I have just been blocked on Twitter by the “Fair Banking All Party Parliamentary Group”, one of their members was linked to Tide, a Bounce Back Loan Lender, who I had recently exposed as BBL recipient scammers.

That story if you are new here is available on this link > The British Business Bank Gives and an Official Comment on My Tide Bounce Back Loan Scam Exposé – Take a Look, I Will Take It As a Thank You – Also a Request for Any Other Victims to Come Forward – Please Do Come Forward

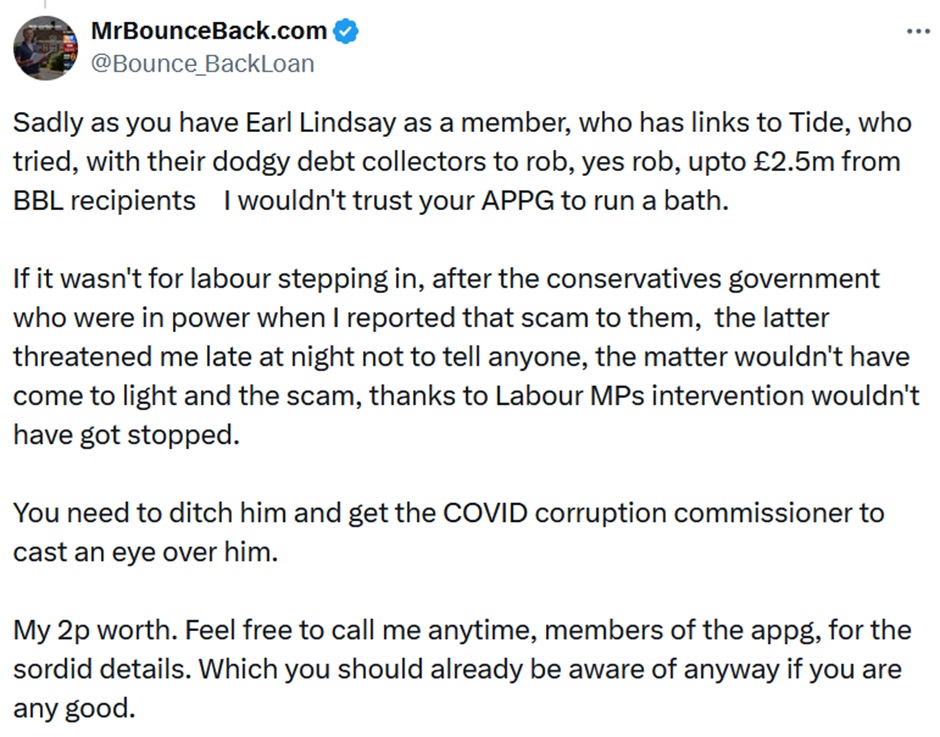

Obviously they took great umbrage at me telling them the following:

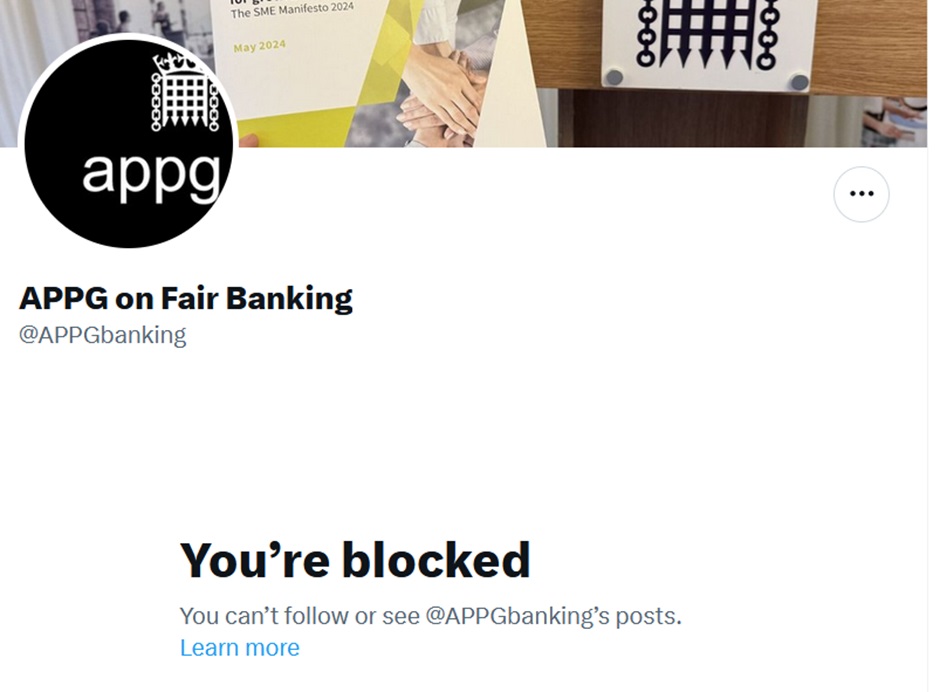

As such, in seconds I was blocked:

