When the last CEO of the British Business Bank legged it out of the door, and who can blame him for doing so looking at the utter shambles the Bounce Back Loan scheme has become, (who would want their name associated with that mess), Catherine Lewis La Torre must have thought all of her Christmases had come at once.

For she was plucked from obscurity and was given the CEO job, and that saw her then bagging a very generous salary and all the additional perks that came with the role too.

However, it does have to be said she has shown very little if any sympathy to the huge number of people that have experienced problems with the Bounce Back Loan scheme, and she has made no effort what so ever to address those problems, that is oh so obvious for all to see.

One must imagine unlike those who are still unable to get a Bounce Back Loan she is happily counting down the days until the scheme ends, which by the way is in 36 days.

If you are one of the many, many business owners that cannot get a Bounce Back Loan, or are still waiting for your application to be processed, often after putting it in months ago, or cannot find a lender offering those loans that will accept you as a customer, you will know just how frustrating that can be.

In fact, with just 28 accredited lenders, 2 of whom have no money to lend out, and 23 of them not accepting new customers, one operating a waiting list with no guarantees they will call you off that BBL waiting list, there are just two lenders offering new customers a business bank account and then access to the Bounce Back Loan scheme.

Those two lenders are Clydesdale Bank and Yorkshire Bank, but many business owners do not have perfect credit score and are being refused a bank account with those two banks, and that means they have no access to a potentially business saving Bounce Back Loan.

It is often their local MP many small business owners will turn to when they are desperate for a BBL, and contacting your local MP is something I urge everyone to do when you are being messed about by any bank.

For reference I have seen some MP’s go above and beyond what is expected of them, and badger certain bank CEO’s to sort out problems, and in some cases also badger a banks CEO to open a business account for their constituents and allow them to go on to apply for a BBL too.

It is all dependent of course on just how committed to helping their business owning constituents, as to whether you MP can pull some strings behind the scenes, but my advice is to give them a try if everything else you have tried has failed, you never know you may just strike gold so to speak.

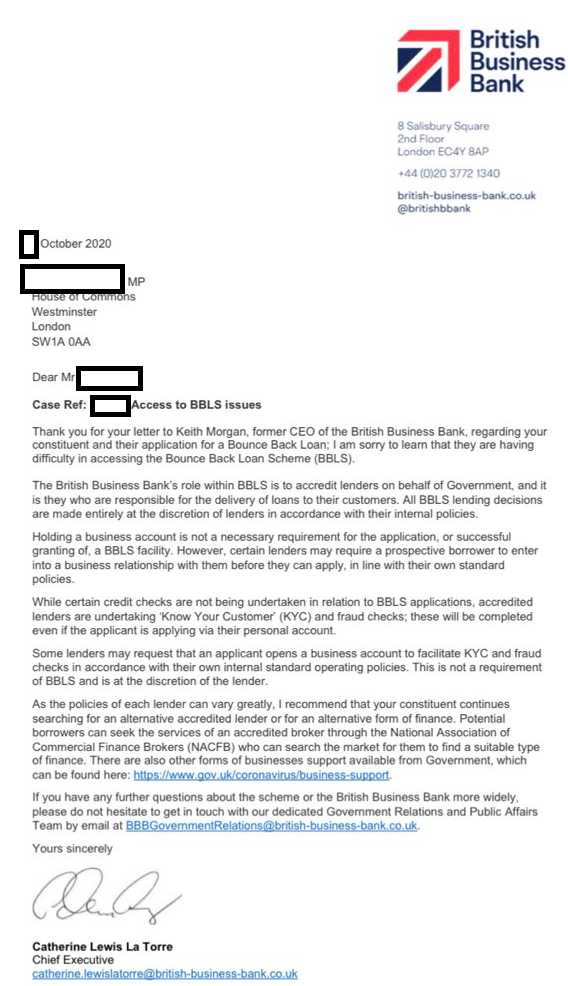

One MP did recently fire off a letter to Catherine Lewis La Torre at the British Business Bank, well to her predecessor, and she replied to that letter which is published below.

As you will see, rather than offer any real help to the business owner via her reply to that MP she has the brass neck to suggest the business owner “looks around for another Bounce Back Loan lender”, when she must bloody well know there are only two accepting new customers, and many people cannot get an account with them.

Then to make matters even worse she suggests the business owner should look at “alternative funding sources” which would entail them possibly making use of a broker to find what would certainly end up being a more expensive form of lending.

**Be aware that there are currently a number of supposed “Brokers” offering a “service” to help you get a Bounce Back Loan online, under no circumstances should you make use of any of them that charge any type of fee or demand a share of the BBL, they cannot get you one using any other method than you applying yourself, and the Department for Business, Energy & Industrial Strategy have made it very clear no Broker can charge any type of upfront fees. >> Bounce Back Loan Brokers Causing Added Misery for SME’s

Erm, Catherine, the Bounce Back Loan scheme was set up to help small business owners gain fast access to business finance, the British Business Bank is supposed to be the rule maker and the organisation overseeing that scheme, so how about you make some noise and do everything in your power to help those who cannot get a BBL, bet you won’t though as that will mean you actually having to earn your high salary wouldn’t it.

Where on God’s Green Earth did they get her from? Completely and utterly oblivious to the needs of small businesses, an utter disgrace., but sadly in keeping with what the British Business Bank has recently become, a toothless organisation that could not give a damn.

Here is her reply to that MP by the way.

Applying for a Bounce Back Loan

Whilst the list of accredited Bounce Back Loan Lenders stands at 28 of them, there are only three of them that are accepting new customers, you will find a list of banks that are accepting new customers by clicking HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank you have applied with, and a full list of CEO email addresses are on this page of the website