It has been 166 days now since the Bounce Back Loan scheme was launched, and as of the release of the last set of published figures that being on the 20th September, some £38.02bn has been lend out to 1,260,940 separate business entities via that scheme.

In that time I have spoken to thousands of business owners, some who managed to get a Bounce Back Loan quickly and without any fuss or hassle, and have spoken to thousands of business owners who have had to jump through hoops and have experienced no end of problems getting a Bounce Back Loan too.

Sadly, I sit here with some 45 days left of that scheme and am aware of, and speak to plenty of business owners who feel stressed, full of anxiety and despair at not being able to access the Bounce Back Loan scheme for one of many different reasons.

In fact, I am seeing more and more people now giving up all hope of ever getting a Bounce Back Loan and facing the grim reality of having to close their businesses down.

That has of course been compounded with the new three-tier lock-down that is going to sadly be the final nail in the coffin for many businesses across the United Kingdom, even those who have secured a Bounce Back Loan are now finding it impossible to keep their businesses viable.

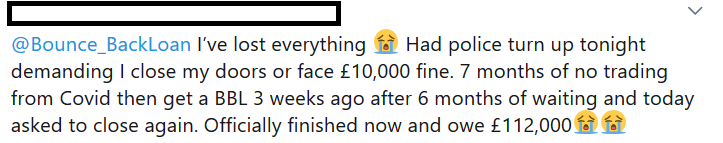

One tweet I received very early this morning broke my heart, I have formed some great cyber friendships via my Twitter account with many people from all business sectors, but what words of support could anyone possibly give after reading this:

I have always told those still scrambling around who are trying everything possible to get a Bounce Back Loan to never give up, keep the faith and keep on trying, however for many there are simply no options left for them to get access to that scheme and secure a loan to help them try and “Bounce Back”

How the Bounce Back Loan Failed Many Business Owners

We all know the pandemic is the cause of the current situation we all find ourselves in, however when it comes to the Bounce Back Loan scheme, and its many failings, there are some very obvious people and organisations we can point the finger at for not doing all they could to iron out those failings.

Rishi Sunak Offering Something that Could Not be Delivered to Many

Perhaps in hindsight Rishi Sunak should not have given the impression that is would be a breeze to get a Bounce Back Loan, as experience has taught many people getting one in just a few days is pie in the sky so to speak and for many, getting one of those loans is impossible right now.

Offering fast track loans with no real strings attached, even to business owners who may not have a perfect credit score is one thing but allowing banks to then credit check potential customers for an account is another. Whilst many business owners do qualify 100% for a Bounce Back Loan, many of them cannot open a bank account with an accredited lender.

British Business Bank Did Not Like the Scheme Even Before It Launched

The British Business Bank, in my opinion have acted appallingly, they have offered no real support to business owners and even before the scheme launched they hated the idea of it, so much so their then Chief Executive Officer & Accounting Officer Keith Morgan CBE fired off a Reservation Notice to the Rt Hon Alok Sharma MP, Secretary of State, Department for Business, Energy & Industrial Strategy.

That Reservation Notice outlined the concern of the British Business Bank on several aspects of the scheme, and whilst they were not happy with the scheme, they were told in no uncertain terms to make it live and oversee it.

Its true to say they have done everything to distance themselves from the ongoing problems with the scheme and have stood back and watched and have done nothing to help, as many business owners have been failed by the scheme.

Then, low and behold Keith Morgan CBE stands down from his position at the British Business Bank. That speaks volumes.

For what it’s worth, and I say this to the British Business Bank, people desperate for a Bounce Back Loan want helpful advice and information on how to get one, an overview of the problems they will face and solutions to their problems, not gleeful tweets telling them how many Bounce Back Loans have been awarded and where they went in the UK, and which business sectors had them.

That compounds their agony, seeing others have got one when they have tried everything in their power to get one, let that sink in, and one day you might understand where you failed. Sadly, I doubt you will.

Some Banks Tried to Enter into the Spirit of the Scheme

Let me now turn my attention to the banks and lenders that signed up to the Bounce Back Loan scheme. You can, in fact, separate them into different groups.

Some banks did enter into the spirit of the scheme and allowed new customers to apply for a bank account and then go on to apply for a Bounce Back Loan once their new business account was set up and opened.

How the Big Banks Coped

It is worth keeping in mind that the largest UK lenders that are part of the Bounce Back Loan scheme have between them supplied 89% of all Bounce Back Loans awarded, those lenders being Barclays, HSBC, Lloyds/Bank of Scotland, NatWest/RBS and Santander.

HSBC to be fair to them did launch their “Feeder Accounts”, I will not go into the hundreds if not thousands of complaints I have received about HSBC, suffice to say they did stand alone in entering into the spirit of the scheme, and did their best, however they slammed the door shut to new customers in September due to the sheer volume of new account applications they were receiving and how many BBL applicants they still have to process.

Lloyds decided they were not going to accept new customers and as such concentrated their efforts on servicing their own customers but did allow Halifax Personal Account Customers to onboard with them. However, they only accept Sole Traders so LTD’s could not secure a Bounce Back Loan with them. Bank of Scotland also took a similar approach.

Santander also decided they were not going to allow new customers to apply for a Business Account, and as such imposed a cut-off date, and anyone who had opened a business account after that date would not be able to apply for a Bounce Back Loan, they did however allow their Carter Allen customers to onboard with them.

NatWest along with Royal Bank of Scotland also decided they were not going to allow new customers to get a Business Account with them during the Bounce Back Loan scheme, and as such if you were not and are not one of their customers then it is impossible to get a Bounce Back Loan with them.

How the Smaller Banks and Lenders Coped

Moving onto some of the smaller banks, FinTech’s and lenders, well most of them imposed a “existing customers only” rule, and as such they only offered Bounce Back Loans to their established customer base.

Metro Bank did open then close then reopen and have now one again closed once more their online new Business Account application system, but have been approving Bounce Back Loans, then either locking accounts of some of those who got one and were paid out one and snatching those funds back.

Starling Bank did and still do (however that could change at any moment) allow new customers to get a Business Account, however they operate a waiting list with no guarantees they will call those on it to apply for a BBL or even give them a BBL when invited to apply for one.

Both Metro Bank and Starling Bank have their own “added criteria” on top of the standard Bounce Back Loan criteria, meaning they can pick and choose who they want to offer a BBL to, based on their “appetite” for the business sectors applicants operate in.

Tide destroyed the hopes of tens of thousands of small business owners by launching their Bounce Back Loan scheme, then abruptly announcing they had run out of money and could lend no more out, after around 1500 applicants had secured a BBL from them.

In fact, when Conister arrived very late on the scene they appeared to offer the perfect solution, for anyone who was eligible could apply for a Bounce Back Loan with them without the need for a bank account with them.

However, they too massively failed to deliver the volume needed, and I wont go into the huge number of problems some applicants faced with them but questions do need to be asked why they did not shut the door on their scheme sooner than they did.

I say that as they allowed some 4,607 applications to apply which had a collective total of some £162,739,000 in potential loans, when in reality all they had funds to lend was to some 301 customers with a total amount of £11,675,997 available.

Problems Business Owners Faced when Applying for a Bounce Back Loan

I did attempt back in the early days of the Bounce Back Loan scheme going live to document all complaints I received about each bank. However, it soon became apparent that was going to be impossible, due to the sheer volume I received on a day to day basis.

You will however find 500 or so complaints on this website if you look around, but in reality the number of complaints I have seen and am aware of now total the tens of thousands, and as for how many people cannot even access a Bounce Back Loan, that is possibly in the hundreds of thousands.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website