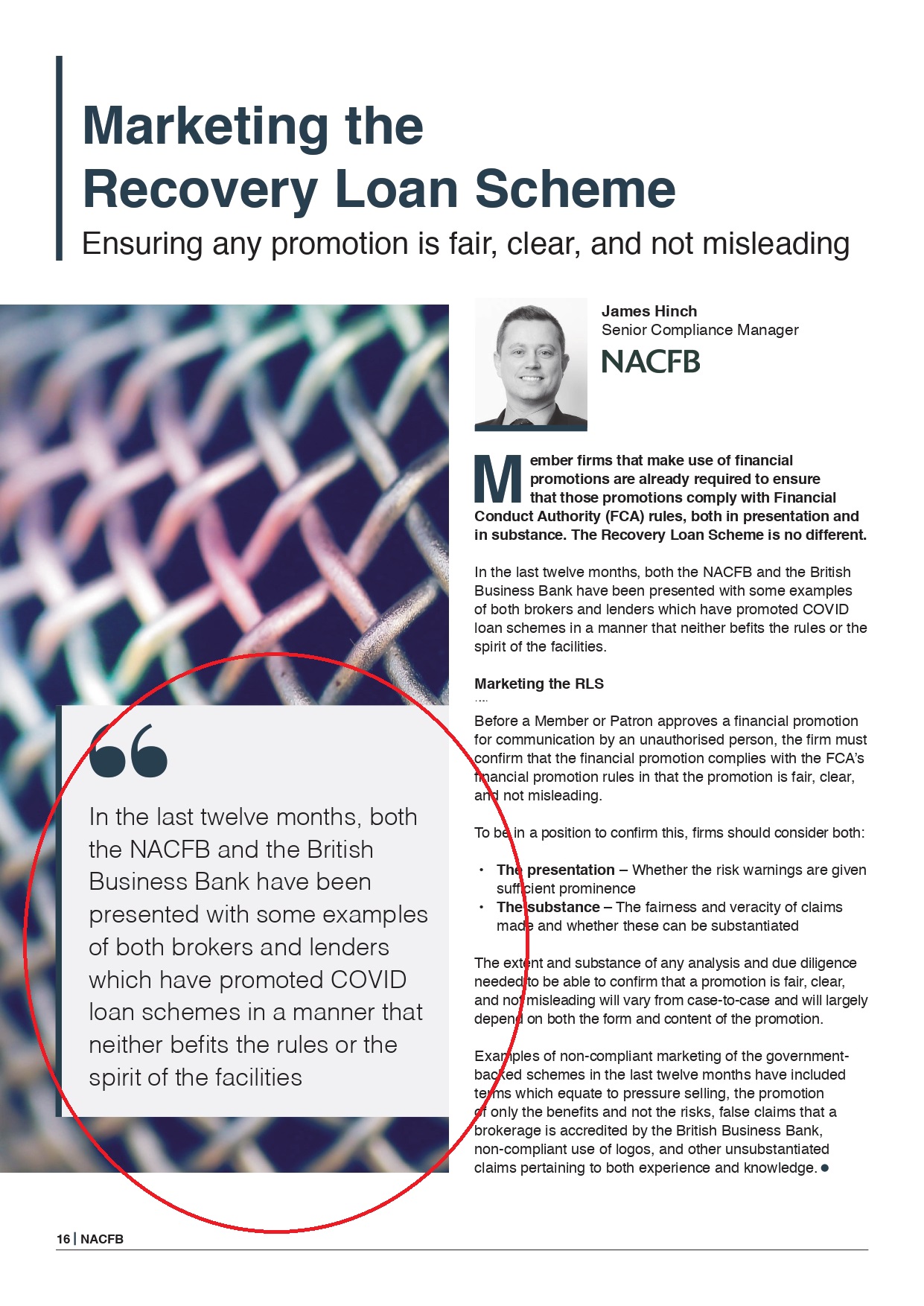

Back in April 2021, the British Business Bank owned by the Government, did a webcast with the National Association of Commercial Finance Brokers, promoting the virtues of, and how much money “Brokers” could pocket via the Recovery Loan Scheme by charging those poor souls who desperately needed one of those loans, fees, but begging them to keep the fees low.

Tune in below, as you will hear and see a special section on that webcast mentioning how Brokers and Lenders promoting the Bounce Back Loan / CBILs Schemes did so in a manner that breaches the rules of the spirit of the scheme, and the Brokers viewing were told not to do it for the Recovery Loan Scheme, which replaced the BBL Scheme.

