I like to remain positive, as that can be infectious, however let us look at the newly accredited Bounce Back Loan lender, that being Conister, and see if we can spot any early warning signs, as I have worries that they are sadly yet another BBL lender that are an accident waiting to happen.

Below are some things that are screaming out at me as things that are going to see some people let down by them in the days or weeks ahead. I do so hope I am wrong.

Launch Day

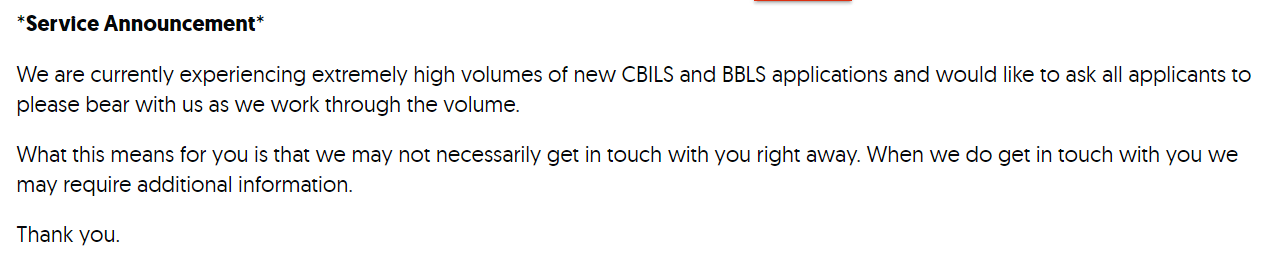

They have offices in the UK and their headquarters are based on the Isle of Man. So, was launching their scheme just before an extended Bank Holiday weekend (Friday on the IoM and Monday too) such a good move?

Surely, they are going to be swamped with applicants and will need all hands-on deck to cope with the expected demand the British Business Bank would have warned them about?

Alas, perhaps the BBB forgot to mention that to them or they didn’t have a clue about demand, and as sure as night follows day they had to quickly put up a service announcement much like all other lenders have done when being swamped:

Application Process

On first appearance, their Bounce Back Loan scheme is open to everyone, however the way they have set up the application process leaves a lot to be desired, and they have already had teething problems and have caused confusion to those applying for one of their Bounce Back Loans.

You take their Eligibility Test and fill in your personal details, and bingo an applicant form is sent out to you.

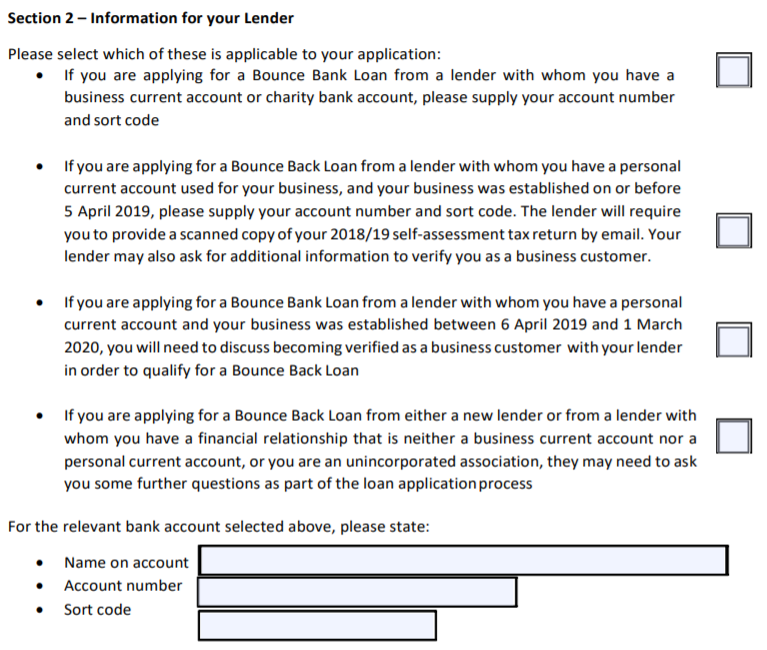

However, there are parts to that application that do not make sense to most people, such as section two:

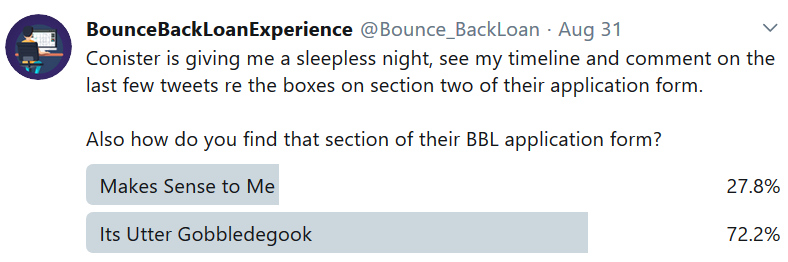

A quick poll of my followers resulted in over 72% of them agreeing that section of the applicant form is confusing:

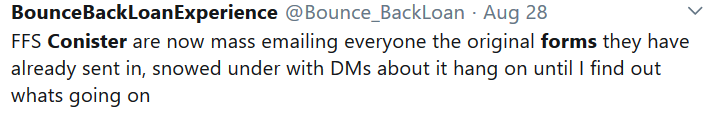

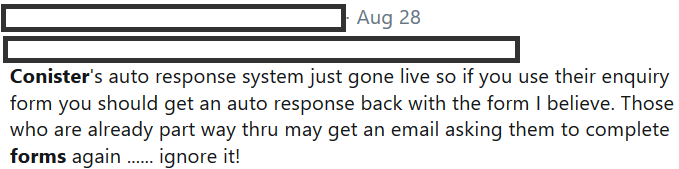

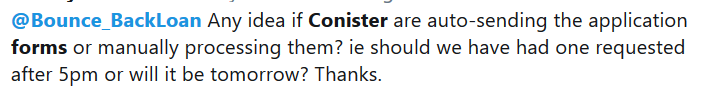

The application forms appeared at first to be sent out manually by staff members at Conister, but then at some point in time on Friday everyone who had been sent out those forms, and may have filled them in and returned them were sent them out again.

