Please have a read of this article, it’s a long one, but introduces a new and very simple way that you can check whether your BBL has any red flag compliance issues, using a state of the art online Artificial Intelligence platform.

Those with a Bounce Back Loan often fit a certain demographic, you will all have heard of the worst type, those being people who tried to, and often did abuse the scheme, and got away with it.

Members of Parliament, of all parties, are as good as screaming that those who did abuse the scheme should be, for want of a better phrase, hung, drawn, and quartered.

Those who did cheat the scheme are not the ones this important news update is aimed at.

Allow me to present to you some facts, please read and digest, and if you need proof, simply follow the respective links.

Fact:

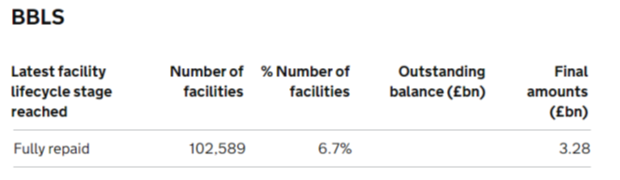

Ministers of State (current ones and those who have resigned recently), Chancellors of the Exchequer (they come and go quite quickly too don’t they), and MPs of a certain political party, are of course singing the praises of those who have repaid their BBL’s, and for reference at the last time of counting, 6.7% of Bounce Back Loans have been paid back.

Fact:

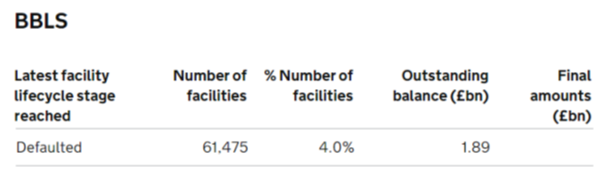

There are many, who have sadly had to default on their BBL’s, and those people get my sympathy, for being told there was a pandemic, you could die, and to close your businesses and stay indoors was a nightmare scenario for many a business owner, and many have not recovered.

Fact:

However, there are a growing number of people who are repaying their Bounce Back Loans who feel that they were possibly mis-sold that loan, and a growing number of people are convinced their BBL has red flag compliance issues.

The number of complaints received by the Financial Ombudsman Service alone related in one way or another to Bounce Back Loans speaks volumes:

- Financial Ombudsman Service Data

- Annual Complaints Data 2021/22

- New BBL Cases: 921

- Non-Ombudsman BBL Resolutions: 1,417

- Resolutions by BBL Ombudsman: 141

- Total Resolutions 1,558

Take a Look > https://www.financial-ombudsman.org.uk/data-insight/annual-complaints-data

A quick click on the BBL Complaints and Outcome section of this website will reveal plenty of Financial Ombudsman Service decisions upheld and not upheld, the former in which BBL lenders have been found to have made all manner of errors, mistakes or even treated people unfairly and have pulled all manner of tricks and have been told to pay compensation to their customers.

Take a Look > https://mrbounceback.com/category/bbl-complaints-and-outcomes/

Even worse than that, a recent report by the Financial Conduct Authority revealed a huge number of failings related to Bounce Back Loan lenders, which makes me feel sick to the stomach reading of how they pulled all manner of unfair stunts on their customers.

I did demand to know whether compensation had been paid to those BBL customers they uncovered that had been treated like a used tissue by those lenders.

Read Their Reply > https://mrbounceback.com/after-badgering-the-financial-conduct-authority/

When the FCA have noticed the banks are up to no good, it makes you think what else they have been trying to cover up and could be getting away with.

Fact:

Let’s face it, with over one and a half million Bounce Back Loans being issued, there were bound to have been all manner of mistakes made by lenders.

In fact, last time I asked there was a whopping £240million in Bounce Back Loans that are currently sat with no guarantee, as the lenders have asked for them to be suspended/withdrawn due to “errors”…..

Has Your BBL Got Compliance Issues Worthy of Compensation?

So, what are you faced with doing if you are of the mind that a mistake has been made with your BBL?

Well, you could fire off a complaint to the Financial Ombudsman Service and wait for up to a year or two for them to get back to you with a decision.

However, I have been contacted by a software Company that designed and operates an AI platform that checks for, among other things, BBL red flag compliance issues, using what I can only describe as a state-of-the-art Artificial Intelligence platform.

That platform not only allows you to check your financial statements and generate a report listing any detected errors. You can also upload all related documents and correspondences. More importantly the software does a detailed compliance sweep automatically highlighting any red-flagged compliance issues it detects, using its comprehensive AI database within the software.

Again automatically generating a potential complaint and claim for you and can send it directly to your bank in “Real-Time” within the platform with a click or two of your mouse.

Should the bank play funny buggars and refuse to put the situation right, you can then get the platform to contact the Financial Ombudsman Service instantly and automatically for you by generating the previous reports with a covering letter, including your complaint and claim, once again with a click or two of your mouse, all within the platform.

Is the Platform Easy to Use?

You will have to answer several questions as well as upload the required documents such as your loan agreement onto the platform, but that has been made as straight forward as possible, and I can vouch for that, having seen the platform in use.

But, and this is a big but, you need to be honest when answering the questions, which are straight forward enough, and certainly not there to trap you or anything like that.

By using the platform you will soon know whether any compliance issues have been flagged up and the platform will do all the hard work for you regarding submitting your potential claim for compensation.

OK, I’m Interested How Much Will It Cost Me?

Now, if you are prepared to give it a try, there is a fee to pay, which is £29.99, and what I would love for anyone who does try it out is to give me feedback on how good, bad, or ugly your experience was of using it.

The platform, being an Artificial Intelligence one has a comprehensive data base working underneath the software and already has a slew of issues picked up by other users, of which a huge number have already successfully used it, so you will soon discover if you have a claim to put into your lender for compensation.

Having seen it in use and being aware of what some BBL lenders are like, if you do have a claim to put into them, and do so, do not take phone calls from them on the matter, if they phone you up making you an offer of compensation or to discuss your claim, tell them very clearly that they must only communicate with you via email or write a letter to you.

That way you have an audit trail, and just as importantly cold hard proof of what has been said, discussed and offered.

As you will see when you visit the website of the platform, they do have plenty of other services surrounding all manner of different financial and related products, and it is their vast experience of those other products that has led them to launch one for those with a Bounce Back Loan.

Feedback Is What I Want As That Way It’s a Team Approach.

Is it worth £29.99? Well that is your decision to make, however as I say I would love your ongoing feedback if you do try it out and having spoken to enough of you I know you will tell me how your experience went and what outcome was arrived at.

I can then pass on, anonymously if you like to everyone via regular updates on this website how successful or not everyone has been.

That way it will help others decide whether it will be worth their while giving it a try, and remember, passing on information about BBL’s is what I do, all aspects of Bounce Back Loans, and if you feed your experience back to me I will certainly let everyone know.

Please have a good look over their website and study the information before making your decision, and this is important, let me know how you get on.

Now go and take a look > https://www.overchargedchecker.com/business

OverCharged Checker is not a claim company or a legal firm they are a FinTech Software Company.

- They have years of experience in complaints and claims.

- They have built an easy-to-use “DIY” consumer centric A1 software platform.

- The OverCharged Checker operates a simple but unique reactive AI real-time online dispute resolution (ODR) platform designed to make sure banks, lenders and other financial institutions treat you fairly.

Let Me Know.

If you do give it a try email me your feedback on info@mrbounceback.com or conversely you are always welcome to call me on the helpline, the details are here >https://mrbounceback.com/bbl-helpline-tracker/, you know the drill by now, anything you tell me will be in complete confidence, and if you are happy for me to pass on your experience of the platform I will do so without naming or identifying you.

Look out for ongoing updates, as like I say, good, bad, or ugly I will be reporting on how it’s going.

That is what I do.