Not a day goes by without me being told of new problems and ones that I have never seen before regarding Bounce Back Loans, so today I have decided to list some of the problems that you are likely to comes across if you are still trying to get one, that way you are at least aware of them and will not feel like you are the only one experiencing them.

One current problem I am seeing time and time again is that one not so bright spark over at the executive offices at Barclays is making up their own interpretation of the rules of the scheme.

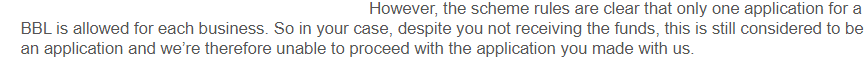

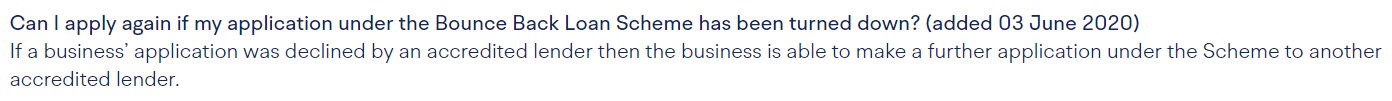

In a nutshell they are tasked with reviewing any declines that pass their way, but are telling those applicants they cannot have a Bounce Back Loan from Barclays simply for having applied for a BBL elsewhere (and have been declined elsewhere and/or did not get a BBL elsewhere).

This is what they are telling applicants who have been turned down by another lender or have not got a BBL elsewhere:

These are the rules of the scheme:

Therefore I have not got a clue why they are making up rules that do not exist, but as I say I see all kinds of nonsense every single day of the week, and that is just one example.

Lack of Lenders Taking on New Customers

With 28 accredited lenders, and one that mysteriously vanished from the accredited lender list (JCB Finance) one would imagine there is a very good chance someone seeking a Bounce Back Loan would have plenty of choice of where to get one.

However, one of the most depressing aspects of perusing the British Business Bank accredited lender list is that you will notice several banks are not accepting new customers, and the majority of them have chosen to only allow their existing customers to apply, or even worse some lenders appear to be handpicking customers and inviting them to apply.

Below is an overview of each of the accredited lenders doing just that and alongside each of their names is an overview of how they have designed their scheme, regarding who they will allow BBL applications from.

Adam and Company – Existing customers only.

AIB – Existing customers only.

Arbuthnot Latham – Existing customers only.

Bank of Ireland – Existing customers only with Business Current Accounts opened on or before 4th May 2020

Bank of Scotland – Existing customers only.

Capital on Tap – Existing customers only.

Close Brothers – Existing customers only.

Coutts – Existing customers only.

Danske Bank – Existing customers only.

Funding Circle – Existing LTD customers only.

Investec – Existing customers only.

Lloyds Bank – Existing Sole Trader customers only. However, they will allow Halifax Sole Trader personal account customers to onboard with them if they were using a personal Halifax account for business purposes before March the 2nd 2020.

NatWest – Existing customers only.

Paragon – Existing customers only.

Santander – Existing Santander or Cater Allen current account customers who had opened those accounts before March 1st, 2020

Skipton – You cannot have a BBL with Skipton unless you are using their Invoice Finance facility.

Co-Operative Bank – Existing customers only, who had an account with them opened before 6th of July 2020.

RBS – Existing customers only.

TSB – Existing customers only, who had an account with them opened before the 11th of May 2020.

Ulster Bank – Existing customers only.

Lack of Updates and Poor Communication

Getting access to some form of an update on either your application for a Bounce Back Loan or Bank Account application can be tiresome and sometimes even impossible.

Bank support phone lines can often ring out for hours and hours, and many people do magically seem to get cut off after waiting a couple of hours. Even when someone answers they are often unable to answer your specific question and will simply tell you to wait as the relevant department is overwhelmed.

Many banks will also tell you to avoid contacting them to chase up your bank account or Bounce Back Loan application, which when you are watching the clock tick down and the days pass until the end of the scheme is not really what you want to hear them telling you.

Delays in Receiving Loan

Another quite common problem arises once you finally get approved for a Bounce Back Loan, and that is there can be an exceptionally long delay in you receiving your loan.

Some lenders will tell you onscreen once you have finished your application and its been approved that you will receive funds in 24 hours, however that is often not what happens, and you could be waiting many days or even a good couple of weeks before the payment drops.

Inability to Open a Bank Account

The small number of lenders that are allowing new customers to apply for a Bounce Back Loan will either require you to open a business bank account with them first or you may be given the option in the case of HSBC to open a feeder account.

As with any bank account you apply for you are going to go through the standard checks regarding KYC etc, and many people are being declined an account but not necessarily for failing those KYC checks.

Take for example HSBC, they have an online new account opening portal which you are required to use to apply for a new account, and by doing so you will be asked to load up to it your identification documents and any other documents they request from you.

That portal has proven to be riddled with technical problems, and you may believe you have successfully loaded up your documents when they haven’t been, you will not be aware of that fact and may eventually be declined for a new account due to your application “timing out”.

The reason for that time out is that your documents have not been successfully loaded up onto that portal (even though you believed they had been), and the bank will often not tell you that was the problem, so you are left thinking your decline was for some other reason, unless you are lucky enough to contact the bank and actually speak to someone who is aware of that problem and can re-activate your application.

You may simply be declined for a bank account as the bank has no “appetite” for the business marketplace you operate in. Banks sadly can decide who they want as customers and can pick and choose their customers.

Declines Based on “Additional Criteria”

The rules of the Bounce Back loan scheme are not overly complicated, much more so when it comes to you finding out whether you are eligible for a loan.

However, some banks have decided to bolt onto the standard criteria their own additional criteria, and as such you may think you are eligible for a BBL and apply with one lender and then they decline you. Two banks that are famed for having their own criteria are those listed below, so be warned and be aware of them both.

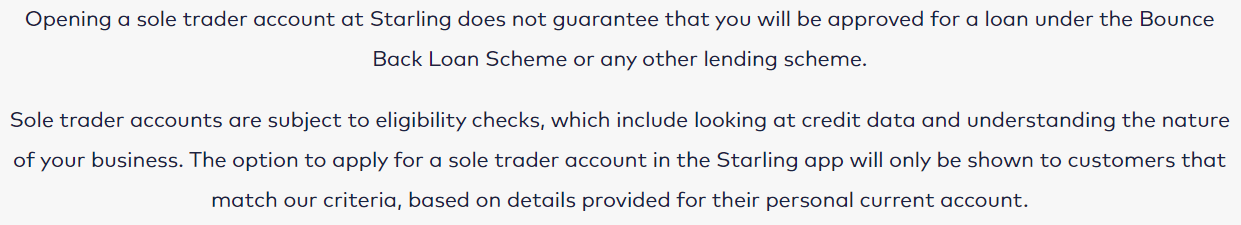

Starling Bank – Starling Bank will decide whether they want to approve your BBL based on their own added criteria.

Metro Bank – Metro Bank have form for declining BBL applications as they may not have the “appetite” for the market place some applicants operate in.

Waiting Lists

Two BBL accredited lenders operate a waiting list system, and as such you cannot immediately open an account with either of them then go on to apply for a Bounce Back Loan, and will not be able to instantly and at any time apply for a BBL if you are a customer of theirs, even if you have been a customer of theirs for many years, until and if you are lucky enough to be invited to apply.

Tide – Tide have no more money to lend out, they did have a waiting list, however they have now closed it down and have “paused” their lending.

Starling Bank – Starling Bank also have a waiting list and even if you are on that waiting list they tell you in no uncertain terms they may not invite you to apply for a BBL and if they do they still have the right to decline you for any reason, which could be they do not like you or your business model.

Long Processing Delays

Half of the battle of getting a Bounce Back Loan is opening up a suitable bank account with any accredited lender, however there are going to be some very long delays in the processing of your BBL application even if you do manage to open an account.

One bank that is famed for such is HSBC and below is an insight into just how long you could be waiting if you manage to open either one of their business bank accounts or feeder accounts.

HSBC – I am often asked by those who have finally been able to apply for a BBL with HSBC just how long it will take for that bank to process their BBL application. Well, it can take several weeks for that application to be processed, and when chasing them up you will simply be told to wait.

The final link in the Bounce Back Loan application chain will be HSBC sending you out an echo-sign via an email marked “urgent” which you must sign online. Payment can at times be the same day if you have a business account with them or two working days when you applied via a feeder account, however you may need to add on an additional few days on top of that two days wait if the account you nominated via a feeder account was a Tide account or some other non-standard type of account.

However, I am often contacted by people who have been waiting a good couple of weeks for payment, even after signing their echo-sign.

Also, sadly HSBC have form for making errors on EchoSign’s too, so a longer than normal delay could, but not always, be due to such a problem, if it is HSBC will then have to send out a new EchoSign to you, but will often not make you aware of a problem until after a long wait and with very little if any communication.

Shared Industry Database

If you apply for a Bounce Back Loan, the lender you are applying with will of course perform their standard checks to ensure you are eligible, and one of those checks is to look on the Shared Industry Database to see if you have already got a Bounce Bank Loan with another lender.

Whilst that seems like a good fail-safe system many people are finding out that their details are on that database when they have simply applied for a BBL and have not been approved for one, been on a waiting list for a BBL or even applied for and never got a Feeder Account.

Some lenders are not going to approve you for a BBL if they see you on that database, even if you have not got a BBL, and will then force you to contact the bank that has entered your details on that database and get written proof that you have not received a BBL for the business entity you are applying for a BBL for.

That database is also being misread by some bank staff processing BBL’s, and in some instances that database has wholly inaccurate information on it, I.E. you have got a BBL but have not, again due to staff members of another bank adding information onto it incorrectly and/or reading the database incorrectly.

When you are declined for a BBL you may not be told why, so you will first have to ascertain if its due to you allegedly having a BBL or that you have applied for a BBL or even a Feeder Account with another bank and if it is, you are then forced to have to try and contact the bank that added your details onto the register to get a letter proving you have not got a BBL from them.

That sadly is going to stress you out no end, for you will not know which department to contact and could be on the phone for hours and hours each day trying to get in touch with someone on phone support who understands what your problem is and can direct you to the right team to supply you with that written proof.

Tide and Starling Bank have however explicitly stated they can and will supply such a letter, proving if nothing else that problem does exist, but the other lenders have not. So be aware of that added bit of nonsense as quite disgustingly the banks have turned their problem into your problem in that regard.

If you find yourself in that situation and have no idea of who to contact with any bank, please read the section below on how to contact the CEO of a bank, as most banks will have a team of staff answering such emails and will hopefully point you in the right direction as to who to contact.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website