September 2020

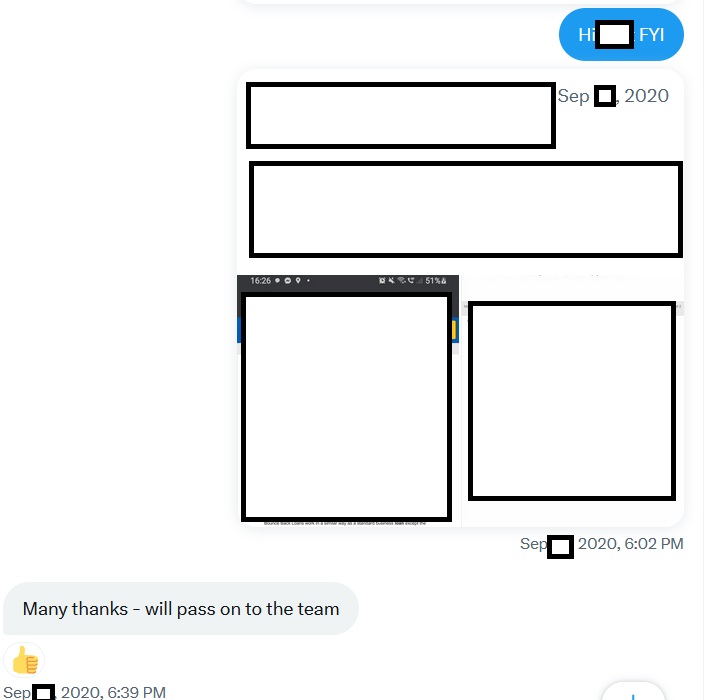

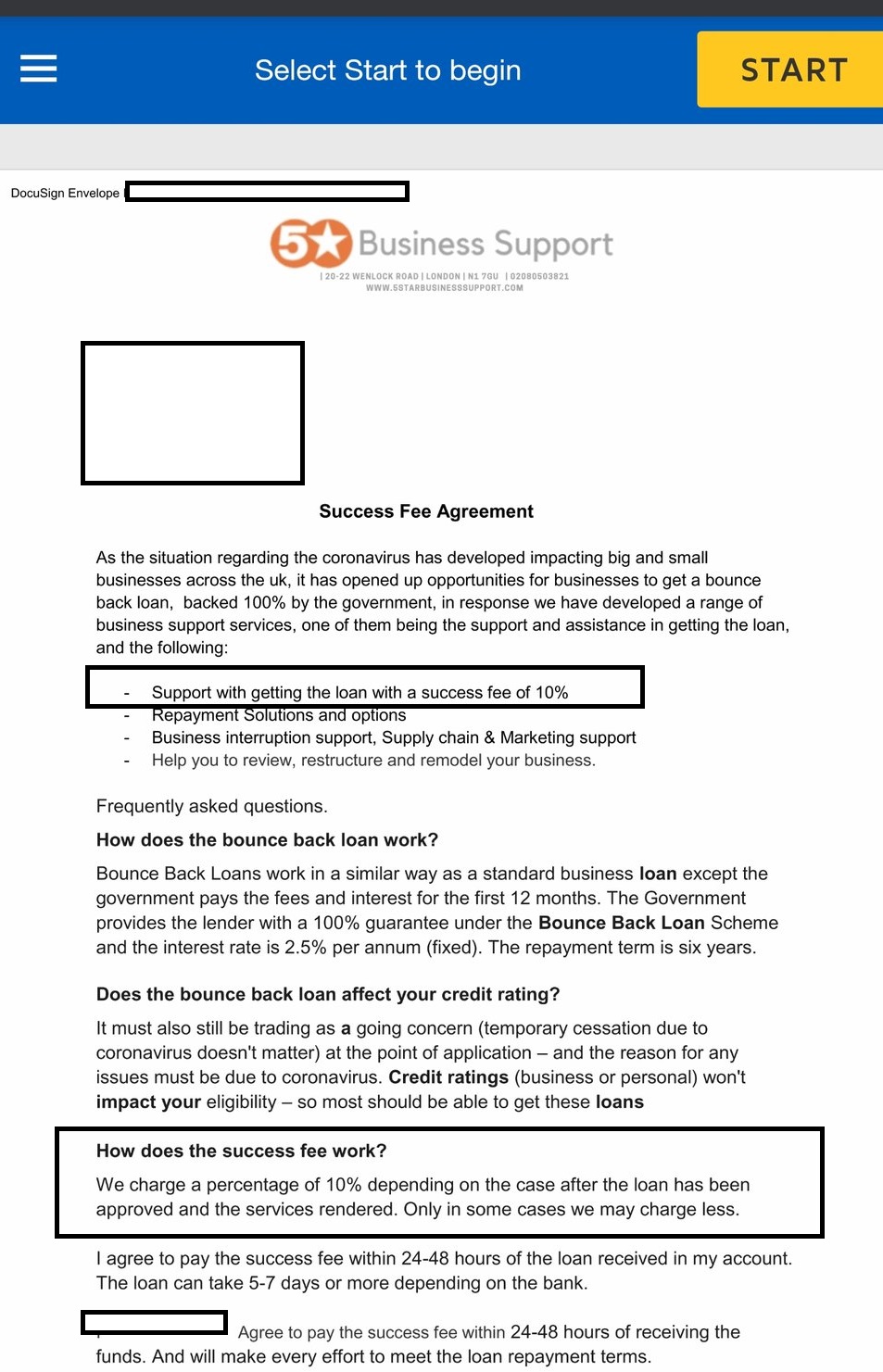

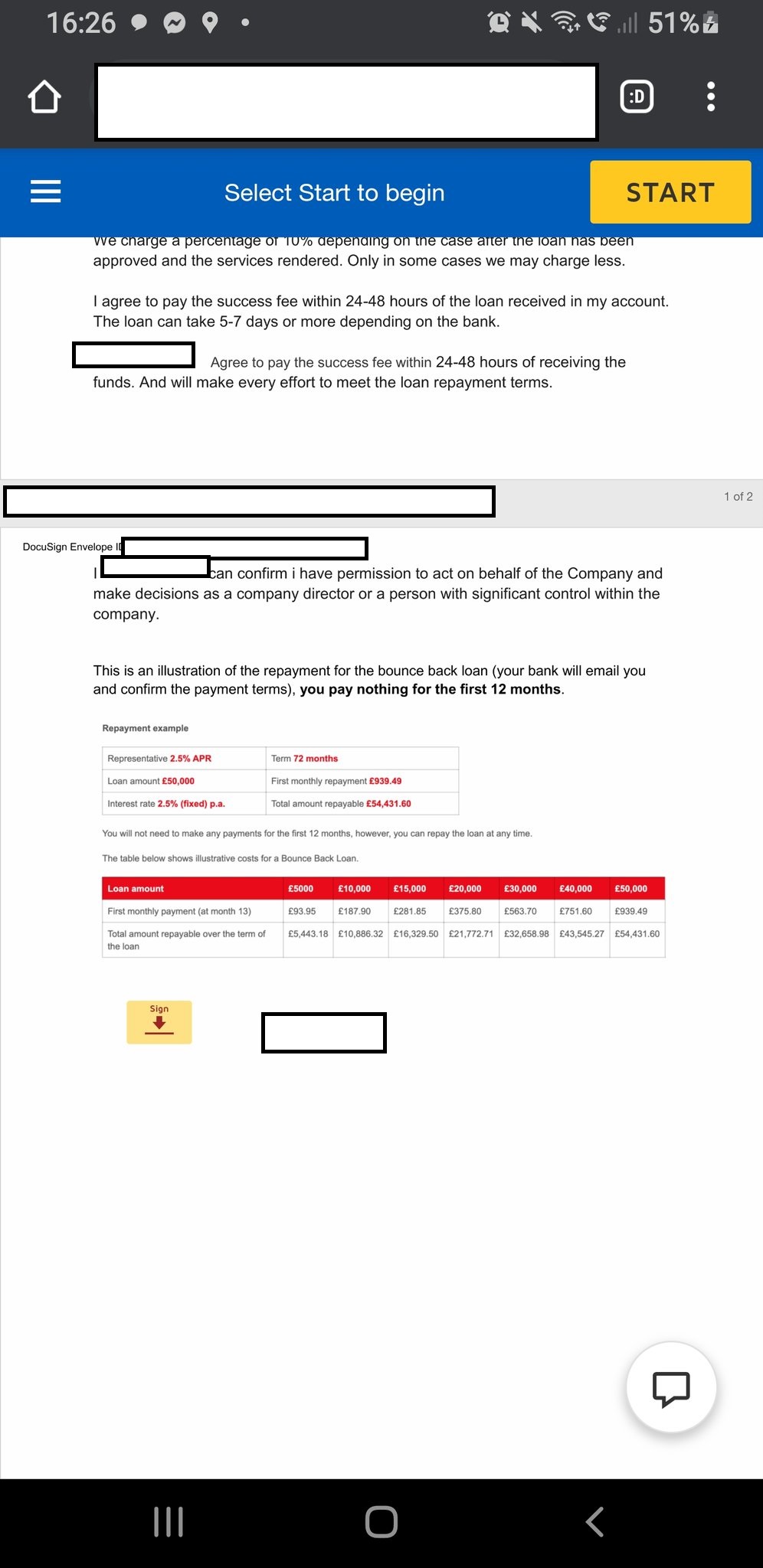

Not only that, I got wind of some “Brokers” were charging people a hefty chunk of a BBL those “Brokers” helped secure. So alarmed was I by this I contacted a very high up person at the National Audit Office to bring it to their attention:

This is what the screenshots contained:

I have checked with Companies House and the Ltd Company offering that “BBL service” has been dissolved

So HM Treasury will have me believe, that they were blissfully unaware of any such thing, even though the above proves everyone else knew, including their own Departments?

What is much more worrying it I have been told other “Brokers” managed to get people Bounce Back Loans, and charged some truly staggering amounts, and it has since come to light those “Brokers” lied on the BBL application forms, and have since legged it. Leaving those who utilized their services paying back a BBL they cannot afford and running the risk of being grilled by their lender when things such as the over-egging of turnover those “Brokers” were happy to blag comes to light.

In most cases those “Brokers” were local villains and criminal gangs who lured in unsuspecting business owners, or even worse with threats of violence or simply due to some business owners not having a clue about how to get a BBL. I did report on this a while back:

