I have advised all my Twitter followers to take a day off today and go chill. Let’s face it they deserve a break from all this Bounce Back Loan nonsense, especially those that are going off their minds with worry over the Conister saga that has been playing out before our eyes, and affecting many of them badly.

Feel free to check out my past daily Bounce Back News updates to get an idea of the problems Conister applicants have been facing over the last few days.

Anyway, back to business, as everyone is taking a break today, that does of course mean I am free to chat to you, the Conister bosses who may just be staking this website and my Twitter feed, as I am sure you are.

Below are some ways that I feel you can sort out the current “situation” you have found yourself in. I have laid it out nice and simple, but it should assist you in putting things right. Feel free to ignore it, but it is my hope you will read and digest it and hopefully help the Bounce Back Loan applicant community.

Look away everyone else this is just for the Conister bosses!

Dear Douglas Grant:

I write this open letter to you in my own unique way, if it in anyway appears arrogant or rude, that is not my intention, its just I feel I need to write this letter from my heart, and as I would speak to you in person, on behalf of the many people currently unable to get a Bounce Back Loan.

1. Apportioning Blame

Now, as it stands you have made a series of very well documented errors in the way you have handled your Bounce Back Loan scheme. It takes a strong leader to stand up and say, “I got it wrong”, but that is something you should do, everyone will respect you for that.

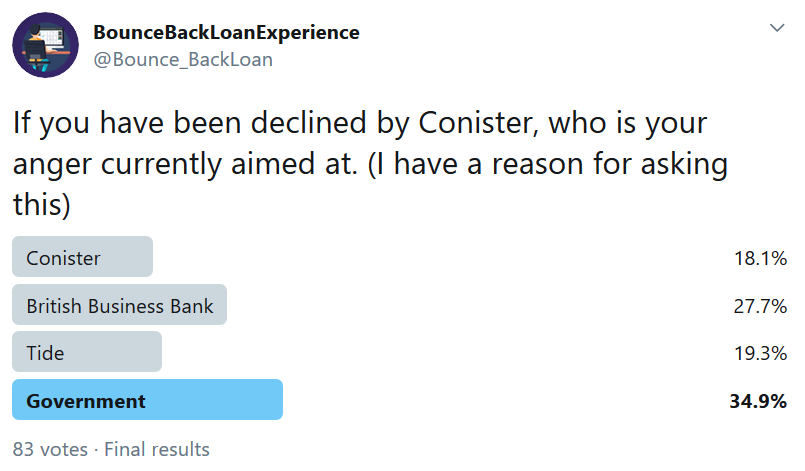

As it stands the first batch of people you declined the other day (for it appearing that they may have a BBL somewhere else) are not all currently aiming their anger at you, so keep that in mind as it should give you the boost you need to apologise and put things right.

**This vote was before the mass run out of money type email**

Just 18% of them blame you for being declined on the grounds of allegedly having a BBL elsewhere, get in there Douglas that is great so far!

2 Mass Email Decline

OK this is your first task, you need to get in touch with everyone you sent out the “we have run out of money” type email and let them know what is what, as you did send that out to people who you have so far approved for a BBL, and may have sent them out to others who are still being processed.

That, whether you like it or not stressed a lot of good men and women out, I know as I was there chatting to many of them yesterday and over the weekend. You will know that though as the emails and phone calls to your staff just before they finished for the day should be proof enough on that one.

Decide what you are going to do and then send out corrective emails to each application based on where they are up to with their application and/or whether there is no chance of getting a BBL now. Once again that is the right thing to do and will help many people understand what is what.

3 Putting the Errors Right

I am only going to dwell on the “major” mistakes made, lets face it you are new to the BBL scheme and any individual “minor” employee mistakes that are down to human error, well, we are all human and have all made mistakes so let’s concentrate on the biggies for now.

One of your first errors was incorrectly declining people for having a BBL for their company when that has been proved clearly not to be the case. This could be due to the way you checked the BBL database, for let us face it that database is known to cause all manner of problems.

Fear not though, Clydesdale Bank and Yorkshire Bank are struggling with it too, and if you have been incorrectly declining people based solely on you reading that database incorrectly, and let’s say for example you saw that people on Tide’s waiting list were in the process of getting a BBL (obviously they aren’t) that’s an understandable mistake, other banks make it so we can forgive you for that.

How to handle that problem if you have erroneously declined people for being on Tide’s waiting list you need to contact them and apologise, how you make things right with those applicants, well that all depends if you have any additional funds to lend out, if indeed you have reached your allocation.

