I am still being inundated with problems experienced by those applying for, well at least trying to apply for a Bounce Back Loan with Barclays.

So today I am dedicating today’s news update to those problems and looking at how you can address them and hopefully get them sorted out.

Extending Phone Support Opening Hours

The first thing which is a good sign, is that from this Saturday the 10th of October Barclays are going to be extending the opening hours of their phone support service.

One thing to keep in mind though if you do attempt to contact them via phone, is that you can easily be on hold for at least 2 hours, so keep that in mind if you do phone them up. You may also get cut off at any time when on hold, so keep that in mind too, as you could be on hold for hours.

Those new opening hours will be from 7am to 10pm Monday to Friday and 8am to 6pm on Saturday and Sunday.

Is There Still Time to Open a New Account?

You have a couple of options when it comes to opening a Business Account with Barclays. You can switch an existing business account from another bank to them or apply for a Business Account with them from scratch.

Both options however will see you initially needing to open a Personal Account, and as such you should download their banking app onto your phone and then apply through the app for that type of account.

One thing to note is that you can quite quickly get a Personal Account opened and activated. Then the coast is clear to open a Business Account or switch another Business Account to them.

Be aware though you are going to face quite a few weeks wait to open a Business Account when doing so online, but they may give you the option of visiting a branch to do so instead.

However, it will all be dependent on whether there is a Business Manager local to where you live and just how busy they are as to the timescale of that appointment.

One tip if you do want to try and speed things up, is to be prepared to travel to a not so local branch, phone up the help line and ask them to scan other branches for appointments, you could strike gold and get one much sooner if you are prepared to travel.

I understand that may not be an option for some of you, but it is an option if you are beginning to worry about not getting a Bounce Back Loan.

Providing Supporting Documents

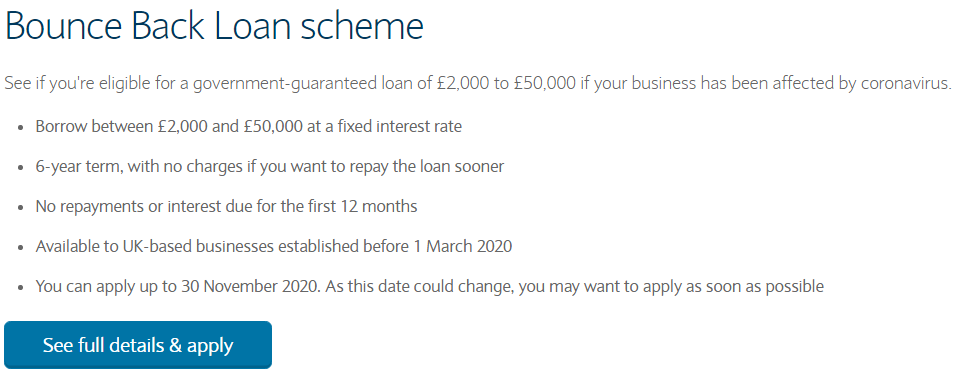

Be aware that when you finally do get your Business Account open, you will notice the link for the Bounce Back Loan will become live when you log into your online Banking and click on the “Business Loans” tab:

However, when you click on that tab you may then be faced with the following screen:

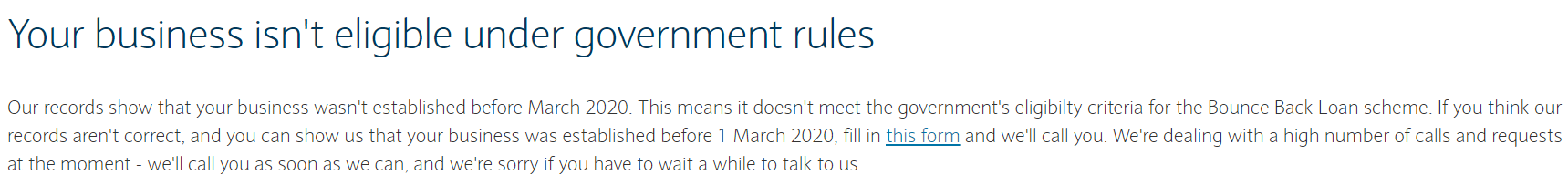

Sadly, that screen is not the best worded one, as it gives you the impression your business is not eligible due to the date you started trading, which is probably not the date onscreen.