Now, people are being slapped with Director Bans and Bankruptcy Restrictions Orders for wrongdoing, after explaining they utilized Brokers and Intermediaries:

Yet HM Treasury have seen no evidence of such! You really couldn’t make it up.

How could they not know when this document says they have known for over a year? Since at least November 2020?

Lord Agnew Moves On

As you may be aware Lord Agnew resigned from his position as the Minister of State at the Cabinet Office and Her Majesty’s Treasury, shortly after I received the letter above from HM Treasury, and he is now the face of a Bounce Back Loan “Bounty Hunting” firm. Some could say he is now coining it in by chasing those the Department he was involved with enabled dodgy Brokers and Intermediaries to blag BBL’s possibly unknown by their clients who were trusting them to get a BBL for them.

Who is to blame for all of this scandal and the never-ending madness that was and is the Bounce Back Loan scheme? Well Lord Agnew has had a right go at Sir Tom Scholar who was Permanent Secretary to the Treasury of United Kingdom (2016–2022), I will let you make up your own mind if Sir Tom seems an on the ball character:

Thought for the Day…… Why did you get rid of Sir Tom from @hmtreasury @trussliz ? We liked the faces he pulled when being told off about Bounce Back Loans….. pic.twitter.com/hDcNG2TxOS

— MrBounceBack.com (@Bounce_BackLoan) February 5, 2023

