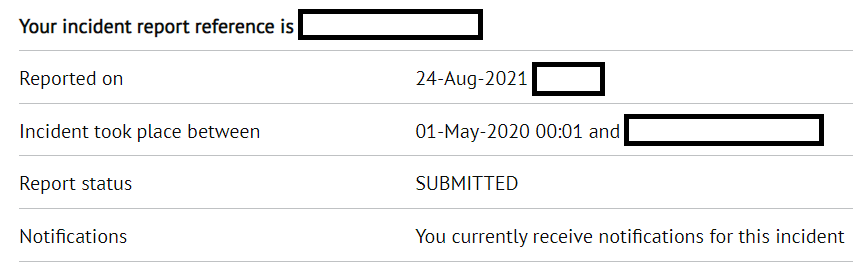

On Tuesday the 24th of August 2021 I reported The Rt Hon Alok Sharma MP, Sam Beckett Acting Permanent Secretary at the Department for Business, Energy, and Industrial Strategy (BEIS) and Rishi Sunak Chancellor of the Exchequer to the police for the crime of Misconduct in Public Office.

A Brief Overview of My Allegation:

This case involves the launch of the Bounce Back Loan scheme, in which the above permitted the scheme to go ahead.

I believe that all three named above were at the time each:

(First element): a public officer acting as such

(Second element): wilfully neglecting to perform his or her duty and/or wilfully misconducting him or herself.

(Third element): to such a degree as to amount to an abuse of the public’s trust in the office holder

(Fourth element): without reasonable excuse or justification

The elements of the offence are summarised in Attorney General’s Reference No 3 of 2003 [2004] EWCA Crim 868.

Merit of Complaint:

(First element): a public officer acting as such:

The three people named above, did, whilst acting as public officers instruct the British Business Bank to launch the Bounce Back Loan scheme.

(Second element): wilfully neglecting to perform his or her duty and/or wilfully misconducting him or herself

(Third element): to such a degree as to amount to an abuse of the public’s trust in the office holder:

However, the scheme, in the design the three named above wanted, would expose vulnerable business owners to great risks, some of those risks being financial, mental, and sadly potential self-physical harm, and would be required to sign away their legal rights of protection when applying for a Bounce Back Loan.

They were warned about those risks by the very organisation that they instructed to launch that scheme, chose to ignore them, and instructed that organisation (British Business Bank) to launch that scheme but to keep those risks the bank highlighted secret and away from the public and by their actions secret from Members of the House of Lords.

Due to their Misconduct in Public Office many people are now experiencing financial, mental, and physical self-harm. This cannot go unchallenged and all three must be held responsible for their actions, due to many people now experiencing the consequences of those risks those public officers were warned of, which is an abuse of the public’s trust in the office holders.

(Fourth element): without reasonable excuse or justification:

Much safer options were available to offer such loans in a speedy fashion without exposing those applying to any kinds of risks, so they cannot claim they had any reasonable excuse or justification for their actions.

The Bounce Back Loan Scheme:

HM Treasury Introduces the Bounce Back Loan Scheme:

https://www.gov.uk/government/news/small-businesses-boosted-by-bounce-back-loans

HM Treasury Announce the Launch of the Bounce Back Loan Scheme:

https://www.gov.uk/government/news/new-bounce-back-loans-to-launch-today

Detailed Information:

Upon being instructed to make the Bounce Back Loan scheme live, the CEO of the British Business Bank as per their Shareholder Relationship Framework Document:

Did trigger their “Right to raise reservations” section of the above Shareholder Relationship Framework, and the CEO of the British Business Bank at the time Keith Morgan CBE (he is no longer in that role and has left the British Business Bank, surprisingly not long after the Reservation Notice was made public) sent to the three people named (via and including Sam Becket) above a Reservation Notice, in which he clearly states the risks to vulnerable business owners:

“The Board also discussed the conduct-related risk that borrowers sign away rights under the Consumer Credit Act and may then later claim they were vulnerable and so cannot be held accountable for doing so.”

As you can see, he was extremely aware of the risks and how borrowers were in a vulnerable state, and what sane and level-headed person would allow vulnerable people (who wouldn’t be vulnerable in the midst of a pandemic) to sign away their legal rights under the Consumer Credit Act to get a well-advertised and heavily promoted “Government Backed/Guaranteed” Bounce Back Loan.

That would be a huge and glaring red flag for any person acting in public office to take a step back and reconsider some alternative options for launching such a scheme, putting vulnerable people at any type of risk is surely a criminal act. In fact, it is.

In reply to the Reservation Notice, Sam Beckett, the day before the scheme went live sent a letter to Keith Morgan OBE and stated that it had been agreed to make the scheme live, however she did request the Reservation Notice be kept secret.