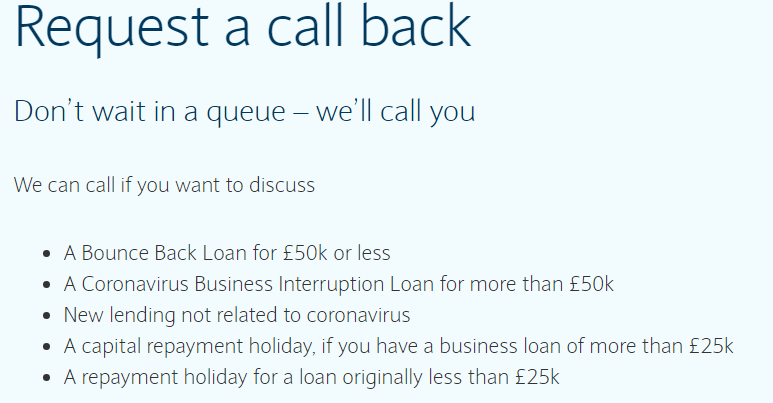

That is simply a “default screen” and as such what you should do is to click through to the “call back” option and then fill it in with your details. You will then have to await the call back.

When the call back comes you will then be talked through the supporting documents you will need to supply to Barclays so that they can then allow you to apply for a Bounce Back Loan and make the link to the application form work.

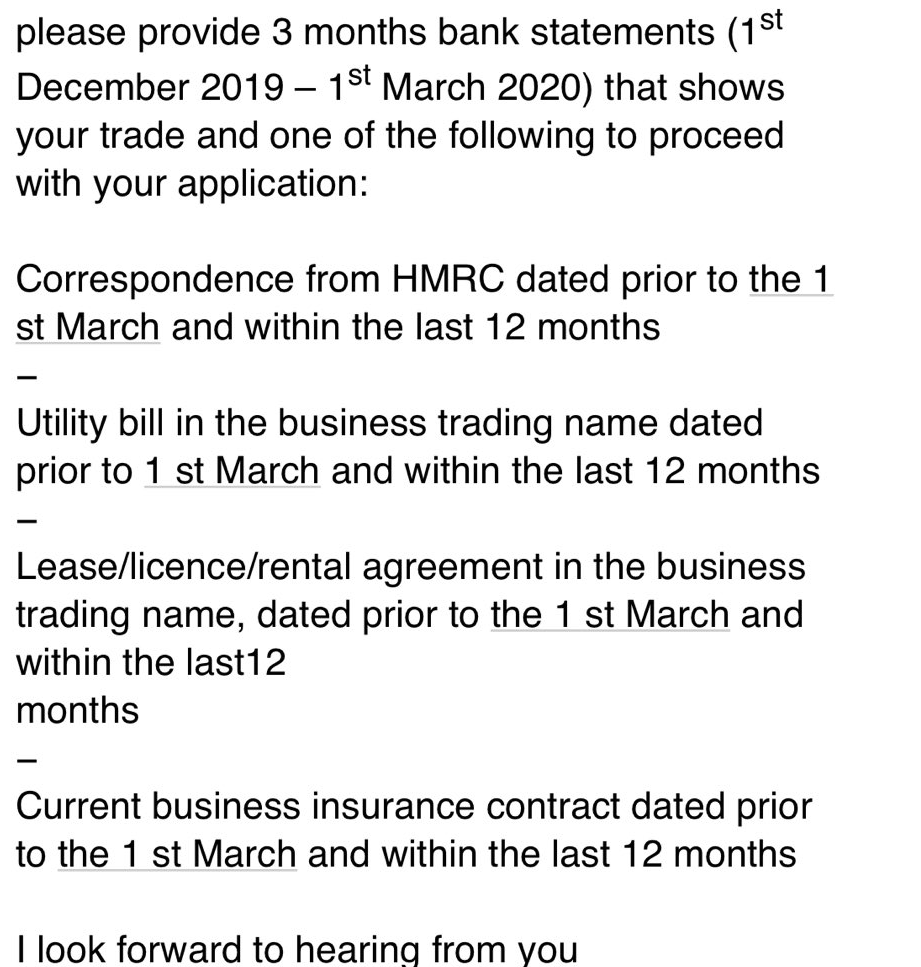

The options will be to supply a Self-Assessment from 18/19, or for those of you who were not trading then you will be required to furnish them with the highlighted documents below.

