Today will be another quiet day on Planet Bounce Back Loan, so do not expect any major developments today or possibly tomorrow, however let me turn my attention to one development that is making me chortle.

That is the current “arse covering” exercise being played out right before our eyes. Now, thanks to you, my website visitors and much more so the community over on my Twitter account, made up of both followers and a higher multiple of “lurkers”, those of you actively involved in the tweets and DM’s have kept information coming in, backed up with proof of a huge and constant stream of the stunts banks have pulled on you over the past three months.

I have, as you will be aware, given my input into the National Audit Office Bounce Back Loan audit, and I am confident they are now fully aware of what is what from an applicant’s point of view, so I am happy with them.

It is the British Business Bank who need a huge big spotlight turning onto them, whether they like it or not, for they are supposed to be the “rule maker”, and yesterday I found out they have commissioned several accountancy firms to audit the banks regarding Bounce Back Loans.

All standard practice of course, but there is no doubt in my mind they are aware that the banks have played a massive part in denying many people the right to apply for a Bounce Back Loan, but that is not with the BBB are worried sick about it is any element of fraud that has taken place or any major rule breaking.

Hey “accountancy firms” if you want some idea of where to look for the rule breaking of any of those banks, give me a bell, I have 1000’s of examples of banks rule breaking, all backed by cold hard proof.

But it appears that the British Business Bank seem to care not about the problems accessing the scheme many of you have been experiencing since May the 4th, and just want to cover their arses and blame the banks, the banks are also looking for ways to counter any failings, and will be pointing the blame and the spotlight on the Government.

The British Business Bank will probably claim they have done everything they were required to do and will possibly blame the pandemic for any failings of theirs, however lets not forget the powers that be there are paid a small fortune for the jobs they do, and should be working hard to earn that money showered upon them week in week out, pandemic or not, just like business men and women have had to try and do whilst battling through the maze and minefield that getting a BBL entails.

