As you will have noticed if you look around the website, the latest Bounce Back Loan performance data dump occurred on the 29th of February 2024.

Whilst a huge fortune has already been paid back to BBL Lenders via the Government Guarantee, due to 282,552 BBLs having defaulted and the Lender having claimed and been paid their money back from the Government, and with another 122,558 on the way to having their guarantees back paid, it is not all doom and gloom for taxpayers, who will ultimately have to pay that money back.

Thanks to forward thinking banks offering Defaulter Discounts and with many BBL Borrowers having repaid at least something before they defaulted, and as some banks managed to snatch something back from the accounts of BBL Borrowers after they defaulted, those discounts, partial repayments made before a default, snatch backs and additional things such as Court issued Compensation Orders given to BBL Blaggers, a total of £12.529 Billion has been returned to Lenders that way.

As such when you add that figure to the tad over £5.972 Billion that has been repaid by BBL Borrowers who have repaid their BBLs in full and early, that means of the £46.592.54 Billion lent out via the Bounce Back Loan Scheme, the taxpayer is now on the hook for a lot less via the Lender guarantee.

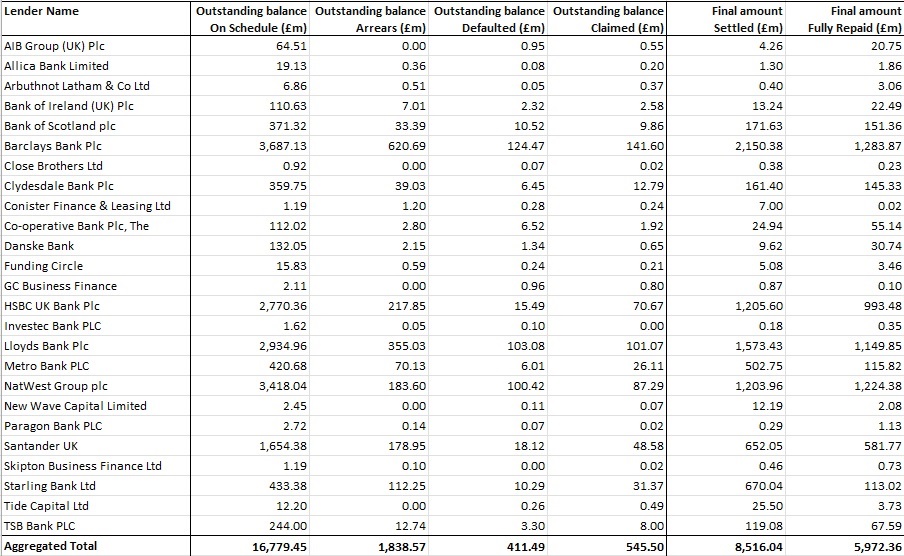

Here is a breakdown of the current state of play

Column 1. BBLs on Scheule – Value of BBLs repaid each month with no problems.

Column 2. Arrears – Value of BBLs that are currently in arrears

Column 3. Defaults – Value of BBLs that are currently in default

Column 4. Outstanding Balance Claimed – Value of BBLs that Lenders have slapped a guarantee claim in for but haven’t yet been paid it out.

Column 5. Final Amount Settled – Value of BBLs that Lenders have been paid out the Guarantee on.

Column 6. Repaid in Full – Value of BBLs that have been fully repaid by Borrowers.

For added context, here are the figures displayed as individual Bounce Back Loans

Below you will find an overview of each BBL Lender, the columns after their names represent the following

Column 1. What each Lender lent out in BBLS

Column 2. The total of BBLs on schedule, in arrears, in default, awaiting a guarantee payment, had guarantee payment and those BBLs fully repaid, basically everything in the image above. This column includes the BBLs repaid figure £5.972.36 Billion in full too.

Column 3. What was repaid before a BBL went tits up such as the amount repaid via a Defaulter Discount or snatched back etc. So we are not on the hook for that columns figure £12.529.12 Billion along with the additional £5.972.36 Billion that has been repaid by BBL Borrowers thus reducing taxpayer liability by over £18billion. Rejoice.