I am still trying to work my way through the maze that is Whitehall/Government and make contact with Team Rishi for a chat, I will keep on trying, fear not on that front.

Now, those of you who have been waiting for HSBC, keep badgering away at their CEO team, I have multiple reports of people contacting Noel Quinn (CEO) and getting (not long after sending in an email complaint) a phone call from his team, who appear (currently anyway) to be helping people progress with either their feeder account application, receiving their final EchoSign and getting paid out too.

His email address is noelpquinn@hsbc.com

Also, I have listed plenty of CEO email addresses on this page of the website HERE so if you are being messed about with any bank then feel free to contact the respective CEO, each bank does of course have a team of staff who will deal with complaints sent in.

Had some people confused about filling in the digital paperwork that you need to complete when applying for a feeder account and then a BBL from HSBC, remember the nominated bank account you want the money to be paid into (sort code and account number) needs putting down on those digital forms, people have been putting the feeder account details where their nominated bank account info needs to be.

If you have applied for a personal account with Barclays via their app, and they have opened a personal account for you, you then have three options for opening a business account.

- You can switch a business account from any other bank that is part of the switch scheme to Barclays (business accounts not personal accounts to get a BBL) and will need to phone them up to arrange this, be aware you will be waiting hours on the phone, but it’s worth the wait, as the switch scheme is fast.

- If you want to arrange to open a business account via an appointment to visit a branch then you will need to phone them up (long hold times though when doing so) and the call handler will scan the list of nearby branches to you to find one that has the right staff member and an available appointment, just be aware that appointment could be in October or November.

- You can apply online via their website and that will take around 6 weeks to be processed once you have put your application in. Be aware that you will need to have access to your new personal account debit card, and a Pin Sentry, either a physical one or the mobile pin sentry on the app, and the latter will only become activated on your app a few days after your new personal account has been opened.

Those of you who want to apply for a BBL with HSBC and haven’t an account with them, then try the HSBC Kinetic App, (iOS only currently), you will save time doing so compared to applying online, and will find out quickly if they are going to open a business account for you.

Other options for getting a suitable business account and then a BBL are by applying to either Yorkshire Bank, Clydesdale Bank or Metro Bank.

Tide’s Official Response to Their Problematic Waiting List

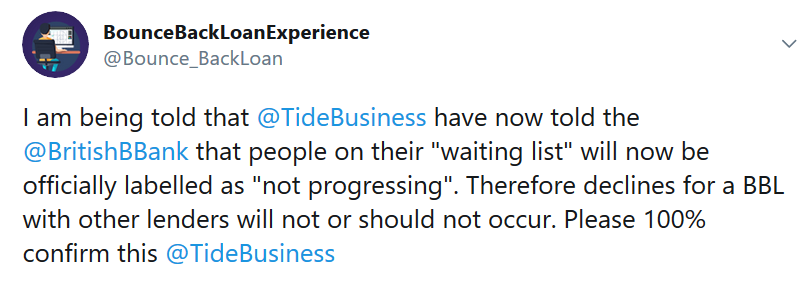

I have been banging on about the Tide waiting list for quite some time. In a nutshell if you are on that waiting list, and keep in mind they have no money to lend out, then you are likely to find that when you apply with another lender for a BBL you may initially get approved, but during the final checks, those being interbank checks some lender will then decline you for being on that waiting list.

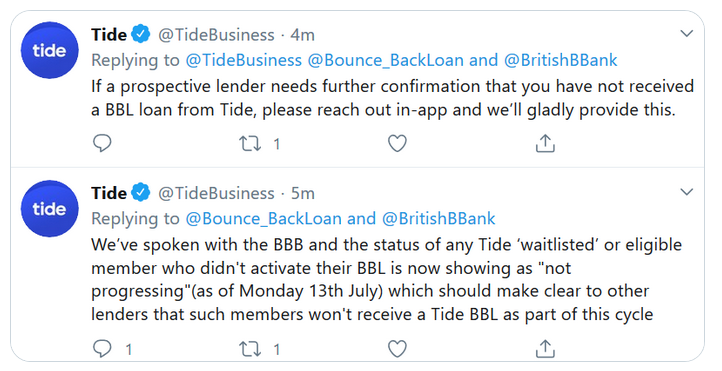

The reason for approval but then a decline is that other lender sees your name upon that waiting list as a BBL in progress, not simply being on a waiting list. Below is a tweet I sent to Tide and their official response about this situation:

Be aware though that despite what they are saying, people after July the 13th applying with other banks have still been declined for being on that waiting list.

If you find for example you get approved by but then are declined by Clydesdale Bank Yorkshire Bank or Metro Bank you will need to ask Tide for proof you have not got a BBL from them and supply that proof the respective bank to get the decline overturned.

This is madness but sadly it is something you need to do, as for who is to blame, well the British Business Bank do have Tide listed as an accredited lender even though they have no money to lend out, Tide have, or state they have told the British Business Bank about the problem with their waiting list and other lenders, but other lenders appear not to have been told hence them still declining people solely for people being on the Tide waiting list.

Thanks for the Donations by the Way

If you want to help keep me and this place going and can throw a few bob in the donation tip jar it is appreciated. Asking for donations was not my initial aim when I launched the Twitter account or the website, however they have both taken off and both are now consuming a lot of my time.

But either way, as usual this website will be free to use and advert free, and you can always contact me via DM over on Twitter if you want anonymity with your problems, worries or concerns, or just need someone to talk to, if I don’t respond instantly I will get to you.

The website is coming along great as you can see, over 600 posts and pages already loaded up, not bad in just a week of it being live, some posts may just be a paragraph or two long, and some are rather long and intense real life Bounce Back Loan experiences that you will relate to, so do please have a good look around, and when doing so you will see you are not alone with whatever BBL problems you are experiencing. .

Been Declined a Bank Account or BBL?

Please read below for some reasons as to why you may be declined a bank account and/or a Bounce Back Loan with some lenders.

Many people who are declined tend to fear it is their credit rating/score that is the cause of a decline, and whilst that can and may play a part obviously, there can be a whole host of other reasons, some of which can be sorted out, and when the latter is the case you may find it much easier to open a bank account and/or obtain a Bounce Back Loan.

Some Lenders can and will and are in within their rights to decline anyone for an account and/or BBL based on their own criteria in additional to that laid down by the British Business Bank.

With that in mind, if you have checked all of the following and/or have been declined by one lender then you are also within your rights, and encouraged to apply to any other lender that is part of the Bounce Back Loan scheme.

Potential reasons not relating to credit score/rating

SIC Code – Not matching on companies house vs what you put in your application.

SIC Code – considered a reputational risk – you would be surprised how many business types fall into this category.

Directors/owners name(s) not matching companies house and/or

Voters roll e.g. Chris vs Christopher, as your middle name.

Business address not matching, has your accountant used their address to register? What is your correspondence address at companies house?

Business name not matching e.g. Ltd v limited

Recent changes of directorship and/or ownership – red flag at the moment due to BBL fraud

Markers registered against the company or director

Previous financial relationship with the bank or one its subsidiaries that did not end well

Compensation

Many Bounce Back Loan applicants that have been through hell and still are experiencing problems have been offered compensation from a bank ranging from £50 up to £2500 for the more complicated problems.

It is your choice as to whether you accept any offer of compensation and the amount you accept too.