Money worries are a common source of stress that can take a toll on your emotional and mental well-being.

Whether you’re facing financial hardships, managing debt, or dealing with unexpected expenses, it’s crucial to prioritize your emotional health while navigating these challenges.

By adopting effective strategies, you can maintain your sanity and find a sense of balance amidst financial uncertainties.

Acknowledging the Impact

Financial worries can trigger a range of emotions, including anxiety, fear, frustration, and even shame. Recognizing and acknowledging these feelings is the first step towards addressing them in a healthy way.

Strategies for Maintaining Sanity

- Open Communication:

Discuss your financial concerns with a trusted friend, family member, or professional. Sharing your worries can help alleviate the burden and provide valuable perspectives.

- Create a Budget:

Developing a clear and realistic budget can provide a sense of control over your finances. Knowing where your money is going and making informed spending decisions can ease anxiety.

- Prioritize Essentials:

Focus on covering essential expenses such as housing, utilities, and groceries. Prioritizing your basic needs can reduce the fear of not being able to meet them.

- Seek Professional Advice:

Consulting a financial advisor can help you develop a plan to manage debt, save, and invest wisely. Professional guidance can alleviate uncertainty and provide a roadmap for the future.

- Limit Negative Self-Talk:

Avoid blaming yourself for financial challenges. Remember that circumstances change, and financial difficulties are not a reflection of your worth

- Mindfulness and Stress Reduction:

Practice mindfulness techniques, deep breathing, or meditation to manage stress. These techniques can help ground you in the present moment and reduce anxiety.

- Focus on What You Can Control:

While you might not have control over every financial aspect, focus on the areas where you can make positive changes, such as cutting unnecessary expenses.

- Explore Additional Income Sources:

Consider part-time work, freelancing, or selling unused items to supplement your income. Every little bit can help ease financial strain.

- Educate Yourself:

Take the time to learn about personal finance, budgeting, and money management. Knowledge empowers you to make informed decisions.

- Practice Self-Care:

Engage in activities that bring you joy and relaxation, whether it’s reading, exercising, spending time with loved ones, or pursuing hobbies.

- Limit Comparison:

Avoid comparing your financial situation to others’. Social media often presents an unrealistic view of others’ lives, which can exacerbate feelings of inadequacy.

- Set Realistic Goals:

Break down financial goals into manageable steps. Celebrate small achievements along the way to keep your motivation high.

- Reach Out for Help:

If money worries are severely impacting your mental health, don’t hesitate to seek professional support from a therapist or counsellor.

Embracing Resilience and Well-being

Maintaining your sanity during times of financial uncertainty requires a blend of practical strategies and emotional resilience.

Remember that financial challenges are a temporary phase, and seeking help when needed is a sign of strength, not weakness.

By taking proactive steps, focusing on what you can control, and prioritizing your emotional well-being, you can navigate money worries with a sense of clarity and inner calm.

In the midst of financial turbulence, your well-being remains a valuable asset that deserves nurturing and protection.

If you need a chat about BBL related worries, then do feel free to give me a bell, all in complete confidence on the helpline, the details are here >https://mrbounceback.com/bbl-helpline-tracker/.

Please consider making a donation to help keep my helpline going:

Donation Link Here > https://fundrazr.com/d2Psr2

Alternatively consider subscribing to the website

Subscribe Here > https://mrbounceback.com/membership-join/

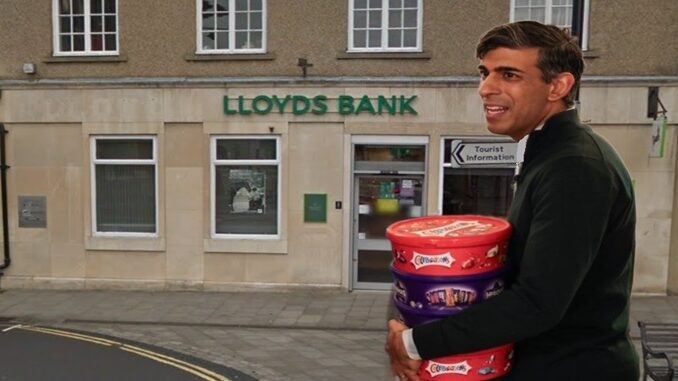

Never, ever forget, it was the Government who told you to close/suspend your business, then filled your heads with stories of how going outside could lead to your death due to the “pandemic” then as you sat there with your business devastated, and in most cases, in a very, very vulnerable state, dangled a huge £50k loan before your eyes, with no credit checks and no affordability checks.