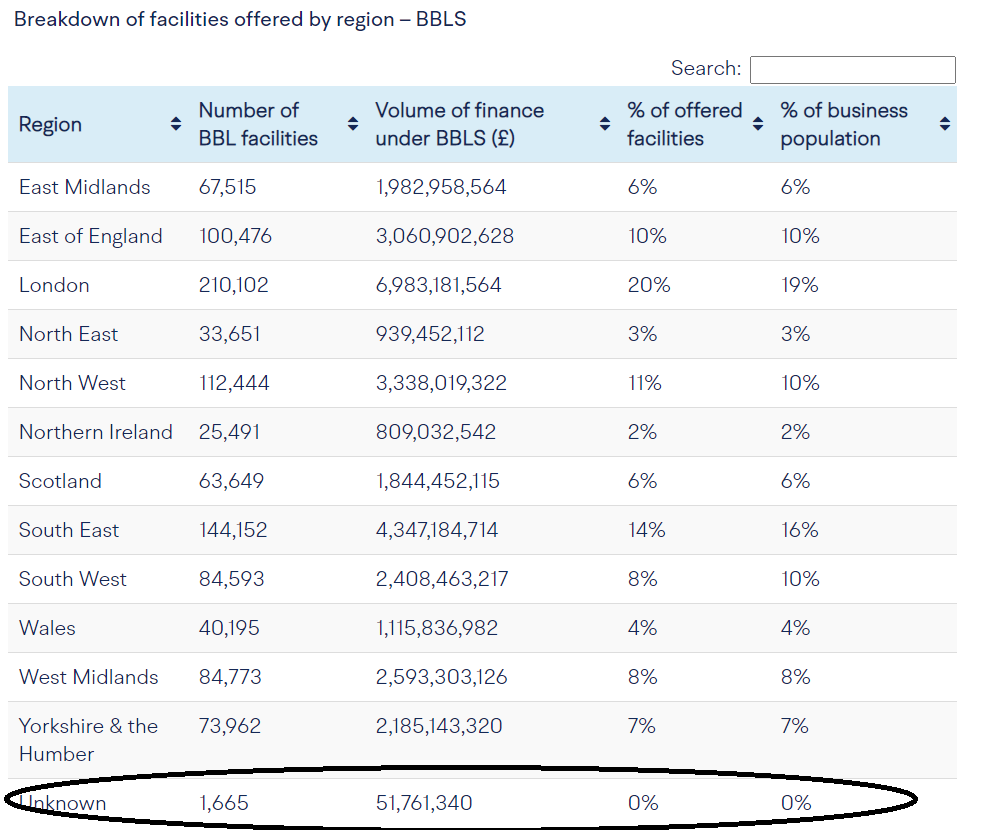

Let us look at a few facts. The British Business Bank by their own admission, has not, it appears, got a clue where some 1665 Bounce Back Loans went, over £51,000,000 unaccounted for if you look at their figures below. Hey British Business Bank, where has that money gone?

They also claim the following:

Has any bank, that slammed the door firmly shut to new customers or imposed a cut off date, that anyone applying for or opening an account after said date could apply for a BBL actually gone on to open up their schemes to those excluded? The answer is NO.

So, the banks are in effect sticking two fingers up to the British Business Bank, and in turn those desperate to get a Bounce Back Loan.

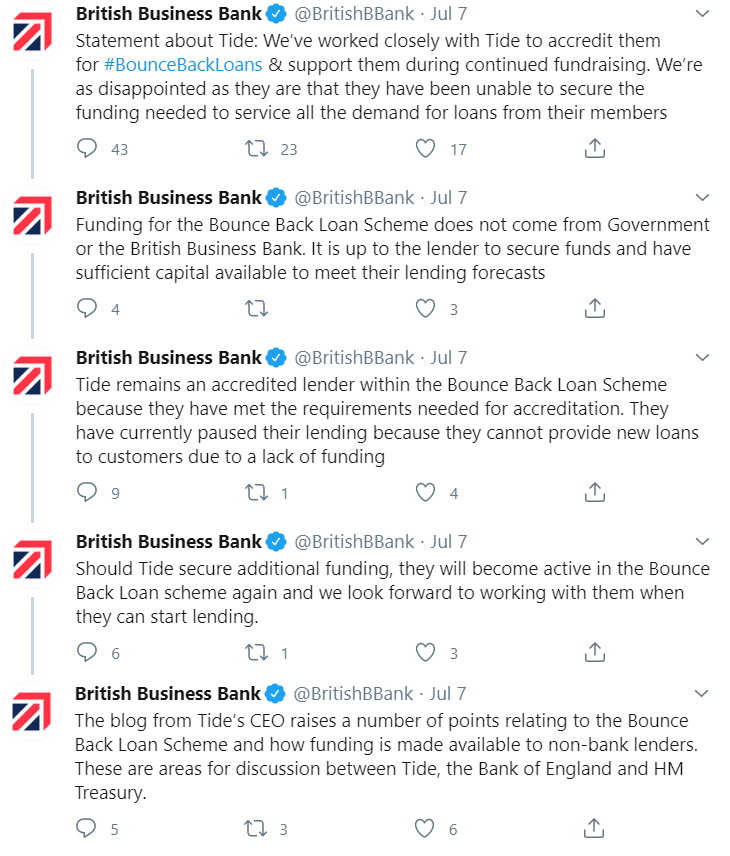

You then had the ongoing Tide saga, they have no money to lend out, and I won’t go into detail about that, as you will be aware 10,000’s of people were disappointed when their funds dried up, and even more have been completely devasted when their applications for a BBL with another lender was approved, but then declined for simply being on the Tide “waiting list”.

What has the British Business Bank done about that? Kept them on as an Accredited Lender that’s what:

The length of the tweet thread, proves they are quite adept at trying to cover their arses, and are mastering the pass the parcel of blame game.

