There is no end to the madness of the Bounce Back Loan scheme, but this did make me roar with laughter, except the bit that us the daft sods the taxpayers might have to repay the wayward CBILS Loan.

Two British financial institutions are entangled in a dispute over a COVID loan, potentially leaving taxpayers liable for a six-figure sum.

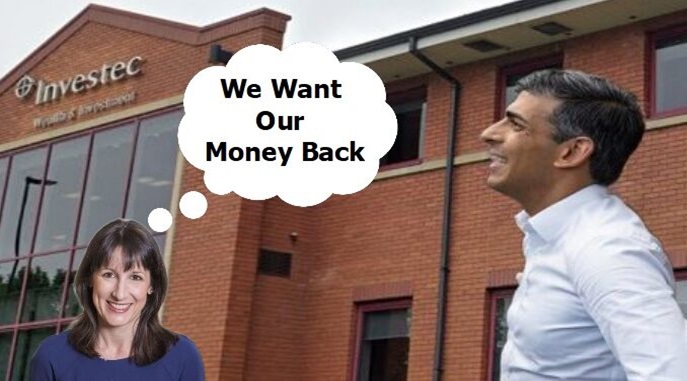

According to sources, OakNorth an approved CBILS Lender, is currently in negotiations concerning a £20 million loan extended to a real estate joint venture between Newmark Properties and Investec Bank UK, the latter, wait for it, being a Bounce Back Loan Lender.

But clutch your pearls my lovelies, a portion of that debt includes a Coronavirus Business Interruption Loan (CBIL) valued at nearly £300,000.

Reports indicate that the joint venture is in default on its repayment obligations, leading to a standoff between the two banks regarding a resolution. Should an agreement not be reached, it could result in the joint venture being placed into administration, triggering the taxpayer guarantee on the CBILS loan.

In response, an OakNorth spokesperson stated, “OakNorth has been seeking, and continues to seek, a constructive solution with Investec, with a fully solvent outcome. Investec has not provided a proposal which would avoid loss to the taxpayer which is consistent with the underlying loan and CBILS documentation.”

“Investec is fully committed to paying the CBIL liability in full and strongly refutes any suggestion otherwise. We continue our discussions with the relevant parties to ensure this takes place.”

Further details regarding the ongoing discussions were not clear.

According to the terms of the CBILS scheme, taxpayers guaranteed 80% of the value of those loans issued by banks.

I have asked the British Business Bank and OakNorth for a comment. I will let you know if they do so.

Oh, and guess what, Philip Hammond the Ex-Chancellor works for Oak North, along with Lord Maude of Horsham and Lord Turner of Ecchinswell

You couldn’t make it up.