Once you have had a call back and the above documents have been supplied they will make the link for the application form on your online banking live, and you can then set forth and apply for a Bounce Back Loan.

Once you have completed it you may receive the following email:

Then if all is well you should receive the following one:

Payment will then follow.

Possible Shared Industry Database Problem

Barclays are of course going to check whether the business entity you are applying for has already got a Bounce Back Loan, and that is what they should be doing to negate the chances of fraud.

They do so by scanning the shared industry database, and if your business entity is not listed upon it all will be well, however that database is riddled with errors.

As such you may be listed upon it for having a BBL, or having applied for a BBL or you may even be listed upon it if you have simply added your name onto another banks Bounce Back Loan application waiting list.

If you are listed upon it for any of the above reasons, and you have not received a BBL for the business entity you are applying for then you will need to appeal any decline that Barclays will send out to you.

You will however need to get proof from the lender they allege you have a BBL from, or the lender you are on the waiting list for, and the onus is on you to get the proof. Most lenders will supply a confirmation letter that you do not have a BBL from them in PDF form or will email you a confirmation you have not received a BBL from them.

However, expect to have to jump through hoops and spend hours on the phone trying to get someone from that other bank to understand your request and furnish you will proof. For reference Starling Bank and Tide are aware of that problem and should speedily (ish) be able to send you proof.

Once you supply that proof to Barclays, they will re-evaluate any decline if it was due to you being listed on the Shared Industry Database.

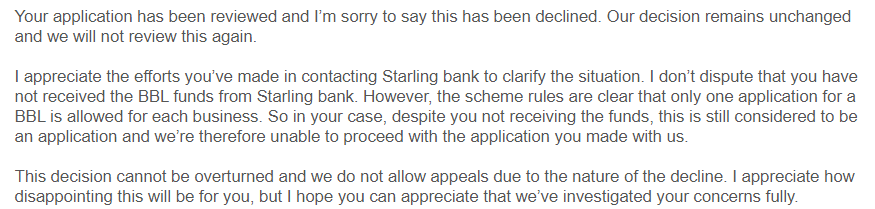

“Stupid People” Evaluating Declines

One final thing to be aware of, sadly Barclays have some people in their BBL team who we shall call “stupid people” for want of a better term.

They appear to make rules up that do not exist such as the one below:

That staff member has decided that due to someone applying for a Bounce Back Loan with another lender AND NOT GETTING ONE, that negates them from applying with Barclays, as in their head you can only ever apply for a Bounce Back Loan once, and if declined you cannot try with another lender, in this case with Barclays.

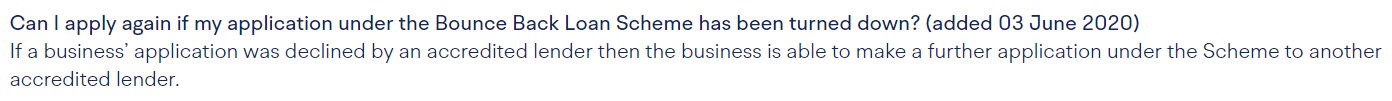

For the record they are without a shadow of a doubt wrong, as the rules very clearly state:

If you are declined and you are unfortunate enough to get one of those “stupid people” looking at your decline you will need to get someone with a “brain” to do the review, or even contact your local MP and ask them to get in touch with someone higher up at the bank on your behalf.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

CEO Email Addresses

One way to get some action or some form of update from a bank when you have been waiting a long time for a BBL or bank account (including feeder and servicing accounts updates), is to contact the CEO of the bank and a full list of CEO email addresses are on this page of the website