That moment when you are being grilled about the Bounce Back Loan scheme, and they ask about your WhatsApp messages….. Poor Sir Tom from HM Treasury, the look on his face….Bless. pic.twitter.com/K6A5eAHfO7

— MrBounceBack.com (@Bounce_BackLoan) April 29, 2022

Sir Tom (HM Treasury), have you removed Lord Agnew's name from your Christmas Card list…..(they cant stand each other) pic.twitter.com/cgMFN069oX

— MrBounceBack.com (@Bounce_BackLoan) April 29, 2022

Oh and as for the 8 foot tall Count Sunakula

This is a video I filmed a few weeks before I got the letter from HM Treasury when I rocked up at their budling.

As for Lenders Breaking the Rules

Have a look through the BBL Complaints and Outcomes section of the website, you will find plenty of BBL Lenders who have broken the rules, something no doubt HM Treasury will deny.

You couldn’t make it up. Well, unless you are working in HM Treasury.

The FCA released a stomach churning report detailing how lots of Bounce Back Loan Lenders had not been following the rules:

So one can only guess just what HM Treasury are thinking, or playing at, maybe they caught that terrible Liar Bug off Boris Johnson? Who Knows.

Comment

If you need chat about anything that is worrying your about your BBL you are always welcome to give me a bell.

Please support my never-ending work by signing up to the website

>https://mrbounceback.com/membership-join/

Or by making a donation

My helpline is open as always today

https://mrbounceback.com/bbl-helpline-tracker/