Being a Company Director does of course come with a lot of responsibility. However, due to current financial landscape, many such business owners who took out a Bounce Back Loan are facing great difficulties in being able to afford to repay those loans.

Whilst Rishi Sunak did boast about the additional Pay As You Grow options he bolted onto the BBL scheme and swathes of business owners made us of them, over half a million in fact, we are now at the stage of the BBL scheme whereby all of those PAYG options have all been used up for many people and they are now faced with making the full repayment amount each month moving forward.

I have taken call after call from business owners who tell me that they are paying their Bounce Back Loan repayments out of their savings, or borrowing money from friends and family members, or even selling their personal possessions just to make those monthly repayments as their businesses cannot sustain the repayments.

I have also heard from some people making BBL repayments from their Universal Credit or Disability or Sickness benefits as they have fallen on hard times and need to claim those benefits just to survive.

As you can see from the table below, as of June the 30th 2023, over half a million Bounce Back Loan recipients have opted to make use of the PAYG options and those Bounce Back Loans have a combined value of over £17billion.

| PAYG

Option Taken |

Number

of Facilities |

Proportion of

BBLS facilities (%) |

Drawn value (£m) |

| 10 Year Extension | 148,455 | 9.66 | 5,126.43 |

| 6mth Payment Holiday | 78,348 | 5.10 | 2,384.85 |

| Interest Only Repayment | 35,859 | 2.33 | 1,029.84 |

| 10 Year Extension + 6mth Payment Holiday | 85,983 | 5.59 | 3,032.46 |

| 10 Year Extension + Interest Only Repayment | 32,391 | 2.11 | 1,105.96 |

| 6mth Payment Holiday + Interest Only Repayment | 45,694 | 2.97 | 1,420.96 |

| All 3 Options | 81,398 | 5.30 | 2,915.46 |

| Aggregated Total | 508,128 | 33.06 | 17,015.97 |

The main problem with those PAYG options, from any business owners point of view, is that no matter which ones you make use of, or in which order, you are going to end up paying more in interest over the term of the loan.

Be aware if you are one of the many, many business owners who are struggling to repay your BBL having used up all of the PAYG options, or you are struggling to repay and averse to taking any of those options due to them lumping even more debt onto your Company, some BBL Lenders can offer additional forbearance (help and support).

That could include a short Breathing Space whereby they will not contact you and not take a repayment during that period, some can tailor a specific repayment plan moving forward but most will simply tell you there is nothing they can do, and defaulting on your BBL is all they can suggest.

In fact, I have also seen some Lenders speeding up the default process, when it becomes obvious one of their customers is completely unable to make their BBL repayments.

Having been beaten down by the pandemic, the resulting cost of living crisis and in many cases, a massive and unsustainable downturn in business, or even sickness, there may however come a point when you realise that the only option is for you to take the Liquidation route with your Limited Company.

That is without a shadow of a doubt an alien concept for most business owners who will not have a clue how to go about doing so, but will be ever wary of the fact they have not repaid a Bounce Back Loan which may or may not be the only debt the business owes.

Making the Decision to Liquidate Your Company With a BBL Owing

If you have reached that point in time when the Liquidation of your Company is the route you are going to have to take, be aware there is no shame in that decision and it is one that sadly a huge number of business owners have had to take.

I always tell business owners to never, ever forget, it was the Government who told you to close/suspend your business, then filled your heads with stories of how going outside could lead to your death due to the “pandemic” then as you sat there with your business devastated, and in most cases, in a very, very vulnerable state, dangled a huge £50k loan before your eyes, with no credit checks and no forward looking affordability checks.

The fear of the unknown when taking the Liquidation route is what worries most business owners, much more so when they hear of the long Director Disqualification, Compensation Orders and even Jail Sentences being handed out to those found to have, in some way, either inadvertently or not, abused the Bounce Back Loan scheme.

However, no matter what you have or haven’t done, if the time has come to Liquidate your Company then please read on for I will present to you a step by step guide I have compiled with the input of and/or documentation provided by the Insolvency Service, the Department for Business and Trade, the British Business Bank and just as importantly Lawyers and Insolvency Practitioners.

There are some pitfalls that you could fall into when taking the Liquidation Route that you also need to be aware of, and I will present those to you moving forward so you do not end up in a nightmare situation.

Applying for a Strike-Off/Dissolution of Your Company

I must first warn you that attempting to get a Strike-Off/Dissolution of your Company with a Bounce Back Loan owing is not going to succeed. Those that managed to do so are now being taken to court and jail sentences are being given to those who did so.

