As you will be more than aware, I have more respect for my mop bucket than I do for the British Business Bank. However, on Monday Oct 5th it appears they have a new “Bounce Back Loan Team Director” taking up that roll, and as such I present to him the following open letter.

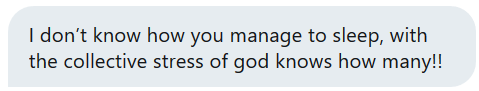

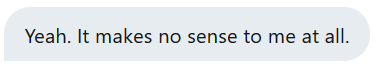

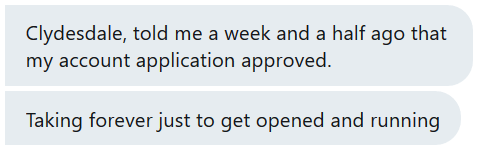

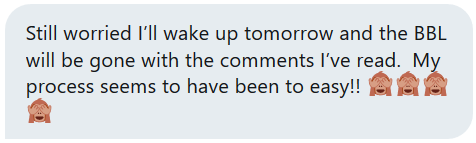

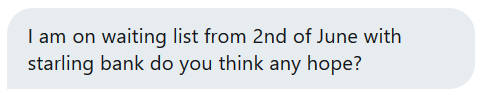

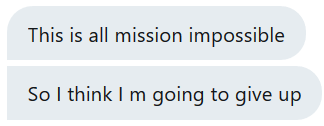

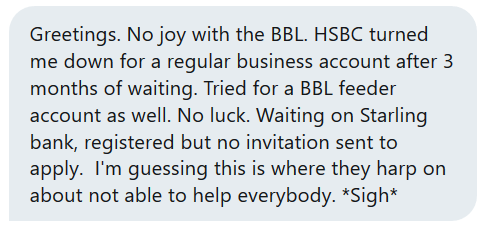

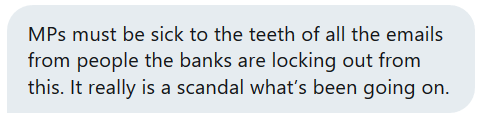

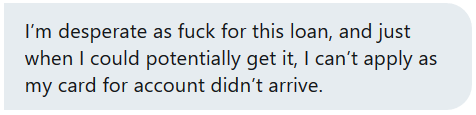

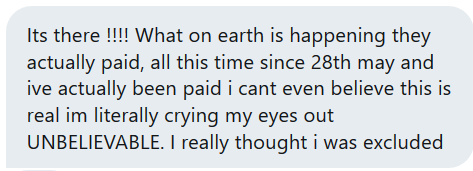

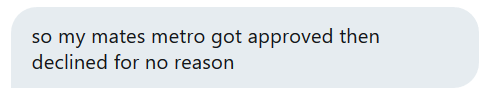

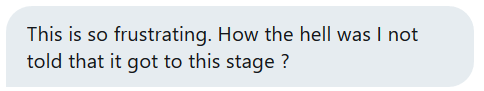

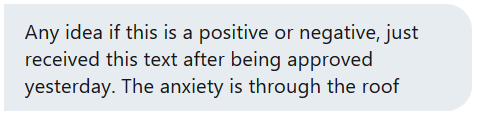

I have however inserted into this open letter a tiny selection of the 1000’s of messages and tweets I get sent day, after day after day, to help him understand the problems people are facing with the scheme he is now tasked with overseeing.

Based in Sheffield the job is a permanent one, and one thing that did catch my eye when I saw the job being advertised, is that the full time and permanent Bounce Back Loan Director is going to be earning a whopping £75,000 per year with plenty of additional perks.

Up to 30 days annual leave plus public holidays, a pension scheme, life assurance, healthcare cash plan and even a performance related bonus.

It is true to say that £75,000 is two and a half times the average value of a Bounce Back Loan, and he will be getting that per year, so he better be bloody good at his new job, and this open letter will be letting him know how he better start earning that money.

Business owners with the average £30k Bounce Back Loan are going to have to bust a gut to make their business viable over what could be the next 10 years to be in a position to pay it back, not sat in some plush office somewhere, so he does need to keep that in mind, as two and a half times the average BBL is a lot of money, and boy are we demanding some proof it is money worth paying for such a position.

