*****The Bounce Back Scheme Has of Course Closed to New Applicants Now*****

With just 70 odd days left until the planned closure of the Bounce Back Loan scheme, I know lots of you out there are reading this and are giving up hope of getting one.

With 27 lenders signed up to the scheme, on first glance you would imagine the chances of you finding one of them to apply to would be high, however we all know that unless you have an account with one of them your chances of getting a BBL are zero from the majority of those lenders.

One accredited lender, Tide, don’t have any money to lend out, so I wouldn’t pin your hopes on getting a BBL from them, even if they do magically find someone willing to lend them money to then lend out, they are going to need a huge amount of cash to supply a BBL to their customers that have shown an interest in getting one.

As for the remaining 26 lenders, 20 of them are only letting their current customers apply for BBL’s and most of those twenty lenders are not allowing new customers to apply for a business account or have a cut-off date, meaning that if you didn’t have a business account with them before a certain date you are not going to be able to apply for a BBL.

So, that leaves the six lenders who are taking on new customers and allowing them to apply for a BBL, and as you would imagine all six of them are overwhelmed with applications. Thus, that means that it can be weeks before you manage to apply for and get a business bank account with them and an added delay for them to process your Bounce Back Loan application.

Below is an update on those lenders, and any tips/advice for getting an account with them quicker, be aware though that they are all going to put you through the standard Know Your Customer procedure when opening an account, which is to be expected, and they can decline you for an account and/or a BBL for any reason they dream up.

Starling Bank – If you want to apply for a Starling Bank account, you will need to download their app and then apply via the app. To be fair to them the account opening process can be much quicker than other banks. However, they do operate a Bounce Back Loan “waiting list”, and they state clearly on their website that not everyone who is on that waiting list is guaranteed of getting a BBL.

They have however committed to lend over £1 billion via the various Covid related loan schemes, but keep in mind that they also have their own set of criteria in addition to the light touch set of criteria the Government put in place for getting a Bounce Back Loan, so you could get declined for a BBL with them even if you meet the Governments criteria for getting one.

Apply for a Starling Bank Business Account

Add your name onto the Starling Bank BBL waiting list

Barclays – To open a Barclays Business Bank Account you will need to phone them up to make an appointment with them to visit a branch, or you can apply for a personal account by downloading their app and then apply for a Business Account either via a branch appointment or can apply online, or you can speedily switch your Business Account from another bank to Barclays.

The personal account opening procedure is fast and very efficient by the way and you will usually find out in a few hours if you are getting one and if so, it will be opened there and then.

It can take about six weeks to open a Business Account with them, appointments to visit a branch are dependent on just how busy each nearby branch to where you live is and whether there is a Business Manager at those branches.

Once you have a Business Account set up and opened you can then apply via your online banking for a Bounce Back Loan, and will be told onscreen at the end of the application when it will be processed and paid out.

Apply for a Barclays Business Bank Account

HSBC – You can apply for a Business Bank Account with HSBC in one of several different ways, you can apply online for one, or if you bank elsewhere you can apply for a Feeder Account. A Feeder Account is a one-use account that when opened allows you to apply for a BBL, get the money paid into the feeder which then fires it out into the account you have nominated with another bank.

Keep in mind that being one of a tiny number of accredited lenders that are offering the above they have been overwhelmed with applications. So, it can take weeks to get a Feeder Account, but they have recently launched an iOS app that will allow you to apply via the app for a Business Account with them which cuts out the many weeks wait.

Apply for an HSBC Feeder Account Online

Apply for an HSBC Business Account Online

Apply Via the HSBC Kinetic App

Apply for an HSBC Bounce Back Loan

Yorkshire Bank – You can apply online right now for a Yorkshire Bank business account, be aware it can take a weeks to open that account, but if you do manage to do so you can then apply for a BBL. Be aware that if you are on the Tide waiting list they are probably going to approve your application then decline it at the last minute until you provide them with proof you are off that waiting list (see section below for details on that saga).

Apply Online for a Yorkshire Bank Business Account

Apply for a Yorkshire Bank Bounce Back Loan

Clydesdale Bank – Yorkshire Bank and Clydesdale are part of the same group and as such everything mentioned above about Yorkshire Bank also stands for Clydesdale Bank too.

Apply Online for a Clydesdale Bank Business Account

Apply for a Clydesdale Bank Bounce Back Loan

Metro Bank – Metro Bank have just reopened their online bank account opening system, you can now apply for a new business account and could be approved instantly and if so you can then apply for a BBL which could also be approved instantly too.

Apply for a Metro Bank Business Account

Then

Apply for a Metro Bank Bounce Back Loan

Onboarding with Personal Bank Account

Some banks will let you open a service/feeder account or even a business account if you have a personal account with them that you have used before a certain date for business purposes, and those banks are listed below.

Halifax – You can apply for a Business Account with Lloyds or Bank of Scotland if you have a personal account with Halifax that was being used for business transactions fore March the 2nd this year.

Onboard with Lloyds via a Halifax Personal Account

Onboard with Bank of Scotland via a Halifax Personal Account

NatWest – Anyone that has been using a personal account with NatWest that wishes or apply for a Bounce Back Loan will first need to open a servicing account, but you must have both been using your personal account for business purposes and that account must have been opened and in use before March 1st this year.