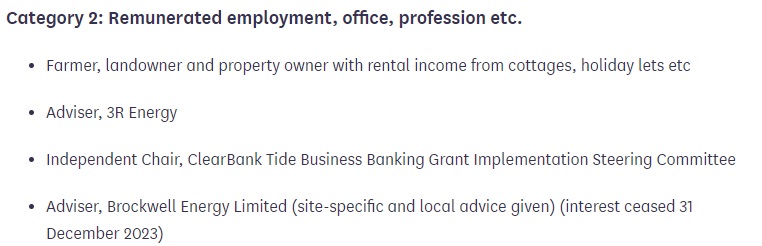

Here is his link to Tide >>https://members.parliament.uk/member/2059/registeredinterests

So obviously I then went through all of the Direct messages, phone calls and emails I had exchanged with them during the last few years, and sadly, when I did I had an Alan Bates, Post Office Horizon Scandal moment.

Allow me to explain. I will try and keep it brief….

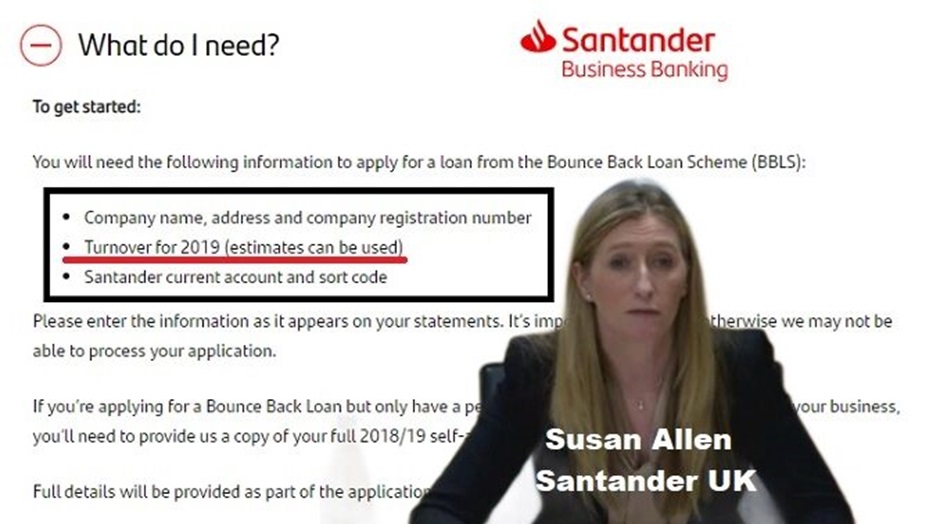

I have for quite some time been contacted by many people with a BBL from Santander who were being accused by that Lender of over-estimating their turnover, and they were convinced they were allowed to estimate their turnover to get a Bounce Back Loan.

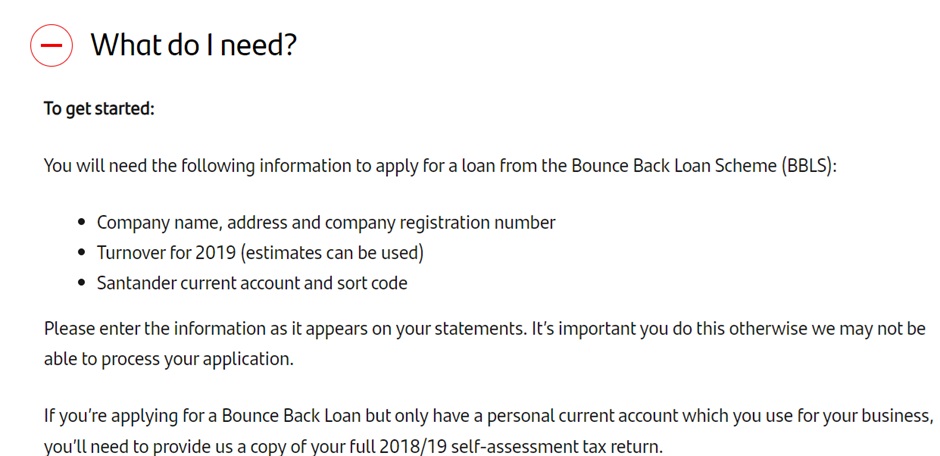

That is hardly surprising, for in big on the Santander website at the time was the following:

