Another weekend is upon us, so let me give you a quick overview of how the last week has progressed. Some banks do have staff working on BBL’s over the weekend but not many do, and as such do not expect to see any progress with the majority of banks either today or tomorrow regarding anything Bounce Back Loan related.

Be aware that of the 27 accredited lenders just six of them are allowing new customers to open a business account with them and letting those new account holders apply for a BBL.

Noel Quinn at HSBC is Listening

Firstly, HSBC have been responding to emails sent in to the CEO and as you will see via the timeline on my Twitter account, plenty of followers and lurkers who emailed Noel Quinn have received a phone call and had their BBL or feeder account application speeded up.

Therefore, if you have been waiting and waiting for HSBC to set you up a feeder account or start processing your Bounce Back Loan application, fire off an email to noelpquinn@hsbc.com and give him as much information as is needed so his team can look up your application and give you a call back.

Flurry of Invites from Starling for My Followers

People either have a love or hate relationship with Starling Bank, their CEO Anne Boden has made no secret of the fact that she isn’t going to lend a penny via a BBL to anyone her bank feels isn’t suitable for one.

As such you will find splattered all over their website and in emails they send you out to update you on their waiting list, all manner of disclaimers telling you as much, so be aware that being on that waiting list is no guarantee you will get a loan.

They have declined 1000’s of people for a BBL, however yesterday my inbox and Twitter feed lit up with messages and tweets from followers and lurkers (a lurker being those who for one reason or another have chosen not to follow that account but watch from a distance) letting me know they have finally been invited to apply.

Therefore, in the week ahead it will be interesting to see just how many of them are approved and if any of them are declined. One word of advice, if you are still on that waiting list have some other options available for getting a BBL, for there is, as the bank says, no guarantee they will give you one.

Good Success Rate at Barclays

Barclays are accepting new customers too, you have a few options as to how you can open an account with them, for more information on those options take a look at my news update yesterday.

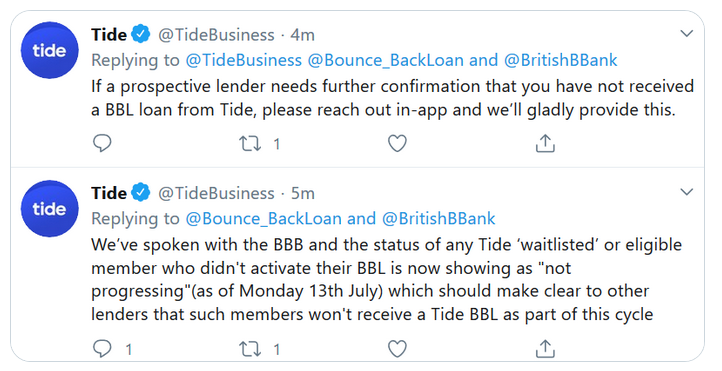

Clydesdale and Yorkshire Bank

Both Clydesdale and Yorkshire Bank and been doing their own thing for quite some time now, and fair play to them, they are still accepting new business account applications and letting those they give such an account to the option to apply for a BBL.

Be aware that being one of a handful of banks doing so, there will be a delay in them processing your account, and they will ask for supporting documents proving you are trading.

However, before applying make sure you are off the Tide waiting list for, they are still approving BBL’s then at the last-minute declining them if they discover you are on that waiting list. If you get declined for that reason contact Tide and get them to provide you with a letter/email stating 100% you are off their list.

Even if you are off their waiting list (or think you are) you could still be declined by those two other banks. By sending in to those two banks proof supplied by Tide you are off their waiting list you will then see the decline being overturned and you should get the BBL. See below for more details on this sorry saga.