I am not sure if this is a new position dreamed up by the powers that be at the bank, but surely looking at the shambles that has become of the Bounce Back Loan scheme, and the way the British Business Bank have been, in my opinion, useless at overseeing it, I do so hope they haven’t been paying someone £75,000 per year up to the date that this new Director starts that job, for there is no evidence a previous Director has been doing that roll successfully if they have been.

Anyway, let us look at what that roll entails, he will be tasked with being responsible for the successful delivery of the government-backed Bounce Back Loan Scheme, including accountability for:

- New lender accreditation

- Management of existing lender relationships

- Accountability for scheme risk and operations management

- Lead a department of account managers

- Risk and operations staff who work to support the delivery of BBL’s

- Lead the team to on-board and accredit new lenders within risk governance frameworks

- Manage existing lender relationships to a high standard

- Ensuring lender queries are answered accurately and promptly

- Provide scheme expertise

- Offer lender guidance regarding fraud and recoveries processes

Notice how there is nothing in the above that states anything along the lines of “helping Bounce Back Loan applicants access a BBL in a smooth and hassle free type of way” or anything referring to the end user to ensure they do not face the ongoing problems and nightmares associated with getting a Bounce Back Loan?

Of course not, why on earth would the British Business Bank care one jot about the huge number of business owners who are having to jump through flaming hoops to get a Bounce Back Loan, they have proven to date they do not care, which is of course shocking.

Your First Few Hours in Your New Roll

So Mr Bounce Back Loan Team Director, this is what I would suggest you spend some time doing, in the first few hours of your new job, so please read it through, digest the following and then make sure you do the following, to help those still unable to get a Bounce Back Loan.

08:30 – Do ensure you have access to enough coffee and food to last you throughout the day, as its going to be a long day, and let everyone in the building know your phone extension number and that of course you have arrived and mean business.

09:00 – You sit the person or people in charge of the Twitter and other Social Media accounts that the British Business Bank operate, and let them know in no uncertain terms that they must respond to any and all questions quickly and accurately and anything they cannot answer gets passed to you to answer.

That will make a pleasant change right from the get go, as experience has taught everyone your Social Media person or team are sadly a gift that keeps on giving but not in a good way and makes the British Business Bank a laughing stock and completely ignorant to the problems BBL applicants are facing.

Those applicants do not want to see the odd BBL related tweet designed as a gleeful gif telling them how lovely the scheme is and the odd success story, they want information and answers to all important questions that they are seeking and quickly, and a way of finding out how to overcome the problems they are facing too.

If you cannot understand that then its time to resign and walk out of the building.

09:15 – Your next task is to get the rest of the BBL team in your office, hopefully it is a large one and they can all social distance, or get them on a conference call and ask them how many lenders are waiting to be accredited.

That is of course presuming there are any new potential lenders waiting to be accredited, and you instruct the team to get them approved and onboard by the end of the day.

One would imagine if there are any new BBL lenders lined up they will already be Cbils lenders who can be fast tracked to offer BBL’s. If any completely new lenders are itching to offer BBL’s then you must bust a gut to get them accredited and their schemes live asap, meaning within 24 hours. No ifs no buts get them onboard, working overtime if that is required.

09:30 – This is going to be your hardest mission yet, that being you need to phone up each of the accredited lenders and ask them to open their BBL schemes to new customers.

You will of course face responses such as “no” “not a chance” “get lost” “not bloody likely” from those lenders, however offer them a compromise, that being if they are not prepared to open up the scheme to new customers they should, those that have them, move their “cut off dates”.

Many lenders have imposed a cut off date, that being a date often in March when only those customers who had an account with those lenders on or before that date can apply for a Bounce Back Loan with them.

If those lenders move that cut off date forward from March (or whenever it is) to say October the 2nd, then 10,000’s will be instantly be given access to the BBL scheme, which will in turn reduce the pressure on the six lenders who do currently offer BBL’s to new customers.

12:00 – To show willing, I suggest you stay at your desk over your lunch hour, so have your sandwiches at hand.

Your next task and boy is this an important one, is to send out an urgent memo to all accredited lenders telling them in no uncertain terms they need to use the “shared industry database” correctly.

