Update – Late in the evening of the 4th of January, I was contacted by the Labour Party and Rachel Reeves Office about this news story and currently I am arranging a meeting to discuss their Covid Corruption Minister regarding defaulted Bounce Back Loans. I will keep you updated on this and report what they tell me about the role of that person.

Keir Starmer today, January the 4th 2023, gave a speech in which he announced if Labour win the next election they make the UK a much better place, and that does of course mean the introduction of their “Covid Corruption Commissioner” who will be actively chasing down and prosecuting everyone who defrauded the Public Purse during the pandemic.

That is all well and good, and those who robbed your hard-earned taxes, such as those involved in the PPE VIP Lane scandal should be getting their collars felt.

However, as the number of bank employees who have been found to have abused the BBL Scheme rising. and with more and more bank staff having been found to have lied and misled business customers when they were interested in and went on to apply for a Bounce Back Loan, there is a very real danger of a huge number of miscarriages of justice, if Labour do not get things 100% spot on with their Covid Corruption Commissioners abilities and who they go after.

Many bank bosses, due to the unique and ill-thought rules of the Bounce Back Loan Scheme are unable to define or even agree just what BBL fraud is, regarding that scheme.

It is an open secret that most BBL Lenders are not marking most of their Guarantee Claims as suspected BBL fraud, when they submit their Guarantee Claims on defaulted BBLs, fearful of being named and listed as a Lender with a high number of such claims.

Whilst we can agree everyone and anyone who did rob the BBL scheme needs their collar felt, there is a very real danger that there are going to be lots of people wrongly accused of BBL fraud, often due to bank errors and wrong information given out by bank staff.

In fact, plenty of people have already been wrongly accused of BBL fraud or BBL related wrongdoing, but thanks to their own persistence at proving their innocence have eventually been cleared.

As you will shockingly discover below, some banks are incorrectly giving BBL defaulters fraud markers with CIFAS, so I urge you to check you are not one of them, as you may chased by the next Labour Government for the Banks error and may have to endure years of agony to clear your name, which some people have already experienced.

Lets just hope Keir Starmer, Rachel Reeves and any future Labour Government get things right, for if not, mark my words, innocent business owners will be hounded and could be accused of BBL related fraud when they actually did no wrong, or even more horrifying, could, when under suspicion and when being investigated, do something that I dare not even mention.

I have alerted both Keir Starmer and Rachel Reeves of this article. So any failings or miscarriages of justice and the consequences of such moving forward by not safeguarding people, will be on their heads if of course they win the General Election and do indeed start clumsily chasing those they think blagged the BBL scheme.

Bounce Back Loan Lender Outrages

Here are some recent cases in which those who got a Bounce Back Loan were accused of wrongdoing but, thanks to them being prepared to battle to prove their innocence, they took their cases to the Financial Ombudsman who eventually upheld their complaints.

I should point out such cases can take a year or two to finally get such complaints and cases resolved, just think of the agony each of the following people went through during that time.

Also, I should point out, that in an attempt to cover their own backsides, many Ombudsmen now put the following disclaimer on their official individual complaint outcomes.

With that in mind, here are some recent cases of Bounce Back Loan Lenders who were found to have been up to no good, worryingly many of the cases could have resulted in someone being found guilty of alleged BBL fraud if they hadn’t complained.

Just imagine what each of the individuals in these cases must have felt, being sat all alone, some being accused of fraud and even reported for such and their details put on a fraud register by a huge bank, when all along they were innocent.

There are plenty of similar cases in this section of the website

>https://mrbounceback.com/category/bbl-complaints-and-outcomes/

Here are some rather distressing cases, let us hope that Keir Starmer or Rachel Reeves will not be hounding these victims.

