One aspect of applying for a Bounce Back Loan that is going to become very relevant to you when you do not have an account with an accredited lender, is that you are going to have to try and open a bank account at one of those accredited lenders.

Many people end up applying for lots of bank accounts in the hope that they strike it lucky and manage to open an account with an accredited lender and can then go on to apply for a Bounce Back Loan.

However, looking at my Twitter account feed, that can either be a simple process for many people, or a complete nightmare for others.

You may find that your bank account application is declined, and if so there can be lots of reasons a bank will decline your application, but many people immediately jump to the wrong conclusion as to why their applicant may have been declined.

Take for example when they are aware that a “credit check” has taken place, now one thing that those two words do tend to do is to fill people with dread as they may not have a perfect credit rating/score, and will confuse a “soft check” with a “hard check”.

To help you understand the difference, below is a Twitter message exchange from several of my followers, that you should read through and digest, as by doing so you will then get your head around those differences, and will hopefully get a much better understanding of the differences between those two types of credit checks.

Follower 1

“Checked my credit score this morning, it’s down 222 points over the weekend due to Halifax, Lloyds and Santander (twice?!) logging new credit accounts on my file – I have no credit facility on those new accounts. All to unsuccessfully get Bounce Back Loan”

Follower 2

“Are you certain the change relates to this and no other factors? E.g. increase in usage of existing credit facilities. If a hard search has been carried out, you can dispute. My score has not changed and have new accounts and BBL’s, only soft searches recorded.”

Follower 1

“Nothing else has changed apart from going from 1 personal account to 5 within a month, all logged on my Experian in the last few days. Experian themselves say it has pushed my score down.”

Follower 2

“As I say, shouldn’t be the case and you should dispute. Account opening process is the same for all. HSBC specifically state the difference on their website and that hard searches only relate to lending products.”

Follower 3

“Hard checks done for all accounts we applied for. No check hard or soft for the actual BBL. Definitely the checks have made our score come down and we haven’t taken out or used any credit products. BBL still approved but credit score gone to sh*t. We have disputed”

Follower 4

“I queried with banks that are accredited for BBL about whether they do a soft or hard search to open a new bank account. It was only TSB & HSBC who confirmed that they do a soft search others reported that they do hard searches so I never bothered trying to open account!”

Follower 2

“Always consider the source of your information. Don’t rest your businesses future on the word of a guy/girl in a call centre. It may be their last call of the day, their first day on the job, they could just not care. If it’s important and worth it, research it for yourself.

*no disrespect intended to anyone there, worked in a call centre myself once upon a time, and I was s**t”

Follower 4

“Ok thanks! I’ve been misinformed then.”

