Time for me and you to have a little chat, this is for those of you with one eye on the repayment date fast approaching for paying back your Bounce Back Loans.

Keep in mind this is not financial or legal advice, this is me chatting to you as I would with someone down the pub who is worried, therefore I will speak as I would in such a situation so keep that in mind as I know many of you appreciate it that way.

So set that scene in your mind, you, me, and some others who got a BBL, in a quiet corner of a pub, no, let us be outside in a beer garden instead….

Some of you wildly exaggerated your turnover to get a Bounce Back Loan, some of you did not, many of you got that loan fairly quickly, and some of you had to endure months of torture before you saw, which at the time was an amazing sight, a small fortune appear in your bank account thanks to that magical ping on your banking app.

That ping and the appearance of that deposit alert will be, for many of you, in your mind right now, and you have to admit, at the time, it was memorable for many of you.

For some of you it was like a lottery win, and you may have treated it as such and rushed out and started buying new cars, bits and bobs for the house and treating those around you.

Some of you immediately started clearing down your overdrafts, bank loans and other debts you had at the time hanging over your head. Many others used it for its intended purpose and started to invest the money in their business as they deemed necessary.

Some of you just stashed it away, knowing it was there as a handy buffer.

However, the pandemic and resulting lockdowns and the forced closure of your businesses did drag on way, way longer than anyone had hoped for, and those BBL funds started to dwindle away, and for many they seem like a distant memory right now.

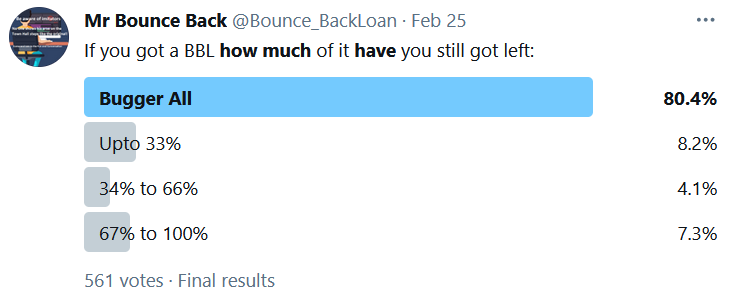

You are not alone:

So, you are now faced with paying that loan back in the weeks or months ahead, and that is causing you stress, and a great deal of it.

You will be seeing headlines related to bounce back loans in the papers and online and those headlines may fill you with dread, but boy do they get your attention when its Bounce Back Loan related. In fact, some of you will purposely Google anything Bounce Back Loan related hoping to see a story that addresses your worries.

Some of you may check my Twitter feed as regular as clockwork, some of you follow me and join in the banter, madness, and the serious stuff, most of you just watch my Twitter feed and check this website as a lurker preferring not to follow me, and that my dear friend is perfectly fine, once again you are not alone.

The one thing I can guarantee many of you are wondering right now is how are you going to pay your BBL back, sure, things are slowly but surely getting back to normal, but it is a debt around your neck so to speak and one you will need to address sooner than later.

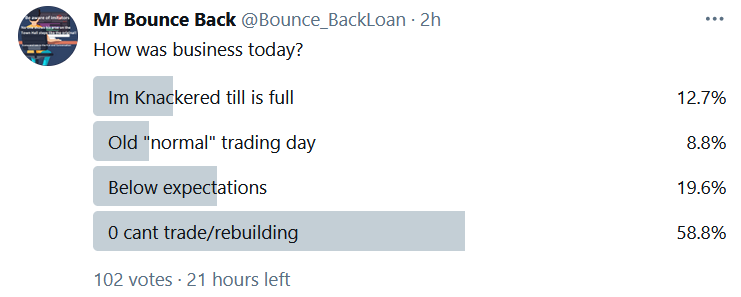

Even with lockdowns slowly ending, some of you have not been able to even attempt to bounce back yet:

(poll was still live when screen-grabbed, so current/final vote may be slightly different but you get the idea)

I have spoken to 1000’s of you, so I want you to know, first and foremost whichever category of BBL’er you fall into above, you are by no stretch of the imagination alone.

I spoke to one chap who was so worried about how he over-egged his turnover he decided the only way he could keep his sanity would be by paying it back.

He did so, but that is an option not open to many of you.

