Banks such as HSBC treated a lot of their potential Bounce Back Loan customers and still do treat a lot of their current BBL customers in a very shoddy, nasty and some would say pure evil way not only during the application process to get an account and/or a BBL but beyond that process too.

You only have to look how many people got paid off by them by way of a quick compensation offer at the time, when those customers kicked off at the bank to see that is true beyond any reasonable doubt.

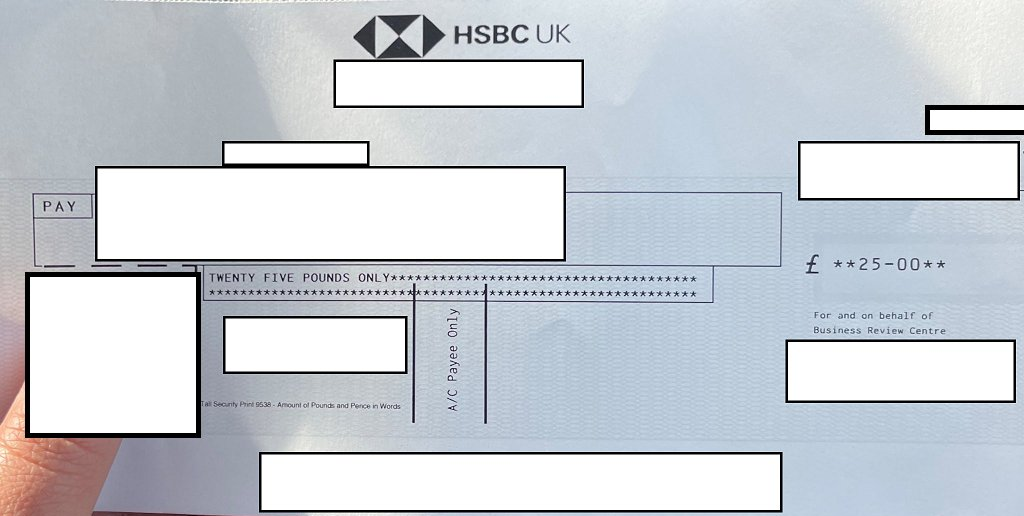

I have been contacted by an ever-growing army of people who got bunged a cheque for the way HSBC treated them or got paid money into a nominated back account to get them to go away, the amounts varied with many people get just £25 but many did get £50, £100 or even more:

But the value of the compensation they paid out will pale into insignificance when the true cost of their shenanigans that has been uncovered by either the British Business Bank or to use a BBL application term “self-assessed” by the bank themselves.

I have been reliably informed that currently over £240m worth of BBL guarantees have been yanked from a huge number of BBLs, with that figure likely to increase moving forward as banks like HSBC and a few others get slapped or own up to their wrongdoing with many of those loans.

The problem now for the banks whose loan book is made up of those dodgy BBLs is what to do with them as they were sold as Bounce Back Loans and alas, they are certainly not Bounce Back Loans now. Especially with no Government Guarantee.

The decent thing to do, HSBC and the other banks reading this who have made all manner of errors with lots of BBLs, is to write them off and save the taxpayer a few bob, it is your ineptitude and neglect after all that has caused the guarantee to be yanked not the taxpayer.

In fact, now the Government Guarantee has been yanked it’s not a taxpayer liability anyway.

It should be interesting to see how they try and recover those now non BBLs that were sold as BBLs without the correct FCA etc rules and laws in place when they approved them……

You can see why those banks involved are having hissy fits. £240m and rising, lot of money that.

UPDATE

The British Business Bank have said they have to “absorb the loss”…. Interesting