Their Q and A section simply had the following:

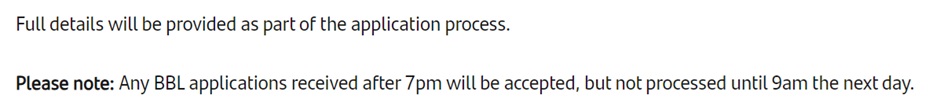

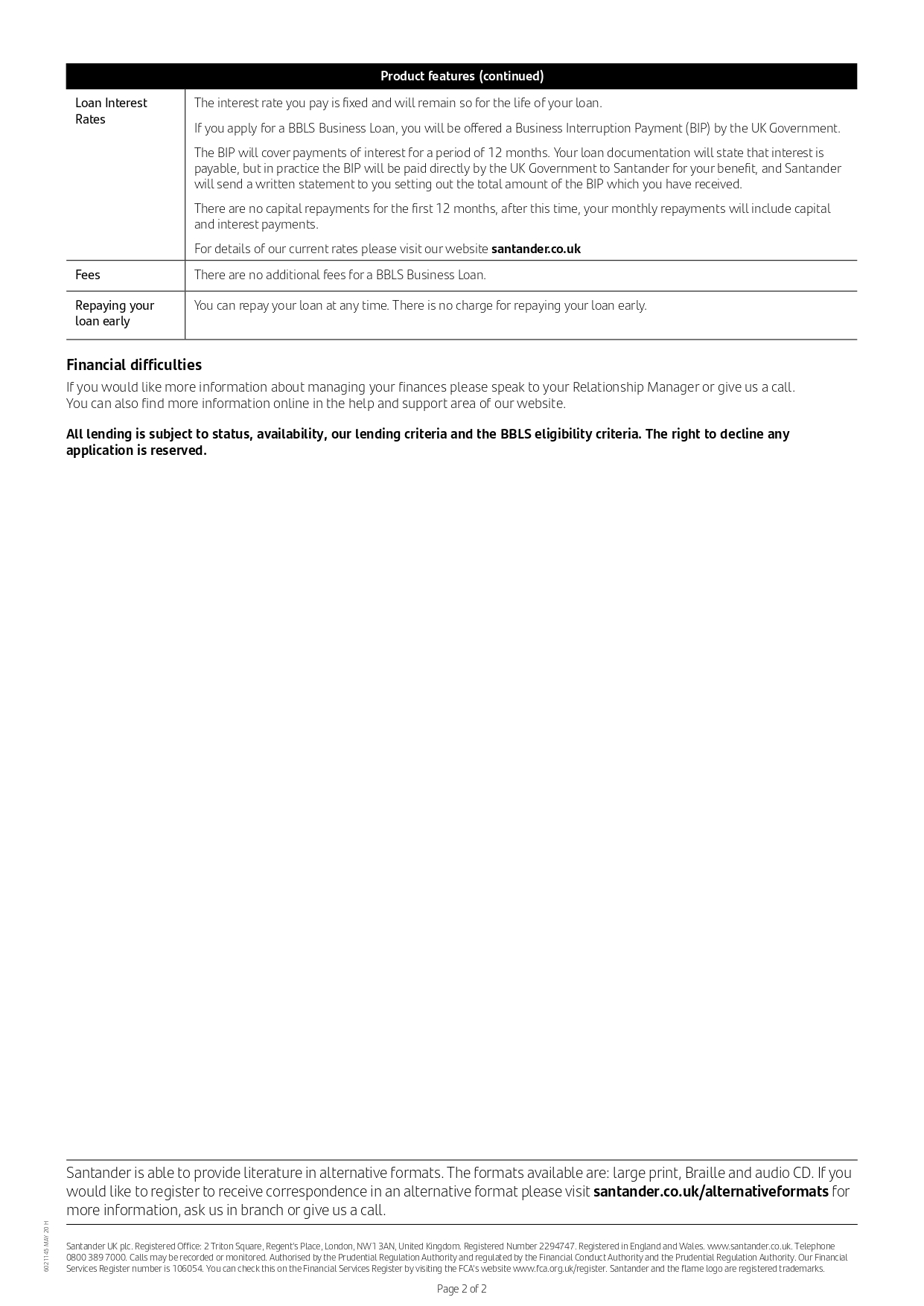

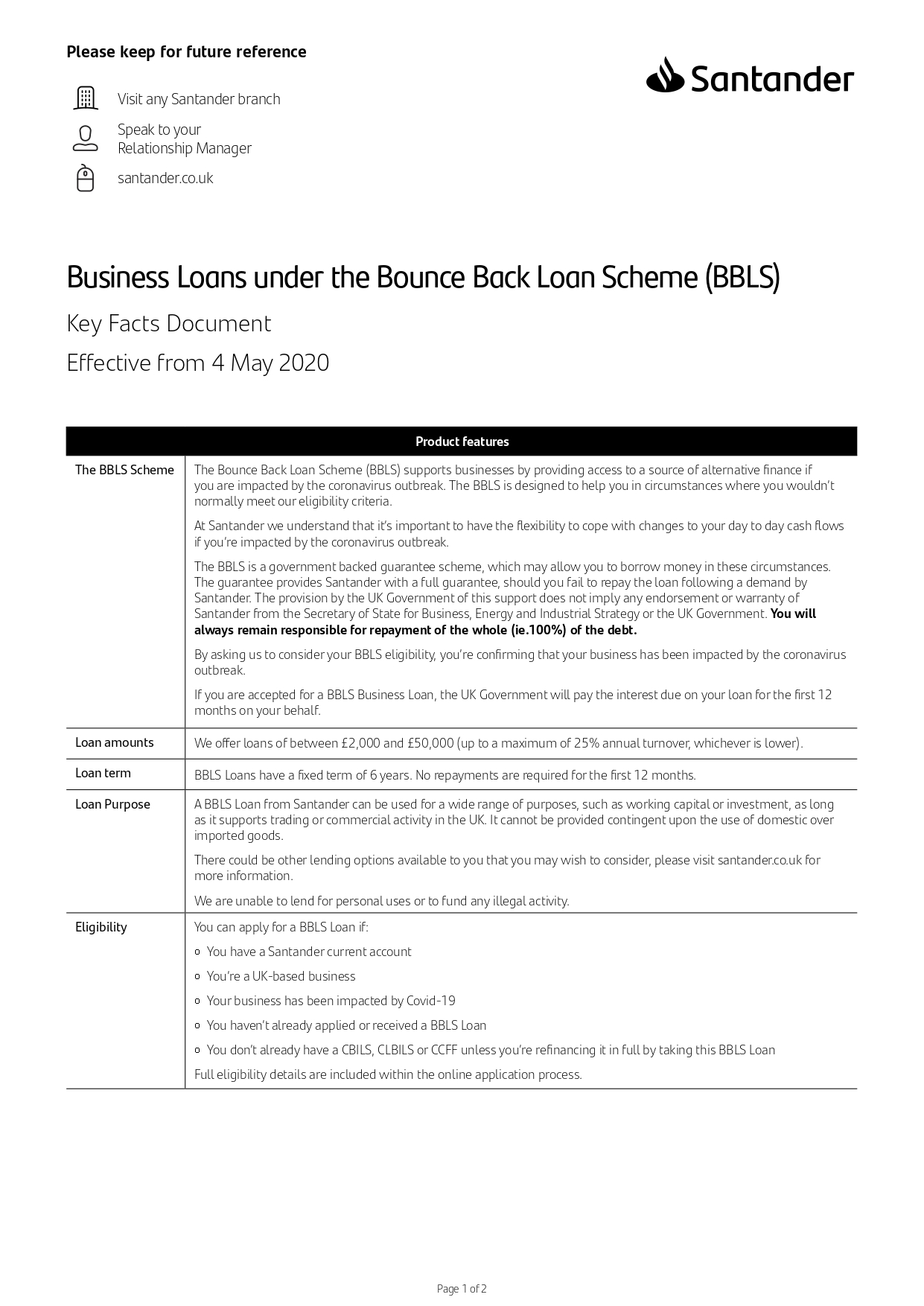

Plus, there was no mention of turnover in their Key Facts Document:

Now, many people have been Disqualified as Directors for over-estimating their turnover with Santander, these are some from the last few days:

- Zunair Kler the Director of Zunair Kler Limited Starting a 10 Year Ban Today for Over-Egging His Company Turnover to Blag a £50k BBL from Santander When Only Eligible for a BBL Valued at £8,169

- Wasim Haroon the Director of Papas Wok Ltd Starting a 10 Year Ban After Liquidator Tauseef A Rashid Signed Him Up as a Client of His Insolvency Practitioners Then Reported Him For Over-Egging the Turnover He Used to Blag a £50k Santander Bounce Back Loan

- Christopher Paul Taylor the Director of Taylor Signs & Laser Craft Ltd Given a 9 Year Ban After Liquidator Daniel Taylor Grasses Him Up for Over-Estimating His Estimated Turnover to Secure a £30,000 from Santander

It is to be remembered that the Insolvency Service are as good as Judge and Jury when it comes to such matters, and sadly most people tend to just agree to take a ban rather than take the legal route to prove their innocence or alert them of any mitigating circumstances.

Others complained to the Ombudsman, but often get slapped down and their complaint tossed aside like a used tissue:

- Despite Very Clearly and in Big the Santander Website Saying “Estimates Can Be Used” the Ombudsman Tosses Out a Complaint That Bank Demanded Back a Customer’s BBL Back for Using an Estimate – “You Should Have Read the Small Print”

- Ombudsman Takes 20 Months to Decide Not to Uphold a Complaint Regarding a Declined Santander Bounce Back Loan Application as They Say The Lenders Could Demand to Ask for Proof of Turnover Even Though It Was Self-Declared

- Simon Louth the Ombudsman States That Even Though Santander Had in Big on Their Website “Turnover for 2019 (Estimates Can Be Used)” He Expects Actual Turnover Figures To Be Used When Applying for a Bounce Back Loan!

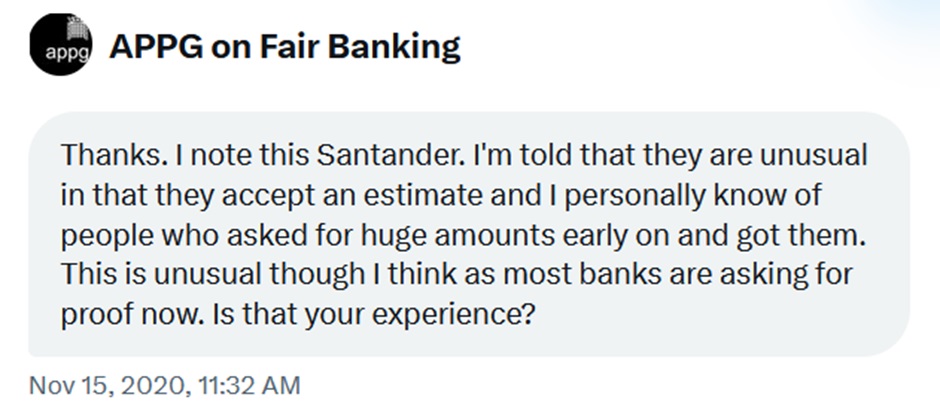

However, way back in November 2020, this is what I was told via a Direct Message by the Fair Banking APPG:

I bet that made you choke on your coffee….

So, they knew all along, and even know people who, if I am reading that message correctly blagged a BBL.

Even if there is just one person who was given a Director Disqualification or had a BBL snatched back unfairly then that is wrong.

In fact, low and bloody behold an Ombudsman did see sense not too long ago and ruled in favour of one such person, admittedly for TSB, but you get the point.

Shockingly though, that person had to suffer for quite some time until fair play was decreed by an Ombudsman, but many people do not complain, knowing it can take a year or two to get their problem resolved, and in that time they can be hit with negative credit file markers or even worse CIFAS Fraud Markers.

