Tuesday has always been the day when HM Treasury releases the figures showing just how many Bounce Back Loans have been approved during the following week.

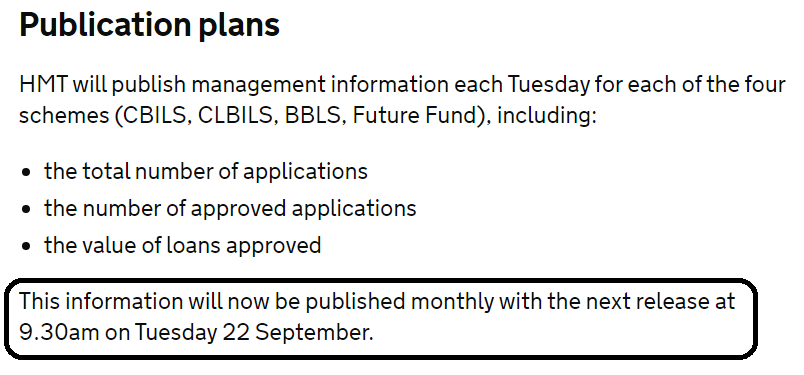

However, those very easy to calculate figures are apparently not going to be released this week, nor next week or the following week, in fact it has been decided to release them once a month moving forward.

This is HM Treasury’s statement on this “This information will now be published monthly with the next release at 9.30 am on Tuesday 22 September.” Short and sweet and no reason given.

You may wonder why that is, well once you take a look at just how many Bounce Back Loans have been approved each week for the previous weeks, you will spot something very obvious, and that is a continued drop in the number of approved loans being paid out week after week.

Keep in mind that during the first few weeks the number of actual lenders was tiny, and even though the number of accredited lenders now stands at an all time high, that being 27 of them, the number of approved loans continues to fall each week.

Does the continued drop in approved loans mean the scheme is rapidly achieving its goal of giving a BBL to every business that is eligible for one?

No, of course not, there are plenty of people who are screaming out for such a loan, but are unable to get a business account with any accredited lender, keep in mind that only six, yes SIX of the twenty seven accredited lenders are allowing new customers to sign up, and one of those twenty seven hasn’t any money to lend out (Tide).

Grab a calculator and divide last weeks approved BBL’s (17,558) by 26 (as only 26 lenders have money to lend out not all 27) then divide that by the number of days in a week then divide it be the number of hours in a day and that equals 4 loans per hour per lender on average being approved, FOUR!

HM Treasury and the Government has stated that:

You can see the source of that information HERE.

For reference not one single accredited lender that has only been offering BBL’s to current/existing customers has opened up their BBL lending facilities to non-customers.

Is that likely to change? I seriously doubt it, for when one of them does they will then be overwhelmed with new customers trying to apply for a new business bank account initially then putting in an application for a Bounce Back Loan.

One has to guess at why HM Treasury and the Government want to release the approved BBL figures monthly and not weekly, I have asked but have not been given an answer.

That answer is obvious, it is now getting embarrassing, if not shameful, that the majority of BBL accredited lenders are denying many people their right to apply for a BBL, and do not want to open up their schemes to non-customers hence the massive drop in approved BBL’s week after week.

I live in hope some of those lenders will have a change of heart in the last 10 weeks or so that the scheme is live, or even a new accredited lender comes on board that will lend out to new customers, but looking at how things have progressed so far, and the stubborn reluctance of most lenders to do so, I am fearful that will not be the case.

If you are one of the many people still unable to get an account with an accredited lender, keep trying, and if you have tried all six lenders accepting new customers and have been declined a new account with all of them, then contact your local MP and see if they can pull a few strings behind the scenes and get them to assist you.

No guarantees your local MP will be able to help you, but I have seen some MP’s being able to sweet talk a banks CEO into opening an account for local business men and women, despite them initially being declined.

Something may change in the final ten weeks of the scheme, to allow those who cannot access a BBL through no fault of their own to access one, and let’s hope it does.

Below, for reference are the weekly approved BBL figures.

Bounce Back Loans Approved

Week Ending:

10 May BBL’s Approved = 268,173

17 May BBL’s Approved = 196,220

24 May BBL’s Approved = 143,676

31 May BBL’s Approved = 91,285

7 June BBL’s Approved = 82,892

14 June BBL’s Approved = 81,338

21 June BBL’s Approved = 57,645

28 June BBL’s Approved = 46,092

5 July BBL’s Approved = 46,089

12 July BBL’s Approved = 34,201

19 July BBL’s Approved = 36,542

26 July BBL’s Approved = 29,159

2 August BBL’s Approved = 22,263

9 August BBL’s Approved = 21,721

16 August BBL’s Approved = 17,558

23 August BBL’s Approved = ???? **TOP SECRET (FOR NOW)**

Don’t Get Caught Out By Tide

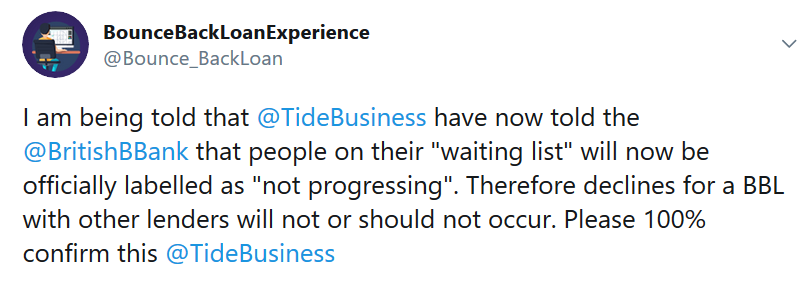

I have been banging on about the Tide waiting list for quite some time. In a nutshell if you are on that waiting list, and keep in mind they have no money to lend out, then you are likely to find that when you apply with another lender for a BBL you may initially get approved, but during the final checks, those being interbank checks some lenders will then decline you for being on that waiting list.

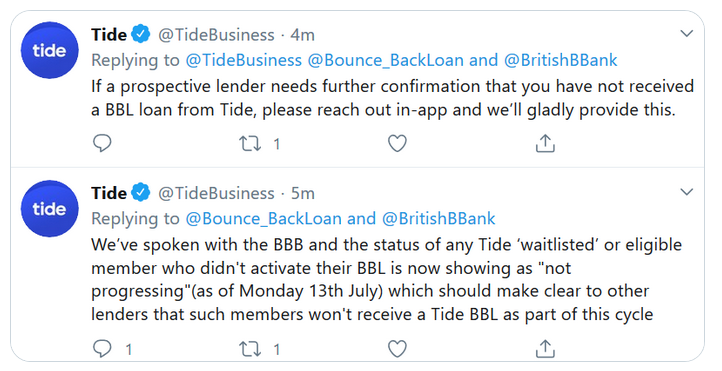

The reason for approval but then a decline is that other lender sees your name upon that waiting list as a BBL in progress, not simply being on a waiting list. Below is a tweet I sent to Tide and their official response about this situation:

Be aware though that despite what they are saying, people after July the 13th applying with other banks have still been declined for being on that waiting list.

If you find for example you get approved by but then are declined by Clydesdale Bank Yorkshire Bank or Metro Bank you will need to ask Tide for proof you have not got a BBL from them and supply that proof the respective bank to get the decline overturned.

This is madness but sadly it is something you need to do, as for who is to blame, well the British Business Bank do have Tide listed as an accredited lender even though they have no money to lend out, Tide have, or state they have told the British Business Bank about the problem with their waiting list and other lenders, but other lenders appear not to have been told hence them still declining people solely for people being on the Tide waiting list.

Thanks for the Donations by the Way

If you want to help keep me and this place going and can throw a few bob in the donation tip jar it is appreciated. Asking for donations was not my initial aim when I launched the Twitter account or the website, however they have both taken off and both are now consuming a lot of my time.

Been Declined a Bank Account or BBL?

Please read below for some reasons as to why you may be declined a bank account and/or a Bounce Back Loan with some lenders.

Many people who are declined tend to fear it is their credit rating/score that is the cause of a decline, and whilst that can and may play a part obviously, there can be a whole host of other reasons, some of which can be sorted out, and when the latter is the case you may find it much easier to open a bank account and/or obtain a Bounce Back Loan.

Some Lenders can and will and are in within their rights to decline anyone for an account and/or BBL based on their own criteria in additional to that laid down by the British Business Bank.

With that in mind, if you have checked all of the following and/or have been declined by one lender then you are also within your rights, and encouraged to apply to any other lender that is part of the Bounce Back Loan scheme.

Potential reasons not relating to credit score/rating

SIC Code – Not matching on companies house vs what you put in your application.

SIC Code – considered a reputational risk – you would be surprised how many business types fall into this category.

Directors/owners name(s) not matching companies house and/or

Voters roll e.g. Chris vs Christopher, as your middle name.

Business address not matching, has your accountant used their address to register? What is your correspondence address at companies house?

Business name not matching e.g. Ltd v limited

Recent changes of directorship and/or ownership – red flag at the moment due to BBL fraud

Markers registered against the company or director

Previous financial relationship with the bank or one its subsidiaries that did not end well

Compensation

Many Bounce Back Loan applicants that have been through hell and still are experiencing problems have been offered compensation from a bank ranging from £50 up to £2500 for the more complicated problems.

It is your choice as to whether you accept any offer of compensation and the amount you accept too.