You couldn’t make this stuff up, you really couldn’t. But make no mistake about it, they, the British Business Bank will be scrambling around in the background ensuring their arses are covered, as best they can.

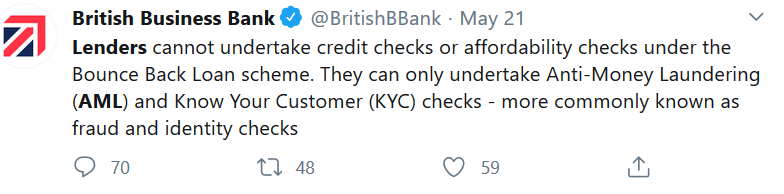

Then we have the British Business Bank putting out tweets like this one:

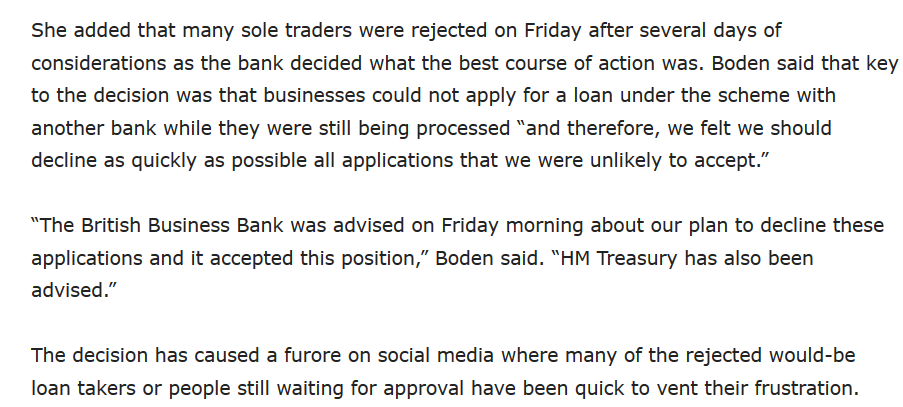

Then we see a Bank CEO (Anne Boden – Starling Bank) saying the following, after having decided to bolt onto the BBB criteria her own criteria (basically that criteria being the opposite of what the above tweet says) and passing the buck back to HM Treasury and the British Business Bank, by letting the world know she told both of them and they approved her dumping 3000+ applications on a Friday night back in May:

Effectively cherry picking which customers they want to give a BBL to, and to attempt to cover the banks arse, she did cleverly “tip off” the BBB and HM Treasury what the bank was up to, so the parcel of blame was immediately passed back to them.

Oh, and the “key to the decision” bit in the image above, somewhat contradicts what they told me the other day, but hey ho:

Not quite how Rishi Sunak presented the scheme to our great nation of Businessmen and Businesswomen.

What puzzles me HM Treasury and the British Business Bank, how come many of those declined by Starling fortunately went on to get BBL’s elsewhere, why didn’t you say to Starling, oi on your bike stop taking the p**s and using the scheme to bag what you feel are the best customers? Putting people through more agony of having to try elsewhere, what fools you are and shame on you.

Then again you could turn around and say to them, if any defaults come in from that bank “well you had your own criteria on top of ours, so the Government Guarantee doesn’t kick in you are the guarantor now”.