Those contacting the helpline at Conister were told to ignore the second set of forms as they had performed a “mail merge”and had apparently automated the sending out of those forms, which previously appeared to have been done manually by their staff members.

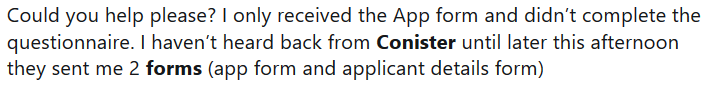

However, some people were only sent out two initial sets of forms on being the application form and a statement on data protection, but when sent out the second set of forms they also had an additional form, one asking for more information on the ownership of the business and other questions.

I have also be inundated with people telling me they have taken the Eligibility Checker and have not been sent out any forms, some tried applying again in case they had messed it up and some are now left hanging on unsure what is going on.

To add more confusion into the mix there is a questionnaire on page 10 of the Conister Bounce Back Loan application form that is also causing some confusion, and as such some people have not filled it in, believing they didn’t have to, but then had been contacted and told to fill it in, even though the form doesn’t lead one to think you have to fill it in.

Declines

Some applicants have already started to receive a “decline” email from Conister, the email is short and sweet and indicates that Conister have their own “criteria”, on top of the standard criteria listed on their website.

There are of course many reasons why Conister will have declined people, so I am not jumping the gun on that one, and will monitor how many others, if any get a decline email in the days ahead.

Volume and Availability of Funding

Looking at what we have so far seen above, it is obvious that Conister cannot currently handle the volume of applications I would expect, their website announcement clearly states that.

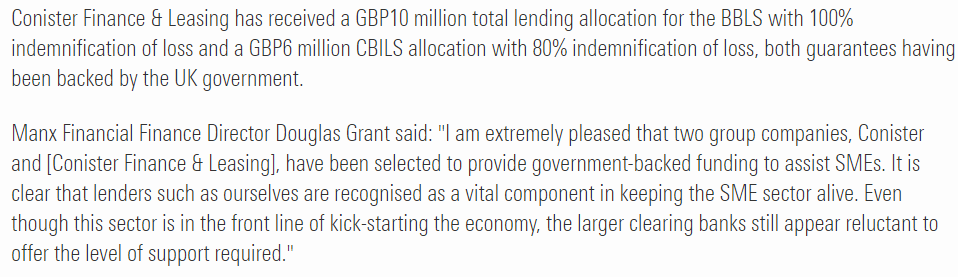

As for whether they have very deep pockets, well checkout the statement below, it clearly states that currently they have £10 million set aside to loan out, which based on the average BBL being £30,000 that is 333 loans.

Are there more than 333 people currently unable to get a Bounce Back Loan with other lenders, due to being unable to apply for an account with those lenders, yes, you can add a few 0’s onto that figure.

Wait and See

I did email and phone Conister when they became accredited asking them a few questions about their BBL scheme, in the hope they would speedily reply and allow me to pass onto everyone the answers to many questions I know they would be seeking.

The logic behind me asking those questions, as I just knew, based on experience when a new lender comes onboard and one that appears to be allowing anyone to apply, they would be swamped which would result in mess-ups and delays and that would then in turn cause people to get stressed out and negatively affect their mental health, which I have seen so many times over the last few months.

Low and bloody behold that exact scenario is now playing out before my eyes.

As of the time of compiling this update, I have heard diddly squat back from Conister, and for reference here are the questions I asked them:

“Below are those questions, if you would be ever so kind as to answer them and reply I would be very grateful.

Obviously, anything commercially sensitive, or security related can be omitted from your answers”

- Is your BBL scheme open to everyone irrespective of where they currently bank or live in the UK? (including/excluding Northern Ireland)

- Will applications be processed in the order they are submitted?

- Is it true you have £10m allocated to loan out via the Bounce Back Loan scheme, and do you have systems in place to increase that level of lending?

- Once someone takes your eligibility checker and is sent out the BBL application form, what is the next stage of the process

- Have you a dedicated BBL processing team to handle expected demand and are they working office hours or around the clock. Will application forms be sent out, outside of office hours or the next day?

- Do you plan on having your BBL processing team working weekends and bank holidays?

- Will all applications be processed or will you be “cherry picking” applicants that only have an A1 credit rating or will you be entering into the spirit of the scheme and allowing those who pass the standard KYC checks to apply.

- Have you got a figure regarding how many BBL’s you may be able to process each day?

- Many British Business Bank accredited lenders have sadly been very poor at communicating with BBL applicants, are you planning on having an increased social media presence or a dedicated BBL support line of communication?

- I have had a few people confused with your application form, if they bank with another lender and do not have an account with you, on section two do they need to tick box four and fill in the details of their bank account in the box underneath that fourth box and does that account need to be a business account or a personal account.

- Also, the questionnaire on page 10, does that need to be filled in by all applicants?

OK, there you have it, come on Conister answer the questions people do not need stressing out and certainly do not need to be messed about and left waiting and waiting at this very difficult time.

Applying for a Bounce Back Loan

If you are new here and are looking for a list of banks that are accepting new customers then click HERE.

Thanks for the Donations by the Way

If you want to help keep me and this place going and can throw a few bob in the donation tip jar it is appreciated. Asking for donations was not my initial aim when I launched the Twitter account or the website, however they have both taken off and both are now consuming a lot of my time.