Those applying for a Bounce Back Loan from May the 4th 2020 onwards when the scheme went live, did have to try, and make sense of the rules of the scheme, which in the middle of a pandemic was often quite hard to do.

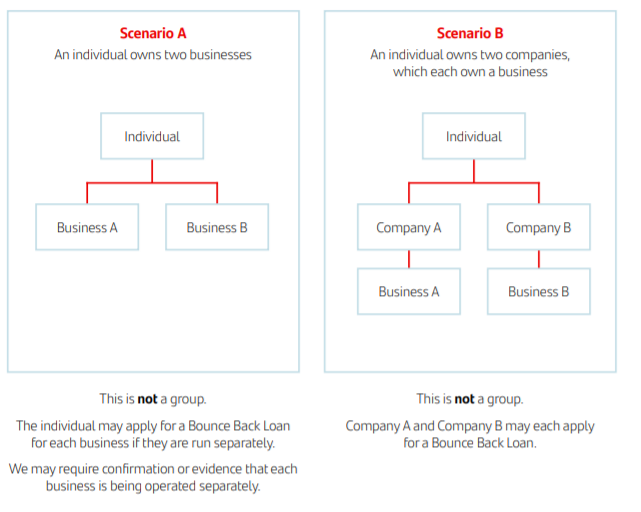

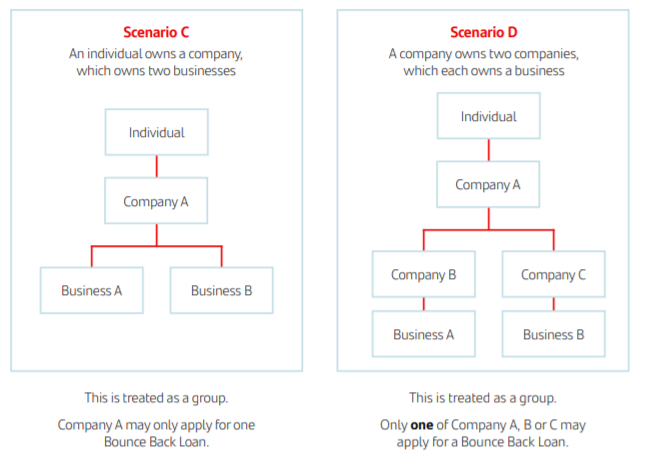

One of the rules often hidden away on BBL Lender websites stated that you could apply for one Bounce Back Loan for each eligible Company you owned as long as they were not part of a Group of Companies with a Holding Company at the top of the structure.

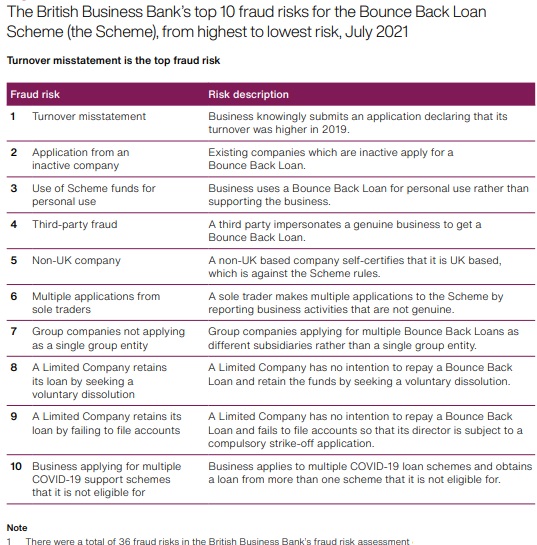

If you have been looking around this website you may have noticed that I have been busy compiling a section revealing the Top 10 Fraud Risks of the BBL Scheme as identified by the British Business Bank, feel free to have a look at that section of the website here > https://mrbounceback.com/category/bbl-wrongdoing/

Number seven on that list of risks was Group Companies Not Applying as a Single Group Entity.

Group Companies Not Applying as a Single Group Entity

Definition: Group companies applying for multiple Bounce Back Loans as different subsidiaries rather than a single group entity.

I have not yet come across anyone that has been found to have blagged more than one BBL for a single group entity.

For those of you confused about this aspect of the BBL scheme, below you will find a very handy infographic that explains this aspect of the scheme and which types of businesseses it applied to: