I am now getting reports from HSBC BBL recipients that they are receiving letters telling them their accounts and facilities with that bank are at risk of being closed, or are being closed, if they do not contact the bank and tell them what they do, where they do it, who they do it with and who benefits. Here is a copy of such a letter and some words from an HSBC insider who has stepped forward to offer some advice.

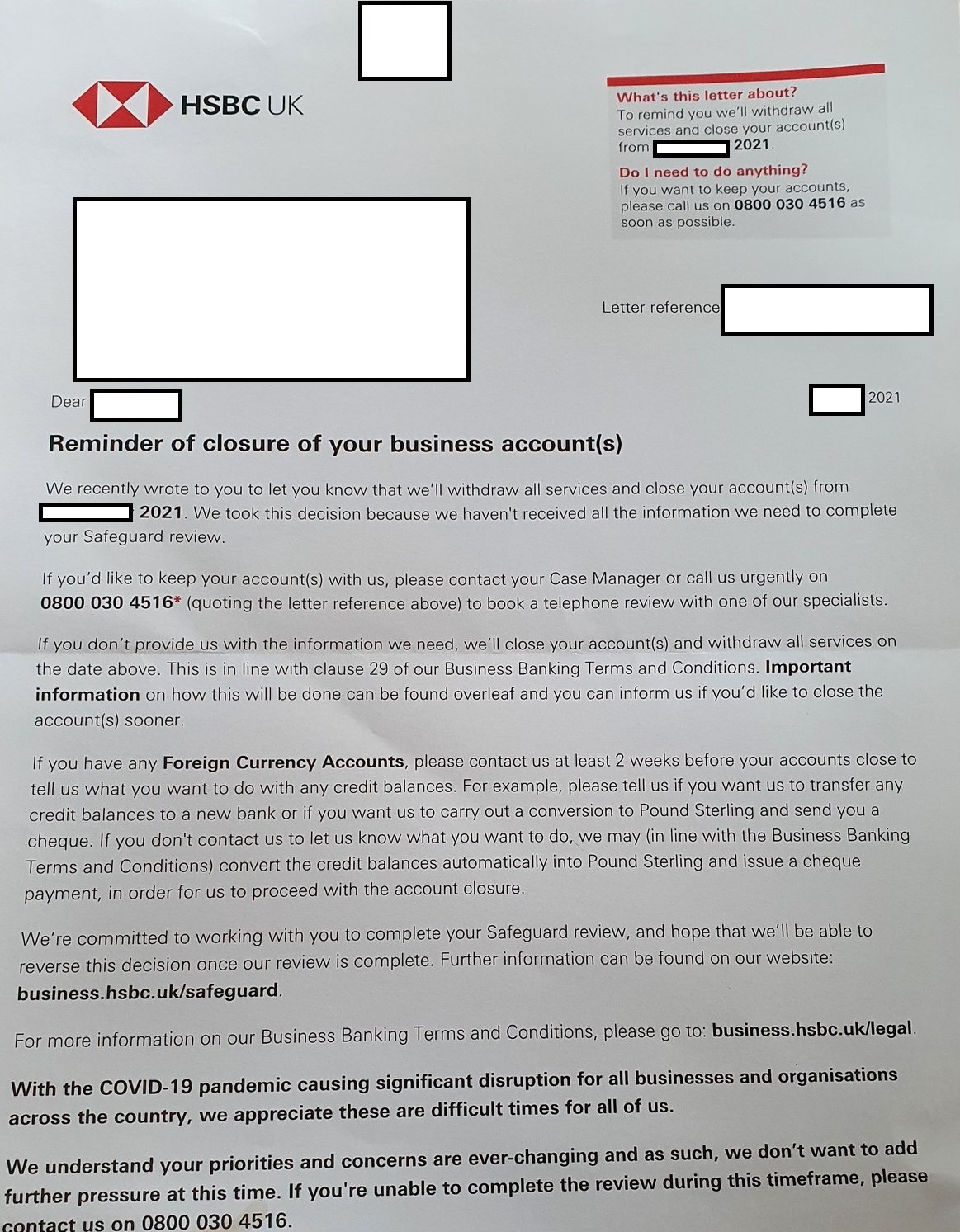

Ok, more madness from HSBC, this time it is regarding what they call a “Safeguard Review” below you will find one letter about that review:

If you visit the link on that letter, you find that HSBC are demanding to know everything about your business here is the link and information on what that review is all about.

https://www.business.hsbc.uk/en-gb/gb/campaign/hsbc-safeguard

The problem is that trying to phone HSBC to get this matter sorted out is a nightmare as they do not have enough staff to answer the calls in a timely fashion, and some people may have changed their address recently for example and they may never have got the letter or it may have even got lost in the post.

I have been sent a couple of links to a couple of articles which are several years old about that problem, so its certainly not a new problem but as I say is one that is now affecting those who recently opened a business account with HSBC and may have a Bounce Back Loan with them too. Here are those links:

https://www.reuters.com/article/us-hsbc-compliance-idUKKCN1GP153

https://www.reuters.com/article/us-hsbc-smallmid-idUSKCN1B41YO

I do have contacts and insiders in most of the banks that are part of the Bounce Back Loan scheme of course, and one has been in touch with an overview of how to get a response and this problem solved, this is what they have told me:

“Just tell them to ring the safeguard, just tell them to stay on the lines, they will be be answered by lots and lots of overworked frustrated people that want to help.

If the business Internet banking isn’t active, make sure They tell them that, it might be a case they try to ring up and they forgot the telephone security details. If so, they will have to fill in a reset form online.

That can take 10 days for it to be activated. Make sure they ask the team to document the phone call and to make sure that they are trying to do everything they can to sort it out, they can give them a telephone appointment if they say they’ve not got any access to the Internet.

It can all be sorted out with a phone call. Just tell them to plough on. It’s so frustrating. Closure of bank accounts can stop.

Listen, if the business Internet banking isn’t active, or it’s not being used, they’ll invite them to go to the http://hsbc.co.uk business and click on the link, I’m sending some screenshots, and they can do the business review there.

However, they can give the customer a telephone appointment to do the review with them over the phone. In my experience, it’s not something they like to offer because it took too much time on the phones, but you can ask for it, you can say your Internet is down you can say you’ve not paid your bill you can say whatever nonsense you can to get this sorted out as quickly as you can”.