Open a NatWest Servicing Account

RBS – Anyone that has been using a personal account with RBS that wishes or apply for a Bounce Back Loan will first need to open a servicing account, but you must have both been using your personal account for business purposes and that account must have been opened and in use before March 1st this year.

Lloyds – You can apply for a Business Account with Lloyds if you have a personal account with them that was being used for business transactions before March the 2nd this year.

Onboard with Lloyds via a Lloyds Personal Account

Bank of Scotland – You can apply for a Business Account with Bank of Scotland if you have a personal account with them that was being used for business transactions before March the 2nd this year.

Onboard with Bank of Scotland with a BoS Personal Account

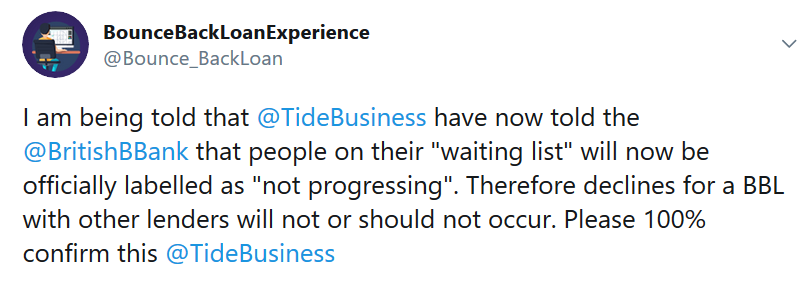

Tide’s Response to Their Problematic Waiting List

I have been banging on about the Tide waiting list for quite some time. In a nutshell if you are on that waiting list, and keep in mind they have no money to lend out, then you are likely to find that when you apply with another lender for a BBL you may initially get approved, but during the final checks, those being interbank checks some lenders will then decline you for being on that waiting list.

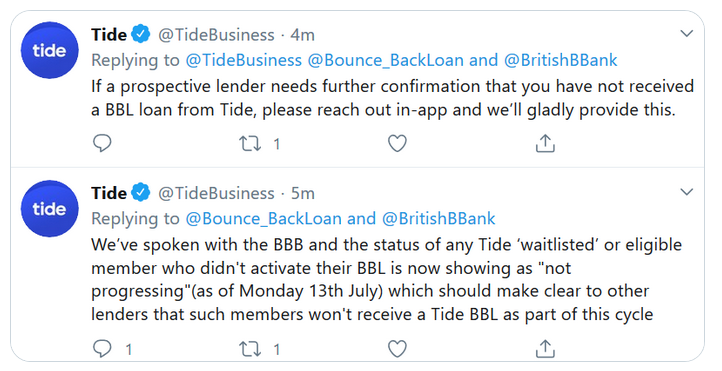

The reason for approval but then a decline is that other lender sees your name upon that waiting list as a BBL in progress, not simply being on a waiting list. Below is a tweet I sent to Tide and their official response about this situation:

Be aware though that despite what they are saying, people after July the 13th applying with other banks have still been declined for being on that waiting list.

If you find for example you get approved by but then are declined by Clydesdale Bank Yorkshire Bank or Metro Bank you will need to ask Tide for proof you have not got a BBL from them and supply that proof the respective bank to get the decline overturned.

This is madness but sadly it is something you need to do, as for who is to blame, well the British Business Bank do have Tide listed as an accredited lender even though they have no money to lend out, Tide have, or state they have told the British Business Bank about the problem with their waiting list and other lenders, but other lenders appear not to have been told hence them still declining people solely for people being on the Tide waiting list.

Thanks for the Donations by the Way

If you want to help keep me and this place going and can throw a few bob in the donation tip jar it is appreciated. Asking for donations was not my initial aim when I launched the Twitter account or the website, however they have both taken off and both are now consuming a lot of my time.

Been Declined a Bank Account or BBL?

Please read below for some reasons as to why you may be declined a bank account and/or a Bounce Back Loan with some lenders.

Many people who are declined tend to fear it is their credit rating/score that is the cause of a decline, and whilst that can and may play a part obviously, there can be a whole host of other reasons, some of which can be sorted out, and when the latter is the case you may find it much easier to open a bank account and/or obtain a Bounce Back Loan.

Some Lenders can and will and are in within their rights to decline anyone for an account and/or BBL based on their own criteria in additional to that laid down by the British Business Bank.

With that in mind, if you have checked all of the following and/or have been declined by one lender then you are also within your rights, and encouraged to apply to any other lender that is part of the Bounce Back Loan scheme.

Potential reasons not relating to credit score/rating

SIC Code – Not matching on companies house vs what you put in your application.

SIC Code – considered a reputational risk – you would be surprised how many business types fall into this category.

Directors/owners name(s) not matching companies house and/or

Voters roll e.g. Chris vs Christopher, as your middle name.

Business address not matching, has your accountant used their address to register? What is your correspondence address at companies house?

Business name not matching e.g. Ltd v limited

Recent changes of directorship and/or ownership – red flag at the moment due to BBL fraud

Markers registered against the company or director

Previous financial relationship with the bank or one its subsidiaries that did not end well

Compensation

Many Bounce Back Loan applicants that have been through hell and still are experiencing problems have been offered compensation from a bank ranging from £50 up to £2500 for the more complicated problems.

It is your choice as to whether you accept any offer of compensation and the amount you accept too.