Due to the sheer number of complaints I am getting about Metro Bank, today I will be giving you an insight into those problems.

With HSBC now slamming the door shut to new business and feeder account applications, that means fewer choice of where to apply, and some of you will be left with no other option than to try Metro Bank if you do want a Bounce Back Loan.

Be aware that if you take the plunge and opt to go with Metro Bank, there is a very good chance you will run into one of the following problems, which sadly they appear to be very ill-equipped to handle and rectify in a speedy fashion.

Opening a Business Bank Account with Metro Bank Online

If you operate a LTD Company then, as it currently stands, you can apply online for a Business Bank Account with Metro Bank. To do so click here and complete the online application form.

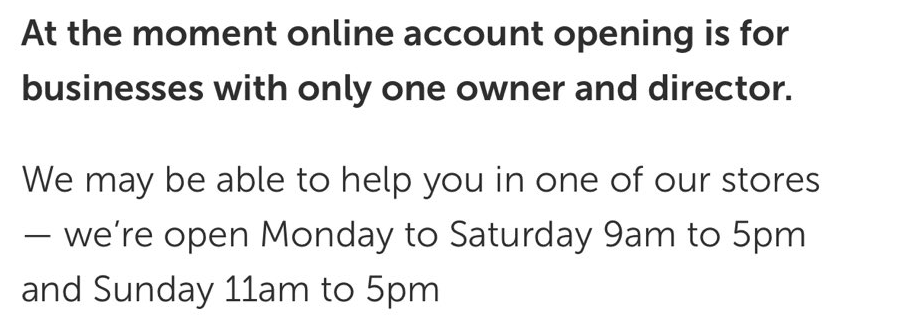

However, be aware people have been running into problems if their business has more than one owner and/or more than one Director:

If you do run into that problem then you will need to contact Metro Bank (and good luck with that as their support staff are overwhelmed), and ask them for an “in-store” appointment to open a Business Bank Account.

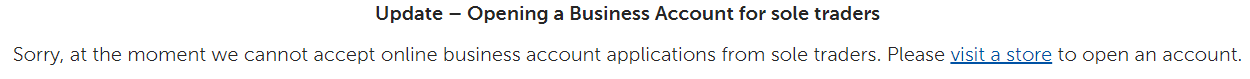

If on the other hand you are a Sole Trader, then sadly they have chosen to shut the door to such business owners who want to apply via their online Business Bank Account application system, and you will have to arrange to open an account “in-store”.

Metro Bank call their branches “stores” so just making you aware of that!

Be aware when applying online, and some Sole Traders were able to do so before Metro Bank shut down that online option, there were four possible outcomes of the application:

Instant Approval

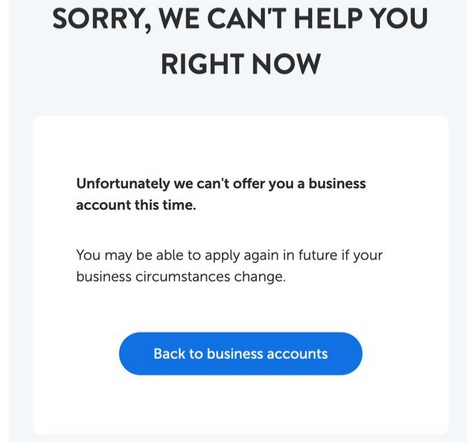

Instant Decline

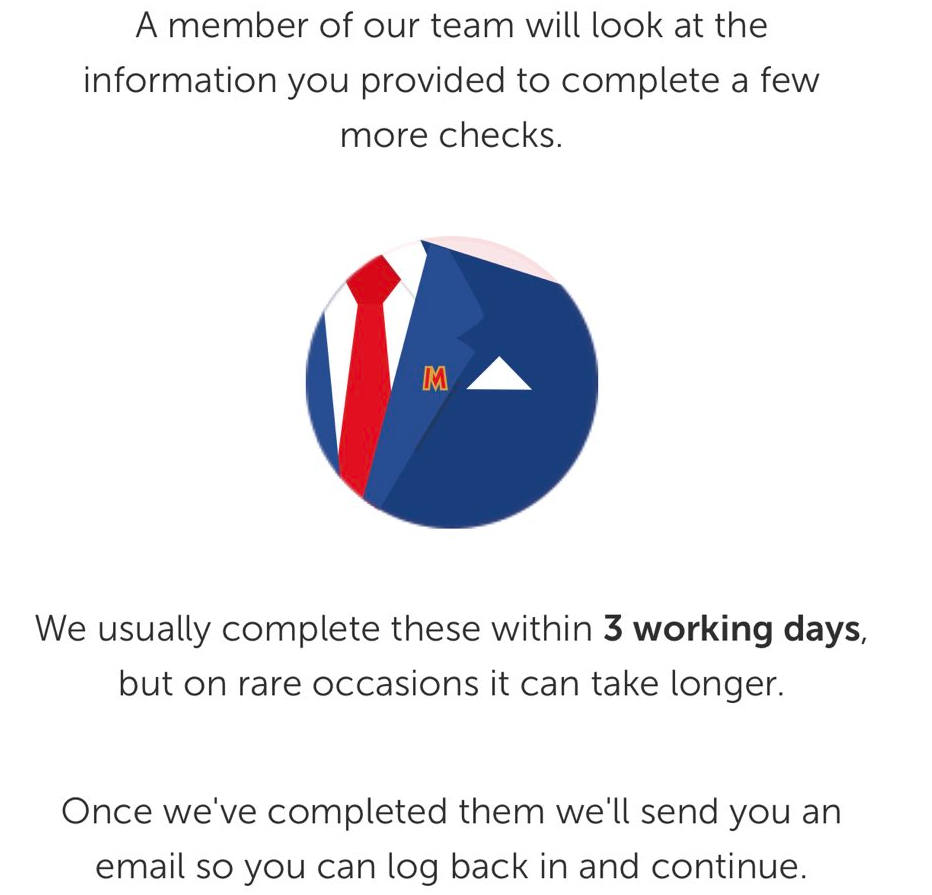

Review

Error

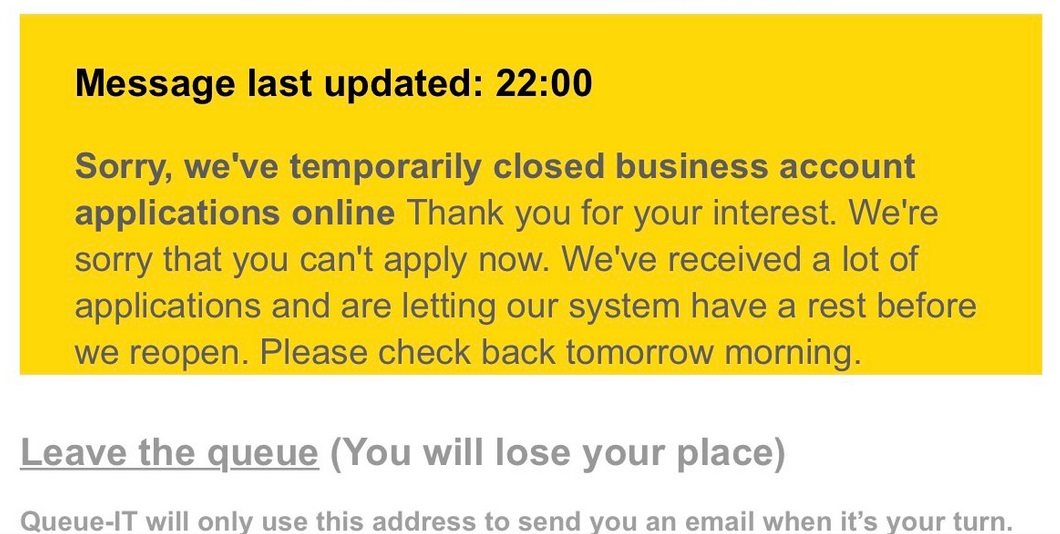

Oh and be aware that the new account application system can get tired just you like or I and as such they tuck it up in bed at times:

By getting an instant approval you would be furnished with your new bank account sort code and bank account number and can then apply instantly for a Bounce Back Loan.

An instant decline is of course just that, so unfortunately if you did get a decline, they do not want you as a customer.

A review means one of their staff members will have to look over your application and review it manually, be aware that despite any onscreen message or email that review can take much, much longer than just a few days, and could lead to an approval for an account or a decline.

Whether they like to admit it or not, the Metro Bank new business account online application system can also be riddled with technical errors, and as such there could be a chance if you apply for a new account with them you may get one of the many error screens/error messages.

Trying to get sense out of their customer support members when chasing up an account opening review or a solution an error message will see you being told to wait.

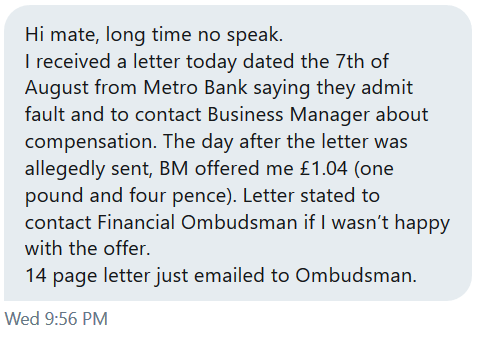

One applicant who went through weeks and weeks of technical problems, but did eventually get sorted out has been offered compensation:

Metro Bank In-Store Appointment to Open a Bank Account

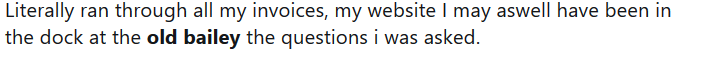

Now, if you are advised that the only way you can apply for a Business Bank Account with Metro Bank is by visiting one of their “stores” then there is no nice way of putting this, they are going to go over your business with a fine tooth comb.