The contents of that reply do indicate all three named above were 100% aware the very real risks if the Reservation Notice was published, along with the negative confidence in, and take-up of the scheme. Well, there is an admission of guilt if ever I saw one.

“As you have noted, the Framework Document provides for any Reservation Notice and Written Direction to be published unless the Shareholder has directed in writing to the Company that the matter must be kept confidential.

While I am content for this exchange of letters to be published in due course, I am mindful of the potential impact that publication might have on the confidence in and take-up of the scheme, and consequently on our efforts to support the economy.

Publication should take place in due course, once the loan scheme is fully established and only after you have made an assessment of the impact of publication. I would be grateful if that assessment could be shared with me and the Secretary of State ahead of publication.”

I am confident that the three named above were aware of very real and documented risks to the General Public, namely business owners accessing that scheme, and committed Misconduct in Public Office by putting people in the direct line of those risks, when other options were available, made even worse by not openly and honestly letting those applying be aware of what the British Business Bank stated, that organisation is of course packed full of experienced banking professionals with many years of experience under their belt, best placed to offer sound and sane advice.

The speed at which for example the SEISS scheme was set up, proves beyond any reasonable doubt other options were available for an emergency loan distribution system to be put into place, that would not put anyone at risk of having their legal rights stripped away whilst in a most vulnerable state of mind.

Now, for the Bounce Back Loan scheme to go ahead and for those wanting one to have to sign away their legal rights under the Consumer Credit Act, a Statutory Instrument would need to pass Royal Assent.

https://www.parliament.uk/globalassets/documents/commons-information-office/l07.pdf

The House of Lords did debate the removal of the Consumer Credit Act as per the Statutory Instrument put before them, but low and behold the Members of the House of Lords were not informed of the existence of the Reservation Notice, if they had their debate would surely have been very different.

They were the last line of defence to protect the vulnerable members of the public those being small business owners from the risks outlined above, which have come to fruition.

That is proven by the response in a Lords debate about Section 12 and speaking in favour of an amendment, Baroness Bowles of Berkhamsted expressed strong reservations about the potential implications of the proposed change

I asked Baroness Bowles of Berkhamsted on the 23rd of August 2021 whether the Members of the House of Lords were aware of the existence of the Reservation Letter, to which she replied, “Pretty sure the answer is no, otherwise we would have been quoting it”.

How can those three public officers named above keep such an important document secret and away from Members of the House of Lords who were debating the very topic it related to.

https://researchbriefings.files.parliament.uk/documents/CBP-8906/CBP-8906.pdf

This is what Baroness Bowles of Berkhamsted said in that debate:

“Apart from for micro-businesses, there is no regulatory protection for business loans or recovery procedures other than the measure the Government now seek to disapply…

Why do I care so much about this, especially when the Government are being generous with loans? I am not disputing good intentions, but the high-profile government publicity surrounding the loans can be misleading.

There is constant reiteration of the good things about bounce-back loans: 100% guaranteed by government; try again if the first lender declines you; you cannot be asked for personal guarantees.

This is encouragement to apply and gives the impression that the government guarantee is coming into play for the benefit of the borrower.

That is not the story, though. The Government back the lender; they are not a guarantor for the borrower. That is not stated on the GOV.UK website, although I am not sure that everyone would understand the significance even if it were…

Other standard terms also apply, such as that any default, anywhere, on any other loan, with anyone, can trigger default. A bank can also take the view that the position of the borrower has declined since the making of the loan agreement.

Given that a loan condition for a bounce-back loan is that the business has suffered from the effects of coronavirus, just about every loan is at risk of being defined as in default.

Of course, not many defaulting people or companies can go to court, so what does it matter if that route is blocked? Well, the principle matters; the deterrent matters; and the comparison matters. It gives away that the Government care little about those that go under; the focus is on the economic benefit of survivors. That view was reinforced during the meeting we had with the Minister and Treasury officials.

In the future, the story of bounce-back loans will be one of borrowers thinking that the Government have backed them. The usual debt-recovery operations will be a sorry tale, even without bad behaviour, but in that event the law has been changed and that has consequences.”

One worrying aspect of the above debate was the following reply to the above by Baroness Penn on behalf of the Government:

“Lenders have informed us that, should the amendment be agreed, it is likely that they would cease to offer any new lending under the scheme, thus depriving small businesses of the vital finance they need to weather this crisis. I understand the concerns expressed by noble Lords, but it is not possible to be in favour of the Bounce Back Loan Scheme but not in favour of this part of it—a part that has been crucial in getting the lending going.”

Banks Hold Government to Ransom

So from her reply above, you ended up with the banks saying we won’t lend any more money unless you keep in place the risks that we are exposing borrowers to. A set of bankers holding the Great British Public and the Government to ransom is yet another result of the Misconduct in Public Office by the three people named above.