- Victim of Identity Fraud Complains to the Ombudsman That Santander Closed All His Accounts After Applying for a Bounce Back Loan Which They Also Declined Saying He Had a CIFAS Marker – Ombudsman Upholds His Complaint Saying the Bank Acted Unfairly

- This is What BBL Lenders Are Putting by Way of Markers on the CIFAS Fraud Database for Those They Suspect Blagged a Bounce Back Loan from them by Avoiding Repayment

- Check to See If Your BBL Lender Has Logged a CIFAS Marker Against Your Name for “Avoiding Payment” (or Worse) For If They Have, You Could Be High Up On Rachel Reeves’ List of People Her “Covid Corruption Commissioner” Will Be Chasing If Labour Win the Next General Election

Oh, and they knew about the dodgy BBL related CIFAS Markers too, as we had a chat back in October of 2020, and they are still being logged even now….:

My questions to any of those Fair Banking APPG Members who I just know are reading this, are:

- Are any of the people given Director Disqualifications actually innocent having believed they were allowed to estimate their turnover, but being faced with a David and Goliath moment, with the Government via the Insolvency Service on their back, just signed an undertaking, accepting the ban?

- Are any of the business owners who had their Bounce Back Loans snatched back by Santander innocent, many of whom never recovered their businesses finances due to those snatch backs?

- Did they grass up any of the people they knew, friends, family members possibly fellow MPs that had got “huge amounts” from Santander?

No doubt Santander will claim hidden away in their terms and conditions it may have said what an estimate is, when you could use them, but obviously with so many business owners affected, and as the MPs and Members of the House of Lords who knew about that problem, why did they not step up to the mark an act on what they knew?

What is an estimate if it isn’t an estimate. After seeing Boris come on your telly telling you that you might die and don’t go outside and stay at home, closing your business in the process, then along comes Rishi saying you can get £50k by pressing a few buttons, then seeing “estimates can be used” in big on Lenders website, who, when sat in such a vulnerable position would have scoured through the small print? Some people clearly didn’t, and many of the were obviously vulnerable. In fact, it could be said, everyone was vulnerable during the pandemic.

By the way if you do get accused of any type of wrongdoing make sure that you seek legal advice if there are mitigating circumstances as I have seen plenty of people threatened with a Director Ban having those proposed bans dropped when a solicitor gets involved, if you need help with that and/or you are being bullied or threatened by the powers that be, and deep down you know you did nothing wrong give me a bell.

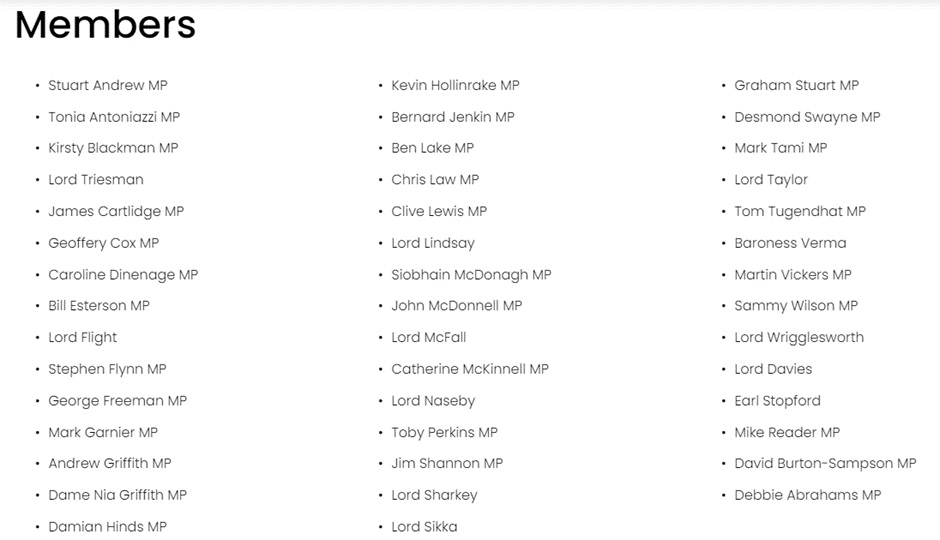

Here is a list from the Fair Banking APPG website of the MPs and Members of the House of Lords who may just have been in on this scandal all along, but disgustingly chose to keep their gobs shut and draw their wages and claim their expenses.

You all have an open invitation to call me if you can be bothered…..:

To the above MPs who will no doubt get their knickers in a twist with this article, lest we forget, one BBL’er was hounded and died. I don’t want to have to report on any other similar stories moving forward. I warned you often enough times, to many of your faces, that such things would happen. That is why I do what I do and my helpline is open daily.