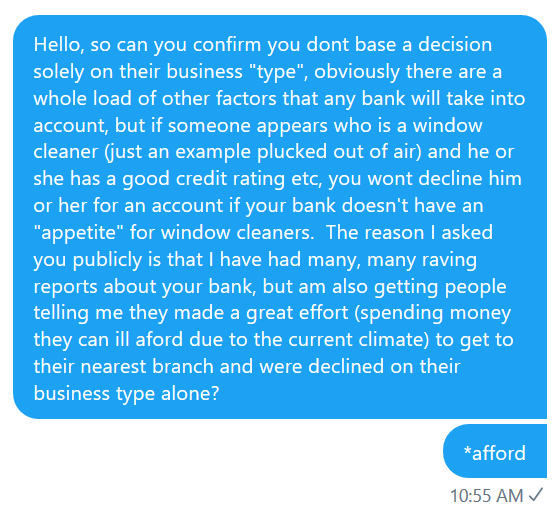

In fact, some people have had to travel 100’s of miles to attend such an appointment and have been declined for all manner of different reasons. One being the market sector they operate in is one the bank does not have an “appetite” for. Sadly, any bank can decline you for an account for any reason they dream up.

If you are about to attend such an appointment with Metro Bank then take everything you have as far as documents go to prove you are a legit business and one “worthy” of one of their Business Bank Account. You basically have to “sell” your business to them.

You may be approved “in-store” or may have to wait until they refer it to another team for final approval.

Applying for a Bounce Back Loan with Metro Bank

If you do manage to finally open a Business Account with Metro Bank, then you can head straight on over to their Bounce Back Loan application form online and apply for one.

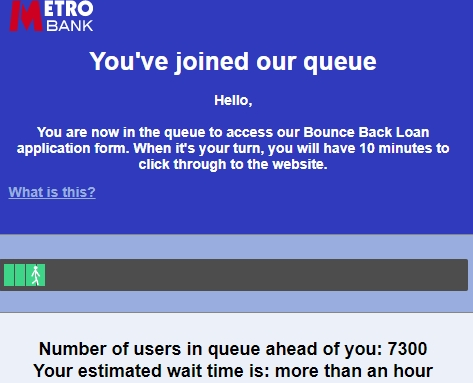

Be aware they do operate a waiting system, as they can be a tad busy at times:

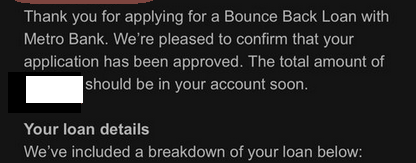

You simply need to fill in the Bounce Back Loan application and by doing so at the end of the form filling you will know whether you have been approved or not.

However, being approved for as Bounce Back Loan with Metro Bank does not necessarily mean you are going to get a BBL!

I have been inundated with people who have been approved for a Bounce Back Loan with Metro Bank, some of whom have been paid out that loan and once they access their accounts and for example start to use the funds their account has been locked.

That is when sadly the nightmare begins, for anyone that does experience such will of course immediately contact the support staff at Metro Bank and ask them what the problem is.

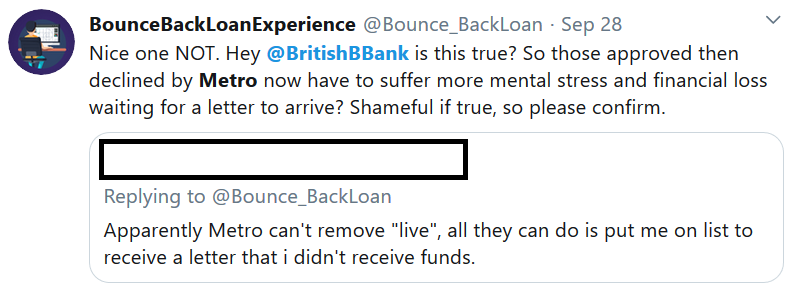

They may be told on the phone their Bounce Back Loan has been snatched back and declined and they should await a letter to arrive letting them know such.

Many people caught up in that saga have demanded a review of their Bounce Back Loan application and that decline, and have been able to get such a review instigated and in some instances the approval > decline gets reverted back to an approval and they can get access to those funds snatched back.

Others have been told they have to write into the bank and await a reply which could be many weeks in coming, to find out what if anything they can do.

