I have been up all night digesting the latest National Audit Office (NAO) report into the Bounce Back Loan scheme, and it was like reading a mix of a horror story and a book of fairy tales.

Now, one elephant in the room that I did enlighten the National Audit Office team about, when I was called upon to speak to their audit team, was the confusion over the “turnover” figure that you had to self-certify when applying for a Bounce Back Loan.

The way that aspect of the scheme was promoted and advertised was confusing, for it was supposed to be 25% of your turnover figure for the calendar year 2019.

However, some SMEs applying for a BBL took it to mean the tax year, and there was also the option to “estimate” your turnover if you were a recently established business.

Reading through the NAO report, it appears that the Department for Business, Energy & Industrial Strategy (BEIS) have decided not to focus its investigative resources on borrowers who overstated turnover by less than an additional 25% of their permitted 25% turnover, provided there were no other fraud risk indicators.

To be honest through what investigative resources they do have are going to be over-stretched for decades based on the 2100 or so cases of much more serious fraud they have already got intelligence on.

In fact, it will be down to lenders to pursue upfront recovery where feasible and cost-effective to do so, and to always seek recovery action where loans are not repaid.

Knowing how the banks are much more interested in just claiming the Government Guarantee and washing their hands of any unpaid BBLs and getting their money returned, I doubt any lender will be putting much effort into chasing those who do not repay, much more so based on the huge number of defaults that they are expecting.

I say that as what is “feasible and cost-effective to do so” will differ from lender to lender based on the volume of defaults.

But as always, we will have to wait and see whether banks want to hound the life out of and stick the knife so to speak in the back of SMEs who genuinely cannot repay their BBLs due to no fault of their own and this seemingly never ending pandemic. that has decimated their businesses.

FYI below you will find an overview of what I told the NAO on the topic of turnover:

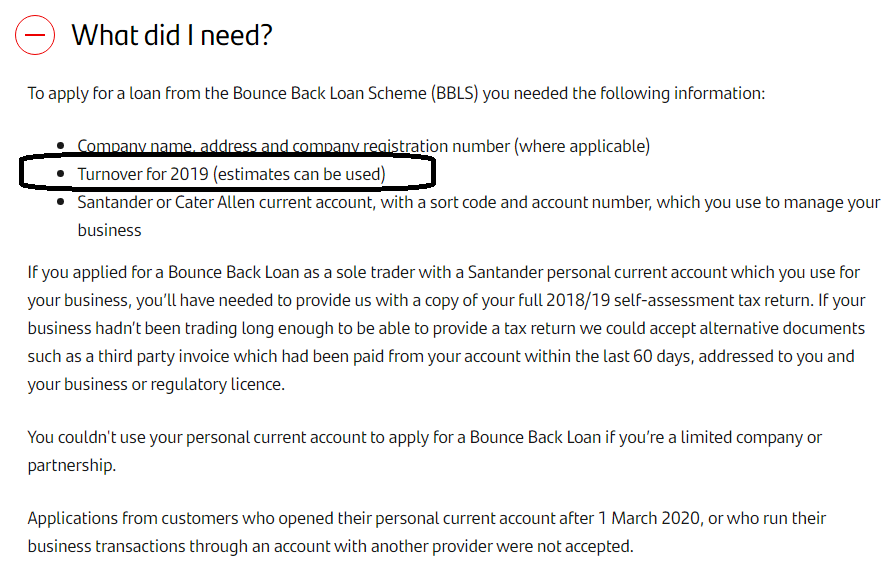

Regarding turnover figures to apply for the Bounce Back loans, it was the case that some lenders were promoting the turnover aspect of the scheme as being “an estimate” an example of which can be found below with Santander who displayed this on their website (in fact upon checking today it was still there):

Shockingly, when the British Business Bank took part in a recent presentation bestowing the supposed virtues of the Recovery Loan Scheme to brokers and letting them know how much cash they can earn in commissions/fees, they commented, on their official literature for that event that they had been aware of Bounce Back Loan lenders who had promoted covid loan schemes in a manner that neither befits the rules or the spirit of the facilities.

The above example from Santander is surely a clear example of that and one must ask why it is still up on their website now, even after the scheme has ended. Here is the respective part of their literature. Misleading those applying for a Bounce Back Loan is a scandal and not one single person who may have been confused or misled about their turnover figure should be made to suffer. Why did the British Business Bank not get them to remove it, but it is now way too late the damage may already have been done.

That did cause confusion, as too did the fact that the turnover figure was meant, it turns out, to be for the calendar year 2019 but was badly worded as some thought it was the 2019 tax year turnover.

Which meant people may have applied with an incorrect turnover figure, thinking they had done no wrong.

Also, when top ups were permitted those who were allowed to estimate their turnover, which according to the scheme rules were the newer businesses they could not amend their estimated turnover figure when the top up element of Bounce Back Loans went live, even if they now knew their actual turnover figure.

So, by the very design of the scheme, they were forced to have to apply for a top with an incorrect turnover figure.

This huge legal problem was pointed out to the British Business Bank. Ministers and MPs via Social Media at the time, many times by those worried about it, to no avail.

The utter stubbornness and the refusal to allow those applying for a top up to amend their turnover figure (higher OR lower) if then known, cannot be legal by any stretch of the imagination, and leave those who had to apply by those with a knowingly now incorrect figure open to accusations of fraud?

I would suggest an urgent review of this is instigated as you cannot tell lenders to report alleged fraud re an incorrect turnover figure when both the way the lenders advertised the scheme, the confusing rules of the scheme and the fact those wanting a top up were forced to possibly give incorrect information to get one, by the rules of the scheme.