It was only going to be a matter of time before business owners en masse decided to take things into their own hands and collectively refuse to pay back their Bounce Back Loans, having seen how the Government have flatly refused to offer them any more support, except costly Pay as You Grow options.

Whilst the collections and recoveries procedure that lenders must adopt has been known for quite some time, the National Audit Office did the decent thing and did everybody with a BBL a favour by making it public, and they are to be commended for that.

Learn More >

The procedure is fully laid out, and it does not take a financial or legal expert to work out the banks have played a huge part in making that procedure as straight forward as possible, to ensure they are not going to be forced to pay out huge sums of money chasing BBL defaulters and can rapidly get their hands on the Government Guarantee when BBLs turn sour.

I spent the day yesterday asking a great many people that I know have a Bounce Back Loan what their intentions are regarding paying it back, and whilst their replies were varied, many are now indicating that they have no intention of repaying their BBL for the reasons outlined below

It is as if Government Ministers through their own actions, policies and some would say their lies and corruption have incited furious and exhausted business owners not to repay their Bounce Back Loans.

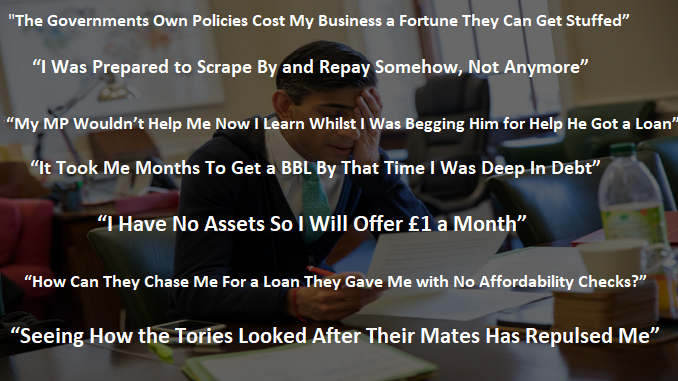

Here is what business owners have told me:

“My Credit Rating Has Always Been Crap So What Difference Does It Make Being Made Worse”

“If the worst thing that I have to live with is a bad credit rating by defaulting on my Bounce Back Loan then so be it, I have had to live with a poor credit rating for years so what difference will it make, the way the Government have acted throughout the pandemic and the lack of real meaningful help has turned my stomach and I was once a Conservative voter, not anymore.

“I Have No Assets So I Will Offer £1 a Month”

“I only took out a small and modestly sized Bounce Back Loan but have seen my business decimated by lockdowns and my customer base has dried up, now I know they are giving a clear passage to defaulting to those with no assets and no way of repaying, guess what, I am going to offer £1 a month if they do not accept that offer then I will default.”

“How Can They Chase Me For a Loan They Gave Me with No Affordability Checks?”

“I have gone from being worried and having sleepless nights worrying about how I am going to repay my BBL to having a good night’s sleep, the rules of the scheme said no affordability checks would be made so how do they expect me to repay a loan I cannot afford to repay? I intend to default”

“Forcing Me To Beg For a Grant I Never Got Has Forced My Hand”

“If I would have had access to and got the same value of grants some other business owners got then I would not have been forced to take out a Bounce Back Loan or could have repaid it. Listening to Rishi Sunak announcing all these business grants and discovering how some of my competitors got tens of thousands of Pounds in grants whilst I got nothing is and was unfair. I won’t be repaying my BBL.”

“It Took Me Months To Get a BBL By That Time I Was Deep In Debt”

“What boiled my blood was listening to Rishi and his mates saying how quickly SMEs could get a Bounce Back Loan, it took me literally months to finally get one and by that time I was deep in debt, in fact the BBL only covered a fraction of the debt I amassed whilst unable to trade and whilst I was waiting for a lender to come along and let me finally apply for a Bounce Back Loan, they can kiss my arse I won’t now be repaying it.”

“Seeing How the Tories Looked After Their Mates Has Repulsed Me”

“I will keep this simple; I am not going to repay my BBL it’s been nearly two years since the pandemic started, and my business is shot to pieces now, and reading day after day how friends of MPs and Government Ministers bagged mullions in dodgy contracts has repulsed me”

The Governments Own Policies Cost My Business a Fortune They Can Get Stuffed”

“Having no set in stone procedure to handle a pandemic was the Government’s fault, that then led to so many rules and regulations forcing businesses to hibernate and stop trading. They now offer me the Pay as You Grow options which cost me more to take, I have no money left, I am trading on borrowed time, no way can or will I be repaying my BBL, sorry Rishi it is NOT MY FAULT”

“I Was Prepared to Scrape By and Repay Somehow, Not Anymore”

“Like everybody else I have had to make some huge cutbacks just to survive this never ending pandemic, I was prepared to do so to try and repay my Bounce Back Loan for at least another 18 months by paying just the interest, but not anymore, if they want to force me out of business they can do, I am losing the will to continue trading anyway with so much uncertainty on the horizon.

One Rule for Them

One person told me the following which does give you an indication off why many business owners are so angry right now:

“My MP Wouldn’t Help Me Now I Learn Whilst I Was Begging Him for Help He Got a Loan”

“I got a blunt reply from my MP when I begged him for help trying to get a Bounce Back Loan, I am now spitting blood to discover whilst I was trying and failing at the time to get one and begging him for help, he managed to get a massive Government backed loan for his business”