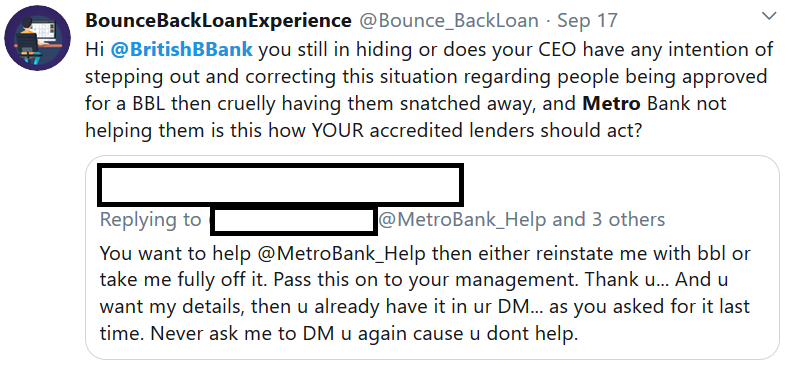

General customer support staff have been quite abrupt with those approved then declined for a Bounce Back Loan, and I have been advising people to try and contact a Business Manager at Metro Bank branch if possible, as they appear to be the only people who can assist quickly.

That is however proving to be much more difficult now due to the sheer number of people approved then declined. Currently I would suggest if you have experienced the above you contact your local MP and ask them to step in and help, they may do or they may not do, but failing to try everything such as contact a Business Manager and/or your local MP could see you losing that Bounce Back Loan you thought you had been granted.

Some people have also seen Direct Debits set up and are being given the option of repaying the Bounce Back Loans Metro Bank paid them out then snatched back, which is even more confusing for applicants.

This is a cringe worthy saga and one that needs addressing urgently, for the mental anguish alone for most people caught up in it is serious and may tip some people over the edge obviously.

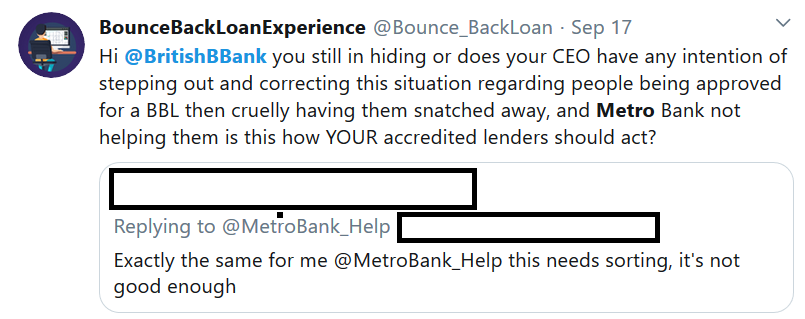

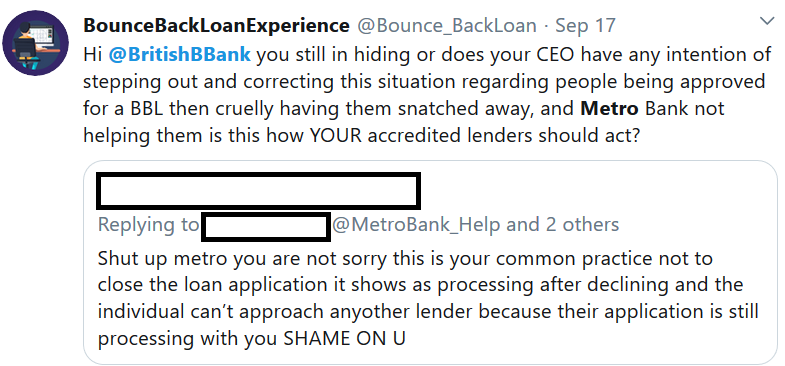

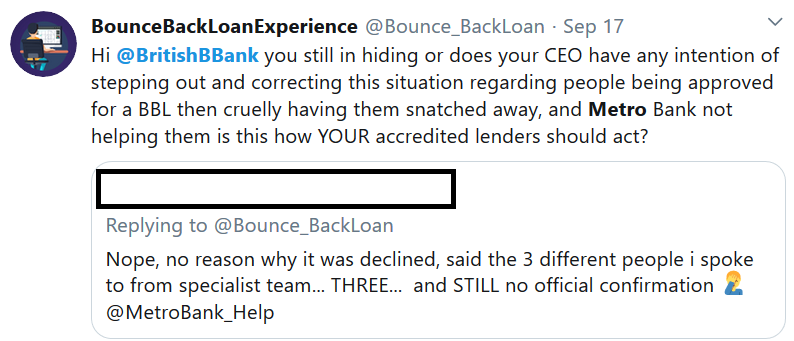

Below are some tweets I have been sent on this very sorry affair, which Metro Bank should be thoroughly ashamed of. I have of course alerted the British Business Bank, but you know how useless they are at keeping their accredited Bounce Back Loan lenders in check.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website