I did report on this quite some time ago, but think its time to bring it to the attention of people who may have missed it:

Sadly, with all the sleaze swirling around the Covid Loan Schemes, it is no surprise to hear an Ex-Shadow Chancellor of the Exchequer (Labour) who, part way through the Bounce Back Loan Scheme, became the CEO of a “Debt Collectors Association” urging the Government, Lenders, and the British Business Bank and BBL Debt Collectors to stick to a hard-line approach to those who received one of those loans.

That person is of course Chris Leslie, CEO of the Credit Services Association.

He showed his true or should I say “new” colours, and it also shows how a well-paid job can change one’s outlook and moral compass, which is a sad state of affairs as he was also once a trustee of the Consumer Credit Counselling Service advice charity (now Step Change) and Credit Action (now the Money Charity).

Taking part in a podcast chaired by Bill McCall, President, Chartered Banker Institute, Leslie said the following:

“The scheme in the UK (Bounce Back Loan Scheme) has already baked in a certain approach to forbearance, I think it started with the option of a 6 year repayment period, that has been extended to a potential 10 year period, there are already options in there about interest repayment holidays, 6 months erm, so forth if payments can’t be made in a particular way.

But, er, you know, I think the phycological animal spirit issues are really important in the design of all this, we are talking about one and a half million businesses here, if they get that sense that there is a write-off in prospect, the payments will then cease, and I think its really important, its an obvious thing to say, the Government, British Business Bank and the creditors the banks as well need to make it clear this is due for repayment, and that is a consistent message that continues right from the offset.”

Money Talks I Guess

Sad how he appears to have crossed over to the “other-side”, still I am sure he is being paid handsomely in his new job, working with debt collectors day in and day out, one must talk the talk and walk the walk, I guess.

Not a dickybird about how those suffering any type of mental health problems brought on by being so vulnerable at the time they took out the loan, they did not have a clue they were signing away their legal protections the Government removed to make the scheme go live, or any of the many other problems as to why SMEs might not be able to repay their Bounce Back Loan.

Tom Chandos (Viscount Chandos)

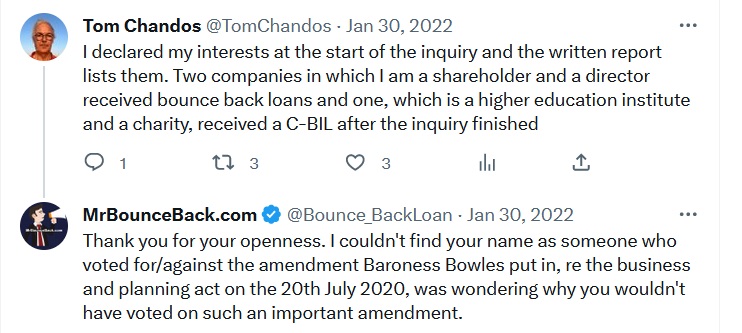

The Chair of the Credit Services Association is no other than Tom Chandos a Labour Member of the House of Lords. I did ask him a while ago whether he had any Government Backed Loans, and why he didn’t vote in the House of Lords for extra protections for those with a BBL, when an Amendment to offer such was put forth by Baroness Bowles with reference to the Business and Planning Bill.

Well he answered the former but legged in when it came to answering the latter:

Good Afternoon @TomChandos when chatting to @RishiSunak as shown below, I heard you mention Loan Schemes, did your business interests get one or more of them and which schemes were they out of curiosity. Also any reason why you did not vote on the Business and Planning Bill? pic.twitter.com/bNcuM9qXRv

— MrBounceBack.com (@Bounce_BackLoan) January 29, 2022

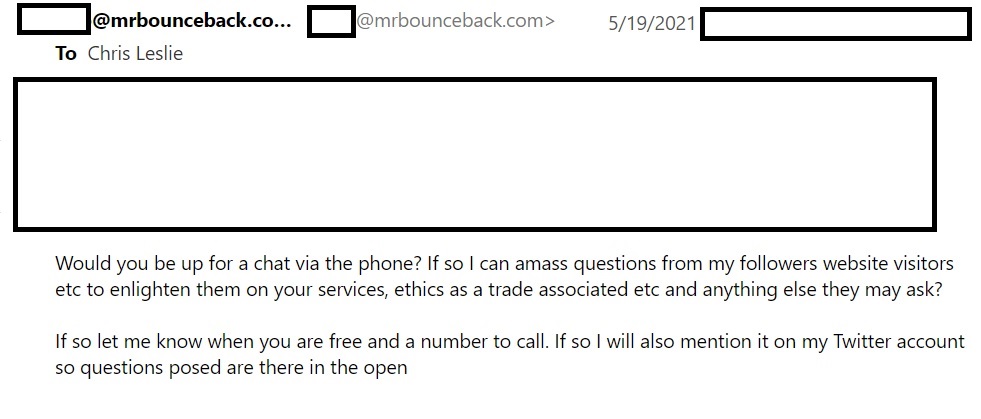

Oh, and before either of them start bleating, I did reach out to Leslie, but after an email exchange, when he rumbled I knew what he had said, he decided to climb back under his stone and never replied again:

**In that email Associated should have been Association.

These Debt collectors are part of the “association”.

If they phone you, and you are vulnerable, tell them, if they hound/threaten you etc and cause you distress and alarm, alert The FCA (I can do that for you if needed)

You May Find the Following of Interest Too>

Comment

Oh, and despite what this pair have to say, as it stands, the current number of people hounded or even contacted after the Debt Collectors have had 12 months of trying to contact a BBL recipient to try and set up a repayment plan for not repaying a BBL who did nothing wrong and they failed to set one up, currently stands at ZERO.

I will let you know if that changes.

Leslie obviously hasn’t a clue of how some people, many of whom I have chatted to via my helpline are in a seriously dark and lonely place with their BBL repayments, and his comments are revolting. One can understand why people don’t answer the phone to BBL debt collectors if he has brainwashed them into talking down to vulnerable people and try to panic them.

Please support my never-ending work by signing up to the website

>https://mrbounceback.com/membership-join/

Or by making a donation

My helpline is open as always today

https://mrbounceback.com/bbl-helpline-tracker/