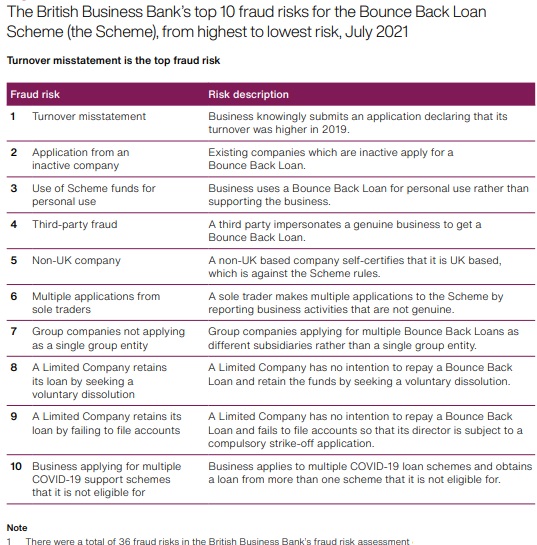

I am working through the top 10 fraud risks associated with the Bounce Back Loan scheme as identified by the British Business Bank. The second highest risk to that scheme in their opinion was applications from Inactive/Dormant Companies, and it is fair to say they got that call right.

Just so you know, the Government Counter Fraud Function, the last time they counted, discovered £297 million worth of Bounce Back Loans that were from borrowers with filed dormant accounts. That suggested that dormant companies were resurrected simply to claim loans.

They know who you are, where you are and what you did. Their biggest problem is getting Banks to take enforcement action against you, but Barclays for example are getting quite good at that.

Applications from an Inactive Company

Definition – Existing companies which are inactive apply for a Bounce Back Loan.

You will need to lawyer up, and for want of a better word, haggle, with the powers that be if you bagged a Bounce Back Loan for an Inactive Company. The punishment for such can be harsh and burying your head in the sand is not the best option as you are on the radar of the banks and Government.

Here are some examples of recent cases, which involved an application from an Inactive Company and possibly some other related BBL wrongdoing too. If this is something you relate to and are panicking, give me a call in complete confidence, to discuss your best course of action.

The longer you put off correcting this situation the worse things can get. Give me a call if you need a chat.

| Director and Company Name | Punishment | Details of Case |

| Adrian Cusiac – Rocasca UK LTD | 9 Year Disqualification | CLICK HERE |

| Amin Younis – Peri Peri (NE) Ltd | 7 Year Disqualification | CLICK HERE |

Investigations and Red Flags

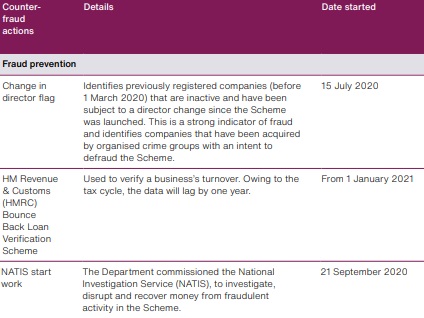

A change in director flag identifies previously registered companies (before 1 March 2020) that are inactive and have been subject to a director change since the Scheme was launched.

This is a strong indicator of fraud and identifies companies that have been acquired by organised crime groups with an intent to defraud the Scheme.

I recently took part in a BBC Documentary that tracked down one such organised crime group, who, as you will discover if you watch it, they made use of Company Directors who claimed to have been completely unaware of the existence of a Bounce Back Loan.

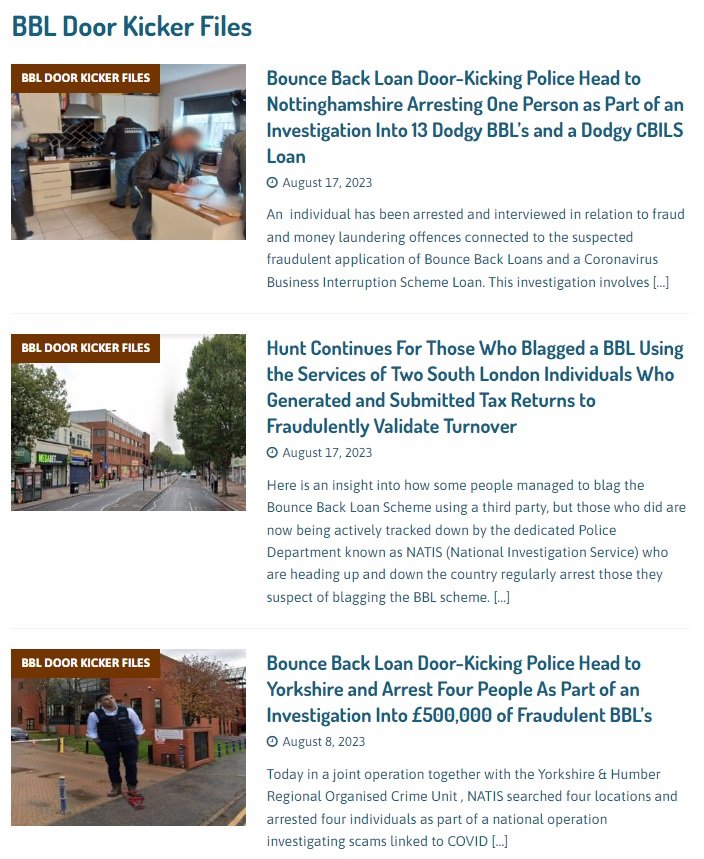

The National Investigation Service (NATIS) regularly go kicking in doors across the UK investigating, tracking down and arresting such gangs and Directors of firms used in that way, and the National Crime Agency have been involved in some prolific cases too, as featured in that documentary.

Recent NATIS Activity

You will find a comprehensive list of when NATIS went out and about kicking in doors in this section of the website > https://mrbounceback.com/category/bbl-door-kicker-files/

You may not of course be part of a criminal gang but did apply for and get a Bounce Back Loan for a Dormant/Inactive Company, if so, like I say above, you need to come clean and agree to a solution for there is no let-up in investigations into such Company Directors and it will always be hanging over your head, or the Lender may force your hand and head to the High Court.

For what is it worth, some Lenders are prepared to come to an agreement if you did commit some form of skulduggery, and in most cases they already know you did. If you want a chat, give me a bell.

Banks are of course successfully getting High Court Orders to wind up such Companies, and by doing so are speeding up the uncovering or Director wrongdoing.