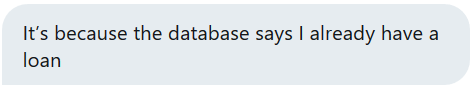

When they are processing BBL applications they need to understand that many applicants are blissfully unaware of its existence and the problems it is causing.

If a BBL processor is processing someone’s BBL application and they see on that wretched database the business entity an applicant is applying for is listed upon it as having a BBL in progress, been paid or even that they are on a waiting list with another lender, the applicant needs telling.

They also need to be supplied with a monitored email account by the BBL processor team for the bank who has listed that information on the database so that they can then request and be supplied with a letter dated and signed as good as instantly informing the lender they have applied with who has seen that information on the database that their application is not in progress and they have not received a BBL for that business entity, if that is the case.

Currently, those that are listed on the database face an uphill task trying to get proof they haven’t yet received a BBL from the other lender, and staff at some banks are reading the database incorrectly, entering information on the database incorrectly and are making a whole host of other errors with that database and the information contained upon it too.

Give lenders access to a person at each of the other accredited lenders who can be phoned up to verify instantly the information on the database is correct and who can amend any errors on the database in real time too, as a fail-safe back up.

By doing the above you will instantly smooth the path for applicants to get a BBL whilst at the same time protecting the scheme against fraud.

13:00 – You have now been at your new job for four hours and have already made some huge progress, you can now move onto doing what you have been employed to do, that being each of the things listed above in the bullet points.

Which are of course more orientated at the lenders and not BBL applicants, but always keep in mind the problems BBL applicants still struggling to get a BBL are facing day after day, so be on hand to offer practical support as and when any problems are fed to you, whilst doing the job you have been employed to do.

Those problems include banks such as Metro Bank approving people for a BBL paying them then declining them for a BBL and locking those customers accounts. Then not communicating with those applicants or letting them know how they can get that late decline reviewed or how they can appeal that sudden and late decline.

HSBC having an online feeder and new account portal that is riddled with technical problems and can often time out someone’s account application without them knowing it’s possibly due to the documents they have uploaded not actually being uploaded, or even being sent out EchoSign’s that are riddled with errors thus meaning payment will not be forthcoming until a new EchoSign is sent out.

Applicants being told they can expect payment from let’s say Barclays within 24 hours or in just a few days when in reality they could be waiting much longer, or even Barclays executive office staff reviewing declines and making up non existent BBL rules and refusing to overturn a BBL decline based on fictitious and non-existent BBL rules/criteria.

I could go on and on and on listing problems, but I won’t, suffice to say however you need to be on hand to immediately be told of them as they start to occur and be able and willing to address those problems rapidly.

Always Put Yourself in a BBL Applicants Shoes

One final thing, you must never forget, and that is a BBL applicant is not your enemy, unless you make them so. There is a real person behind every application, who is possibly in some form of lock-down and is desperate to save their business and their livelihood and need to secure a Bounce Back Loan.

Always be prepared to put yourself in their shoes and ask yourself what the current problem(s) they are facing are and how can that problem be overcome.

Applying for a Bounce Back Loan is an alien concept for many applicants, and whilst over a million people have already secured one, there are a huge number still unable to access that scheme.

They are facing non communicative lenders or being denied their right to apply for a BBL and many, many people are being declined a BBL through no fault of their own. That problem dear Bounce Back Loan Team Director is now your problem and you must earn every single penny of your £75,000 (or whatever you have negotiated) salary fixing those problems quickly.

I wish you all the luck in the world and great success in your new job, I am sure you have your own ideas and strategy for your new roll, just never forget those real people watching the clock now ticking down until the scheme ends, and do everything in your power to help them, if that is what you can and do achieve, then your salary will be very well earned and not a single person will begrudge you earning it.

I do stand ready to phone you up, morning, noon or night if you ever need clarity or an overview of any current ongoing problems Bounce Back Loan applicants are facing. Having been sat here for 5 months now, doing this weird little job I have given myself I have seen things that would make your hair curl and things you will not believe.

One final thing, and this is important, when the UK was in the midst of the lock-down at the start of the scheme, those unable to get a Bounce Back Loan, often found themselves in a very, very dark place, and if you fail to help those still scrambling to get a Bounce Back Loan I am worried many other people will also very soon start find themselves in that dark place too, with all the new restrictions and lock-downs that have been announced. Please do not let that happen again.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website