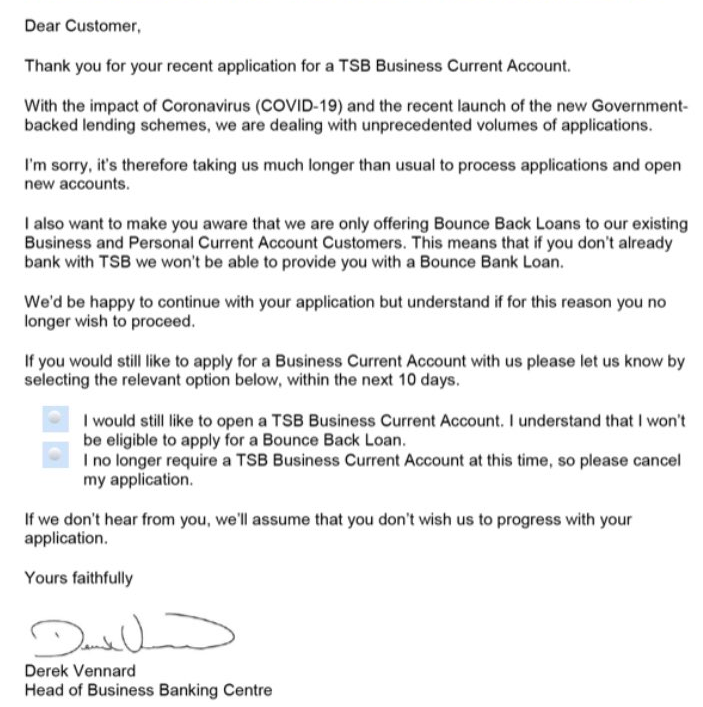

It is not just those banks named above that are arse covering right now, I am sure TSB are wondering how to explain away this little corker of theirs:

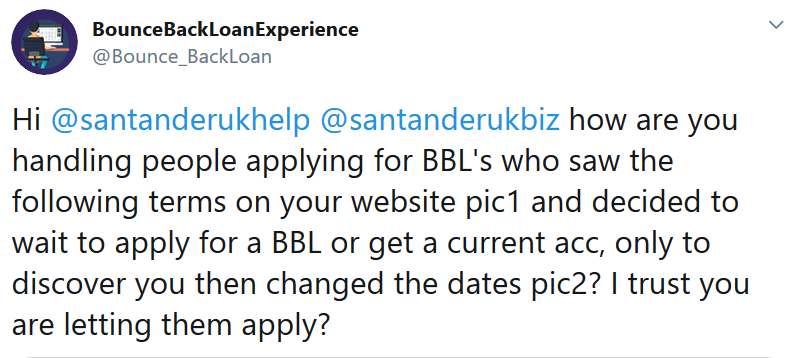

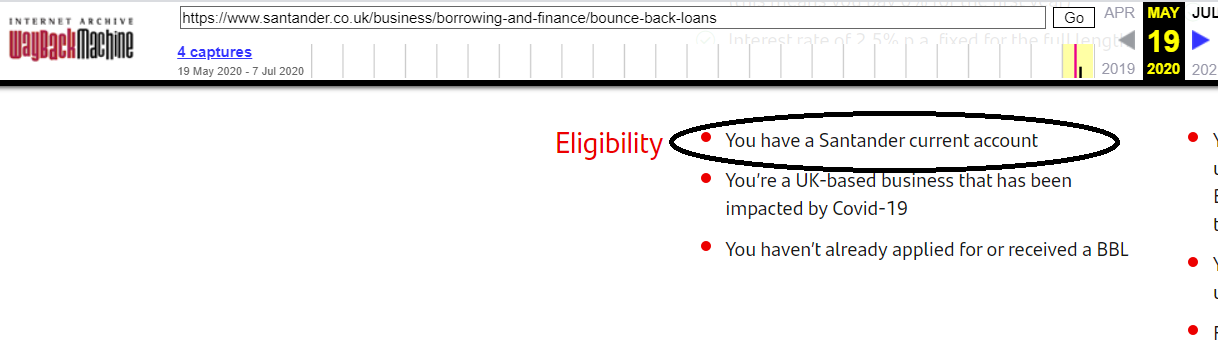

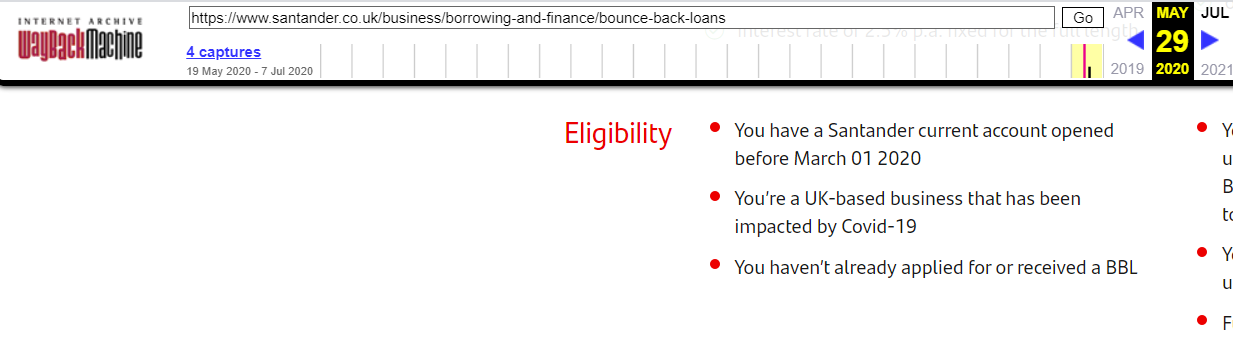

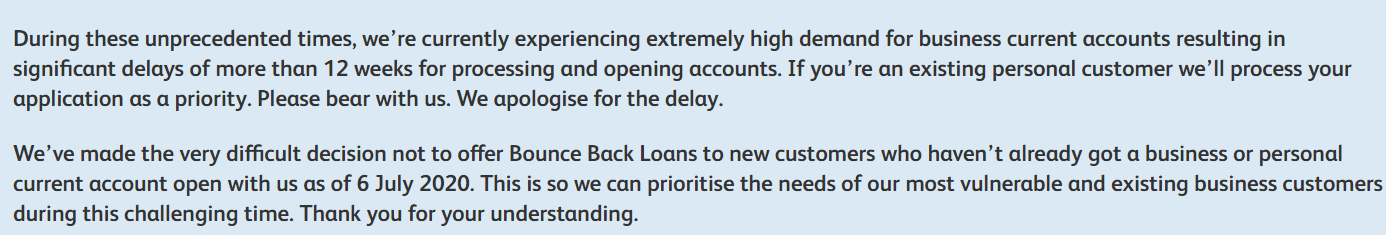

They are all at it the banks, I mean, look at this from Santander:

Then you have beauties like this one from the Co-Operative Bank, 12 weeks to open a bloody bank account? For want of a better phrase, “oh do f*** off”:

I could go on, and on and on, but you get the point.

Anyway, I say to those “accountancy firms”, if you want to know where to look for banks that are bending at least if not outrageously breaking the rules, give me a bell…….

I know, you know, and everyone reading this knows, you won’t, as you will just be tasked with covering the arses of the apparently stone deaf and allegedly aloof British Business Bank who have done diddly squat to help those in desperate need of a Bounce Back Loan, and seemingly do not care about the mental health problems bestowed on them by the lack of action by the BBB too.

Oh well I have got that all off my chest for today, suffice to say dear reader, the number of people involved in this game of pass the parcel of blame is getting bigger and bigger and when the music stops it will be fun to see who is holding the parcel, and what is in it when opened.

The outcome of that audit will of course be “lessons will be learnt”. There, saved you millions of pounds in fees, use it to help those bereft of a Bounce Back Loan…..

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE. Those wishing to apply to Conister a newly accredited lender have a look at my updated How to Apply for a Bounce Back Loan with Conister section of this website

Thanks for the Donations by the Way

If you want to help keep me and this place going and can throw a few bob in the donation tip jar it is appreciated. Asking for donations was not my initial aim when I launched the Twitter account or the website, however they have both taken off and both are now consuming a lot of my time.

A big thank you to everyone who has donated so far, it is through your generosity I am able to dedicate so much time to this cause, and you should be proud that your donation has helped me help others, many of them being people who are in the same position right now as you were when I possibly helped you. Thank You.