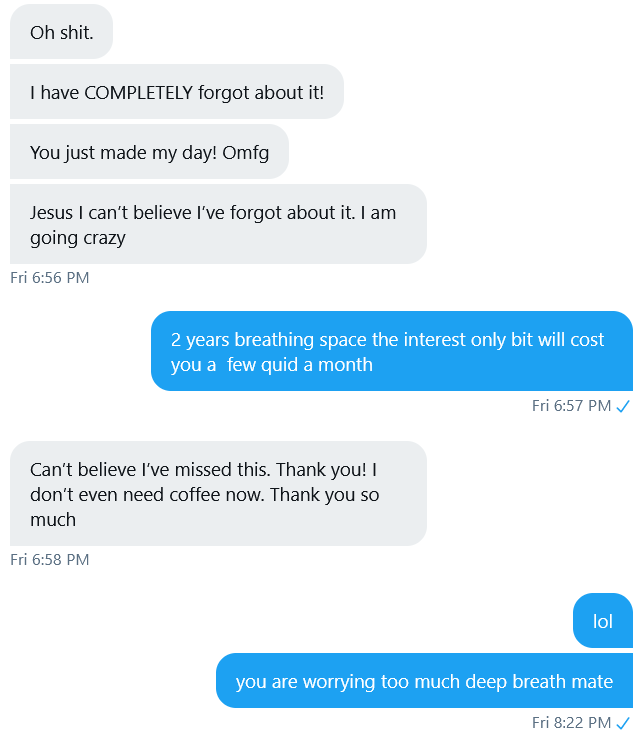

I chatted to one young chap just the other day, and he was that stressed with the repayment date for his BBL fast approaching it was over-taking his every other thought, he couldn’t sleep was getting wound up and was losing his mind.

I chatted to him at length, as I have done with many of you, and it soon became apparent he was indeed losing his mind so much so he had forgotten about the pay as you grow options.

When it dawned on me I reminded him of those options which would allow him, if nothing else, to kick the can down the road for 6 months of no initial repayments then 18 months of interest only payments and extend the loan to ten years his reaction was, well here it is (he gave me permission to put this up here to help others in the same boat):

Once he came back to his senses, he realised he was stressing out way too much and at the time he could not think clearly, if you are in that same boat, take a break clear your thoughts and remember those PAYG options.

Just an update, he is much more chilled now and I am chatting to him daily to make sure he is fine.

Rishi has put those PAYG options in place for a reason, like him or not they are there to be used, you will pay more interest, but most banks will have an online calculator available on their websites for you to use to work out how much extra you will end up paying.

Those options do also, whether they admit it or not help HM Treasury work out who is repaying, who has taken those options but much more importantly who blagged a BBL and did a runner, let us not worry about the latter, the fact you are reading this means you are a genuine person, even if you did over-egg your turnover, most people did, remember that.

The Scare Tactics and Repayment Reminder Letters/Emails and Even Echo-Signs

There are some of you out there who are thinking along the lines of not paying back your BBL, the banks know that, Rishi and the Government know that and it would be stupid for me not to mention it, in fact try stopping me from doing so….

A concerted “BBL Scare Campaign” is now in progress, for those of you clued up on these things, you will have noticed that. Look out for headlines rolling out soon, you will now be able to spot them when you keep “BBL Scare Campaign” in the back of your mind.

Those of you that are thinking of defaulting on your BBL’s the banks call you one of two things, those being “Can’t Pay” and “Won’t Pay”, only you know deep down which category you fall into. I am not going to judge you either way.

However, as sure as night follows day those of you that do fit into either category are going to be taking a wait and see approach, meaning you will be taking those PAYG options before the first repayment is due and will be waiting to see how others who did not take them, and then default get handled by the banks/lenders.

Obviously, there is a whole world of difference between a LTD and a Sole Trader defaulting, and the latter business owners are the ones worrying the most, but many of the former are too.

For what its worth I am aware of some LTD’s that have chosen to wind up their companies already, and quick as a flash they get a letter from the bank demanding repayment of the BBL. I have seen those letters, they are up on this website somewhere if you hunt for them.

Some that are faced with no other option but to default will sit down with their accountant, a solicitor or some other equally qualified professional who will guide them accordingly.

