You cannot blame Lord Agnew for wanting to keep on earning money, much more so since he legged it out the door and resigned as the well paid Counter Fraud Minister at the Treasury, over the way the Government were handling the Bounce Back Loan Scheme.

With news that the British Business Bank have now given the greenlight for Barclays to continue their pilot scheme with Lord Agnew and his merry band of BBL Bounty Hunters, and that other well-known but yet unnamed Lender, that has just signed up to use their services, if you are a Limited Company Director with a Bounce Back Loan in default or on the way to being defaulted, then you really are urged to get your Company affairs in order, and quickly.

If you are unaware of just what those Bounty Hunters do, well they are a firm of Litigation Funders, who pay to go chasing after money owed when a Company Director has done any form of wrongdoing and owes creditors money.

They pay for the privilege of doing so, and in return they then get a cut of all funds recovered, and it is of course a nice little earner for them.

In layman’s terms, Barclays and shortly that newly signed up BBL Lender, apply to the High Court to get a Limited Company wound up, and then they designate an Insolvency Practitioner and in turn a Solicitor to go aggressively after the Directors of such firms, to get as much money back from those Directors as they can, even by going after their personal property and everything else if needed.

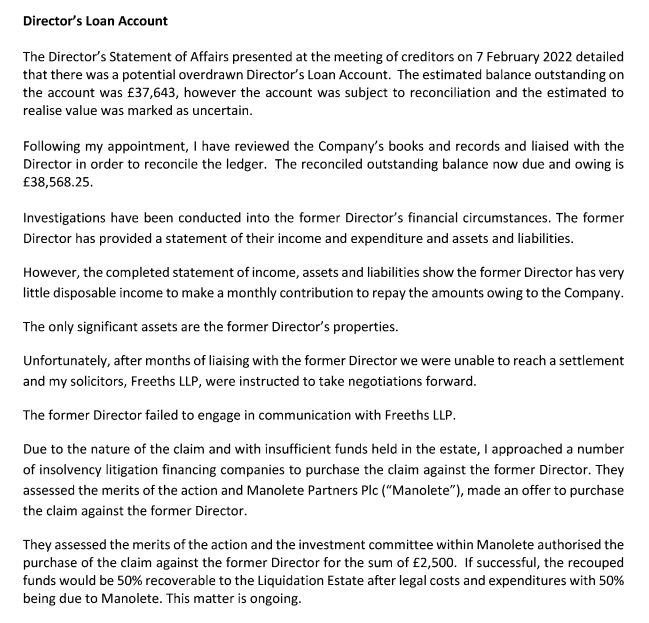

Take for example the recent case below, as you can see Manolete Partners, (the Bounty Hunters Lord Agnew works for) paid £2,500 for a case involving an unpaid £38568.25 Directors Loan account, which was traced and came from a Bounce Back Loan obtained by the Director over-egging his business turnover to get that BBL which was never repaid, and they get 50% of the funds recovered.

It is a nice litter earner for the Bounty Hunters as you can see but does get at least something back for the bank or in turn the UK Taxpayer, who in most cases has already paid out to the Lender the Guarantee payment.

Anyway, back to the matter at hand, as a Company Director you have all manner of rules, laws and regulations that you are legally required to abide by.

Letting you Company slip into a state whereby it has reached the Strike Off stage, submitting Dormant Accounts or anything other failing when and there is a Bounce Back Loan owing will be a huge, big red flag for the Lender, and any attempt to get it struck off without the BBL being repaid will always fail and your Company will still be classed as a live one.

Trying to offload the Company to one of the scam firms out there who charge you a huge fee and they install a new Director will land you in trouble and ignoring the Lender or their debt collector when they are trying to contact you about missed payments is often the trigger for some Lenders, much more so Barclays and the yet unnamed Lender just signed up to the Bounty Hunter services, to go to the High Court and force your hand.

Many Company Directors have stuck their heads in the sand, for many reasons, but now really do need to get their Company’s affairs in order, if you want a chat about your options moving forward, if you can relate to anything mentioned up above, please do give me a bell.