The speed at which Bounce Back Loan Lenders fired out the cash when that scheme was live for applications was impressive, however that did enable plenty of fraudsters to take advantage of the need for speed when it came to paying out those loans.

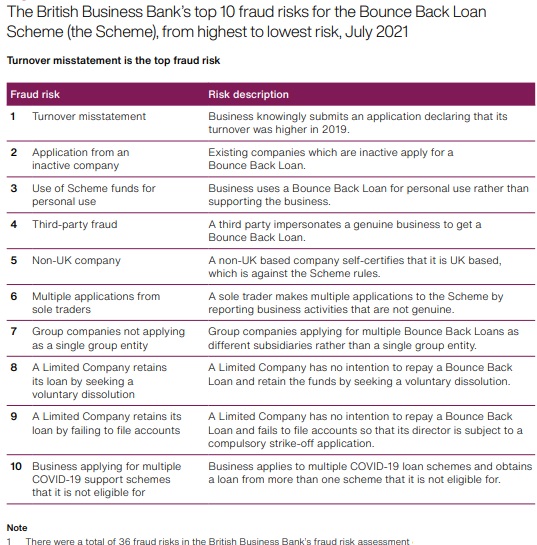

As far as the British Business Bank was concerned, Third Party Fraud was a risk factor they were worried about and they had it logged in position number four on their Top 10 List of BBL Fraud Risks:

Third-Party Fraud

Definition: A third party impersonates a genuine business to get a Bounce Back Loan.

If you did impersonate a genuine business to fraudulently obtain a BBL then no one will have any sympathy for you, and I think all sane level headed people will agree that you deserve some time in prison, at the very least.

Here are two people who were both sentenced to a prison term for BBL third party Fraud:

| Third Partys Name | Punishment | Link to Overview of Case |

| Timilehin Olasemo | 3 Years 2 Months in Jail | CLICK HERE |

| Olufumi Akinneye | 5 Years 6 Months in Jail | CLICK HERE |

Blaming a Third Party For Bounce Back Loan Wrongdoing

When taking for example the Liquidation route or when a Lender secures a High Court Winding Up Order against a BBL defaulter, and it is discovered some form of wrongdoing was associated with a BBL application, some Company Directors will claim that a third party, such as an accountant or broker applied for their BBL on their behalf.

Some have also logged a complaint of such, stating to the Ombudsman that a third party over-egged their business turnover to secure a BBL for their Company or they never applied for the BBL their Company received.

Here are three such recent cases: