I will try and lay this out for you nice and simply, so you get the idea of what is going on behind the scenes, and by me doing so, things may start to ring true if you have been badgered into taking the insolvency route with a company that is struggling to repay a Bounce Back Loan.

The Insolvency Service

The Insolvency Service are basically judge and jury when it comes to punishing any Company Director that has done anything wrong in their role as a Director, including of course any type of BBL related wrongdoing.

They will haggle with you regarding the punishment they will want you to agree to, such as a long ban, but failure to sign the undertaking of such when offered to put an end to the matter, will see them threatening to drag you into court where a judge will decide your punishment instead.

That is all well and good of course, but one imagines that the Insolvency Service and their staff should be completely independent, and not linked to any other organisations.

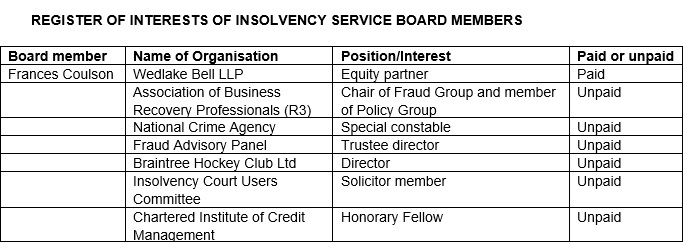

However, to my horror but not to my surprise, I have discovered that Frances Coulson, a non-executive Board Member at the Insolvency Service is linked to some very unsavoury sorts in the world of “Bounce Back Loan Bounty Hunters”, “business recovery firms” and “Liquidators”, the latter of which have had many of their Insolvency Practitioners sanctioned for some horrendous wrongdoing.

Association of Business Recovery Professionals (R3)

The Association of Business Recovery Professionals (R3) have a large membership who are all in the Business Recovery/Insolvency market sector.

However, what you will often tend to find is that when you approach such firms for help you will be pushed to take the Insolvency Route with your Ltd Company.

I have heard of no end of tales from those advised to take that route, which can be very expensive, and often those Business Recovery firms will push you into the hands of their chummy Insolvency Practitioner friends.

They do that as there is often a very healthy kick back in commission they get from those Insolvency Practitioners.

Frances Coulson you may be shocked to hear is of course part of that Association, being the unpaid Chair of their Fraud Group and a member of their Policy Group.

Insolvency Practitioners

Tasked with winding up the affairs of Ltd Companies, Insolvency Practitioners are known for telling any Company Director that sits before them, anything and everything that person wants to hear, and have often been known to tell people not to worry if they have a BBL, as they can make it go away.

They do that to lure that person in and them bag their hefty fee of course, but sadly many Insolvency Practitioners themselves, get sanctioned for all manner of sinister wrongdoing.

You guessed it, many Insolvency Practitioners who work for firms that are members of the Association of Business Recovery Professionals (R3), that Frances Coulson is part of have been sanctioned.

Here are the names of just some of those sanctioned this year, and yes most have links to the Association of Business Recovery Professionals (R3):

- Clive Morris

- Paul Palmer

- Nicholas Myers

- Trevor Binyon

- Hemal Mistry

- Manubhai Mistry

- Tracy Whittaker

- Mark Prideaux

- Rina Rohilla

- Laura Stewart

- Finbarr O’Connel

- Jeremy Bennett

- Wayne Macpherson

- Lauren Louise Auburn

- Mark Prideaux

- Alan Simon

- Zafar Iqbal

- Paul Anthony George

- Gerard Ratcliffe

- Yiannis Koumettou

- David Rankin

- Christopher Brooksbank

- Dominik Thiel-Czerwinke

- Tracey Whittaker

- Adam Boys

- Robert Allen

- Gareth William Latimer

- Kevin McLeod

- David Rankin

- Katy Walker

- Samantha Warburton

- Laura Prescott

Bounce Back Loan Bounty Hunters

You will probably already know the tale of how Lord Agnew, the former Government Counter Fraud Minister legged it from that role, due to the failings of the Bounce Back Loan Scheme, blaming everyone bar himself for those failings.

He went to work for Manolete Partners, who are Bounce Back Loan Bounty Hunters, well their actual business is as Litigation Funders, who buy for as little as £1 from Insolvency Practitioners the job of chasing Ltd Company Directors who have committed some form of wrongdoing.

They often take them to court to make them bankrupt so they can get everything they own, Manolete Partners then split the funds they have recovered with the Insolvency Practitioners, who in most cases I have come across, gobble up their share of those funds in fees and charges.

Therefore the BBL Lender or the Government/Taxpayers who may have paid out the BBL Guarantee to Lenders never see a penny of those funds, nor in most cases do any other creditors of those liquidated Companies.

You guessed it, Manolete Partners are a sponsor of the Association of Business Recovery Professionals (R3). That Frances Coulson is part of.

Company Directors Being Forced to Admit Guilt

Why am I telling you this tale, well I have spoken to a lot of one time Ltd Company Directors who were being forced to sign an undertaking by the Insolvency Service to admit their guilt and punishment for alleged BBL wrongdoing, that Insolvency Practitioners have reported to the Insolvency Service.

Threats and all sorts get sent their way by the Insolvency Service, however, I have conversely seen lots of such cases being completely dropped when for example it is uncovered a Director did no wrong or have mitigating circumstances and those Insolvency Practitioners didn’t do their job properly, such as finding out if the Directors were or are vulnerable for example.

Do not let Insolvency Practitioners, the Insolvency Service or even Business Recovery firms force you to admit something you haven’t done wrong with a Bounce Back Loan, just to make the situation go away, or you will live to regret it for sure.

I did officially ask how many cases the Insolvency Service had dropped that they were initially hounding BBL recipient Company Directors to sign an undertaking for alleged wrongdoing, but they said they didn’t understand what I wanted but even if they did it would be too expensive to supply the information!

Frances Coulson Insolvency Service Register of Interests Entries

Lets hope not a single Insolvency Practitioner linked in one way or another to Frances Coulson gets sanctioned moving forward, her position at the Insolvency Service surely is already hanging by a thread, any more sanctions and she needs to sling her hook, she isn’t daft, she must know that.

Looking at her entries of the Insolvency Service Register of Interests:

You can see she is also an unpaid Special Constable at the National Crime Agency, what a time to be alive!

In an epic display of incompetence the Insolvency Service recently boasted of shutting down 2 Business Recovery scam firms:

- Atherton Corporate (UK) Ltd

- Atherton Corporate Rescue Limited

However a quick search of the above two named Companies, shows their websites are still active and their phones lines are too, well they were when I called them.

The Atherton companies were supported by the below five associates who supported their business model by purchasing the companies in financial distress and providing them with new directors.

- Aguia Group Ltd – director Neville Taylor

- GPA KLM Ltd – director Karen Mortimer

- Namare GRP Ltd – directors Neville Taylor and Suzanne Harley-Davies

- Summers & May Ltd – directors Karen Mortimer and Joanna Seawright

- TPG GRP Limited – directors Neville Taylor and Suzanne Harley-Davies