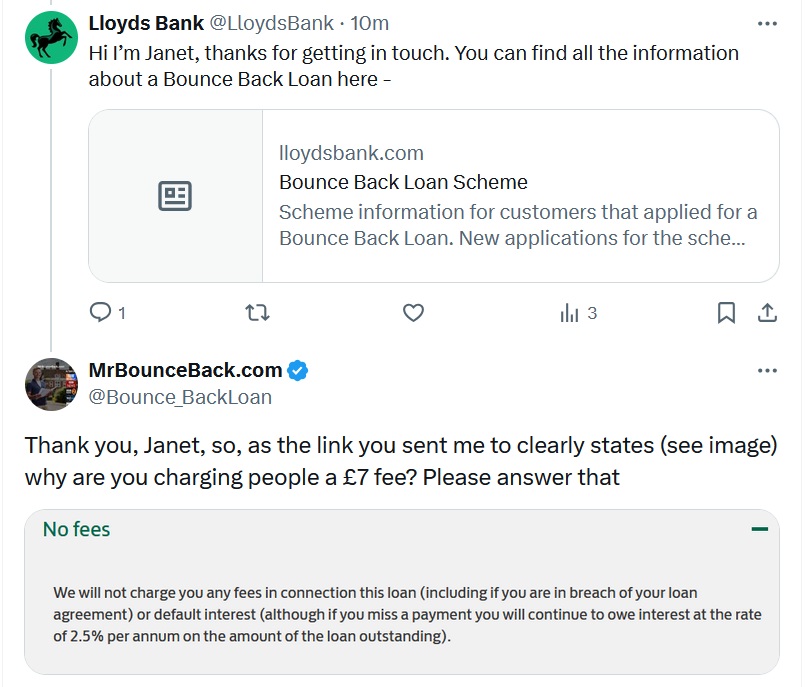

I have asked Lloyds bank on Twitter and via my contacts at the bank by email the following, as someone has contacted me alerting me to a mysterious £7 fee they got charged whenever a BBL repayment fails, this is what I have asked them, I will let you know if/when they reply.

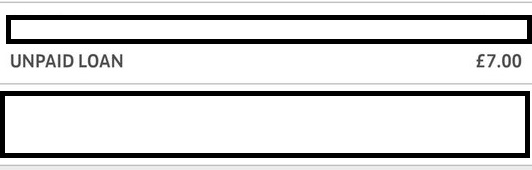

For the record, I have been sent bank statements from those being hit with such a charge, which clearly shows it on those statements.

Tweet/Email

Hi @LloydsBank

is it true if someone misses a BBL repayment you rob them of £7, when the rules of the scheme clearly state no fees or charges of ANY description? If you are adding those fees, do I have to report you to the @TheFCA @BritishBBank @biztradegovuk @jreynoldsMP like I did with Tide who were also pulling a fees and charges scam or are you going to refund them all today with compensation.

I was going to report you also to the Fair Banking APPG via MPs @lukejcr @HattonLloyd @DavidBSampson but I’ve been blocked as one of the Members of that group is linked to Tide, who pulled a similar scam, and they kept quiet on Santander. >https://mrbounceback.com/members-of-the-fair-banking-appg/

I have worked out you may have skanked around £1,229,214 so far from your BBL’ers on the 58,534 BBLs the taxpayer has paid you out the guarantee on.

Let me know what’s what petal x

More Information

The logic behind that £1,229,214, is that it takes, (usually) three repayments to fail before a Lender defaults you, so 58,534 x £7 x 3 = £1,229,214

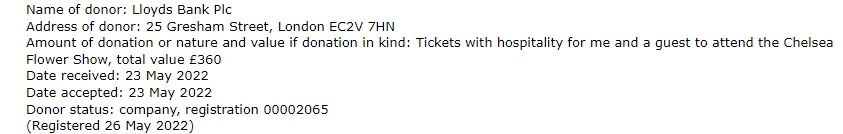

Oh, and Lloyds do like showering MPs and Ministers with freebies, for example they recently bunged Rachel Reeves free tickets to the Chelsea Flower Show, so lets hope when she gets wind of this scandal she doesn’t look the other way!

One would have thought, someone as financially intelligent as the Chancellor could buy her own tickets to such an event, and not leave herself compromised by a BBL Lender, one who has been given plenty of slaps by regulators in the past.

An Update

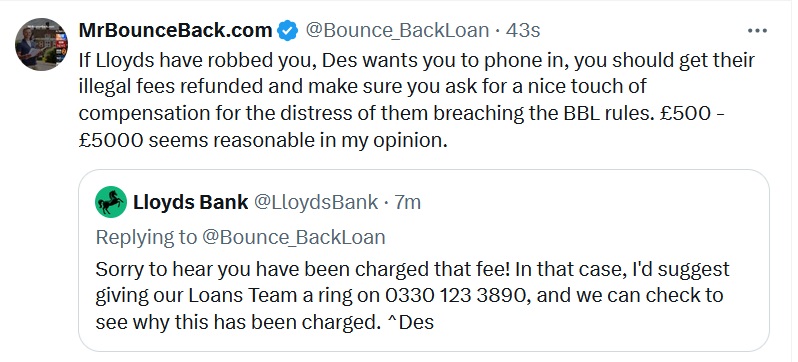

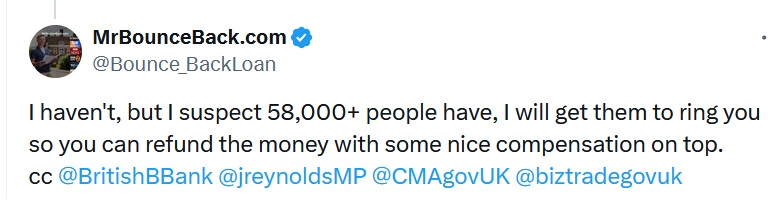

Looks like they are guilty as charged, if they have skanked you out of no end of £7’s demand the money back, with a nice touch of compensation for your distress.

Update 2 – Given them a bell if you have been robbed

Previous Lloyds BBL Scam

‘Bundling’ is where a bank requires small business customers to open a business current account (BCA) with them when applying for a loan. This restricts competition and limits choice because customers may want to hold an account with one provider while using a different bank for their loan.

This action comes after Lloyds Banking Group (Lloyds), which includes Lloyds Bank and the Bank of Scotland, notified the Competition and Markets Authority (CMA) that it had not complied with certain aspects of legal undertakings designed to protect customers from these anti-competitive practices.

The CMA found that Lloyds breached these undertakings from 8 May 2020 onwards. It is requiring around 30,000 customers that were running the finances of their business through a personal current account (PCA) also to open a BCA with them in order to obtain a loan through the government’s Bounce Back Loan Scheme.This scheme is intended to help businesses access finance quickly during the coronavirus (COVID-19) pandemic.

While the CMA notes that Lloyds’ new BCA customers would not initially be charged, small business customers may keep their account open for longer than the fee-free period, resulting in charges for an account that may not be well suited to their business.

Working with the CMA, Lloyds has agreed to a number of actions to become compliant and make sure all affected customers are made aware of their options. This includes writing to customers to inform them that:

- if they opened a BCA with Lloyds, they are not required to maintain this account for the purposes of a loan under the Bounce Back Loan Scheme, and can choose to switch to another provider at any time while keeping the loan; and

- they will be offered the option to switch to a fee-free loan servicing account

- Lloyds will also ensure that any customer that retains the BCA will be reminded of these options two months prior to any newly introduced charges, as well as reporting back to the CMA on its progress.