That magical ping on your banking app letting you know that your Bounce Back Loan had appeared in your bank account may seem like a distant memory now, but for some people that ping was like a lottery win and signalled the start of a personal shopping spree, but one that now, more than three years later, they somewhat regret having.

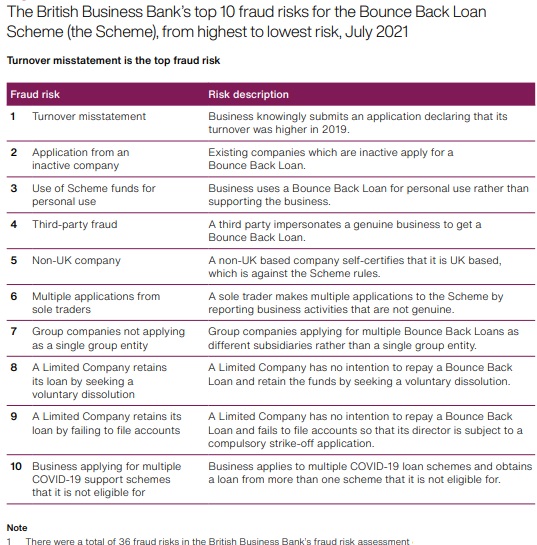

Using funds from a Bounce Back Loan for personal use has pride of place in third position on the British Business Banks top 10 list of fraud risks associated with the Bounce Back Loan scheme, and there is no doubt in my mind some of you reading this right now did use some of those funds for personal use.

There is of course a whole world of difference between putting food in your family’s bellies during a world-wide pandemic and rushing out and buying a new car, expensive watch or booking an exotic holiday with BBL funds.

If you do have to take the Liquidation route with a Bounce Back Loan owing, then the Insolvency practitioner you pay for and use, is not your friend, some of them will say anything they want you to hear to get you to use their services, but they are legally obliged to report any form of wrongdoing they uncover when looking through your Company Accounts and Bank Accounts.

They will do so and will, via a confidential report, that they have to send to the Insolvency Service, list every form of wrongdoing spotted including using funds from a Bounce Back Loan for personal use, and then a punishment befitting of the wrongdoing uncovered will be decided upon. That could be a disqualification and a settlement figure you are told to pay to put the matter to bed.

At the end of the day, if you are about to take the Liquidation route or even the Bankruptcy route and you have a Bounce Back Loan owing, and just know deep down the powers that be are going to come after you for using any amount of your Bounce Back Loan for personal use then give me a bell and lets chat about the options.

Conversely you may have taken that route and have been told you are being held liable and need to make a repayment to close the matter, or a court issued Compensation Order will be coming your way.

If that is the case then call me to discuss an action plan and how you can negotiate with the Insolvency Service or even to get them to take mercy upon you due to mitigating circumstances.

Use of Scheme Funds for Personal Use

Definition – Business uses a Bounce Back Loan for personal use rather than supporting the business.

Splashing out on a new car, holiday, clothes or even a new watch or handbag for yourself using funds from a Bounce Back Loan is frowned upon, and when such wrongdoing comes to light you are not going to be shown any mercy, as the following people found out.

| Director and Company Name | Punishment | Details of Case |

| Daris Paulauskas -Daris Paulauskas Ltd | 6 Year Disqualification | CLICK HERE |

| Simon James Rooney – White Rhino Group Ltd | 7 Year Disqualification | CLICK HERE |

| Jack Roberts – Outline Group Limited | 11 Year Disqualification | CLICK HERE |

| Mohammed Ehsan Hussain – Fat Joe’s HW Ltd | 10 Year Disqualification | CLICK HERE |

| Kevin Wood – KW Lifting Consultants Ltd | 6 Year Disqualification | CLICK HERE |

Some Much More Outrageous Use of BBL Funds for Personal Use

I have two additional sections of the website that take a look at some of the much more outrageous use of BBL funds for personal use, namely buying cars and expensive watches. Follow the links below to view them.

BBL Sports Car Files >>https://mrbounceback.com/category/sports-car-files/

BBL Rolex Files >> https://mrbounceback.com/category/rolex-files/