FCA Regulated Firms Under Investigation

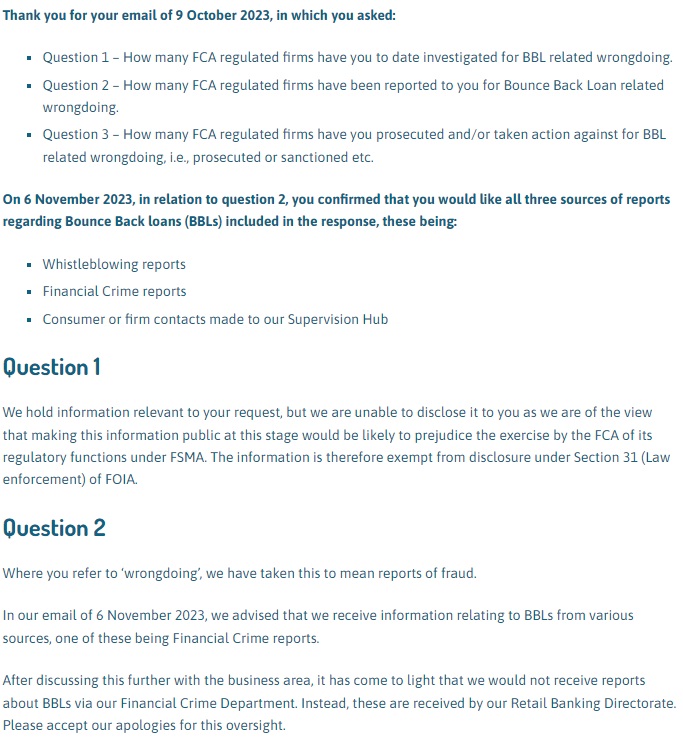

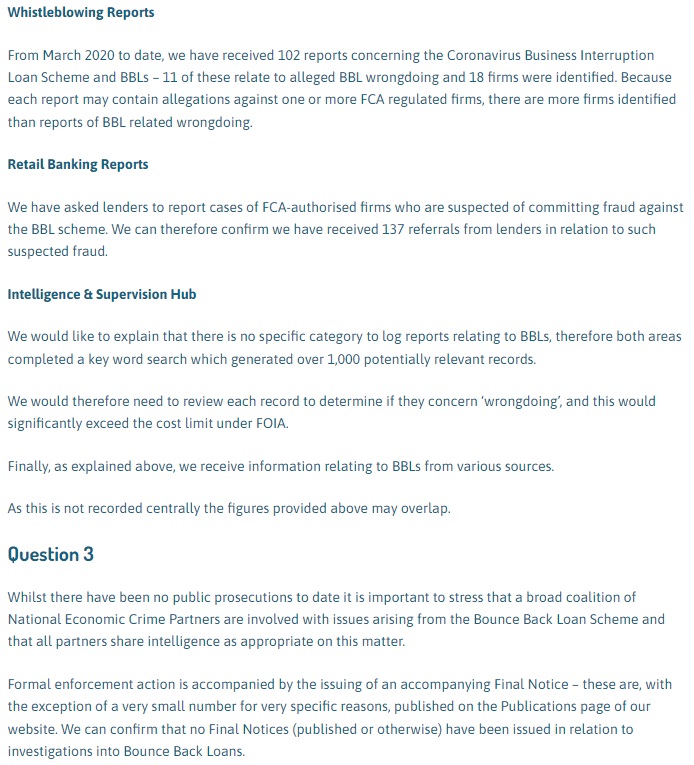

I asked the Financial Conduct Authority how many firms they regulate have been accused or investigated for BBL related wrongdoing.

If the very organisation that is supposed to oversee such firms has so many of their regulated firms under investigated and/or accused of BBL related wrongdoing, it doesn’t instil confidence that innocent business owners will not also be accused of such too, does it?

Financial Conduct Authority Investigation

I have been passing people over to my contacts on the FCAs Executive Team who called my helpline reporting horrendous behaviour from Bounce Back Loan Lenders for quite some time.

