As the self-imploding Bounce Back Loan saga rumbles onward, and with the BEIS Strategy Committee, the Treasury Committee along with the Public Accounts Committee still all unable to wrap their head around that scheme, I will today lob a spanner in the works for all of them.

As part of the agreed rules regarding the procedure for arrears and defaults which has been confirmed by the National Audit Office (see link below to view that procedure), it appears some banks are not following the rules and sticking two figures up to the Government in respect of that procedure.

I have seen more than enough proof that those lenders (you will know who they are if you are experiencing what I am about to tell you) are not reporting to credit reference agencies missed Bounce Back Loan repayments nor are they reporting defaults on those loans either.

I cannot confirm that is the case will all lenders as there are some banks who are part of the BBL scheme that I have not received feedback about or have been told otherwise, but there are several lenders that are currently, for reasons unknown, not reporting arrears or defaults to credit reference agencies.

Maybe it is something hidden away in the heavily redacted Government Guarantee Agreement I have seen that states they are not obliged to report such or maybe they are giving those who cannot repay their BBLs a helping hand or maybe there is another reason.

Added to the fact that most Sole Traders have not actually seen a Bounce Back Loan being logged against their names on credit files in the first place adds to the mystery.

Why am I reporting this, well It would appear until confirmed otherwise that some lenders have sussed if one of their customers is in arrears, gets a default letter then a demand for repayment letter from the lender at the default stage and the bank makes the minimum of effort, but just enough effort to secure the Government Guarantee payment, those customers will keep quiet.

Whilst that is all well and good for those unable to repay, many people are left in a weird place of not really knowing what is going on, with 70% of BBL recipients having never taken on a business loan before.

That is causing a great deal of stress for many people, not only are they unfortunately not able to repay their BBLs but also not knowing why the lender is doing as little as possible to contact them or offer them additional help and support, and when checking their credit files see diddly squat mentioned about their BBL and their arrears or defaults.

Just be aware of the above if anything rings a bell with your current situation, as I am inundated with people telling me it is happening to them, well in the case of credit reference agency reporting, not happening to them.

Maybe some lenders are sympathetic with those who cannot repay and just want them to Bounce Back without big marks on their credit files, I do so hope that is the case….

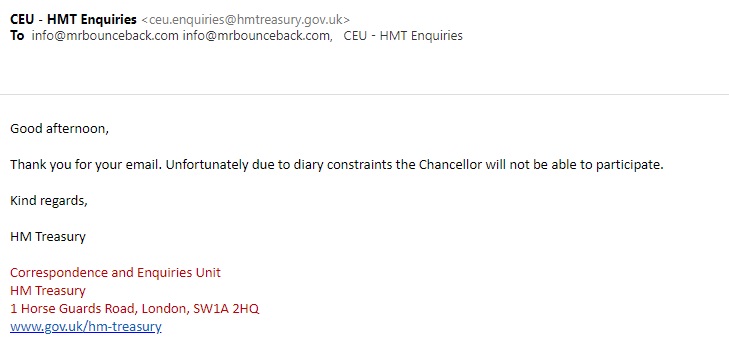

I did ask Rishi Sunak to take part in one of my Fireside Chats to discuss the above and other things related to Bounce Back Loans, I got word back his diary is way too full to chat to the likes of me.