If you attempt to take those routes now, you will find they get blocked and you then find yourself in a limbo-land with the Strike-Off/Dissolution ping-ponging every few months. Your Company by the way is still legally classed as an active Company with the block/objection in place.

This has been confirmed to me by both the Insolvency Service and the Department for Business and Trade.

An Insolvency Service Spokesperson Told Me

“Any company which has its strike-off blocked is treated as a live company”

I then asked the Department for Business and Trade the following questions

Does a strike off just bounce backwards and forwards every six months?

A Department for Business and Trade Spokesperson Told Me

“Objections are renewed on a six-monthly basis if not withdrawn by the lender.”

What are people expected to do if they are in that “limbo land”?

A Department for Business and Trade Spokesperson Told Me

“Where a company with existing creditors applies for voluntary strike off, creditors have the right to be informed and to object to the strike off.

The Bounce Back Loan Scheme is a delegated scheme, and so businesses who have concerns about their debt should contact their lender in the first instance.

If a company is insolvent (because it cannot pay its debts), further guidance can be found on the Government website.

When will the strike off become unblocked and allowed to proceed, if ever?

A Department for Business and Trade Spokesperson Told Me

“The Government will remove its objection when it receives confirmation via the lender that the Bounce Back Loan has been repaid, or the lender confirms the objection can be removed for another reason, for example as part of an agreement with a vulnerable borrower.

Businesses are 100% liable for repaying the loan and any interest to the lender. This is right and proper in order to protect the public purse.

Our expectation is that lenders should do everything within their power to update their data where an outstanding Bounce Back Loan has been repaid, so that DBT’s automatic objection can be withdrawn.”

Liquidating Your Company

If you do decide to take the Liquidation route with a Bounce Back Loan still owing, you will need to find an Insolvency Practitioner.

There is of course a fee involved, but please, please be aware a great number, in fact there is an ever growing list of Insolvency Practitioners out there, who have been found guilty of misconduct and sanctioned, and as such you owe it to both yourself but just as importantly to your creditors to ensure you select one with a good reputation.

I have obtained a list of both sanctioned Insolvency Practitioners from the Insolvency Service and have compiled a list of Insolvency Practitioners who callers to my helpline have used the services of who have never pulled any stunts.

If you want a chat on that topic feel free to give my helpline a call and I will be more than happy to provide you with the information you need to help you make an informed decision and the best Insolvency Practitioner for you and your Creditors.

An Insolvency Practitioner is, in layman’s terms, working ultimately for the Creditors of your Company, even though you are paying them. It may be the case you only have one Creditor that being the Bounce Back Loan Lender if that is the only debt your business owes, or multiple Creditors if your business owes money to more than one of them.

They will request from you all manner of documents, business accounts, bank account statements etc and will then make sense of them all.

Be aware, they are obliged to report any wrongdoing uncovered, which in the case of a Bounce Back Loan could be the over-egging of turnover to get that BBL, using funds from a BBL for Personal benefit and any additional associated wrongdoing.

That report is then sent to the Insolvency Service acting on behalf of the Kemi Badenoch the Secretary of State for Business and Trade.

What Happens If BBL Wrongdoing Is Uncovered

If any type of wrongdoing is uncovered in the confidential report sent to the Insolvency Service, then the suitable “punishment” (Sanctions) will be decided upon.

An Insolvency Service Spokesperson Told Me

“In tackling financial wrongdoing, the Insolvency Service considers each case on it individual merits. Sanctions such as director disqualification or bankruptcy restriction orders are based solely upon the available evidence and consideration of public interest. Factors such as nationality and ethnicity, categorically have no bearing on operational decision making.”

Here is an overview of Director Disqualifications

You can be banned (‘disqualified’) from being a company director if you don’t meet your legal responsibilities.

Anyone can report a company director’s conduct as being ‘unfit’.

‘Unfit conduct’ includes:

- Allowing a company to continue trading when it can’t pay its debts

- Not keeping proper company accounting records

- Not sending accounts and returns to Companies House

- Not paying tax owed by the company

- Using company money or assets for personal benefit

You’re not usually allowed to be a company director if you’re under restrictions from bankruptcy or a Debt Relief Order.

How Disqualification Works

The Insolvency Service may investigate your company (or you personally as a director of your company) if it’s involved in insolvency proceedings or if there’s been a complaint.

If they think you haven’t followed your legal responsibilities as a director, they’ll tell you in writing:

- What they think you’ve done that makes you unfit to be a director

- They intend to start the disqualification process

- How you can respond

You can either:

- Wait for The Insolvency Service to take you to court to disqualify you – you can defend the case in court if you disagree with The Insolvency Service

- Give The Insolvency Service a ‘disqualification undertaking’ – this means you voluntarily disqualify yourself and ends court action against you

- You may want to get legal advice if you get a letter about disqualification from The Insolvency Service.