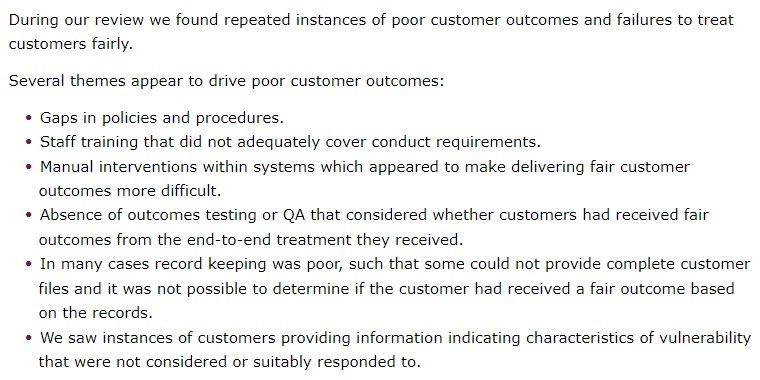

The FCA launched an investigation into many allegations, and found that many BBL Lenders were indeed pulling all manner of stunts with Borrowers, so much so they issued a letter to Bank CEOs telling them to pack it in.

You can find out more about that investigation here

>https://www.fca.org.uk/publications/multi-firm-reviews/sme-collections-recoveries-review

You will find a copy of the letter they sent out to Bank CEOs here

>https://www.fca.org.uk/publication/correspondence/dear-chair-letter-sme-collections-recoveries.pdf

But below is a very basic overview of the shortcomings found

One can only imagine, what BBL Borrowers have been told and wrongly advised on by untrained staff and what they have experienced by those additional shortcomings. Which could ultimately lead to those BBL borrowers being accused of fraud all due to the actions of gormless bank staff.

Insolvency Service Outrages

I asked the Insolvency Service how many people they had suspected of Bounce Back Loan wrongdoing that had been reported to them via an Insolvency Practitioner, but then were found not to have been guilty of such or had the case against them dropped.

I asked that question, as I am aware when for example a Company takes the Insolvency route and the Insolvency Practitioner gives the Insolvency Service their confidential report which highlights suspected BBL and Director wrongdoing, they then issue a questionnaire to the Director demanding answers to questions related to the BBL and anything else of concern.

I have seen them warning some Directors of a proposed Disqualification but then dropping it, when the Director, often with the help of a Solicitor, answers those questions.

One of many of the cases that I am aware of was for the alleged over-egging of turnover but the case was dropped when it was proven the Director was extremely vulnerable when they applied for the BBL.

The Insolvency Service replied to my request, stating they didn’t understand my question, also saying, even if they did it would cost too much money for them to answer it.

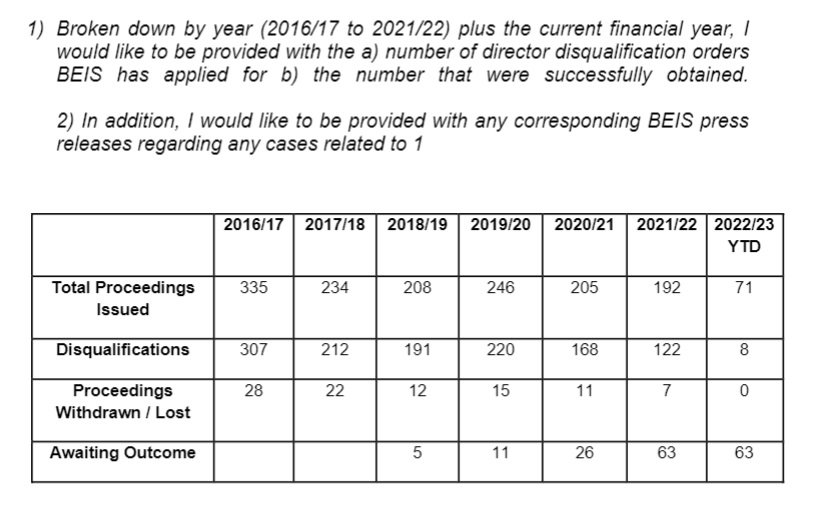

They did however attach to their reply, another Freedom of Information Request dated November 2022, and their answer, whilst not itemised as BBL related they will give you some idea of the number those cases they have withdrawn or lost.

I will keep you updated on this proposed Covid Corruption Commissioner moving forward, in the meantime if you need a chat or have any worries give me a bell on the helpline.