Follower 2

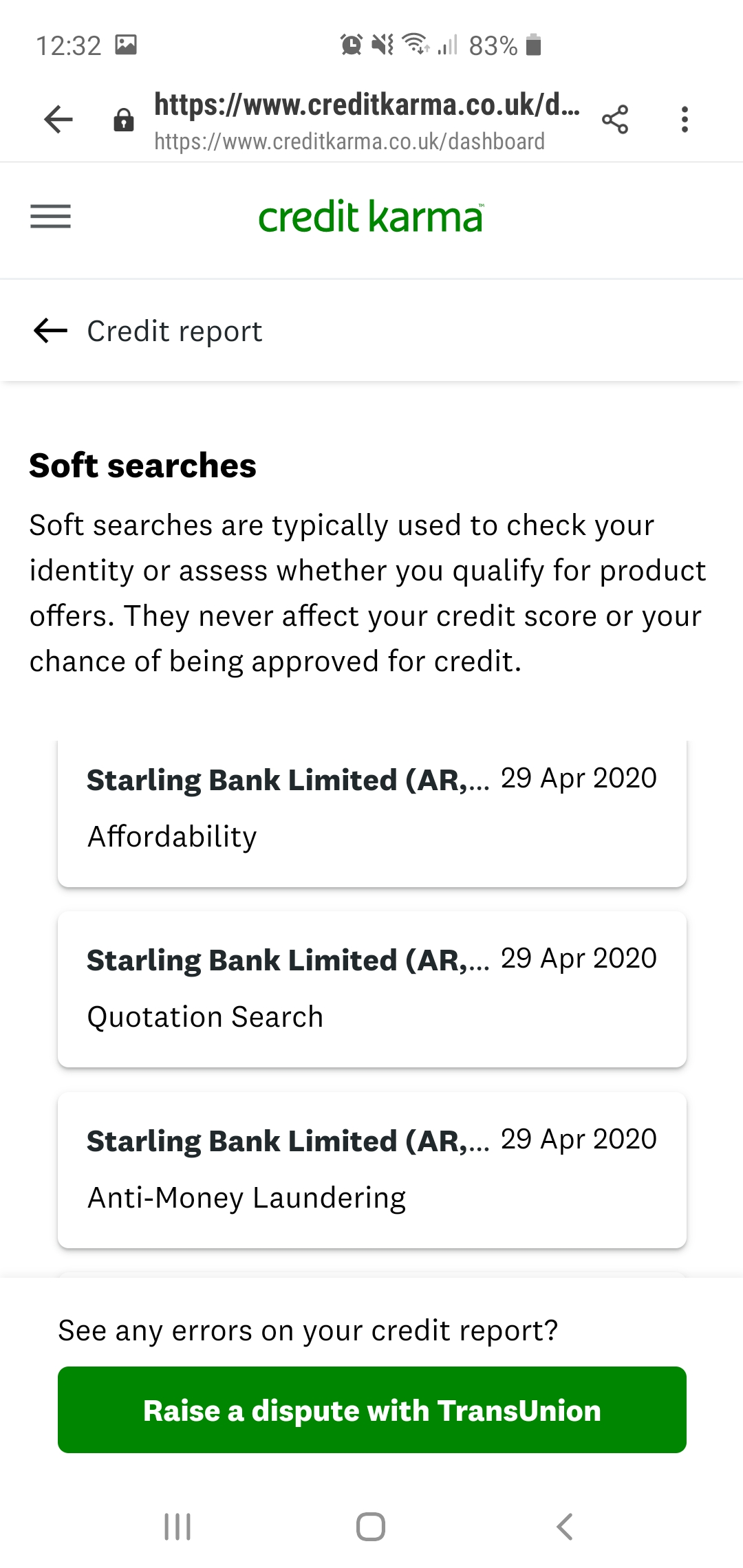

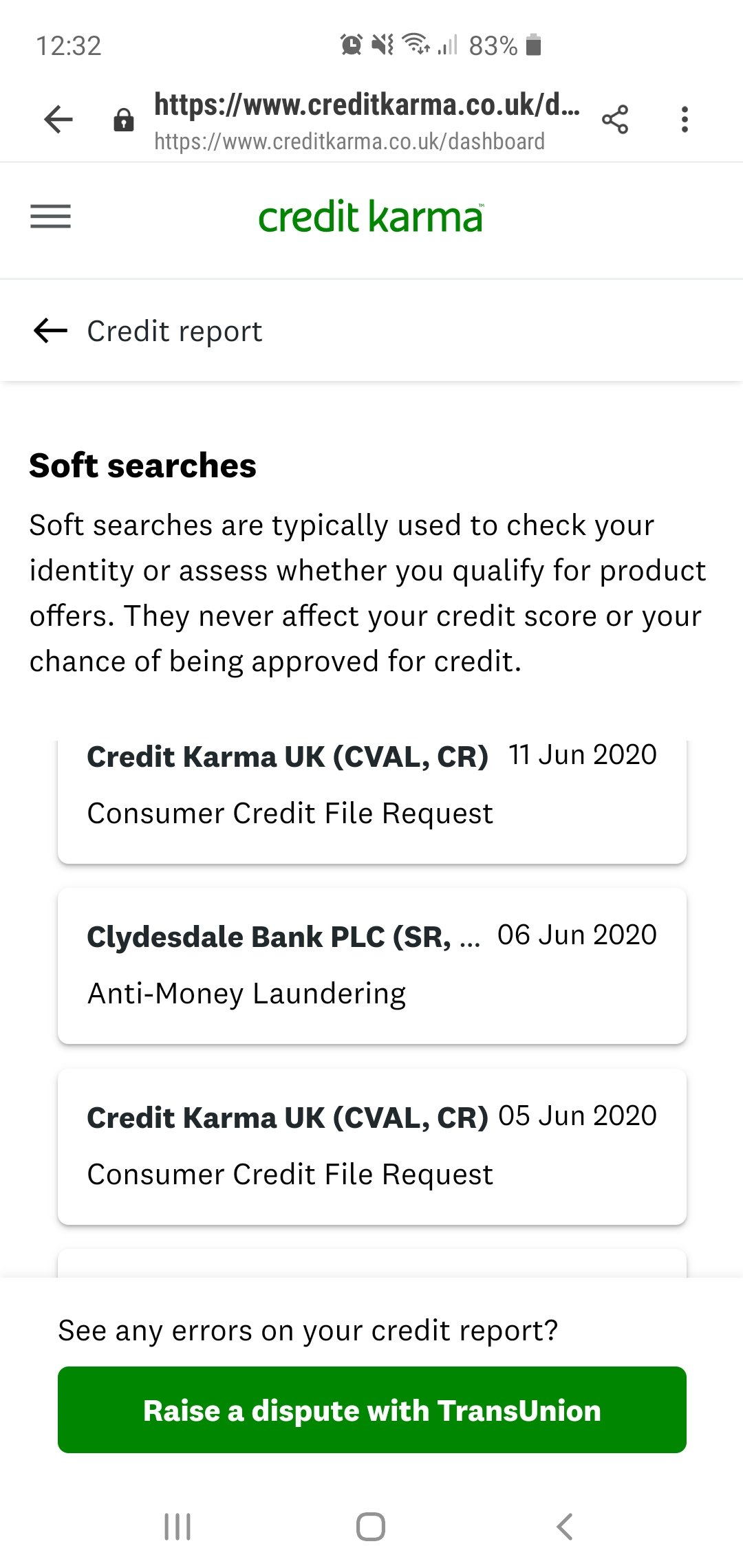

“I’ve already posted screen shots today showing Starling, Clydesdale and Lloyds have only done soft searches. Tide also only soft search, there is no reason for any bank to check percentage of available credit if not offering a lending facility. A soft search shows plenty.”

