Whilst I have been online with my Twitter account since the day the BBL Scheme launched, way back on May the 4th 2020, followed quickly by the launch of the website, I then launched something I am very proud of, that being my Bounce Back Loan helpline.

To date I have received: 23369 calls

(That figure is updated each morning with the previous days callers added to the total)

Subscribers Call Any Time

I managed to keep the helpline available, open and free to everyone for as long as I humanly could do, however due to huge demand and lack of financial resources, as the helpline is self funded, I made the decision, that from the 9th of November 2024 to make it exclusively available to website subscribers and/or those who have made a donation.

If you are a subscriber then you are more than welcome to call me anytime between the hours of 4am and 4pm, 7 days a week.

You can subscribe here > https://mrbounceback.com/membership-join/

Or you can make a donation here > https://fundrazr.com/12BBn6

Number 10 Lets Me Down with Funding

HM Treasury seemed eager in my first meeting with the Covid Corruption Fraud Commissioner to give me some funding to enable me to make the helpline available to everybody and not just subscribers.

However, after promising such for several months on the day before the Voluntary Repayment Scheme launched they said funding could not be found and Number 10 had blocked it.

As this entire operation is self-funded, if you are in a position to make a donation it would be truly appreciated.

Or you can make a donation here > https://fundrazr.com/12BBn6

If you know anyone who is in a dark place worrying about a BBL please pass my number onto them and I will get them sorted.

How to Access the Number

Please log into the website using your username and password, if you haven’t yet done so and then click on the link below to visit the section of the website displaying the new phone number >

CLICK HERE FOR THE NEW BBL HELPLINE NUMBER

(To those who made a donation, as a thank you, you do of course still have access to the new helpline number, drop me an email at info@mrbounceback.com so I can verify such and I will reply, sending you the new helpline number).

Be aware it will be me, Mike, that you are talking to when you call, nobody else, and everything you tell me will be in the strictest of confidence.

Even though I chat to, meet with and often get right up the arse crack of, and annoy the hell out of Bank Bosses, Government Ministers and Civil Servants do not think I am “on their side”, I have and always will be committed to you, the small business owner whose life was turned upside down due to the pandemic.

But you will already know that if I have spoken to you or met you before!

What Can I Help With?

I can help with any and all Bounce Back Loan related questions, you may be about to default and need a chat about the default and recoveries process, you may have a strike off blocked due to an unpaid BBL or you may have been contacted by a debt collector about your defaulted BBL.

I can help you set up a repayment plan if you have been contacted by the Public Sector Fraud Authority about a BBL you shouldn’t have got or misused, in fact anything and everything related to Bounce Back Loan’s is my speciality.

If you think your problem is completely unique, it probably isn’t, but should that be the case and you have an extraordinary unique problem that I can’t instantly get sorted, I can and will, with your permission get the powers that be, behind the scenes, to get it sorted out for you.

My Experience

On the day the Bounce Back Loan scheme launched; May the 4th 2020 I began an online service, initially using Social Media, which developed into the website, and then the additional telephone helpline.

The aim was to collate any and all BBL news and information and pass it on to business owners whilst also offering assistance for people having to navigate the defaults and recoveries route if needed, whilst keeping them updated on any relevant up to the minute changes to the scheme.

I also offer an advocacy service, whereby if anyone is mentally or physically unable to contact their BBL Lender or is in a dark place or is suicidal, I can step in with their permission and alert the Lender, this is something both those with a BBL and the actual Lenders appreciate, and I have been thanked by all concerned many times for stepping in when someone needed urgent assistance.