Others, and this maybe you right now sat there all alone worrying will not, and like I say you will take the PAYG options to kick that can down the road and will be hoping for a miracle.

The banks/lenders have been told to pursue defaults as they would any other loan defaults, so you will have the force of them coming down on you by way of demanding letters and that will push many of you over the edge, it would be stupid of me not to mention that and address it.

Those banks/lenders all have “support groups” (financial and otherwise) listed on their websites which some of you will contact but some of you won’t.

The loans are guaranteed by the Government, however when you see things like this:

That puts fear in your mind, it does, we all know that. So will the banks hound you, force you out of business then claim back their guarantee, or will you be able to say you can’t pay, put up with a few nasty letters, stay in business and wait for HM Government to pay the lender back.

That is the million dollar question,.

It will be a case of wait and see, for the banks are, for want of a better phrase, and I do apologise if this startles you, but we are in that beer garden remember, “shit scared of bad publicity” much more so for badgering those who cannot pay back money they lent them during a pandemic when most were vulnerable and had signed away their rights to protection to get those loans, however HM Government has made it clear it is their (banks/lenders) job to chase the debts not theirs.

Let us face it, HM Treasury will not want the bad publicity either, besides they guaranteed the loans and I cannot recall anyone signing for their BBL agreeing to a deal with HM Treasury, only deal they mentioned regarding the Guarantee was with the lender NOT YOU:

I have it on record on my YouTube channel someone from HM Treasury saying that HM Treasury WILL NOT pursue recoveries. In fact, here it is:

Some MPs are suggesting a late in the day “student loan” type arrangement whereby those SME’s unable to repay even after the PAYG options can repay only when their business recovers to such an extent repayments are affordable, if it doesn’t reach a certain level of profitability you won’t pay it back and it the debt will be wiped. Whether anything comes of that we will have to wait and see.

If you are one of what the banks call a “won’t pay” you will do whatever you need to do not to pay it back, if you are a “can’t pay” you will be worried and worried sick. Even the won’t pay’s are a tad worried.

I am not the one making the rules and only through badgering and getting on the nerves of those who can listen and change things will they ever get changed.

I will continue to do what I do for as long as I can and will report how things are being handled moving forward, until then I will continue to make your voices heard in the way I have been doing for months.

Important – Read and Digest PLEASE

One final thing, that the banks and Government will not mention or discuss, in a realistic way, but I am going to do so as I was in the heart of it and was living it day after day with many of you, it enveloped me and I saw it playing out at the launch of the BBL scheme, and throughout it when people were in a very dark place for a long time.

That was that alien, dark worrying place.

If your Bounce Back Loan debt/repayments are putting you in the darkest of places, do not do anything others around you who love and care for you will regret you did. You know what I am talking about here.

This is the Government’s problem, not yours and I for one, to the best of my ability, will not let any of you suffer for their decision to launch that scheme.

I will keep passing onto you what others are experiencing, I will badger, annoy, get right up the crack of the arse of those in power, in my own unique way. Shame those who need shaming etc.

So, in the meantime, as I say this is not legal or financial advice that is for the experts, but if you want a good 6 months of breathing space from repayments and 18 months of interest only payments until you know what’s what then take those Pay as You Grow Options, and we will all see how we get on and any late changes to the scheme.

Do I honestly think there will be changes. YES, and deep down you do too. We will see.

OK said my piece, love you all, in a weird type of way, oh, and be good and no silly nonsense from any of you over-worrying, YOU ARE NOT ALONE, not by a longshot, no matter what stunts you had to pull or games you had to play to get your BBL, like I say you are here as you are a decent person caught up in the midst of a pandemic and were possibly vulnerable and not thinking straight like most others when you took out the loan.

The real fraudsters have long gone with the cash, the banks can go after them. We need to stick together and do what we have done for 10 months, make it through this together.

The banks may not like me, MPs are wary of me, hey I even get the odd troll in unwashed underwear, but it is you that provides the cold hard proof of the shit they have pulled on you, so you know its all true, “it will get sorted”.

Just to make clear, I am in no way shape or form telling you to do anything illegal, nor am I offering any legal or financial advice, I am however telling you to keep your wits about you and ultimately stay safe and do not do anything (sweary bit) fucking stupid.

End of chat/lecture/bollocking. x