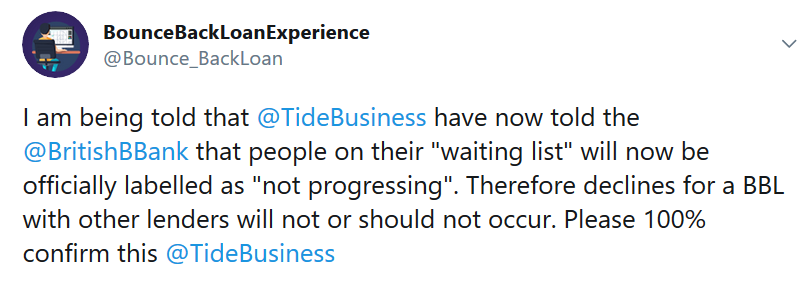

Tide’s Official Response to Their Problematic Waiting List

I have been banging on about the Tide waiting list for quite some time. In a nutshell if you are on that waiting list, and keep in mind they have no money to lend out, then you are likely to find that when you apply with another lender for a BBL you may initially get approved, but during the final checks, those being interbank checks some lenders will then decline you for being on that waiting list.

The reason for approval but then a decline is that other lender sees your name upon that waiting list as a BBL in progress, not simply being on a waiting list. Below is a tweet I sent to Tide and their official response about this situation:

Be aware though that despite what they are saying, people after July the 13th applying with other banks have still been declined for being on that waiting list.

If you find for example you get approved by but then are declined by Clydesdale Bank Yorkshire Bank or Metro Bank you will need to ask Tide for proof you have not got a BBL from them and supply that proof the respective bank to get the decline overturned.

This is madness but sadly it is something you need to do, as for who is to blame, well the British Business Bank do have Tide listed as an accredited lender even though they have no money to lend out, Tide have, or state they have told the British Business Bank about the problem with their waiting list and other lenders, but other lenders appear not to have been told hence them still declining people solely for people being on the Tide waiting list.

Thanks for the Donations by the Way

If you want to help keep me and this place going and can throw a few bob in the donation tip jar it is appreciated. Asking for donations was not my initial aim when I launched the Twitter account or the website, however they have both taken off and both are now consuming a lot of my time.

But either way, as usual this website will be free to use and advert free, and you can always contact me via DM over on Twitter if you want anonymity with your problems, worries or concerns, or just need someone to talk to, if I don’t respond instantly I will get to you.

The website is coming along great as you can see, over 600 posts and pages already loaded up, some posts may just be a paragraph or two long, and some are rather long and intense real life Bounce Back Loan experiences that you will relate to, so do please have a good look around, and when doing so you will see you are not alone with whatever BBL problems you are experiencing. .

Been Declined a Bank Account or BBL?

Please read below for some reasons as to why you may be declined a bank account and/or a Bounce Back Loan with some lenders.

Many people who are declined tend to fear it is their credit rating/score that is the cause of a decline, and whilst that can and may play a part obviously, there can be a whole host of other reasons, some of which can be sorted out, and when the latter is the case you may find it much easier to open a bank account and/or obtain a Bounce Back Loan.

Some Lenders can and will and are in within their rights to decline anyone for an account and/or BBL based on their own criteria in additional to that laid down by the British Business Bank.

With that in mind, if you have checked all of the following and/or have been declined by one lender then you are also within your rights, and encouraged to apply to any other lender that is part of the Bounce Back Loan scheme.

Potential reasons not relating to credit score/rating

SIC Code – Not matching on companies house vs what you put in your application.

SIC Code – considered a reputational risk – you would be surprised how many business types fall into this category.

Directors/owners name(s) not matching companies house and/or

Voters roll e.g. Chris vs Christopher, as your middle name.

Business address not matching, has your accountant used their address to register? What is your correspondence address at companies house?

Business name not matching e.g. Ltd v limited

Recent changes of directorship and/or ownership – red flag at the moment due to BBL fraud

Markers registered against the company or director

Previous financial relationship with the bank or one its subsidiaries that did not end well

Compensation

Many Bounce Back Loan applicants that have been through hell and still are experiencing problems have been offered compensation from a bank ranging from £50 up to £2500 for the more complicated problems.

It is your choice as to whether you accept any offer of compensation and the amount you accept too.