If you do have more money you can lend, let’s face it, you know and I know that is not a problem, then badger for an increase in your Government Guarantee limit, I am sure the British Business Bank will want to hear that, then contact those you declined and offer to re-instate their applications and fairly re-evaluate their application.

If any of them you initially declined are then declined for not being eligible, or for any of your unique rules well simply let them know, that will allow them to move on, at least they then have had a fair crack at getting a BBL.

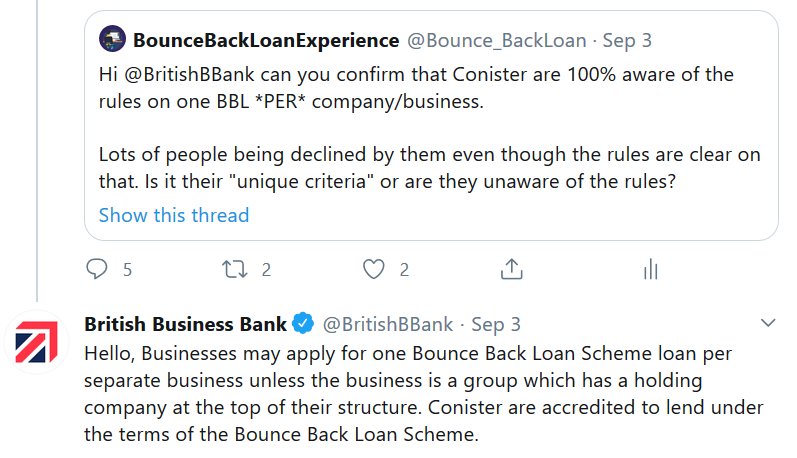

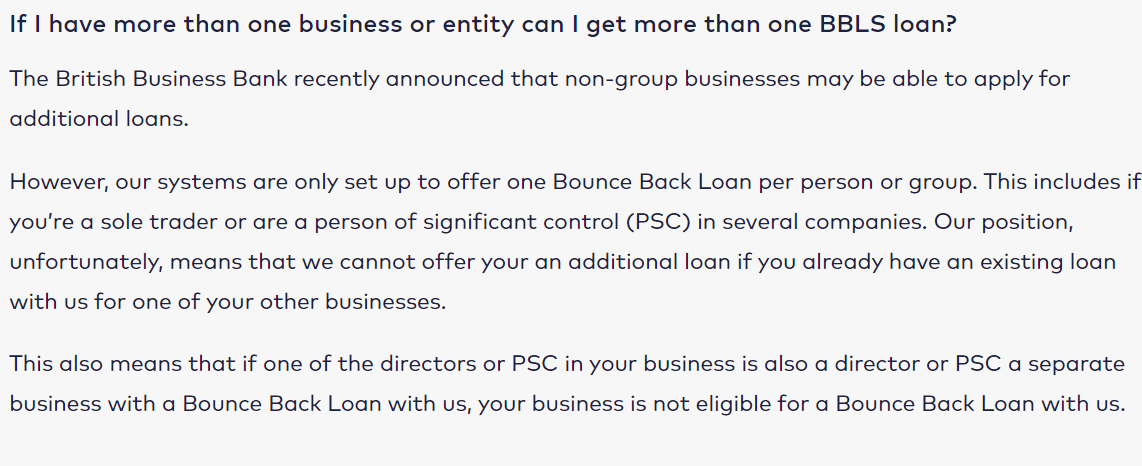

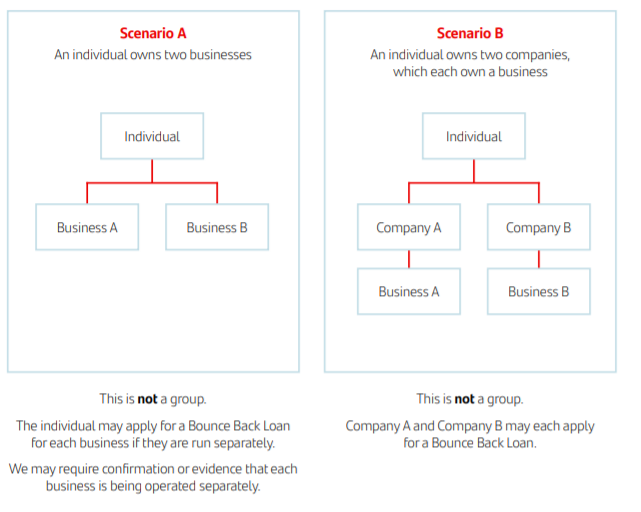

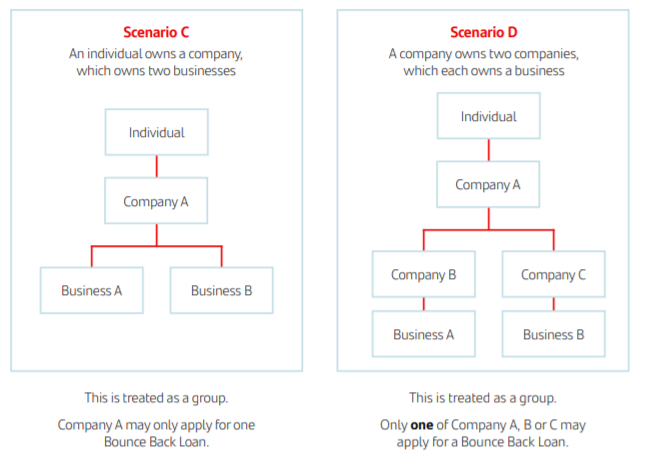

If you have also declined people with more than one business though, you need to check to see if the business they own has been given a BBL as the British Business Bank rules very clearly state you can have more than one BBL, but based on the following criteria:

You need to decide as a bank, whether you want to let those with more than once business apply for a separate business (as per the BBL rules above), if so then those you declined need a quick email apologising and letting them know, if you can raise more money, and get an increase in your government Guarantee limit their applications will be look at fairly a second time.

If possible though they do need putting back into their correct position on the processing list.

If not then put it in big bold letters on your website, look at the way Starling do that

Then look at Santander who have decided to go by the basic BBB rules:

4. Moving Forward

If you have reached your current limit for lending but have more applicants in your system, then if you do want to continue lending, let them know that they are in with a chance of getting one if you get an increase in your Government Guarantee, that will then immediately put the pressure on you know who to pull out all the stops to increase it and fast.

If you want to call it a day and fall by the wayside, then let everyone know that is the way you are going.

But if you do want to continue, and you have more applicants yet to process, keep your new application process closed for now and aim at clearing any backlog, that is the fairest way to proceed, and once you have processed that lot, if you can keep the money coming in and then going out, reopen the scheme to another batch of people.

Be wary of waiting lists or interest lists, as that is a route that sadly does not work and causes even more stress and bad press. Be open and honest if you do want to keep on lending and tell people you will re-open for applicants once your current backlog is cleared.