What made matters worse however, and yes, they get worse due to that Misconduct in Public Office, when the Reservation Notice was finally released on the 30th of September low and hold one of the last big banks lending as part of the scheme (HSBC), slammed the door shut to new applicants, quickly followed by the last couple of High Street banks still offering those loans to new customers.

So, by making the Reservation Letter public, you have clear proof its contents were with merit and borrowers were vulnerable and had to sign away their legal rights, or why else would those last few lenders slam the door shut when it became public.

I urgently request the above is investigated fully, and can give more details of anything unclear above, to help this investigation. My concern is similar to that of the Ex-CEO of the British Business Bank, that being that even more vulnerable people forced to take out a Bounce Back Loan may suffer from the risks outlined above, either when their first repayments are due and/or when they have exhausted the Pay as You Grow Options now added to that loan scheme.

I cannot and will not sit idly by when people are at risk of mental health problems, financial problems or even suicide brought on due by this Misconduct in Public Office.

In fact, it could also be said that as the Government has now launched the Debt Respite Scheme, that is even more proof they are “mopping up” the mess left by this Misconduct in Public Office, surprisingly that scheme was launched one year exactly after the Bounce Back Loan scheme went live, just in time for those experiencing the risks the three people named above exposed them to, to get help for those risks that they are experiencing.

https://www.gov.uk/government/publications/debt-respite-scheme-breathing-space

Ministerial Code

I draw your attention to the Ministerial Code which states:

The Ministerial Code, issued by the Prime Minister of the day, sets out the principles underpinning the standards of conduct expected of ministers. Ministers of the Crown are expected to behave in a way that upholds the highest standards of propriety, including ensuring that no conflict arises or appears to arise, between their public duties and their private interests.

Ministers are under an overarching duty to comply with the law, including international law and treaty obligations, uphold the administration of justice and protect the integrity of public life. They are expected to observe the Seven Principles of Public Life: selflessness, integrity, objectivity, accountability, openness, honesty, and leadership.

Choosing to keep the Reservation Letter from the British Business Bank secret, which if made public would have allowed those taking out a Bounce Back Loan to be aware the organisation charged with designing and launching the scheme were worried about their vulnerable state and the fact, they sign away their legal rights to obtain a loan is a clear breach of the Ministerial Code regarding “openness and honesty” (at least).

Bank Boss Complains of “No Rule Book”

One final thing to note is that during a Treasury Select Committee meeting one bank boss, that being Anne Boden from Starling Bank that was an accredited lender of Bounce Back Loans complained that at the start of the scheme “there was no rule book”

I will let you take your pick as to which of the following that corker falls under as to the Misconduct in Public Office of the three people I named up above (I would say all three?):

(Second element): wilfully neglecting to perform his or her duty and/or wilfully misconducting him or herself

(Third element): to such a degree as to amount to an abuse of the public’s trust in the office holder

(Fourth element): without reasonable excuse or justification

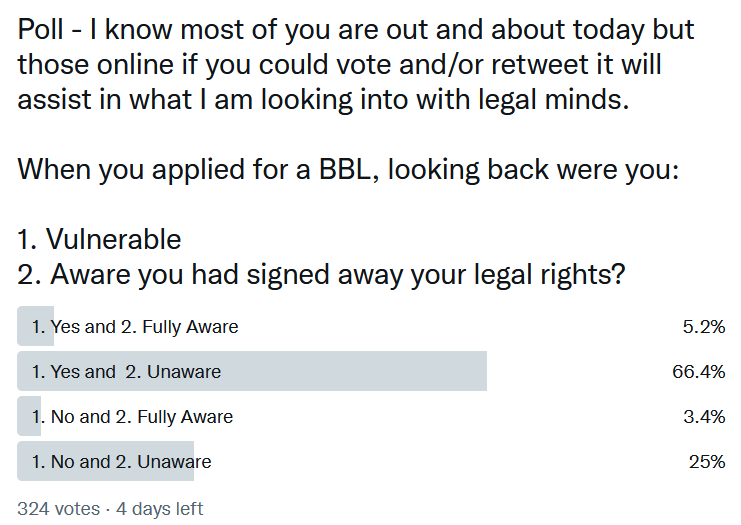

Poll On This Topic

Perhaps investigating officers should ask those who applied for and got a Bounce Back Loan whether they feel they have lost their trust of the office holders named above. In fact, I insist they do, they would know then.

Also ask them if in hindsight, when they applied for a Bounce Back Loan were they vulnerable and knew they were signing away their legal rights, I did and got this response:

*poll currently live results subject to change.

I will keep you updated as the case progresses.

Part Two>>

Part Three>>