Apart from The Insolvency Service, other bodies can apply to have you disqualified under certain circumstances, e.g.:

- Companies House

- The Competition and Markets Authority (CMA)

- The courts

- A Company Insolvency Practitioner

If you’re disqualified

- You’ll be disqualified for up to 15 years.

You can’t:

- Be a director of any company registered in the UK or an overseas company that has connections with the UK

- Be involved in forming, marketing, or running a company

You could be fined or sent to prison for up to 2 years if you break the terms of the disqualification.

- Your details will be published online in:

- You must ask a court for permission if you want to be a company director while you’re disqualified.

Other restrictions

There are other restrictions if you’re disqualified. For example, you might not be able to:

- Sit on the board of a charity, school, or police authority

- Be a pension trustee

- Be a registered social landlord

- Sit on a health board or social care body

Be a solicitor, barrister, or accountant

You can be prosecuted and become personally liable for the company’s debts if you carry out company business on the instructions of someone who’s disqualified.

Compensation Orders can also be sought against those who abused the Bounce Back Loan Scheme.

Additional Information

I would urge you to give me a bell if you are at the stage when you have made the decision to take the Liquidation route but need a friendly voice and a helping hand.

As mentioned above I have obtained a list from the Insolvency Service of both sanctioned Insolvency Practitioners who were found guilty of misconduct and as such it is best to avoid them but have also compiled a list of Insolvency Practitioners who callers to my helpline have used the services of who have never pulled any stunts, are fully licensed and regulated and do the job at hand.

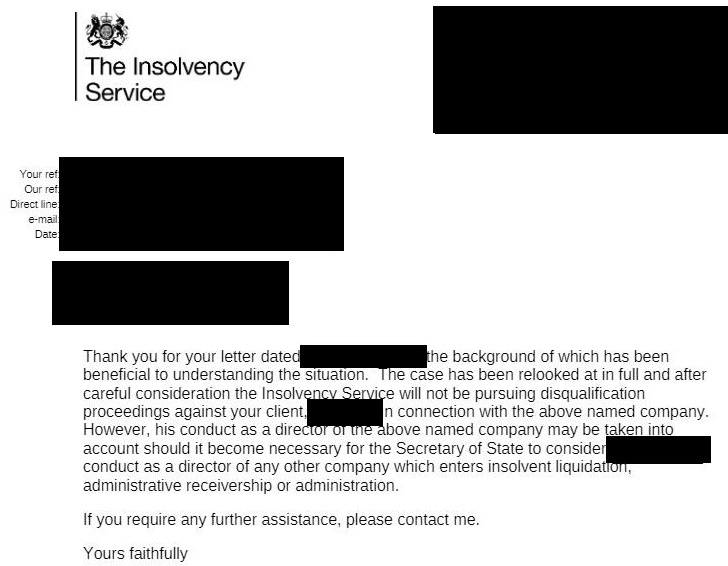

If wrongdoing is uncovered you will need to utilize the services of a Solicitor who can battle your case for you and explain to the Insolvency Service any mitigating circumstances. For the record I have seen proposed Director Disqualification cancelled once a good Solicitor gets involved and explains any mitigating circumstances surrounding the uncovered wrongdoing.

Once again I have spoken to a great number of Solicitors over the years and have a list of those that can assist you if needed, give me a bell for details.

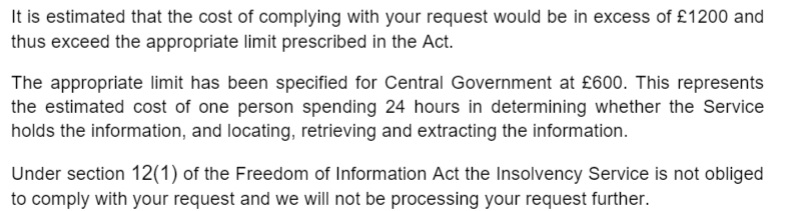

I did ask the Insolvency Service just how many people, with the aid of a good solicitor who explained mitigating circumstances, managed to get proposed Director Disqualifications cancelled, they explained they could not tell me due to the costs involved in looking them all up would be more than they are prepared to spend.

Their Response to My FOI

Moving Forward

Please do not bury your head in the sand, for with Banks now going to the High Court to get some Companies with Bounce Back Loans wound up and with Criminal Court cases now being pursued for those who took the Strike-Off/Dissolution route with a BBL owing, you really do need to get things sorted out once and for all.