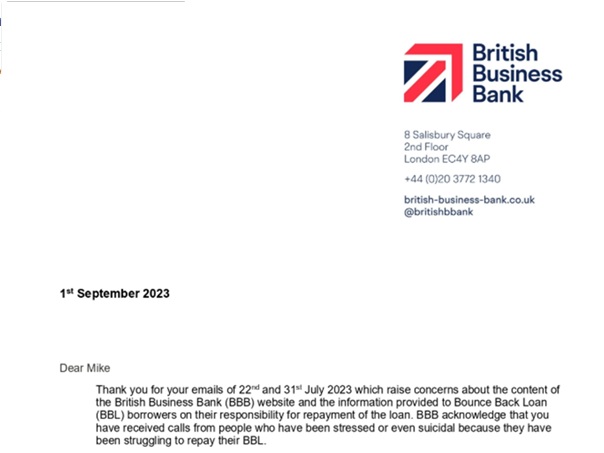

This has additionally been acknowledged by the British Business Bank whose staff members are aware, and have mentioned, I have helped many such people over the years.

In fact, I have contacted them many times to assist in such situations and also to seek clarity of the finer points of the scheme or even rant at them when things have gone wrong for BBL recipients.

The BBL scheme was and is of course like no other business loan scheme in history and there was a lot of confusion in the early days when the scheme went live, as well as now, long after the scheme closed for new applicants, with regard to the rules of the scheme, and which Lenders were offering loans and who could apply and subsequently how the defaults and recoveries process works etc.

Since, that date I have taken over 22,000 calls from business owners in distress with their BBL, and to ensure the information and advice I give to callers, and the much higher multiple of website visitors is correct and up to date, I have made it my business to seek out the information on their behalf and report on it.

I have interviewed the British Business Bank on video and for reference all 28 of the BBL Lenders nominated Stephen Pegge from UK Finance as their representative in that video, I asked them a large array of questions that I was often asked, and some additional ones, and that video has gone on to get 10’000’s of views on both my website and my many other channels.

I was also invited by NatWest to do a similar interview on camera, whereby I asked their top team about many aspects of the Bounce Back Loan scheme, and what people should do at various stages of their loan journey, much like my previous video that has been viewed 10’000s of times.

I have also attended Parliament, observing and reporting on Gov Committee meetings where the subject matter was Bounce Back Loans, and where Government Ministers, Bank Bosses and Civil Servants were quizzed on the BBL scheme, and I have met and spoken to many of those people over the years in a professional capacity.

I have also taken part in BBC documentaries on the BBL scheme and been a guest on several Radio Stations and TV News shows including BBC News, Radio 2 and TalkTV, once again answering questions and giving advice on the BBL scheme, due in no small part to the rules of that scheme being extremely unique and often very, very confusing.

Mike on TalkTV

Mike on Radio 2

BBC Documentary

I have also appeared in many newspapers and given quotes or offered input into articles related to Bounce Back Loans, such as The Times, The Telegraph and the Financial Times to name but a few.

I also have taken part in two National Audit Office investigations into the BBL scheme, and supplied them with advice and feedback from my experiences of the scheme as provided to me by my helpline callers.

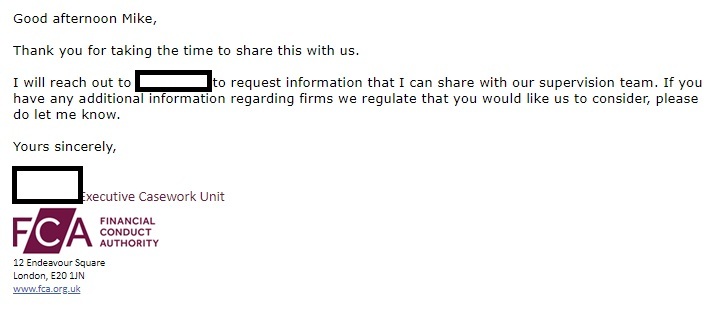

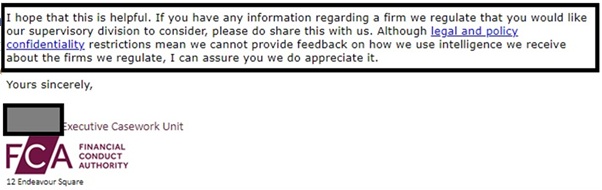

I was also asked to supply intelligence to the Executive Casework Unit of the Financial Conduct Authority regarding any untoward behaviour by any of the Bounce Back Loan Lenders, something I did multiple times.

The feedback and intelligence I supplied, provided with the permission of a select number of my helpline callers did lead to the FCA ordering many BBL Lenders to stop their skulduggery and poor treatment of Bounce Back Loan recipients. More on that here:

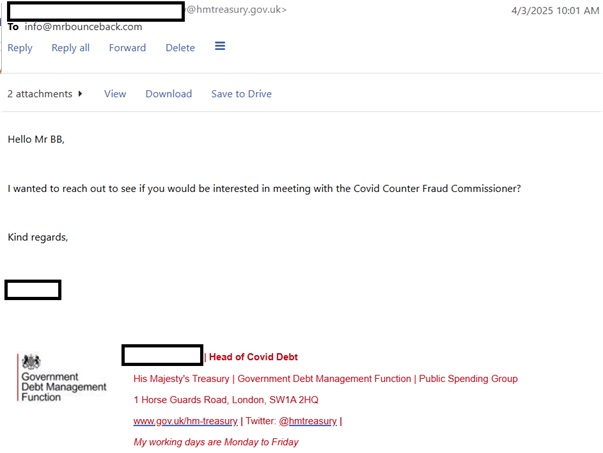

In April of this year HM Treasury invited me to meet with the Covid Corruption Fraud Commissioner as he wanted to “pick my brains” and “offer suggestions and feedback” into a new recovery scheme he had in mind that being the Voluntary Repayment Scheme.

I have since had two meetings with him along with contacting him almost daily over the last 7 months or so, as I have lived and breathed the scheme for almost 6 years so had the relevant experience he and the Government was seeking.

BBL Voluntary Repayment Scheme

I have been giving lots of input and suggestions to the Government and the Covid Corruption Fraud Commissioner regarding the new BBL Voluntary Repayment Scheme, which is part of what I have named the BBL Summer of Love – BBL Winter of Regret.

That scheme/initiative will be giving everyone with a less that legitimate Bounce Back Loan some options to hopefully avoid the oncoming major enforcement action planned and in fact now playing out by the Public Sector Fraud authority.

Sadly, as you have seen from my recent news articles on that Scheme, they have messed it all up, they thought they knew better than me and that Scheme isn’t as good as it was originally planned or envisaged.

If you have any worries or concerns about you current situation with a Bounce Back Loan, which may or may not have questions surrounding it, please give me a call and I will listen to what you say and point you in the right direction and let you know the correct and official course of action to take, to avoid having your collar felt.

After Hours Service

If you are a subscriber or have donated in the past and need a chat but outside of my usual hours, drop me an email, with your number and I will call you between 4pm and 7pm the same day. The email is info@mrbounceback.com, please use the same email address you used when subscribing or making a donation.

When Calling

- Ensure at the start of the call you give me the email address you used when subscribing so I can verify you are a subscriber.

- Be aware I cannot reply to text messages or answer questions via email due to the amount of time that takes, and it is far easier to talk you through the entire process so you can fully understand everything and ask any questions there and then and get the answers instantly, rather than go back on forth on text messages or emails.

- When calling, I will happily talk to you for as long as it takes, so the call may last quite some time, but that is of course all dependent on what stage of your BBL journey you are at, my advice is to have a pen and a piece of paper handy to scribble down notes as I talk you through things, so you know exactly what to do next. I do not give legal or financial advice but I will tell it as it is!

If you call and the line just rings out I am on another call but do have call waiting so I will be aware you have called and I will ring you back once I finish the call I am on.

About My BBL Helpline

Do not sit there worrying alone, if you have something stressing you out about your Bounce Back Loan, feel free to give me a call, you can do so in complete confidence and it will be me taking the calls, no one else.

Keep Me Updated

If you do call, please keep me updated on how you get on, for whilst your first call may be stressful or daunting, when getting things off your chest, once you know you have nothing to fear and that hassle free journey then plays out personally for you moving forward, you can then try and Bounce Back but without the stress of an unaffordable BBL.