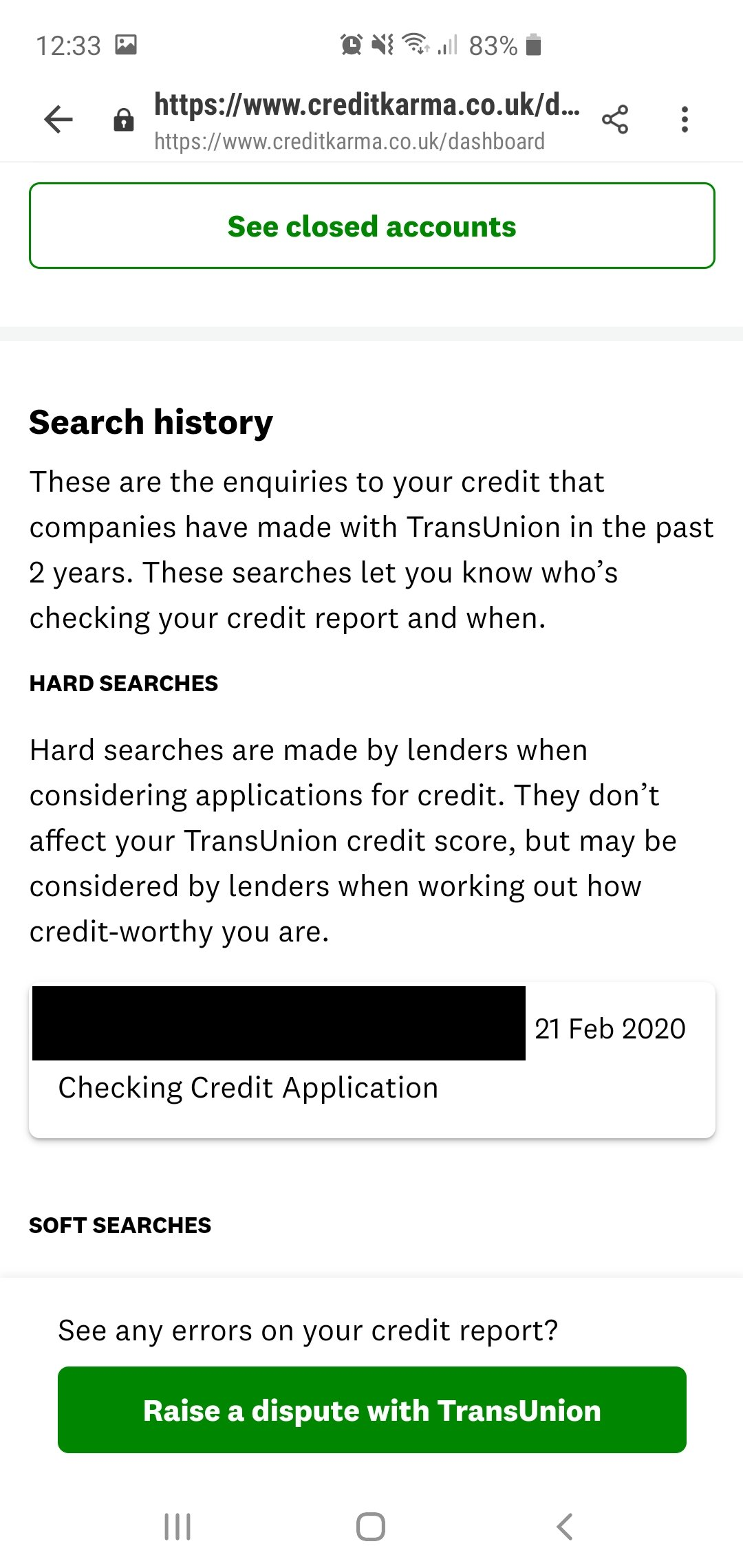

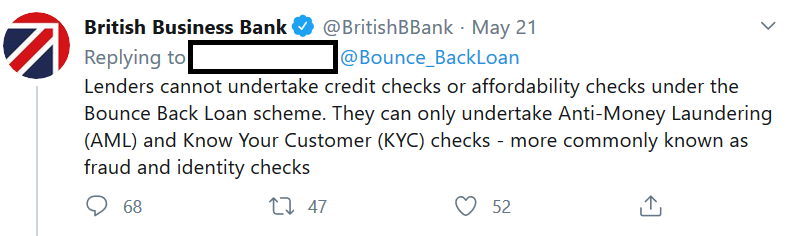

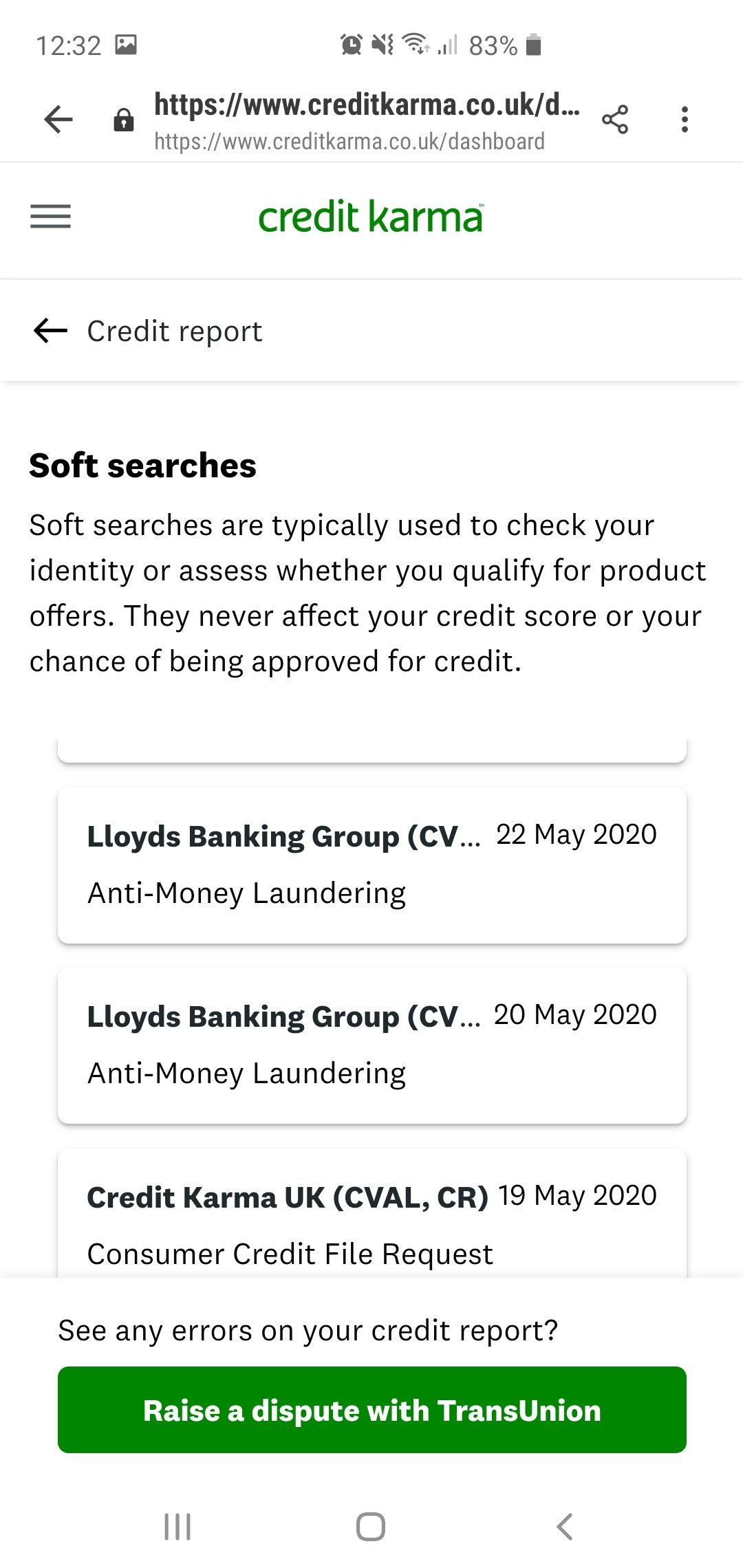

Screenshots:

Follower 5

“They credit check people for a feeder account that’s the issue”

Follower 2

“Yep. They credit check as per the BBB guidelines for KYC, AML and Fraud. Literally the only way to do this is and to verify the application details is a soft credit search”

Credit Checking and a Bounce Back Loan

The way that the Bounce Back Loan scheme has been set up is that apart from the standard Know Your Customer(KYC) requirements, there is no hard credit check performed when you apply for such a loan.

Just be aware though that Starling Bank for example have tagged onto the British Business Bank’s eligibility for a Bounce Back Loan their own criteria and as such have declined 1000’s of people for a Bounce Back Loan on that basis.

*Marin Lewis has stated that MSE is to refer Starling bounce back loan complaints to regulator.

The British Business Bank has very clearly stated that a credit check is not required for such a loan, however they also go on to say the ultimate decision to lend is with the lender. So, any bank or Fintech can reject/decline you.