Then if you do re-open do it on a first come first served basis and have your system set to let x number of people apply then automatically close down again once you have had the number of applicants you can handle for the next batch, repeat as necessary on an ongoing basis.

However, be aware that everyone who has applied and been sent out applicants forms but who have not sent them back due to your email mailbox being “full” need to have their applications fairly processed too.

I am aware that many people are simply sharing your application forms with others, so simply check who applied on your system, got sent out the forms to eradicate any potential “queue jumping” by anyone who has bagged your application forms in an unorthodox way.

5. Turn Zero into Hero

Trust me Douglas, the Bounce Back Loan community are very, very forgiving, and therefore all eyes are now on you to make the bold step, of doing what you initially intended, that being fairly offering Bounce Back Loans to everyone eligible subject to your limits, you are the first bank to do that without the need for an account with you the lender or a feeder type account. (Don’t set me off on feeder accounts I could rant all day on the problems they cause).

This is your chance to stand proud and be the one lender that can and will make a difference, were so many others have failed.

I know you are a small bank, not meant with any disrespect and volume may be a problem, but with so many people waiting any additional funds you can raise and BBL’s you can process will give even more people the chance to Bounce Back, whether that is 1 or 10,000.

The above are just suggestions, I may have missed one or two things out, however I am always prepared to chat to you if you want a chat as from what I believe you are a good man. If I have overlooked anything I am sure my Twitter followers will soon be telling me in their unique way, but like you I am only human.

Whatever you decide Douglas, please, please keep in mind that many businessmen and businesswomen across the UK are struggling right now to get a Bounce Back Loan, just be fair and open with everyone moving forward, have a slightly better communication channel, but keep people updated at all times.

Believe me when I say this, if you do pull it off and be the very first bank to open their doors to everyone eligible and can keep the money flowing, you will very quickly become my personal BBL hero.

I will leave it up to you what to decide, you are the boss of the bank.

Oh, and if you could fire out some payments to those you have approved, possibly on Monday that would be fabulous…..

Thank you for your time.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.